ID: PMRREP32625| 220 Pages | 22 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

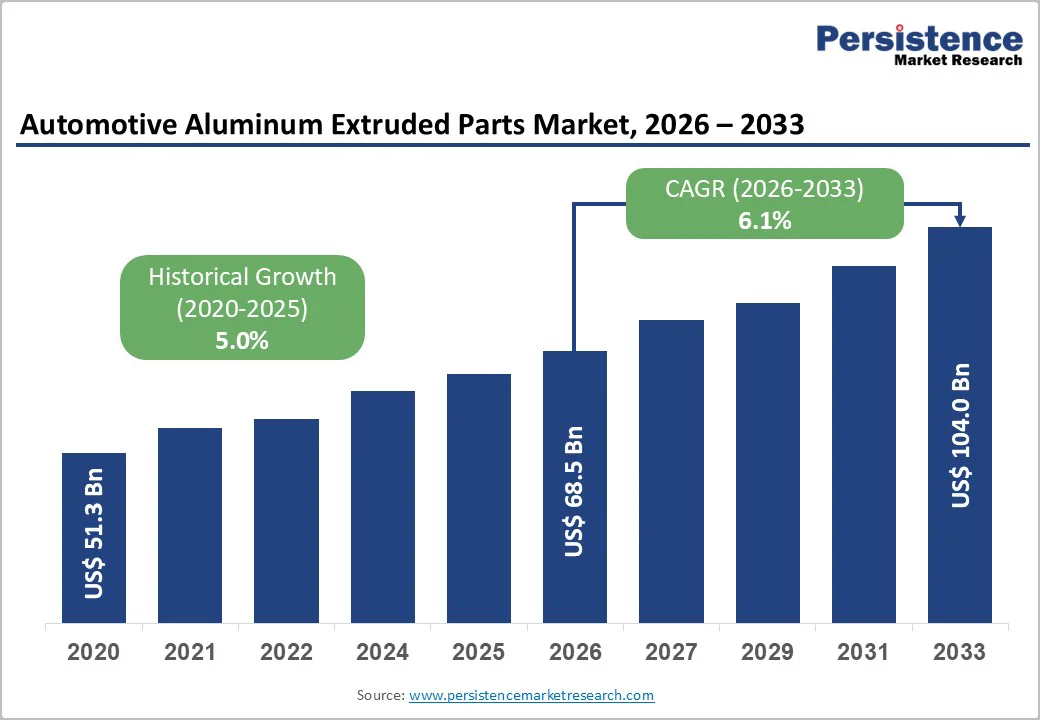

The global automotive aluminum extruded parts market is projected to reach US$104.0 billion by 2033, growing at a CAGR of 6.1% between 2026 and 2033. The market is likely to be valued at US$68.5 billion in 2026.

Market expansion is driven by accelerating vehicle lightweighting initiatives mandated by environmental regulations, the adoption of electric vehicle platforms requiring optimized thermal management and structural efficiency, and advanced manufacturing enabling complex extrusion geometries that support contemporary vehicle designs.

