ID: PMRREP36001| 198 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

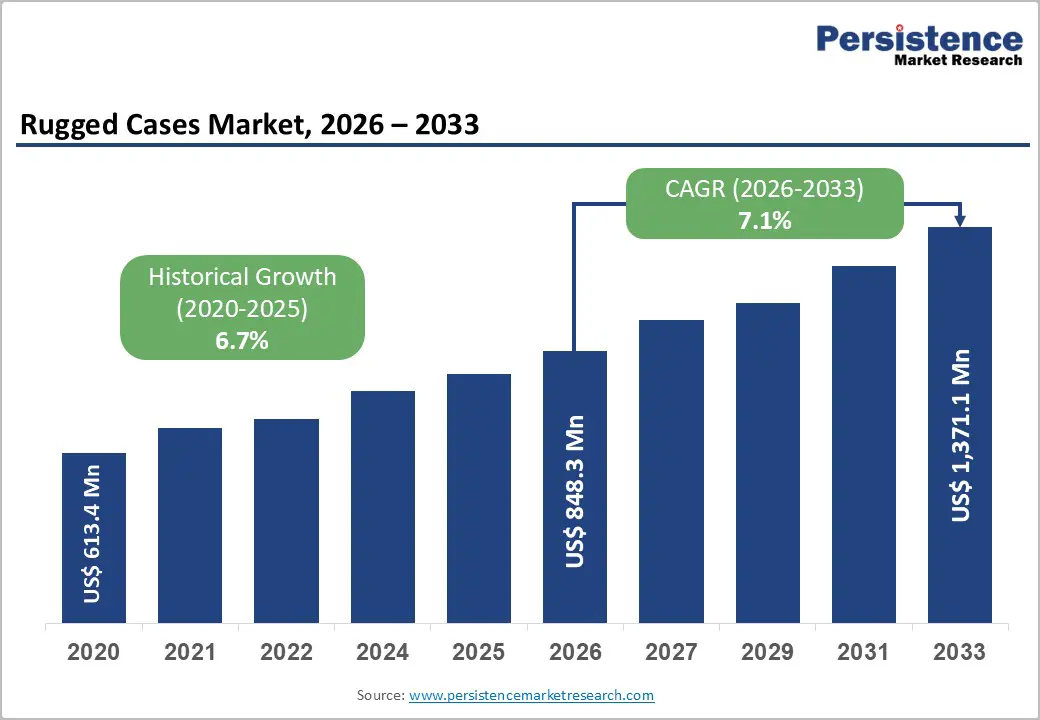

The global rugged cases market is projected to reach US$1,371.1 million by 2033, growing at a CAGR of 7.1% between 2026 and 2033, driven by sustained adoption across consumer electronics, logistics, industrial instrumentation, and government and military procurement. The market is likely to be valued at US$848.3 million in 2026.

Continuous material innovation, particularly lighter polycarbonate blends and advanced composites, is improving durability while reducing weight and expanding the addressable applications. The rapid expansion of e-commerce and direct-to-consumer channels is amplifying market reach and unit sales. Supply-side consolidation, rising raw material costs, and increasing sustainability requirements are creating mixed pressure on margins. The market reflects a balanced growth trajectory, combining premiumization in developed economies with higher-volume growth from Asia Pacific industrialization and digital commerce penetration.

| Key Insights | Details |

|---|---|

| Rugged Cases Market Size (2026E) | US$848.3 Mn |

| Market Value Forecast (2033F) | US$1,371.1 Mn |

| Projected Growth (CAGR 2026 to 2033) | 7.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.7% |

The proliferation of high-value portable devices, including flagship smartphones, tablets, rugged laptops, portable medical equipment, and field measurement instruments, has significantly increased demand for high-performance protective solutions. Consumer electronics account for approximately 44.6% of total market value, reflecting both high unit volumes and frequent replacement cycles. As replacement intervals stabilize at premium tiers, average selling prices for rugged and impact-resistant cases remain elevated. In parallel, industrial-grade handheld devices such as barcode scanners, rugged tablets, and diagnostic tools are increasingly deployed across utilities, logistics, and energy sectors. This combination of consumer and professional demand is expanding both B2C and B2B revenue streams.

