ID: PMRREP34574| 198 Pages | 9 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

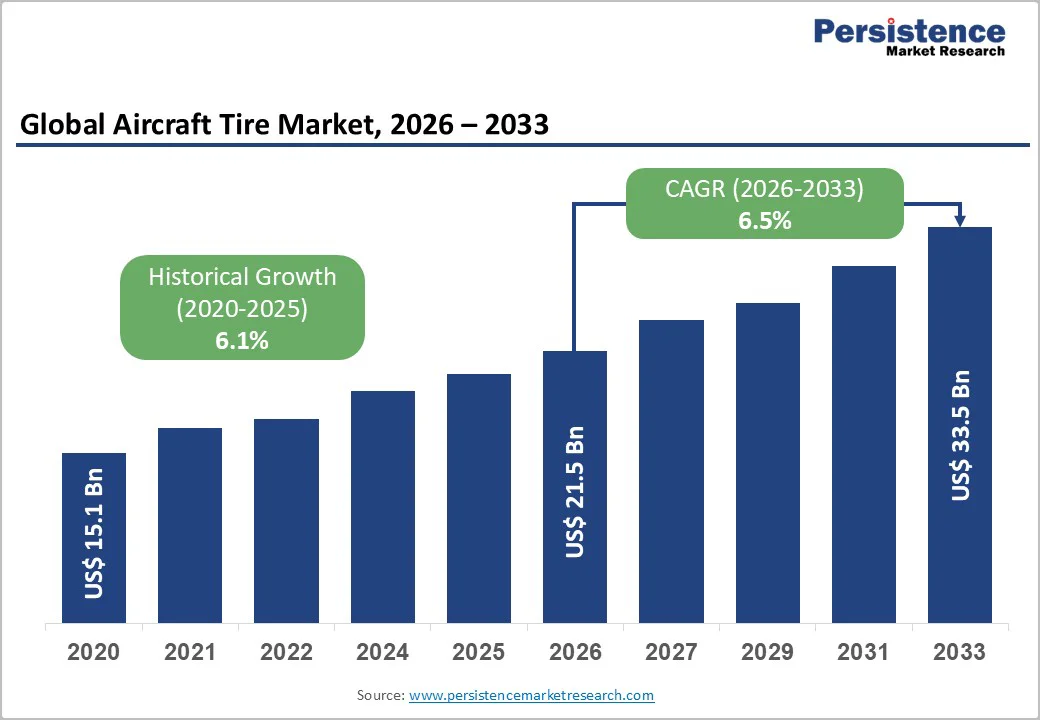

The global aircraft tire market size is likely to be valued at US$21.5 billion in 2026, and is expected to reach US$33.5 billion by 2033, growing at a CAGR of 6.5% during the forecast period from 2026 to 2033, driven by the rapid recovery of air travel, rising fleet expansion in emerging markets, and increasing demand for fuel-efficient radial tires.

High-performance, durable tires for narrow- and wide-body aircraft are driving commercial aviation demand. Innovations in retreadable, low-wear tires support cost-effective, sustainable solutions, while their role in safety and operational efficiency fuels market growth.

| Key Insights | Details |

|---|---|

| Aircraft Tire Market Size (2026E) | US$21.5 Bn |

| Market Value Forecast (2033F) | US$33.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.1% |

The rapid recovery of global air travel is creating strong momentum for the aircraft tire market, especially as airlines restore routes, increase flight frequencies, and induct new aircraft to meet rising passenger demand. As travel rebounds across domestic and international sectors, aircraft utilization rates have surged, leading to shorter tire replacement cycles and higher aftermarket consumption.

Low-cost carriers and major airlines alike are expanding operations, which directly boosts demand for reliable, durable, and high-performance tires.

The industry is witnessing a sharp shift toward fuel-efficient radial tires, driven by the need to reduce operating costs and support environmental sustainability goals. Radial tires offer lower rolling resistance, reduced weight, and improved heat dissipation, all of which contribute to better fuel efficiency and enhanced aircraft performance.

Their longer lifespan and superior retreadability make them more cost-effective over time compared to traditional bias-ply designs. As airlines prioritize both operational efficiency and carbon-reduction strategies, adoption of radial tires is accelerating across narrow-body, wide-body, and regional aircraft fleets.

High development and certification costs represent a major restraint in the aircraft tire market, largely due to the stringent safety, performance, and durability standards required in aviation. Aircraft tires must withstand extreme conditions, high landing impact loads, rapid acceleration, temperature fluctuations, and repeated stress cycles, which demand advanced materials, precise engineering, and costly R&D investments.

