ID: PMRREP36189| 220 Pages | 18 Feb 2026 | Format: PDF, Excel, PPT* | Packaging

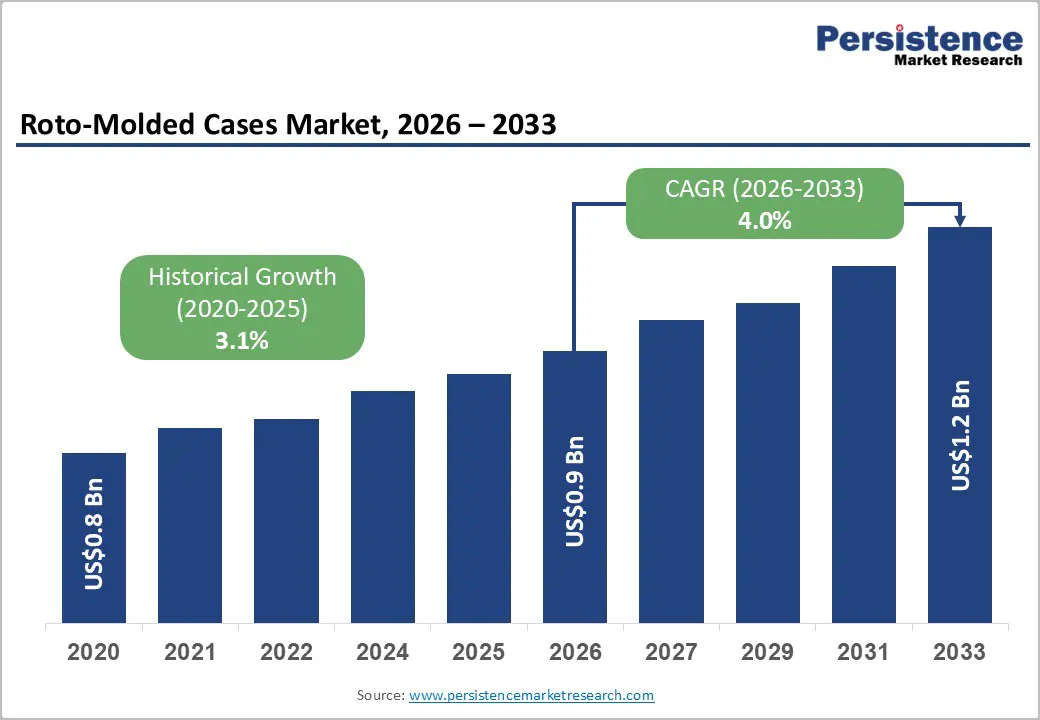

The global roto-molded cases market size is likely to be valued at US$0.9 billion in 2026 and is expected to reach US$1.2 billion by 2033, growing at a CAGR of 4.0% between 2026 and 2033, driven by the rising demand for specialized protective packaging across electronics, defense, and medical applications, where impact resistance and environmental sealing are critical.

Increasing field deployments, modernization of military logistics, and the need for durable transport solutions in global supply chains reinforce steady expansion. While raw material volatility affects short-term margins, improved manufacturing efficiency and expanding OEM adoption in Asia Pacific are expected to support medium-term revenue stability.

| Key Insights | Details |

|---|---|

| Roto-Molded Cases Market Size (2026E) | US$0.9 Bn |

| Market Value Forecast (2033F) | US$1.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.0% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.1% |

The electronics application, which accounts for 38% of market share, represents a stable demand base for roto-molded cases. High-value instruments such as communication systems, broadcast equipment, and diagnostic devices require impact-resistant, watertight enclosures to ensure operational reliability during transport. As global electronics production and cross-border trade expand, shipment values per unit increase, encouraging investment in premium protective solutions to reduce damage-related losses. In healthcare, rising clinical trial activity and the global distribution of advanced diagnostic and imaging equipment increase demand for validated transport cases. Logistics providers increasingly prioritize total cost of ownership (TCO) metrics, favoring durable roto-molded solutions that reduce replacement frequency and lifecycle maintenance costs. These structural trends directly support the projected 4.0% CAGR through 2033.

The military end-use segment, holding 34.6% market share, remains a high-value and stable revenue contributor. Defense agencies prioritize durability, compliance with MIL-STD testing standards, and long service life. Modernization initiatives involving electronic warfare systems, communication modules, portable radar units, and unmanned systems generate recurring procurement cycles for rugged transport solutions. Multi-year contracts awarded to qualified suppliers enable manufacturers to scale production, invest in automated molding systems, and reduce per-unit manufacturing costs. Defense budgets in North America, Europe, and selected Asia Pacific countries emphasize resilient logistics and rapid deployment capabilities. Since military equipment is mission-critical, procurement officers favor premium protective solutions over low-cost alternatives, stabilizing demand even during broader economic slowdowns.