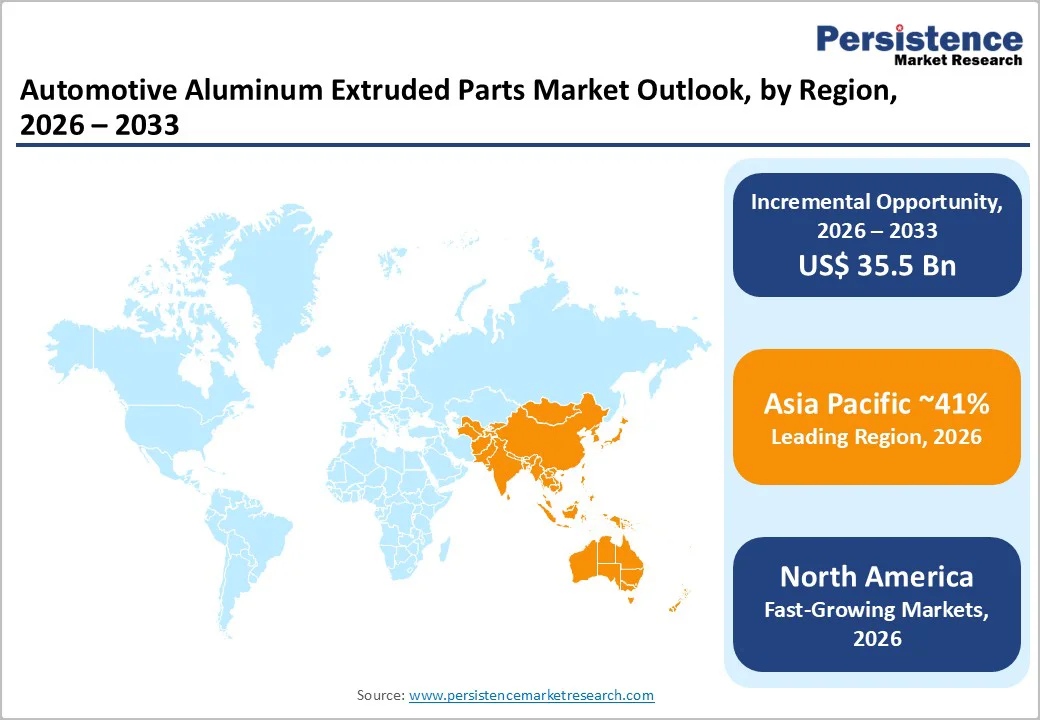

Asia Pacific dominates the global market, with a 41% regional share, expanding at a 7.3% CAGR, supported by massive automotive production across China, Japan, and India. At the same time, Europe and North America collectively hold a significant share, driven by stringent emissions regulations and premium EV manufacturing capabilities.

| Key Insights | Details |

|---|---|

| Automotive Aluminum Extruded Parts Size (2026E) | US$ 68.5 billion |

| Market Value Forecast (2033F) | US$ 104.0 billion |

| Projected Growth CAGR (2026 - 2033) | 6.1% |

| Historical Market Growth (2020 - 2025) | 5.0% |

Vehicle electrification is the strongest growth catalyst, with global EV production reaching 17 million units in 2024 and accelerating toward nearly 50 million units by 2030, reshaping aluminum extrusion demand across battery enclosures, structural members, and thermal systems.

Electric vehicles require optimized lightweight architectures, where aluminum extrusions deliver superior strength-to-weight performance essential for range extension and thermal efficiency.

Battery enclosures rely on advanced extrusions providing crash protection, high thermal conductivity nearly five times that of steel, and tight dimensional tolerances at scale. Structural subframes, space frames, and longitudinal beams increasingly use extrusions engineered for energy absorption, enabling a 20-30% reduction in vehicle weight compared to steel while preserving crash integrity.

Chinese EV OEMs such as BYD and XPeng deploy extrusion-intensive platforms supporting fast charging and advanced thermal management. Government incentives across the US, Europe, and China sustain global aluminum extrusion demand.

Modern extrusion technology enables complex cross-sectional geometries, tight dimensional tolerances, and integrated features that consolidate multi-component assemblies into single aluminum extrusions, reducing manufacturing complexity, assembly labor, and cost while improving structural performance.

Computer-aided design and finite element analysis enable engineers to optimize cross-sections for specific load paths, identifying opportunities to reduce weight while preserving safety and precision. Process advances such as indirect extrusion, online quenching, and automated heat treatment deliver consistent properties and tolerances suitable for high-volume automotive production without secondary machining.

Custom die design and rapid prototyping shorten development cycles, making supplier engineering support a critical competitive differentiator for OEM programs.

Multi-material joining technologies, including friction stir welding, adhesive bonding, and mechanical fastening, enable integration of aluminum extrusions with steel, composites, and magnesium in complex architectures. Sustainability initiatives, including closed-loop recycling and low-carbon extrusion, strengthen the supplier value proposition.

Automotive aluminum extrusion manufacturing faces structural vulnerabilities from raw material disruptions, energy cost volatility, and logistics constraints that limit production flexibility and extend lead times required for just-in-time operations. Bauxite mining and alumina refining constraints restrict primary aluminum supply, with production concentrated among a few energy-intensive producers exposed to geopolitical risks.

Recycled aluminum competes with primary metal, with pricing dependent on scrap availability and uneven regional recycling infrastructure. Energy-intensive extrusion processes heighten sensitivity to fluctuations in electricity prices, especially in renewable-dependent grids. Fragmented supply chains across casting, extrusion, and finishing amplify disruption risks, while die development cycles constrain responsiveness.

Automotive aluminum extrusion development must comply with stringent industry standards, including IATF 16949 quality systems, ASTM, ISO, JIS, and DIN material specifications, crash safety testing, and corrosion validation, creating high entry barriers and limiting flexibility.