Developing such high-performance tires often involves extensive laboratory testing, full-scale simulations, and real-world field trials, all of which significantly increase production expenses.

Certification further adds to the financial burden. Regulatory bodies such as the FAA, EASA, and national defense authorities impose rigorous certification processes to ensure tires meet strict airworthiness and safety requirements. Manufacturers must undergo multiple rounds of compliance testing, documentation, and quality audits, which can take years to complete.

These processes require specialized equipment, expert engineers, and adherence to complex regulatory frameworks, driving up costs even before the tire enters commercial production.

Sustainable retreadable tires and emerging electric aircraft applications are becoming key focus areas in the aviation tire industry, driven by the sector’s broader transition toward lower emissions and cost-efficient operations. Retreadable tires, which can be refurbished and reused multiple times, significantly reduce waste generation and raw material consumption.

They help airlines cut operating costs by extending tire life while maintaining high safety and performance standards. Leading manufacturers are incorporating eco-friendly compounds, improved casing designs, and advanced inspection technologies to enhance retread reliability. As regulatory pressure for greener aviation intensifies, retreading is gaining strong acceptance across commercial and defense fleets, aligning with global sustainability goals.

The rise of electric aircraft and eVTOL platforms is reshaping future tire requirements. These aircraft demand lightweight, energy-efficient tires capable of supporting frequent takeoffs and landings, high torque during electric propulsion, and short-runway performance in urban environments. Tire makers are developing advanced composites, low-rolling-resistance materials, and heat-resistant structures tailored for electric aviation’s operational profile.

Radial tires are estimated to dominate the market, accounting for approximately 70% share in 2026, due to their superior durability, lower rolling resistance, and fuel efficiency, making them the preferred choice for modern commercial fleets. Their steel-belted radial construction ensures even load distribution and heat management, extending tread life and reducing maintenance, while bias tires remain relevant mainly in legacy military or specialized aircraft.

Recent developments include Michelin’s Air?X SKY LIGHT radial tire launched in 2023, offering 10-20% weight reduction and 15-20% longer service life, alongside advanced materials and sensor-enabled monitoring to enhance performance and safety in frequent takeoff and landing operations.

Rotary wing is likely to be the fastest-growing segment, fueled by increasing helicopter demand across defense, emergency services, offshore oil and gas, and medical evacuation operations.

Rising military procurement and expanded civilian applications, including search-and-rescue and border security, have intensified the frequency of takeoffs, landings, and operations in harsh environments, accelerating maintenance cycles and boosting demand for rotorcraft components.

For example, Airbus Helicopters reported 455 orders and 361 deliveries in 2024, its best performance since 2017. The launch of the Airbus H140 in March 2025 for medical evacuation and emergency services highlights growing investment in rotary-wing aircraft globally.