End-users increasingly demand turnkey protective systems rather than standardized empty shells. Integrated offerings, including custom foam inserts, thermal liners, modular racks, and fitted compartments, raise average order value and shift the competitive landscape toward higher-margin engineered products. OEM co-design partnerships shorten development cycles and increase customer retention by embedding suppliers into product ecosystems. Vendors offering certification support, ingress protection testing, and lifecycle services capture a greater share of enterprise procurement budgets. This transition from commodity manufacturing to engineered protective systems enhances pricing power and supports long-term profitability across established brands.

Roto-molded cases are primarily manufactured using polyethylene resins and specialty additives. Resin price fluctuations, often linked to energy and feedstock volatility, create margin compression when manufacturers cannot fully pass cost increases to customers under fixed contracts. A 10-15% increase in resin prices can significantly reduce EBITDA margins for producers operating with low product mix flexibility. Smaller manufacturers are particularly exposed due to limited hedging capabilities and fixed capital investments in tooling and ovens. These cost swings introduce short-term earnings variability and inventory planning challenges.

Roto-molding requires substantial upfront investment in molds, ovens, and finishing equipment. Lead times for custom tooling may extend from several weeks to months, limiting responsiveness to sudden demand surges. This capital intensity increases barriers to entry while simultaneously constraining rapid product innovation cycles. During cyclical downturns, underutilized assets reduce return on invested capital. For mid-volume production runs requiring rapid customization, alternative manufacturing methods such as injection molding may appear more flexible, potentially limiting share capture in specific applications.

The growth of clinical trials and global vaccine distribution drives demand for cases that integrate thermal protection and shock absorption. Pairing roto-molded shells with engineered insulation systems opens high-margin product lines targeting pharmaceutical logistics providers. Given that healthcare is the fastest-growing end-use segment at 6.8% CAGR, specialized clinical transport cases can capture a meaningful portion of incremental growth. A focused product strategy addressing cold-chain compliance and validation requirements could secure several percentage points of the healthcare sub-segment within three years of market entry.

Lifecycle services such as foam replacement, refurbishment, certification, recertification, and fleet maintenance programs transform one-time sales into recurring revenue streams. Institutional buyers, particularly in defense, broadcasting, and clinical logistics, value predictable service agreements that reduce downtime. Subscription-based maintenance programs can increase customer lifetime value by 10-15% while improving order predictability. Since service margins often exceed manufacturing margins, expanding aftermarket offerings presents a scalable profitability lever for established manufacturers.

