ID: PMRREP24706| 198 Pages | 7 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

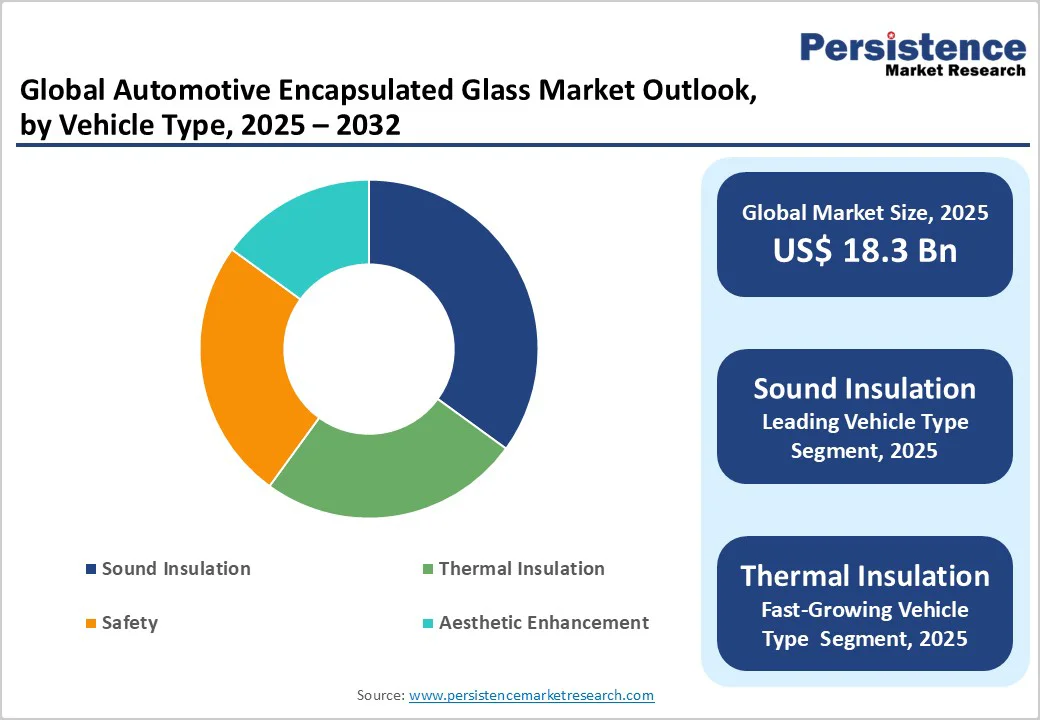

The global automotive encapsulated glass market size is likely to be valued US$18.3 Billion in 2025, expected to reach US$26.3 Billion by 2032, growing at a CAGR of 5.3% during the forecast period from 2025 to 2032.

The market is experiencing robust growth driven by the increasing demand for noise reduction and thermal comfort in vehicles, rising adoption of electric vehicles (EVs), and advancements in glass encapsulation technologies.The market is further propelled by innovations in laminated and tempered glass for better insulation and durability, catering to preferences for sustainable and high-performance materials.

The growing acceptance of automotive encapsulated glass as an essential component for modern vehicles, especially in smart and autonomous cars, is a key growth factor.

| Key Insights | Details |

|---|---|

|

Automotive Encapsulated Glass Market Size (2025E) |

US$18.3 Bn |

|

Market Value Forecast (2032F) |

US$26.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.8% |

The increasing demand for enhanced vehicle comfort and energy efficiency is a primary driver of the automotive encapsulated glass market. Urbanization and growing traffic congestion have heightened awareness of noise pollution, prompting automakers to adopt glass solutions that minimize external sound intrusion.

Laminated and acoustic-insulated encapsulated glass are particularly effective in reducing vibrations and attenuating road and wind noise, creating a quieter, more comfortable interior environment. This trend is especially prominent in premium passenger vehicles, where comfort and luxury are critical selling points.

Thermal comfort is another key driver, amplified by the rapid growth of electric vehicles (EVs). Efficient thermal insulation in encapsulated glass helps maintain stable cabin temperatures while reducing the energy consumed by heating, ventilation, and air conditioning (HVAC) systems. For EVs, this contributes directly to improved battery efficiency and extended driving range, making thermally insulated glass an essential component of next-generation vehicles.

High production costs and complex supply chains, which can limit widespread adoption and slow market growth. Manufacturing encapsulated glass requires advanced materials such as polycarbonate, laminated glass, and specialized polymers, which are more expensive than conventional automotive glass.

The production process itself is technologically intensive, involving precise layering, bonding, and thermal or acoustic treatments to meet safety, insulation, and aesthetic standards. This leads to higher capital expenditure for manufacturers and increased per-unit costs.