Qualification of crash management components requires extensive impact simulation, energy absorption analysis, and deformation validation, extending development timelines beyond conventional testing. Environmental compliance requirements, such as RoHS restrictions, conflict mineral reporting, and carbon accounting, add recurring costs.

Product liability and safety-critical requirements demand detailed documentation, failure mode analysis, and traceability, increasing engineering burden. Regional differences across North America, Europe, and the Asia Pacific force multiple variants.

Asia Pacific markets, particularly India, Vietnam, Thailand, and Indonesia, represent frontier growth opportunities for automotive aluminum extrusion demand, as vehicle manufacturing expands, electrification accelerates, and lightweighting policies gain traction.

India’s automotive sector is shifting toward EVs and weight reduction, supported by mobility programs, commercial vehicle modernization, and premium vehicle growth, creating diverse extrusion applications. Southeast Asian manufacturing is expanding as OEMs establish regional plants serving domestic and ASEAN markets, where localized aluminum extrusion reduces logistics costs and dependence on imports.

Government incentives promoting domestic aluminum processing, investments in extrusion capacity, and workforce skill development are improving regional supplier competitiveness.

China represents the largest global aluminum extrusion opportunity, with domestic suppliers advancing high-performance extrusion technologies for indigenous EV and commercial vehicle platforms. Industry estimates indicate that Chinese automotive aluminum extrusion demand is growing at over 10% annually through 2030, driven by EV penetration and lightweight platforms.

Automotive industry demand for optimized mechanical properties, thermal management, and corrosion resistance is driving development of specialized aluminum alloys, including 7000 series (aluminum-zinc) and proprietary formulations delivering superior strength-to-weight performance compared to conventional 6000 series alloys, supporting next-generation vehicle architectures.

Adoption of the 7000-series aluminum alloy for structural components offers the highest strength among aluminum alloys, with exceptional stress resistance. However, its lower corrosion resistance requires innovative coating and design strategies to enable expanded application environments.

Automotive OEM partnerships with aluminum suppliers for proprietary alloy development create sustained competitive advantages supporting premium vehicle positioning and differentiated performance characteristics.

Advanced heat treatment and precipitation hardening techniques enable 6000 and 7000 series alloys to achieve specialized mechanical properties optimized for specific component functions, supporting engineering flexibility and performance optimization.

Silicon carbide particle reinforcement and other composite manufacturing approaches are emerging as next-generation aluminum extrusion technologies, enabling further weight reduction and property enhancement, supporting autonomous vehicle development and extreme performance requirements.