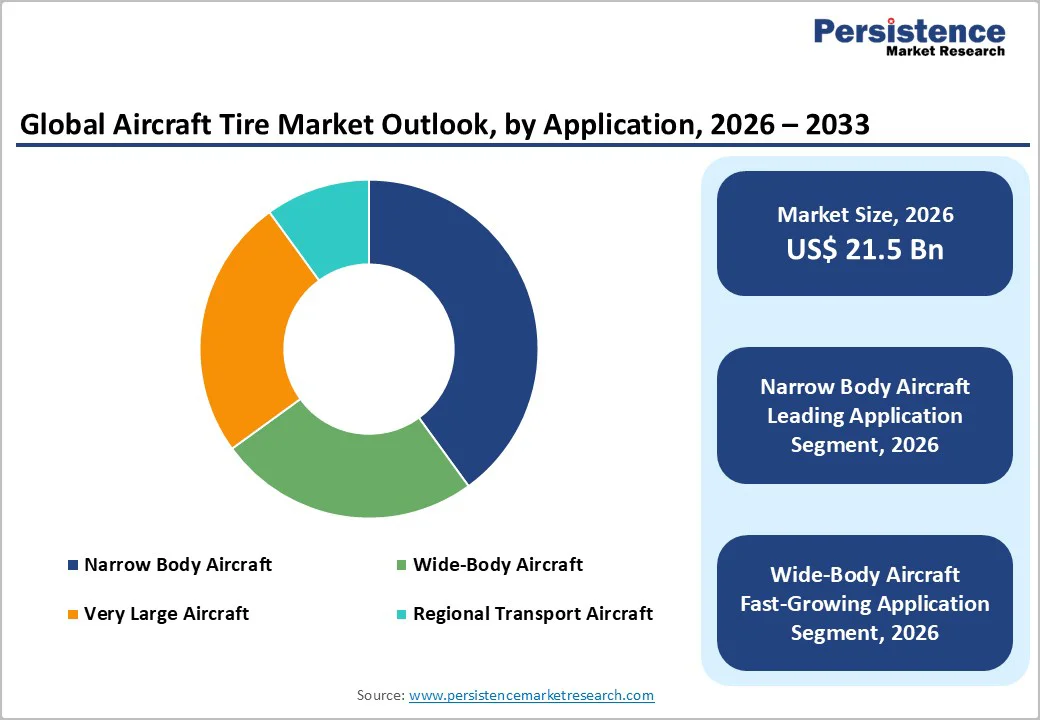

Narrow-body aircraft are expected to dominate, contributing nearly 45% of the revenue share in 2026, driven by intensive daily use on short-haul and medium haul routes where airlines operate frequent flights. High utilization accelerates wear on components and tires, driving shorter replacement cycles and increased aftermarket demand.

Growth is further supported by low-cost carriers and expanding domestic and regional air networks. Recent trends include large-scale orders for next-generation narrow-body jets, such as the Airbus A320neo and Boeing 737 MAX, adopted globally to modernize fleets and meet rising demand for efficient short- to medium-haul travel.

Wide-body aircraft are likely to be the fastest-growing, supported by the strong rebound in long-haul international travel and increasing demand for higher-capacity jets. New-generation models such as the Boeing 787 Dreamliner and Airbus A350, known for fuel efficiency, extended range, and enhanced passenger comfort, are boosting tire and component demand.

The surge in international travel has prompted airlines to expand and modernize fleets, increasing the need for high-performance aircraft tires. For example, Emirates Airlines has recently taken delivery of multiple Airbus A350s in 2025, highlighting the growing adoption of wide-body aircraft and the associated rise in aftermarket tire requirements.

The commercial segment is anticipated to dominate with over 75% share in 2026, driven by rapid global fleet expansion and rising passenger traffic. Rising orders for narrow- and wide-body aircraft, coupled with frequent tire replacements from high utilization, are driving strong demand.

The growth of low-cost carrier networks, which operate shorter routes with higher flight frequencies, further reinforces the commercial segment’s market dominance. Innovations like Goodyear Aero Corporation’s fuel-efficient “WingFoot?WF2” and Michelin’s lighter, longer-lasting radial tires demonstrate how manufacturers are meeting airlines’ demand with advanced products.

Military & defense is the fastest-growing, driven by extensive fleet modernization programs in countries such as the U.S., China, and India, leading to rising procurement of fighter jets, transport aircraft, helicopters, and support aircraft. This surge increases demand for high-performance components such as aircraft tires and landing gear tires built to endure extreme loads and frequent landing stresses.

As large-scale defense procurement and renovation accelerate, the need for reliable, durable spare parts and aftermarket replacements grows rapidly. For instance, recent advances in tire technology, such as the integration of aramid Kevlar in military grade aircraft tires, are enhancing friction, tensile strength, and heat resistance, making tires more suited for demanding military operations.