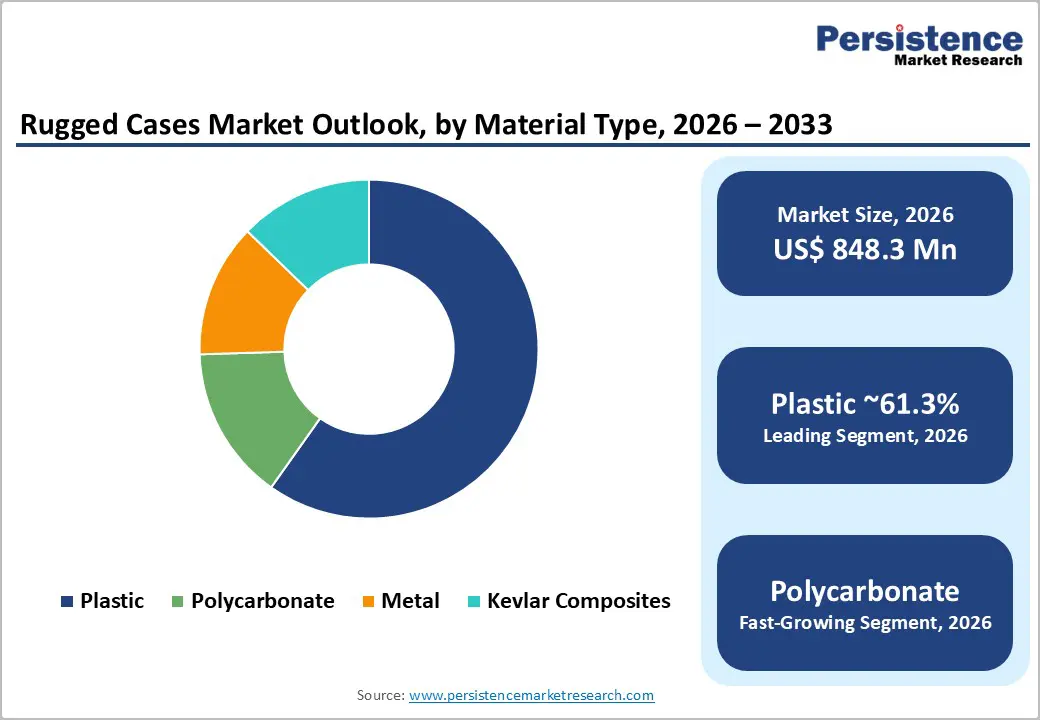

Advances in materials science, including engineered plastics, reinforced polycarbonate blends, Kevlar composites, and foam-in-place interiors, have substantially improved impact resistance, thermal stability, and chemical durability. Plastic-based solutions dominate the market, accounting for roughly 61.3% of value, as they offer an optimal balance between cost efficiency, design flexibility, and recyclability. Lighter materials reduce shipping costs and enable new use cases such as wheeled travel cases, drone transport, and mobile professional equipment. For industrial and defense buyers, the broader availability of certified materials that meet ingress protection and military-grade standards has expanded the addressable market.

The rapid growth of online retail has transformed the rugged cases market by expanding geographic reach and enabling direct-to-consumer engagement. Digital platforms support premium offerings, including customized foam inserts, labeling, and modular accessories. At the same time, B2B distribution through industrial distributors and direct OEM partnerships remains critical for large-volume and specification-driven sales, particularly in defense, healthcare, and infrastructure sectors. This hybrid channel structure improves lead times and enhances aftermarket revenue from replacement components and accessories.

Rugged case manufacturing depends heavily on polymers, specialty additives, and metal components. Volatility in resin and polycarbonate pricing, combined with fluctuations in logistics and energy costs, can significantly compress operating margins. A sustained 15-20% increase in raw material costs can reduce gross margins by approximately 3-5 percentage points for manufacturers with limited pricing power. These pressures are most acute for mid-sized suppliers lacking long-term supply contracts.

Securing large government, military, or regulated industrial contracts requires compliance with stringent certification standards and extensive documentation. Validation cycles are lengthy, and ongoing traceability requirements increase operational complexity. Compliance processes can extend time-to-market by 6-12 months and raise upfront capital expenditure by a mid-single-digit percentage of annual revenue for smaller firms. Certification requirements create high entry barriers, encouraging market consolidation and partnerships between smaller innovators and established, certified manufacturers.

