ID: PMRREP30509| 208 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

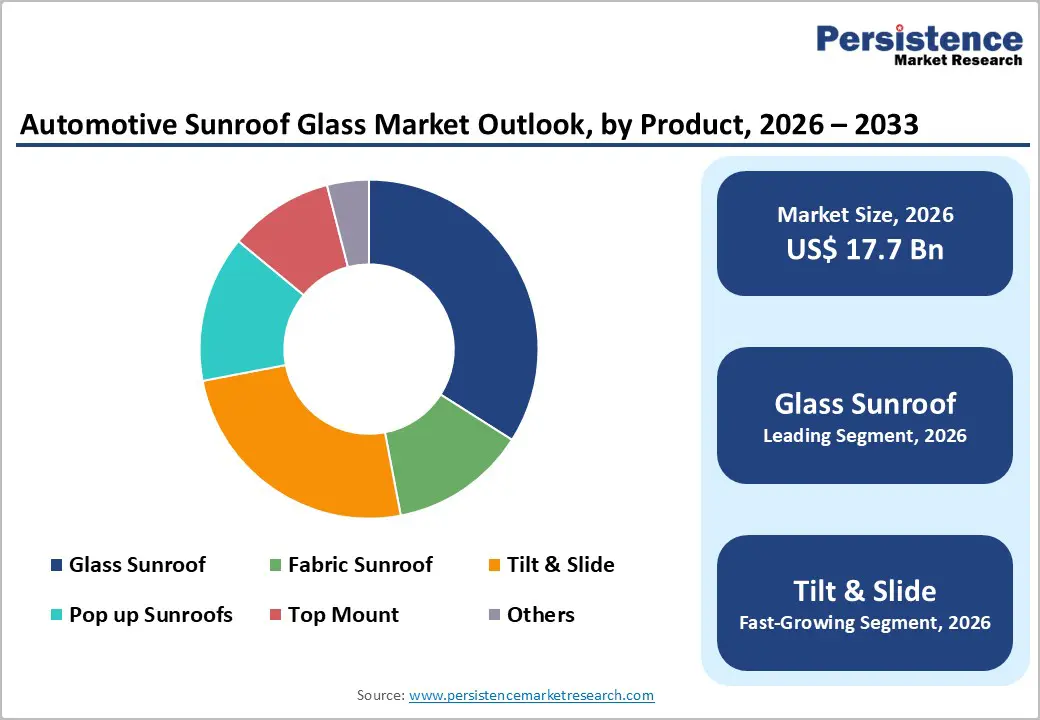

The global automotive sunroof glass market size is likely to be valued at US$17.7 billion in 2026 and is expected to reach US$40.0 billion by 2033, growing at a CAGR of 12.4% during the forecast period from 2026 to 2033, driven by increasing consumer preference for enhanced in-cabin comfort, aesthetics, and natural lighting, along with the rapid adoption of panoramic and electrically operated glass sunroofs, particularly in SUVs and electric vehicles (EVs).

Automakers are increasingly integrating laminated, tinted, UV-protective, and lightweight glass technologies to improve thermal insulation, safety, and energy efficiency. Rising vehicle production in emerging markets, expanding SUV sales, and regulatory emphasis on passenger comfort and vehicle efficiency across major automotive regions are reinforcing demand for advanced automotive sunroof glass solutions.

| Key Insights | Details |

|---|---|

|

Automotive Sunroof Glass Market Size (2026E) |

US$17.7 Bn |

|

Market Value Forecast (2033F) |

US$40.0 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

12.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

12.1% |

Consumers increasingly associate sunroofs, especially glass and panoramic variants, with enhanced comfort, aesthetics, and a superior driving experience. Glass sunroofs allow natural light, improve cabin ambiance, and create a sense of openness, making them a highly desirable feature even in mass-market vehicles. Automakers are responding by standardizing sunroofs in higher trims and gradually extending them into compact and mid-size models. The trend is especially pronounced in SUVs and crossover vehicles, where panoramic glass sunroofs have become a key differentiator. Advancements in sunroof glass technology, such as UV-protective coatings, laminated safety glass, noise reduction, and heat insulation, have addressed earlier concerns about thermal discomfort and safety.