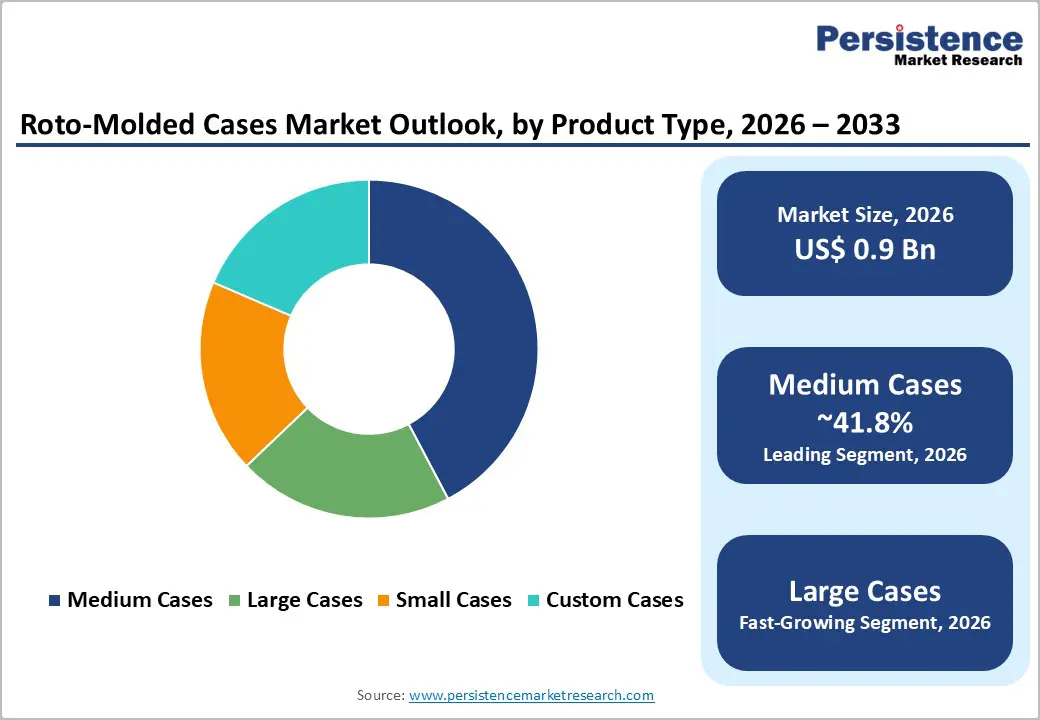

Medium cases are expected to lead, accounting for 41.8% of market share in 2026, due to their versatility across electronics, audiovisual equipment, aerospace tools, and military field kits. Their balanced dimensions allow compatibility with airline cargo standards and standardized pallet configurations, making them suitable for both domestic and international logistics. Manufacturers such as Pelican Products and SKB Corporation design medium cases with modular foam inserts, pressure-equalization valves, and IP-rated sealing systems, supporting sensitive devices such as drones, cameras, and communication units. Distributors favor medium-sized SKUs due to higher turnover rates and predictable reorder cycles across defense contractors and industrial suppliers. Production efficiency benefits from standardized mold dimensions and repeat batch manufacturing, which reduces tooling changeovers and improves throughput consistency.

Large cases are likely to be the fastest-growing, driven by increasing transport requirements for oversized medical imaging systems, radar assemblies, broadcasting equipment, and heavy industrial instruments. As field-deployable systems become more modular yet larger in footprint, demand for single-piece rugged enclosures continues to rise. Technological advancements in rotational molding capacity and expanded oven dimensions have lowered per-unit production costs for large-format enclosures. Companies such as B&W International now offer reinforced large cases with integrated wheels and metal-reinforced corners for easier maneuverability. Defense modernization programs and global event production industries further stimulate adoption, as customers increasingly replace traditional wooden crates with reusable, impact-resistant polymer cases that reduce lifecycle logistics costs.

The military segment is expected to lead, holding 34.6% of revenue in 2026, supported by stringent durability requirements, multi-year procurement contracts, and increasing investments in deployable communication, surveillance, and tactical equipment systems. Military specifications often mandate MIL-STD compliance, waterproof ratings, and extreme temperature resistance, which favor established manufacturers with certified testing facilities. Major defense suppliers working with organizations such as the U.S. Department of Defense require custom foam engineering, serialized tracking, and lifecycle service agreements. These contracts frequently include maintenance and replacement clauses, increasing lifetime contract value and reinforcing high entry barriers for new competitors.

Healthcare is likely to be the fastest-growing sector in 2026, fueled by the rising deployment of portable diagnostic equipment, mobile laboratory units, and temperature-sensitive pharmaceutical shipments. Hospitals and medical device OEMs increasingly demand validated transport protection to safeguard ultrasound systems, infusion pumps, and patient monitoring equipment. Global medical technology leaders such as GE HealthCare and Siemens Healthineers rely on certified transport solutions that combine impact resistance with thermal insulation compatibility. Manufacturers that integrate shock-absorption systems, tamper-evident seals, and traceability documentation achieve above-market growth. Regulatory compliance with healthcare quality standards further supports premium pricing and strengthens margins within this expanding segment.