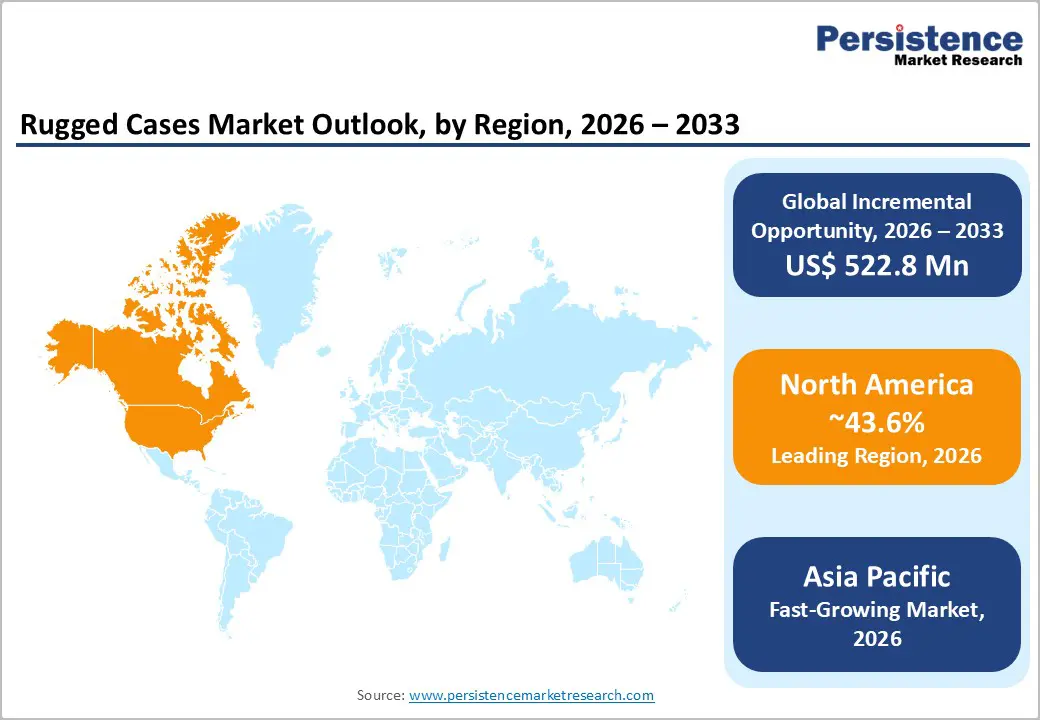

Asia Pacific represents the fastest-growing regional opportunity, driven by large-scale electronics manufacturing, infrastructure investment, and rapid modernization of logistics networks. Capturing even 10-15% of incremental industrial demand in the region between 2026 and 2033 could generate US$80-120 million in additional revenue for leading suppliers. Regional production hubs also offer cost advantages through near-shoring and localized assembly.

Growing regulatory scrutiny and customer demand for sustainability are driving innovation in recycled plastics, modular designs, and product takeback programs. If manufacturers capture 5-7% of market volume with sustainable or circular offerings by 2030, this could represent a US$30-60 million revenue niche based on current market projections.

Plastic-based materials are anticipated to account for approximately 61.3% of revenue share in 2026, supported by low production costs, high moldability, and favorable strength-to-weight characteristics. Injection molding and rotational molding techniques enable manufacturers to achieve consistent quality at scale, making plastics suitable for both mass-market consumer products and industrial-grade protective cases. Polymer shells are widely used in travel-oriented rugged cases for applications such as camera transport, field equipment storage, and mobility solutions, as they integrate easily with wheels, telescoping handles, pressure-release valves, and locking mechanisms while maintaining structural rigidity.

Within this category, polycarbonate and advanced engineered plastic blends are expected to be the fastest-growing sub-segment, driven by their superior impact resistance, thermal stability, and reduced wall-thickness requirements. These materials enable lighter case designs that comply with airline weight limits and support mobile professional use. Demand is increasing across applications such as drone transportation, professional photography equipment, medical diagnostic devices, and portable testing instruments. Owing to premium pricing, extended service life, and expanding compliance with ingress protection and impact standards, growth for polycarbonate-based solutions is expected to outpace the overall market CAGR.

Consumer electronics are anticipated to remain the largest end-use industry, accounting for approximately 44.6% of market share in 2026, driven by high global penetration of smartphones, tablets, laptops, wearables, and accessory ecosystems. Frequent device replacement cycles, rising average selling prices of flagship electronics, and strong brand-driven premiumization continue to support steady demand for rugged and protective cases. Examples include shock-resistant phone cases, protective housings for action cameras, and travel cases for high-value consumer electronics. Direct-to-consumer platforms, influencer-led marketing, and co-branding initiatives with device manufacturers further reinforce recurring revenue streams.

The industrial segment is expected to be the fastest-growing end-use category, driven by the growing deployment of rugged handheld devices across the utilities, logistics, telecommunications, construction, and energy sectors. Industrial applications require certified cases with custom foam inserts, waterproof sealing, chemical resistance, and tamper-evident features to protect sensitive instruments such as barcode scanners, rugged tablets, inspection tools, and communication equipment. Ongoing infrastructure modernization, automation initiatives, and increased adoption of connected field equipment are driving higher procurement volumes and longer-term supply contracts, positioning the industrial segment as a key growth engine over the forecast period.

North America is the largest regional market, accounting for approximately 43.6% of revenue, driven by high device adoption, industrial modernization, and strong demand from professionals and government. The U.S. dominates regional consumption due to widespread ownership of smartphones, tablets, laptops, and professional audio/visual equipment, as well as robust defense procurement programs.