The market growth is strongly supported by rising vehicle production and the expansion of automotive fleets. Factors such as urbanization, higher disposable incomes, and the growing middle-class population, particularly in emerging economies, continue to drive demand for passenger vehicles. As production volumes rise, automakers are increasingly offering sunroof glass across a wider range of models to stay competitive and cater to evolving consumer preferences. The expansion of fleets, including ride-hailing, corporate, and shared mobility vehicles, further boosts overall vehicle output, thereby indirectly increasing demand for sunroof components. Government incentives for EVs and local manufacturing have also encouraged OEMs to expand production facilities, particularly in the Asia Pacific.

Glass sunroofs enhance aesthetics and cabin experience; they also introduce potential risks related to vehicle integrity, occupant protection, and accident resilience. Improperly designed or low-quality sunroof glass can compromise roof strength, increasing the likelihood of injury in rollover accidents or collisions. Panoramic and large glass sunroofs add weight to the vehicle’s upper structure, which can affect handling, stability, and fuel efficiency, particularly in smaller or lightweight models. Manufacturers must adhere to strict automotive safety standards and certifications to ensure that sunroof glass meets impact resistance, shatterproof, and load-bearing requirements, which adds to production complexity and cost. Integrating advanced features such as electric tilt-and-slide or solar sunroofs further increases design complexity, requiring reinforced structures to maintain safety standards without compromising aesthetics.

Structural integration challenges, such as sealing, water leakage, and noise reduction, can impact long-term vehicle reliability and customer satisfaction. Regulatory authorities in key markets mandate rigorous testing for glass sunroofs, including safety compliance, UV protection, and thermal performance. These stringent requirements can slow adoption in cost-sensitive segments and emerging markets, limiting market expansion. Safety and structural concerns remain a critical restraint that manufacturers must address through advanced engineering and high-quality materials. Frequent exposure to extreme temperatures and road vibrations in regions such as Asia Pacific and North America necessitates durable materials and precision engineering.

With the accelerating adoption of EVs worldwide, manufacturers are increasingly focusing on lightweight, durable, and energy-efficient glass sunroofs that help reduce vehicle weight, thereby extending driving range and improving overall energy efficiency. Panoramic and glass sunroofs are now being designed with advanced features such as solar-compatible coatings, electrochromic tinting, and UV/infrared protection, enhancing passenger comfort while regulating cabin temperature and reducing dependence on air conditioning. These smart functionalities allow users to adjust light transmission, minimize glare, and maintain privacy, offering a premium in-cabin experience that appeals to both luxury and mainstream consumers.

The integration of smart glass sunroofs in EVs also creates opportunities for aftermarket services, value-added features, and long-term revenue streams for manufacturers. Innovations such as IoT-enabled sunroof controls, remote operation via mobile apps, and intelligent climate management systems enable users to monitor cabin conditions, control light, and improve safety even before entering the vehicle. Automakers and glass manufacturers are investing heavily in R&D collaborations to develop sunroofs that are not only visually appealing but also structurally robust and energy-efficient, complying with stringent safety and regulatory standards. Panoramic sunroofs incorporating solar panels, electrochromic functionality, and lightweight laminated materials are emerging as high-value differentiators in competitive automotive markets.

Glass sunroofs are projected to dominate the automotive sunroof glass market, accounting for approximately 80% of revenue in 2026. Their popularity is driven by premium aesthetics, durability, UV protection, and prevalence in panoramic designs. Consumers favor glass sunroofs for the abundant natural light, sense of spaciousness, and the overall luxury appeal, making them a key differentiator in passenger vehicles, particularly SUVs and premium sedans. Automakers, such as Toyota, incorporate panoramic glass sunroofs in models such as the RAV4, blending a sophisticated appearance with advanced functionality to attract higher-end buyers. Glass sunroofs are highly compatible with modern technologies, including electrochromic tinting and solar-assisted thermal control, which enhance cabin comfort and energy efficiency, especially in electric and hybrid vehicles.

Tilt & slide sunroofs are expected to be the fastest-growing segment in 2026, driven by rising consumer demand for larger roof designs that enhance visibility, cabin ambiance, and overall driving luxury. For instance, Ford offers tilt & slide panoramic sunroofs in models such as the Escape, providing flexible ventilation and expansive glass coverage without compromising structural integrity. Advances in lightweight laminated glass, UV-protective coatings, and noise-reduction technologies allow manufacturers to create larger openings while maintaining safety and energy efficiency. Growth is further supported by increasing SUV sales, particularly in Asia Pacific and North America, and the broader adoption of these features in mid-range vehicles.