Supply chain complexities further exacerbate these challenges. Sourcing high-quality raw materials from multiple global suppliers introduces risks related to price volatility, lead times, and geopolitical uncertainties. The growing demand for electric and autonomous vehicles requires precise coordination between glass manufacturers, automakers, and Tier-1 suppliers to ensure compatibility with advanced sensors, displays, and insulation systems. Any disruption in the supply chain can delay production schedules and increase costs.

The automotive encapsulated glass market is experiencing significant growth due to expanding applications in electric vehicles (EVs) and autonomous vehicles (AVs). In EVs, encapsulated glass plays a critical role in lightweighting, thermal management, and energy efficiency, directly impacting vehicle range and performance.

Advanced glass materials, such as polycarbonate and laminated solutions, are increasingly used to reduce weight while maintaining strength, durability, and safety. Thermal insulation properties are particularly vital in EVs, as they help preserve battery efficiency and maintain optimal cabin temperatures, reducing energy consumption for heating and cooling systems.

In autonomous vehicles, encapsulated glass serves multiple functional and safety purposes. High-precision laminated and thermally stable glass is essential for supporting sensor integration, camera systems, and LiDAR units, which are critical for navigation, obstacle detection, and passenger safety.

Sound Insulation dominates the market, accounting for 35% of the share in 2025, driven by growing urban noise pollution and increasing consumer demand for quieter cabin environments. By reducing external noise and vibrations, sound-insulated glass enhances passenger comfort and driving experience. Its adoption is especially strong in premium and passenger vehicles, where comfort and luxury are key differentiators.

Thermal Insulation is the fastest-growing segment, driven by the increasing focus on electric vehicle (EV) thermal management. Effective insulation helps maintain cabin comfort, reduces energy consumption, and enhances battery efficiency. Rising adoption of EVs and stricter energy efficiency standards are prompting automakers to integrate advanced thermally insulated glass solutions in both passenger and commercial vehicles.

Laminated Glass leads with 45% share, driven by stringent safety regulations and rising demand for premium vehicle features. Its ability to prevent shattering enhances passenger safety, while its acoustic properties reduce cabin noise, improving comfort. These advantages make laminated glass a preferred choice for luxury and high-end passenger cars.

Polycarbonate is the fastest-growing, driven by the industry’s focus on lightweighting to improve fuel efficiency and EV range. Its high strength-to-weight ratio, durability, and design flexibility make it ideal for electric vehicles, enabling thinner, lighter glazing solutions without compromising safety or performance, while supporting advanced features like noise reduction and thermal insulation.

Passenger Cars hold nearly 50% share, utilizing automotive encapsulated glass to enhance cabin comfort, reduce noise, and improve thermal insulation. The glass also contributes to vehicle aesthetics, offering sleek designs and improved visibility. Rising consumer preference for premium features and safer, quieter rides further reinforces the adoption of encapsulated glass in passenger vehicles.

Electric Vehicles are the fastest-growing, driven by the need for range optimization and energy efficiency. Lightweight, thermally insulated, and aerodynamically designed encapsulated glass helps reduce energy consumption. Integration of smart features such as solar control, acoustic glazing, and heads-up display compatibility further boosts demand in next-generation EVs.