Notable companies such as Pelican Products, OtterBox, and SKB have established a strong foothold here, leveraging certified manufacturing, extensive distribution networks, and tailored solutions for defense, media production, and industrial logistics. Canada contributes niche demand through outdoor and adventure-use markets, where products such as NANUK protective cases are popular among professional photographers and film crews. Meanwhile, Mexico benefits from near-shoring trends, with manufacturers supplying both domestic industrial clients and U.S.-bound logistics operations.

Market growth is supported by premium device penetration, frequent replacement cycles for professional gear, and the adoption of direct-to-consumer e-commerce channels. Companies like OtterBox and Urban Armor Gear have expanded online platforms, enabling faster delivery and customization options, including foam inserts and monogramming, which increases customer engagement and recurring purchases. Regulatory requirements for MIL-STD certifications, AS9100, and ISO standards create barriers to entry for new suppliers but strengthen long-term contracts for certified manufacturers. Investment activity in North America has been robust; for instance, SKB received strategic investment in 2025 to scale certified production for industrial and audio sectors, while Pelican continues to expand its PREPARE™ emergency preparedness and travel-case portfolio, enhancing its market diversification.

Europe represents a stable, mid-sized market with strong pockets of demand in Germany, the U.K., France, and Spain. Industrial users, creative industries, and specialized field services are key consumers of high-specification cases. Companies such as HPRC, Explorer Cases, and regional distributors of Pelican and SKB provide certified solutions for professional imaging, film production, utilities, and energy sectors.

Regulatory harmonization under the European Union REACH regulations and environmental compliance standards encourage manufacturers to document material compositions, certify recycled or non-toxic plastics, and adhere to lifecycle management practices. This increases operational complexity but strengthens long-term supplier relationships, particularly for firms capable of delivering high-quality, compliant products.

While growth is steadier than in the Asia Pacific, several strategic developments are shaping the market. For example, HPRC’s modular case solutions for professional photography have enabled the company to win contracts with European media and broadcast companies, while Explorer Cases’ localized assembly operations in the U.K. and Germany allow faster lead times for industrial and government procurement. Investment activity focuses on niche acquisitions of lightweight composite technologies, customization capabilities, and regional assembly to meet EU public-sector tenders. These strategic moves enhance resilience against logistics disruptions and strengthen the supplier’s competitive position in the region.

Asia Pacific is the fastest-growing regional market, fueled by large-scale manufacturing, rapidly expanding consumer bases, and accelerated logistics modernization. China serves as both a major manufacturing hub for global brands such as Pelican, NANUK, and SKB, and a growing domestic market for rugged-case applications, including camera, drone, and portable medical-device protection. Japan focuses on higher-value, specialized professional segments, including imaging, defense, and industrial instrumentation, where premium case providers offer products with strict certification standards.

India and ASEAN countries are experiencing strong growth in logistics, telecom, and industrial sectors, with companies such as OtterBox and local distributors supplying rugged transport cases for handheld scanners, network equipment, and portable testing devices. The region’s cost-efficient manufacturing and expanding distribution networks attract both global and regional players. For instance, NANUK’s Canadian-based expansion into Southeast Asia and Pelican’s strategic partnerships with Chinese OEMs have enabled faster production, localized customization, and reduced shipping times.

E-commerce penetration, led by platforms such as Amazon and regional marketplaces, has also accelerated consumer access to premium brands in urban and semi-urban areas. Investments in fulfillment centers and regional assembly hubs further enhance supply-chain efficiency. Regulatory frameworks are gradually evolving, with environmental standards and import tariffs affecting production costs and margins. Asia Pacific’s combination of manufacturing scale, rising disposable incomes, and industrial modernization positions it as a critical growth engine for global rugged-case manufacturers.

The global rugged cases market is moderately concentrated, with a small group of global leaders dominating premium and professional segments, alongside numerous regional and OEM-focused manufacturers serving cost-sensitive or specialized applications. Consumer phone cases are highly fragmented, while heavy-duty industrial and military cases are concentrated among certified suppliers. Ongoing consolidation and private investment are reinforcing professionalization and service differentiation.

Leading players emphasize material innovation, certification, channel diversification, and vertical integration. Customization, refurbishment services, and lifecycle support are emerging as key differentiators, while smaller players focus on niche specialization and cost efficiency.

The global rugged cases market is likely to be valued at US$848.3 million in 2026.

The rugged cases market is expected to reach US$1,371.1 million by 2033.

Key trends include growth in consumer electronics protection and industrial handheld devices, and increasing use of lightweight polycarbonate and engineered plastics.

Plastic-based cases dominate by material type, accounting for 61.3% of the total market share, while consumer electronics represent the largest end-use industry, contributing 44.6% of overall demand.

The rugged cases market is projected to grow at a CAGR of 7.1% between 2026 and 2033.

Major players include Pelican Products, Inc., OtterBox/Otter Products, LLC, Urban Armor Gear (UAG), and NANUK/Plasticase.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By End-Use Industry

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author