Electric sunroofs are projected to lead the market, capturing around 80% of the revenue share in 2026, supported by their convenience, push-button functionality, and seamless integration with vehicle electronics. They align well with modern trends in premium and EVs, offering automated control, enhanced comfort, and advanced cabin experiences. For example, the BMW i4, which features a powered tilt-and-slide sunroof that provides smooth electronic operation and an improved cabin ambiance as part of its premium EV design. The high adoption of electric sunroofs is driven by consumer preferences for technologically advanced features and their availability across SUVs, sedans, and EVs in both developed and emerging markets.

Manual sunroofs are likely to be the fastest-growing operation type in 2026, driven by affordability and adoption in cost-sensitive vehicles, particularly in emerging markets. Despite having lower overall market share, manual sunroofs enable manufacturers to offer sunroof functionality in compact and mid-range models at lower cost. For example, Suzuki equips its Vitara models in India with manual tilt-and-slide sunroofs, catering to price-conscious consumers who still seek enhanced cabin light and ventilation. Growth in this segment is supported by rising urbanization, increasing middle-class income, and expansion of mass-market vehicle sales in regions such as the Asia Pacific, Latin America, and parts of Eastern Europe.

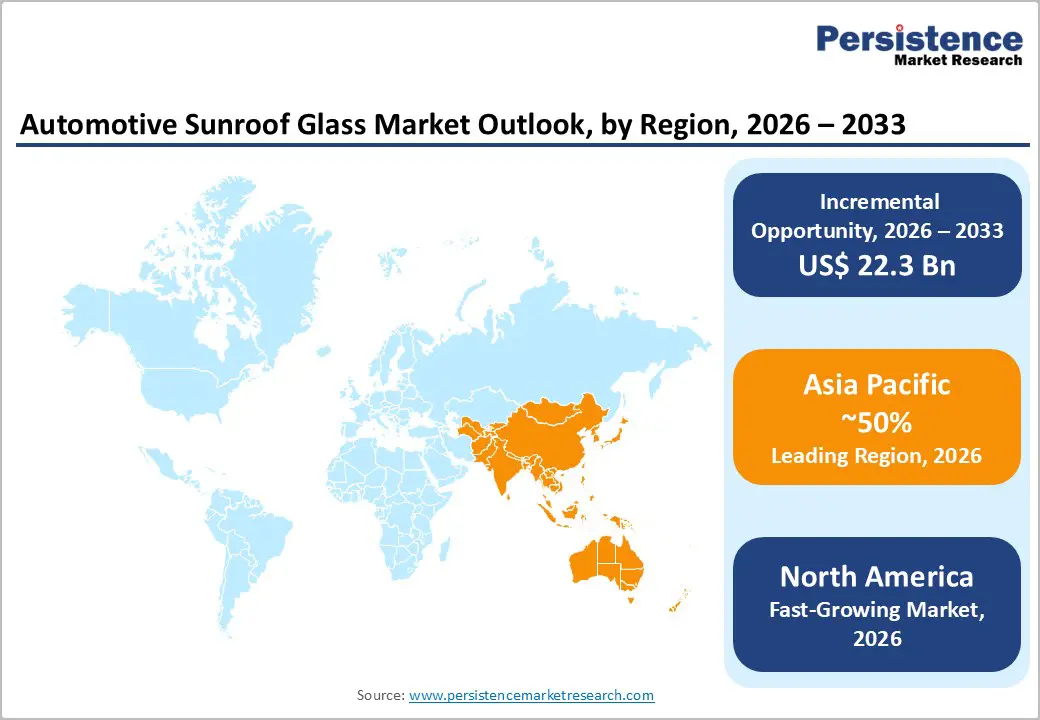

North America is expected to be the fastest-growing market in 2026, driven by strong consumer demand for premium vehicles featuring advanced sunroof systems, particularly panoramic and dual-pane glass roofs, which dominate new vehicle installations in the region. In the U.S., the largest market in North America, buyers increasingly prefer SUVs, crossovers, and premium sedans equipped with enhanced glass sunroofs, either as standard or optional features, reflecting a desire for natural light, openness, and an elevated driving experience. Panoramic sunroofs now represent a significant share of regional installations, as manufacturers incorporate UV protection, noise reduction, and lightweight laminated glass technologies to meet consumer expectations for comfort and efficiency.

Innovation in sunroof glass technology is a defining trend in the North American automotive market. OEMs and suppliers are focusing on smart, lightweight, and energy-efficient solutions that complement vehicle electrification and premium positioning. For example, Stellantis equips models such as the Jeep Grand Cherokee with panoramic glass sunroofs supplied by Webasto Group, featuring laminated safety glass, UV protection, and enhanced noise insulation. This demonstrates how advanced sunroof systems serve as a key differentiator in SUVs, appealing to consumers who prioritize cabin comfort, spaciousness, and premium features. Regulatory requirements related to vehicle safety, emissions, and energy efficiency are driving the adoption of stronger yet lighter sunroof glass materials across North American vehicles.