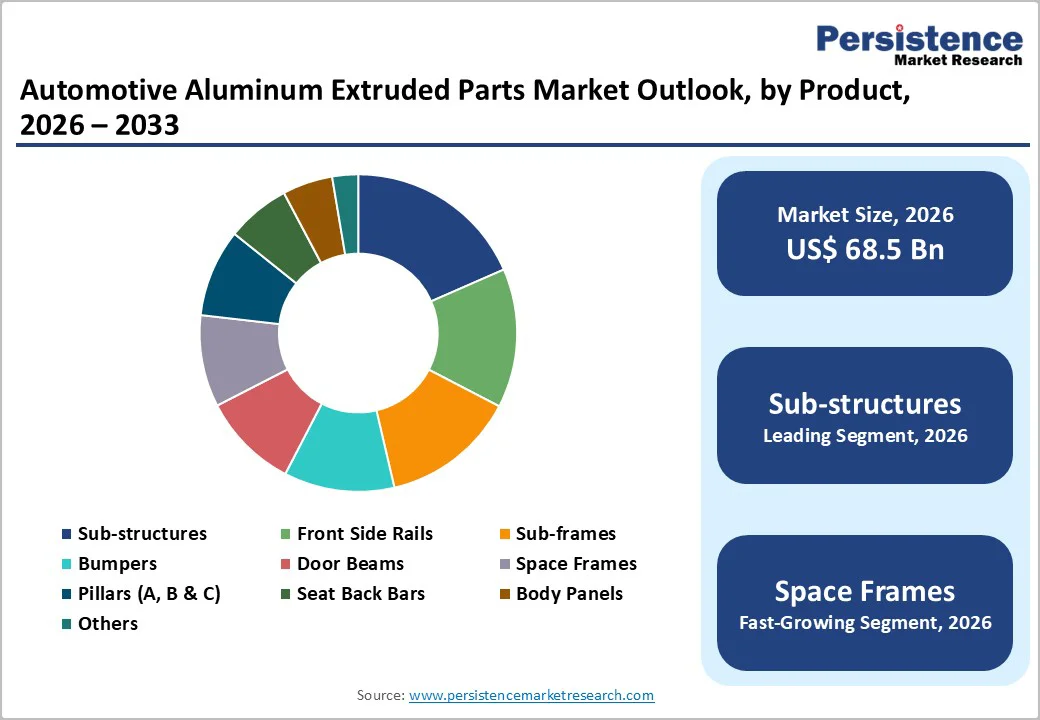

Sub-structures and chassis components are the leading automotive aluminum extrusion applications, accounting for 19% of global market share, driven by structural importance, weight reduction potential, and established supplier ecosystems. Longitudinal beams, cross-members, and sub-frame structures exploit aluminum’s high strength-to-weight ratio, reducing vehicle weight 20-30% versus steel while maintaining crashworthiness.

Multi-chambered extrusion geometries optimize energy absorption and minimize material use. Advanced CAD/CAM and finite-element analysis enable the creation of sophisticated profiles. EV battery pack substructures are a high-growth segment, with extrusion designs providing crash protection and thermal management, and modular interfaces supporting diverse battery configurations across platforms.

Space frame applications are the fastest-growing aluminum extrusion category, expanding at a 7.9% CAGR, driven by advanced vehicle architectures, autonomous platform preparation, and premium segment growth that emphasizes lightweight construction and flexibility. Space frame designs exploit extrusion versatility, enabling rapid prototyping and customization.

EV platforms are increasingly adopting space frames to optimize battery integration, weight distribution, and efficiency.

6000-series aluminum alloys (aluminum-magnesium-silicon) account for 42% of the global automotive extrusion market share, the preferred material specification for the majority of automotive applications due to excellent machinability, superior weldability, and a well-established supply chain ecosystem supporting high-volume production.

6061 and 6063 alloys dominate automotive extrusion applications, delivering an optimal balance of mechanical properties, cost-effectiveness, and process reliability, enabling consistent manufacturing quality across distributed supplier operations.

Environmental advantages, including recyclability, established thermal treatment protocols, and proven long-term performance supporting automotive validation standards, make 6000 series alloys the preferred specification for cost-sensitive vehicle segments and regions where supply chain maturity and manufacturing expertise concentration are highest.

The 7000-series aluminum alloys are the fastest-growing material category, expanding at an 8% CAGR, driven by lightweight architectures, autonomous platform requirements, and premium vehicle demand for maximum strength at minimal weight. 7075 alloys deliver fatigue resistance, enabling thin extrusions. OEM partnerships develop tailored 7000-series grades, where a 35-40% weight reduction versus steel justifies premium costs in EV and performance platforms.

Passenger cars represent the dominant automotive aluminum extrusion application, commanding 69% of market volume, driven by the installed base, standardization of OEM supplier relationships, and established manufacturing ecosystems that support high-volume production across global automotive manufacturers.

Passenger car segments, including compact cars, midsize sedans, luxury vehicles, and SUVs, each incorporate aluminum extrusions for specific structural components, enabling OEMs to optimize weight, safety, and performance characteristics for targeted market segments.

Premium and luxury vehicle segments exhibit disproportionately high aluminum extrusion content, with manufacturers prioritizing lightweight efficiency, performance differentiation, and sustainability credentials, thereby justifying premium material specifications and sophisticated component design.

Electric vehicles are the fastest-growing vehicle category, expanding at 12% CAGR, driven by accelerating adoption, incentives, and consumer shifts toward zero-emission mobility, creating new aluminum extrusion demand. EV platforms integrate extrusions for crash management, battery protection, and modular interfaces. Battery thermal management is critical, and aluminum extrusions offer high conductivity and an optimized geometry for heat dissipation and safety.

North America demonstrates strong automotive aluminum extrusion fundamentals, expanding at a prominent CAGR of 5.7%, driven by stringent EPA emissions standards, established OEM-supplier relationships, and significant EV platform development investment across major manufacturers, including Tesla, General Motors, and Ford.

The United States market is dominated by legacy automotive manufacturers and emerging EV companies, with aluminum extrusion adoption systematically increasing across powertrain, chassis, and structural components.

Government incentives, including the Inflation Reduction Act provisions allocating substantial funding for domestic EV manufacturing and lightweighting infrastructure development, are attracting capital investment, supporting regional manufacturing capacity expansion and technological advancement.