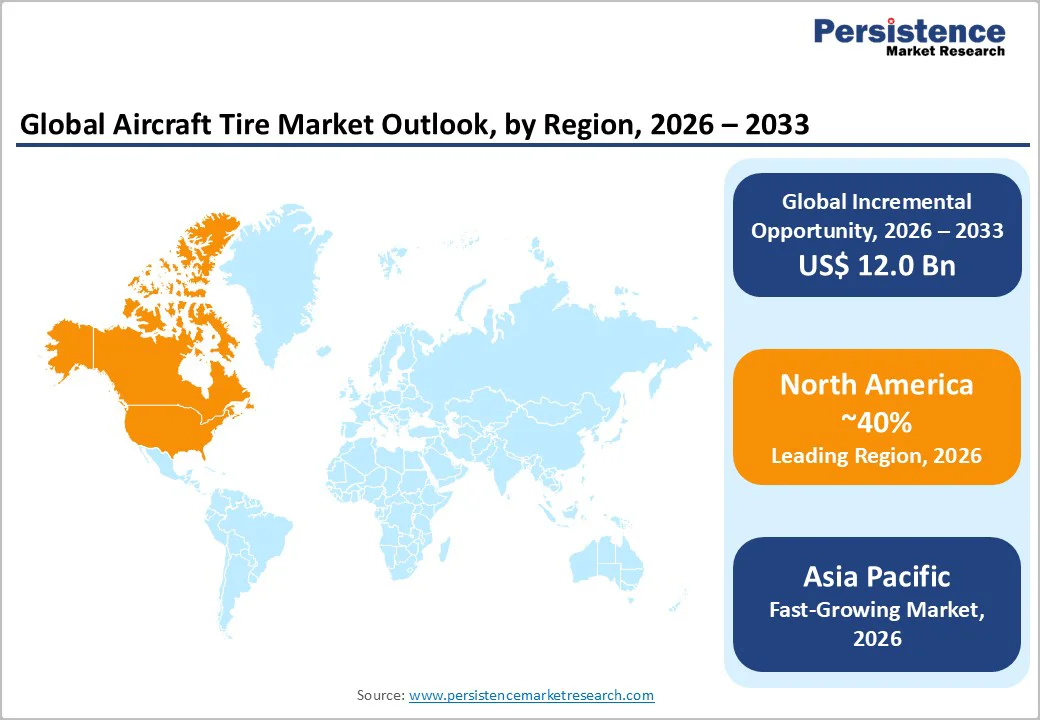

North America is projected to account for nearly 40% market share in 2026, supported by the region’s massive commercial aircraft fleet and a highly developed maintenance, repair, and overhaul (MRO) ecosystem. The U.S. leads the region, driven by its extensive airline networks, high aircraft utilization rates, and frequent tire replacement cycles.

The presence of major OEMs such as Boeing significantly boosts OEM tire demand, while continuous fleet modernization across major carriers such as American Airlines, Delta, and United supports strong aftermarket growth.

A key strength for North America is its exceptionally high retread adoption rate, which enhances cost efficiency for airlines while contributing to sustainability goals. Retreading reduces waste and extends tire life, aligning with the rising industry focus on eco-friendly aviation solutions.

The regional shift toward localized supply chains, accelerated by recent logistics disruptions, supports domestic tire production, faster delivery cycles, and stronger reliability for airlines and defense operators.

Europe is supported by strong aerospace manufacturing capabilities and a robust regulatory framework focused on sustainability. The region benefits significantly from Airbus’s large-scale aircraft production and deliveries, which create steady OEM and aftermarket demand for advanced aircraft tires.

Countries such as France, Germany, and the U.K. continue to play central roles, driven by high investments in green aviation technologies, enhanced MRO capabilities, and the modernization of commercial and military fleets.

A key growth driver in Europe is the increasing emphasis on environmental sustainability, where tire retreading and the development of low-emission compounds are receiving substantial support. The EU’s Fit for 55 packages, which aim to reduce carbon emissions by 55% by 2030, encourage manufacturers to innovate lightweight, fuel-efficient, and durable tire formulations.

This regulatory push is accelerating research in advanced elastomers, bio-based materials, and eco-friendly production processes.

Asia Pacific is likely to be the fastest-growing market, supported by surging air travel demand and substantial fleet expansion across China, India, and Southeast Asia. Rapid urbanization, rising middle-class populations, and the recovery of international tourism are driving airlines to place significant new aircraft orders, directly increasing the need for advanced radial tires with longer service life and better fuel efficiency.

China plays a crucial role in the development and scaling of the COMAC C919, which is gradually entering commercial service and creating fresh OEM and aftermarket tire demand.

India is also expanding rapidly, driven by aggressive growth strategies of low-cost carriers such as IndiGo and Akasa Air, alongside government programs to improve regional aviation connectivity. This leads to higher tire replacement cycles and strong demand for both narrow-body and regional aircraft tires. Rising defense budgets across Asia Pacific are accelerating procurement of fighter jets, transport aircraft, and helicopters.

The global aircraft tire market is highly competitive, dominated by certified manufacturers like Michelin, Bridgestone, and Goodyear. These leaders maintain strong positions through product innovation, advanced materials, and reliable retreading technologies that extend tire life and reduce airline costs.

Extensive global supply chains and partnerships with OEMs and maintenance providers ensure consistent demand across commercial, military, and general aviation. A focus on sustainability, including retreading and lightweight, fuel-efficient designs with superior heat resistance, further strengthens their market position. High certification standards, capital-intensive production, and stringent safety requirements pose significant barriers for new entrants.

The global aircraft tire market is projected to reach US$21.5 billion in 2026.

Rapid recovery of air travel and demand for fuel-efficient radial tires are the primary drivers.

The market is expected to grow at a CAGR of 6.5% from 2026 to 2033.

Sustainable retreadable tires and applications in electric/hybrid aircraft present major opportunities.

Michelin, Goodyear Tire & Rubber Company, Bridgestone Corporation, Dunlop Aircraft Tyres Ltd., and Petlas Tire Corporation are the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Platform

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author