Europe is expected to be a key market for automotive sunroof glass in 2026, driven by strong consumer demand for premium vehicle features and high standards for safety and sustainability. European OEMs and luxury brands, including BMW, Mercedes-Benz, and Audi, are at the forefront of integrating panoramic glass roofs as standard or popular optional features, enhancing cabin ambiance and visual appeal in major markets such as Germany, France, and the U.K. Panoramic sunroofs account for a significant share of installations, reflecting sophisticated consumer preferences for natural light and expansive views, making Europe a central hub for sunroof adoption and technological innovation. Regulatory focus on lightweight construction and energy efficiency further supports the use of advanced laminated and coated glass materials that improve thermal performance while reducing weight.

Trends in the European sunroof glass market also align with the growth of EVs and sustainability initiatives. With rising EV production across European plants, demand is increasing for lightweight, energy-efficient glass roofs that complement electric powertrains, allowing OEMs to maintain cabin comfort without compromising vehicle range. The EU’s regulatory framework, including carbon neutrality targets and material recyclability requirements, promotes the development of advanced glass solutions that meet both safety and environmental standards. For example, Volkswagen Group equips many of its new European models with panoramic and smart glass roofs, enhancing occupant comfort while supporting emissions-reduction goals. Aftermarket interest in advanced sunroof technologies is growing, as consumers seek to upgrade existing vehicles with enhanced features.

The Asia Pacific region is expected to lead the sunroof glass market, capturing an estimated 50% share by 2026. This growth is driven by strong vehicle production, a rising middle-class population, and increasing demand for premium features in passenger vehicles. China represents a major portion of this demand due to its large automotive manufacturing base and widespread adoption of panoramic and electrically operated sunroofs, supported by expanding local production capacity and government incentives for new energy vehicle technologies. India and Japan also play significant roles, as sunroof penetration rises with the growing popularity of feature-rich SUVs and compact premium cars that prioritize cabin comfort and aesthetics.

Technological innovation and regional manufacturing advantages are the key drivers in the Asia Pacific sunroof glass market. Smart and sustainable features are gaining traction alongside traditional sunroof installations. Suppliers and OEMs are increasingly integrating advanced glass technologies, such as UV-protective coatings, laminated safety glass, and heat-rejecting materials, to improve comfort, energy efficiency, and thermal management, particularly in electric and hybrid vehicles, where cabin climate control is crucial. A notable example is Webasto India’s expansion of its Pune facility to produce sunroof systems tailored to regional demand, including electric sunroof modules for popular models such as the Maruti Suzuki Brezza, which features an electric sunroof as either a standard or optional feature in higher trim levels.

The global automotive sunroof glass market exhibits a moderately fragmented structure, driven by the presence of several established multinational players alongside a growing number of regional competitors that cater to both premium and mass-market segments. While no single company dominates the entire industry, major players collectively control a significant portion of supply through strong OEM relationships, diversified product portfolios, and continuous R&D investments to develop advanced glass technologies such as panoramic, electrochromic, and solar-reflective systems.

With key leaders including Webasto Group, Inalfa Roof Systems Group, CIE Automotive, Yachiyo Industry Co., Aisin Seiki Co., Inteva Products LLC, and Magna International Inc., the competitive landscape reflects a balance of large multinational OEM suppliers and niche innovators. These companies compete through differentiated product offerings, advanced technology integration, and partnerships with major automakers to secure long-term supply contracts. Other players emphasize lightweight design, acoustic performance, and smart glass features to attract automakers focused on premium cabin experiences.

The global automotive sunroof glass market is projected to reach US$17.7 billion in 2026.

Rising demand for premium vehicle features, increasing SUV and EV adoption, advancements in glass technology, and growing vehicle production in emerging markets.

The automotive sunroof glass market is expected to grow at a CAGR of 12.4% from 2026 to 2033.

The growing integration of panoramic and smart glass sunroofs in EVs, the expansion of sunroof adoption in mass-market vehicles, the localization of manufacturing in emerging economies, and the rising demand for lightweight, energy-efficient automotive glass solutions.

Webasto Group, CIE Automotive, Inteva Products LLC, Inalfa Roof Systems Group BV, and Valmet Automotive are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Operation Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author