North American automotive aluminum extrusion suppliers, including Hydro Extrusions and Tri-Arrows Aluminum, dominate through strong customer relationships, comprehensive portfolios, and vertical integration from casting to finishing. Regulatory drivers such as NHTSA safety standards, EPA emissions standards, and state EV incentives accelerate adoption. Investments in lightweight materials, advanced extrusion technologies, and specialized alloys support innovation and competitive differentiation across multinational and regional suppliers.

Europe holds around 27% of the global automotive aluminum extrusion market, equating to US$18.3 billion in 2026 for the Europe Automotive Aluminum Extruded Parts Market, and is projected to expand at a CAGR of 5.2%, supported by strict environmental regulations, advanced automotive technology adoption, and strategic aluminum supply chain initiatives centered in Germany, the U.K., and the Benelux countries.

German automotive manufacturers, including Audi, BMW, and Mercedes-Benz, are systematically integrating aluminum extrusions into premium vehicle platforms, driving the need for sophisticated component specifications and advanced manufacturing requirements.

EU decarbonization mandates and progressive emissions reduction targets are systematically accelerating EV adoption, with European OEMs expanding aluminum extrusion adoption across lightweight platform development and battery thermal management applications.

European aluminum suppliers, including Constellium, Hydro, and regional specialists, maintain strong positions through established customer relationships, comprehensive product portfolios, and regional manufacturing presence.

Regulatory frameworks emphasizing product sustainability, material traceability, and environmental performance are creating favorable market conditions for advanced aluminum suppliers that demonstrate closed-loop recycling capabilities and low-carbon manufacturing practices, supporting EU sustainability objectives.

Asia Pacific dominates the global automotive aluminum extrusion market, commanding 41% regional market share and expanding at approximately 7.3% CAGR, driven by massive automotive production volumes, accelerating EV adoption, and vertically integrated supply chains supporting cost-competitive regional manufacturing.

China is the largest market driver, with over 17 million EV sales in 2024, domestic vehicle manufacturers deploying sophisticated aluminum extrusion-based structures, and government initiatives supporting the development of domestic aluminum suppliers.

Chinese automotive manufacturers including BYD, XPeng, and Geely are deploying advanced aluminum extrusion architectures supporting ultra-fast charging and extended range EV platforms, creating systematic demand growth.

Japan maintains a strong presence of aluminum extrusion suppliers, including Hydro, Constellium, and regional specialists, supporting high-volume automotive production and advanced vehicle development.

India is the fastest-growing Asia Pacific market, driven by EV adoption, expanding manufacturing, and vehicle electrification. Cost-competitive labor, established aluminum supply chains, and growing technical expertise enable Asian suppliers to meet regional demand and compete effectively in global markets.

The global automotive aluminum extrusion market is moderately consolidated, with multinational leaders like Constellium, Hydro, Aleris, Tri-Arrows, and Aluswiss dominating alongside regional specialists.

High entry barriers, including specialized manufacturing, qualification protocols, long development cycles, and capital intensity, limit competition. Integrated solution providers offering design, prototyping, manufacturing, and finishing gain competitive advantages, while regional specialists compete through expertise, flexibility, and customized support for OEMs and Tier-1 suppliers.

Strategic Developments (Post-2023)

The global automotive aluminum extruded parts market was valued at US$68.49 billion in 2026 and is projected to reach US$103.95 billion by 2033.

Market growth is driven by vehicle electrification, government emissions and fuel efficiency mandates requiring lightweighting, and advanced manufacturing enabling complex extrusion geometries, precision tolerances, and integrated designs consolidating multi-component assemblies while optimizing structural performance.

The market is projected to expand at 6.14% CAGR during the forecast period.

Key opportunities include automotive production expansion in India, Vietnam, and Southeast Asia with annual growth exceeding 10% through 2030, specialized alloy development including 7000 series for high-performance architectures, and integration of software-defined vehicle features requiring aluminum extrusions for heat dissipation, electrical shielding, and structural electronic component support.

Key players include Constellium, Hydro Extrusions, Tri-Arrows Aluminum, Aleris (Novelis), and Aluswiss, supported by regional specialists such as Pechiney, Aleona, Grangemouth, Nippon Light Metal, and Sumitomo Light Metals, with strategic initiatives focused on low-carbon aluminum, battery enclosure technologies, and sustainability supporting EV manufacturers’ environmental and competitive objectives.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author