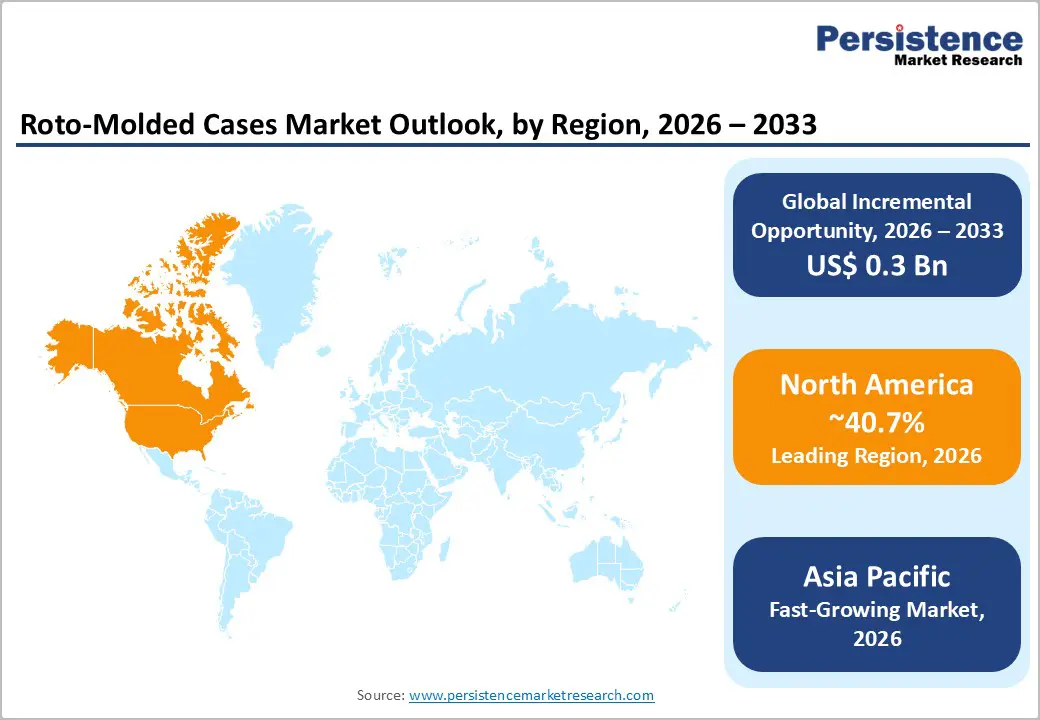

North America is projected to account for 40.7% of the market share in 2026 and is anticipated to retain regional leadership over the forecast period. The U.S. anchors regional performance through sustained defense procurement and a strong medical device manufacturing base. Agencies such as the U.S. Department of Defense continue to allocate multi-year budgets toward modernization programs, supporting demand for rugged transport enclosures used in communications, surveillance, and deployable medical systems. High average selling prices, coupled with structured aftermarket replacement cycles, strengthen profitability across the region.

Major manufacturers, including Pelican Products and SKB Corporation, have expanded customization capabilities and invested in automation upgrades across 2024-2025 to improve throughput and reduce lead times. Growth in clinical trials and portable diagnostics, supported by medical technology leaders such as GE HealthCare, has increased requirements for validated protective transport systems. Regulatory standards, including MIL-STD testing protocols and ISO quality certifications, reinforce supplier qualification requirements and create high switching costs, resulting in strong customer retention. Private equity interest in U.S.-based rotational molding specialists during 2024 reflects long-term confidence in defense, aerospace, and healthcare demand stability.

Europe represents a mature but stable market supported by aerospace, automotive, and industrial manufacturing ecosystems. Germany leads in industrial and export-oriented applications, leveraging its advanced machinery sector and precision engineering strengths. The U.K. and France contribute significantly through defense, broadcast, and event production logistics. Defense contractors supplying NATO-aligned programs sustain a consistent demand for certified protective transport solutions.

Companies such as B&W International and Peli Products differentiate through engineering customization and pan-European distribution networks. In 2024, several European manufacturers accelerated sustainability initiatives by incorporating recycled polypropylene blends and lightweight structural reinforcements to comply with evolving EU environmental standards. While regulatory harmonization across the European Union simplifies cross-border trade, stricter environmental documentation and waste compliance frameworks increase operational complexity. These conditions favor established brands with certified production systems and strong regional logistics partnerships.

Asia Pacific is projected to record the highest growth rate during the forecast period, driven by manufacturing expansion, defense modernization, and rising domestic consumption of electronics and medical equipment. China remains a key production hub for export-oriented protective cases, supported by investments in automated rotational molding lines and cost-efficient polymer sourcing. Japan contributes through high-value electronics and broadcast equipment applications, while India’s expanding defense procurement and healthcare infrastructure programs stimulate new demand channels.

Global brands such as NANUK have strengthened distributor networks across Southeast Asia to capture growing demand from media production and industrial inspection sectors. Regional electronics giants, including Sony Group Corporation, rely on durable transit protection for professional imaging and broadcast equipment exports, indirectly supporting case manufacturers. Industrial relocation trends from Western markets into Southeast Asia have expanded OEM manufacturing clusters, increasing bulk procurement of standardized enclosures. The region’s focus on export competitiveness, scale manufacturing, and cost optimization positions Asia Pacific as the strongest opportunity for volume expansion over the coming years.

The global roto-molded cases market exhibits moderate concentration, with several globally recognized brands capturing the majority of premium defense, aerospace, and healthcare contracts. A fragmented base of regional manufacturers competes on price and customization for local applications. Consolidation activity is increasing as private equity and strategic investors pursue scale efficiencies and service expansion opportunities.

Market leaders emphasize engineered differentiation, cost optimization through automation, and expansion of service-based revenue models. Strategic partnerships with OEMs and compliance-driven positioning strengthen long-term contract retention.

The roto-molded cases market is projected to reach approximately US$0.9 billion in 2026.

By 2033, the roto-molded cases market is expected to reach around US$1.2 billion.

Key trends include automation in rotomolding production, integration of lightweight composite polymers, rising demand for MIL-STD-certified enclosures, expansion of reusable transport solutions replacing wooden crates, and sustainability initiatives incorporating recycled materials.

Medium cases lead the market with a 41.8% revenue share, attributed to their versatility across electronics, audiovisual equipment, and military field kits.

The roto-molded cases market is projected to grow at a CAGR of approximately 4.0% over the forecast period.

Major players include Pelican Products, SKB Corporation, Nanuk, B&W International, and Peli Products.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-user

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author