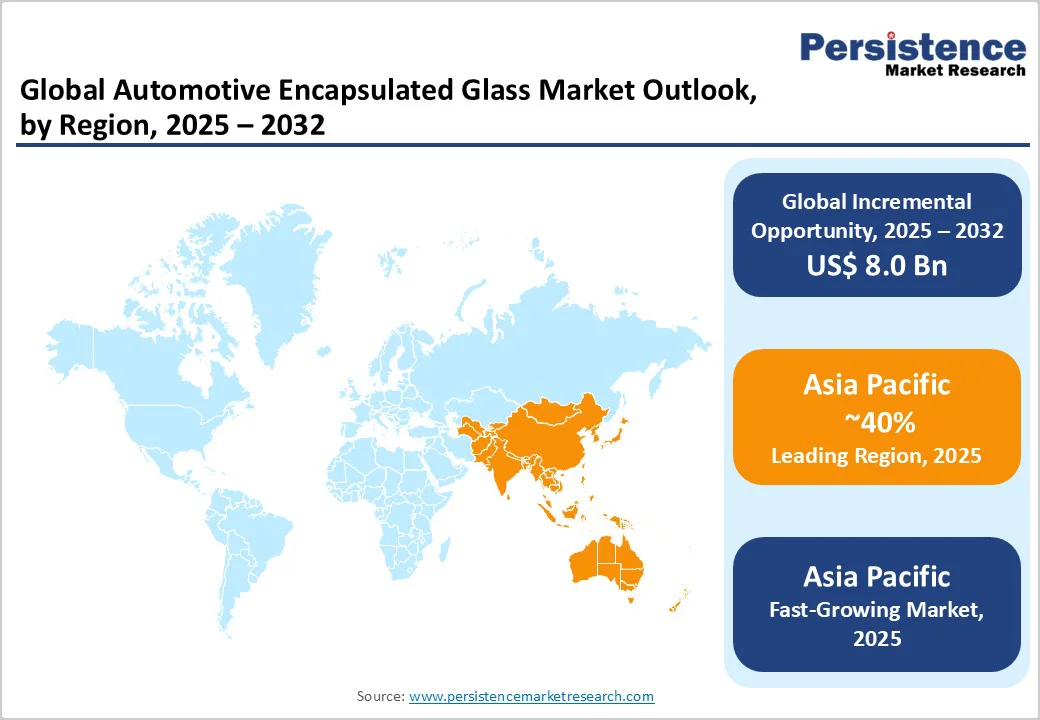

Asia Pacific commands around 40% share and is the fastest-growing region, driven by China’s rapid expansion of electric vehicle (EV) production and adoption, which is creating strong demand for lightweight, energy-efficient glass solutions. China’s government incentives and investments in EV infrastructure have encouraged automakers to integrate advanced encapsulated glass that enhances vehicle aerodynamics, insulation, and acoustic performance.

Japan’s expertise in advanced materials and precision manufacturing has contributed to the development of high-performance encapsulated glass technologies used in premium and hybrid vehicles. Countries such as South Korea and India are also witnessing rising vehicle production, further fueling regional demand.

Growing urbanization, increasing disposable incomes, and stricter environmental standards are prompting manufacturers to prioritize fuel efficiency and sustainability. Local suppliers are expanding partnerships with global OEMs to enhance production capacity and technological capabilities.

North America accounts for 25% in 2025, driven by strong demand for premium vehicles and favourable U.S. government incentives supporting electric vehicle (EV) adoption. The region’s automakers are increasingly incorporating laminated encapsulated glass to enhance safety, noise insulation, and thermal efficiency, aligning with consumer preferences for comfort and advanced design. The U.S. market, in particular, benefits from federal and state-level EV tax credits, spurring automakers to innovate lightweight and durable glazing solutions suitable for electric and hybrid vehicles.

Canada is also contributing to growth through its commitment to zero-emission transportation and sustainable manufacturing practices. Interestingly, the U.K., though part of Europe, exhibits similar market dynamics due to its Zero Emission Vehicle (ZEV) mandate, which promotes the use of encapsulated and thermally insulated glass in EV fleets to improve battery efficiency and cabin comfort.

Europe holds about 30% market share, led by Germany and France, driven by its stringent environmental regulations and advanced automotive engineering capabilities. Germany and France lead the regional market, supported by the presence of major automakers and Tier-1 suppliers focusing on lightweight and energy-efficient vehicle components. The European Union’s CO2 emission targets have accelerated the adoption of lightweight materials and aerodynamic designs, making encapsulated glass a preferred solution for improving fuel efficiency and reducing noise.

German manufacturers, known for their precision engineering and premium vehicle production, are integrating encapsulated glass to enhance vehicle aesthetics, thermal insulation, and safety. Meanwhile, France is investing heavily in electric mobility and sustainable automotive technologies, further boosting demand. The region’s emphasis on research and development, coupled with government-backed incentives for low-emission vehicles, continues to drive innovation in encapsulation materials and manufacturing processes.

The global automotive encapsulated glass market is highly competitive, with a mix of global leaders and regional manufacturers competing through innovation and technological advancement. Major players are focusing on developing lightweight encapsulated glass solutions to enhance vehicle fuel efficiency and reduce carbon emissions, aligning with stringent environmental regulations. The rising adoption of electric vehicles (EVs) has further accelerated the demand for advanced glass designs that support improved insulation, noise reduction, and energy efficiency.

Companies are investing in materials such as polyurethanes and thermoplastics to produce thinner yet durable encapsulations, improving vehicle aerodynamics and safety. Strategic collaborations with automakers and investments in smart glass technologies such as solar control and acoustic glazing are also shaping market growth. Regional expansion and product diversification are key strategies used to maintain competitiveness amid evolving consumer preferences and regulatory pressures.

The global automotive encapsulated glass market is projected to reach US$18.3 Billion in 2025, driven by EV adoption and comfort features.

The market is driven by EV sales to 40 million units by 2030 and demand for noise reduction, necessitating automotive encapsulated glass.

The market is poised to witness a CAGR of 5.3% from 2025 to 2032, reflecting lightweighting and safety innovations.

Expansion in polycarbonate for autonomous vehicles offers key opportunities for automotive encapsulated glass in smart designs.

Key players are AGC Inc., Saint-Gobain, Corning Incorporated, Fuyao Glass, and Sika AG.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Vehicle Type

By Functionality

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author