ID: PMRREP33165| 235 Pages | 29 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

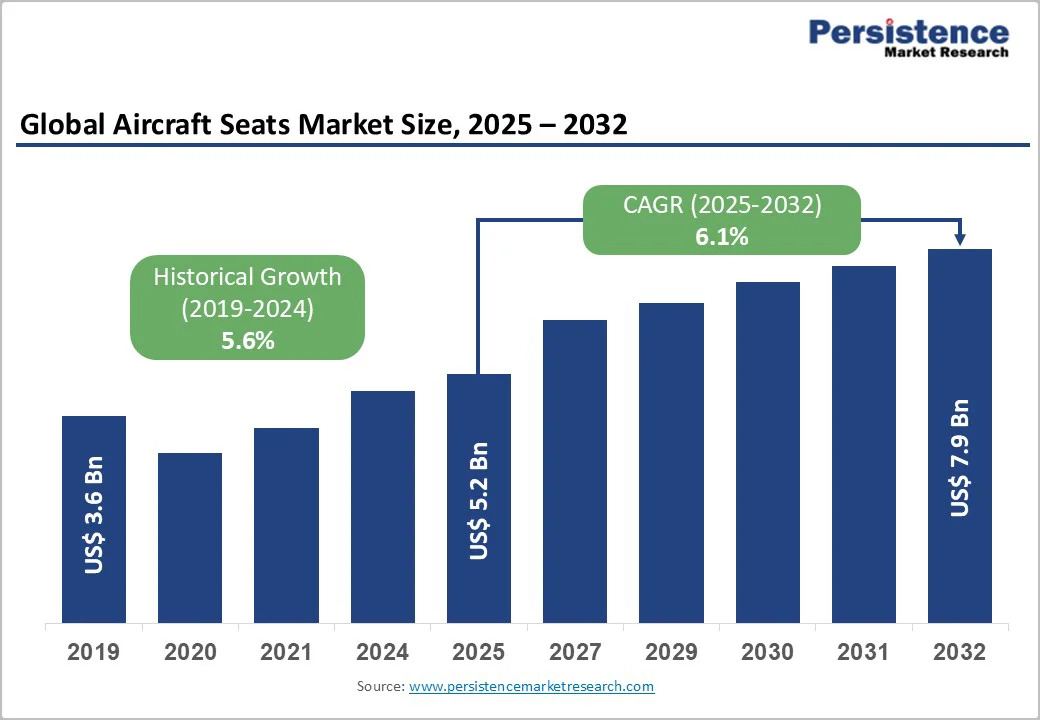

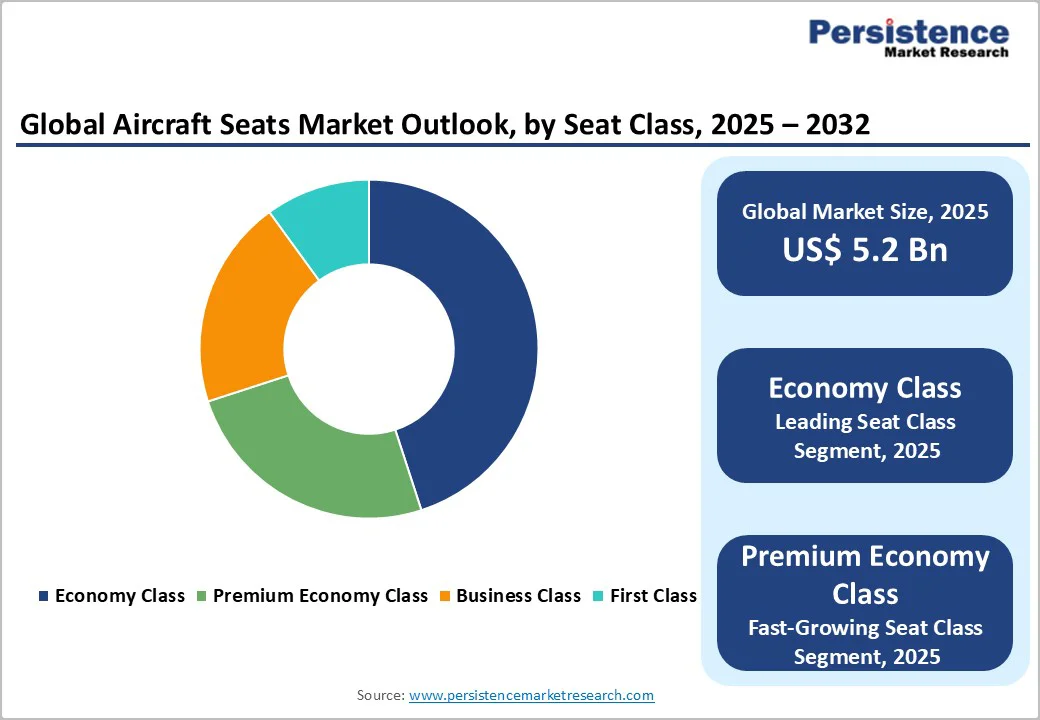

The global aircraft seats market size is valued at US$ 5.2 billion in 2025 and is projected to reach US$ 7.9 billion, growing at a CAGR of 6.1% between 2025 and 2032. The market expansion reflects sustained commercial aviation recovery with passenger traffic reaching pre-pandemic levels and exceeding historical growth rates, increasing aircraft deliveries supporting narrow-body fleet expansion averaging 3,900 units annually alongside wide-body growth, and strategic airline investment in premium cabin offerings delivering enhanced revenue per available seat mile.

|

Key Insights |

Details |

|

Aircraft Seats Market Size (2025E) |

US$ 5.2 Bn |

|

Market Value Forecast (2032F) |

US$ 7.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.6% |

Drivers - Rising Global Air Passenger Traffic and Fleet Expansion Requirements

Global aviation industry recovery with international and domestic passenger traffic exceeding pre-pandemic levels creates unprecedented aircraft delivery demand with commercial aircraft representing 46.8% of aircraft seating market value, driven by low-cost carrier expansion, liberation of aviation policies enabling competitive pricing, and emerging market aviation growth. Boeing's 20-year narrow-body demand forecast increased 160 units to 3,925 single-aisle aircraft through 2045, with 200-seat class models dominating regional fleets at 80% penetration reflecting global preference for efficient regional connectivity.

Asia Pacific passenger traffic forecast expanding at 8.8% CAGR, particularly in Philippines, Thailand, Vietnam demonstrates emerging market aviation acceleration, with Airbus projecting 1,750 new aircraft requirements for India over 20 years supporting domestic connectivity and international expansion. Wide-body aircraft orders declining modestly reflect long-range narrow-body introduction; however, Middle Eastern carriers maintain widebody preference with 42% of projected 4,000 aircraft regional deliveries through 2044 reflecting unique hub-and-spoke operational models.

Premium Cabin Expansion and Revenue Diversification Strategy

Strategic airline pivot toward premium cabin offerings, delivering 4-6% PRASM improvements creates substantial demand growth for premium economy and business class seats commanding 2-3x economy class pricing with significantly reduced seat counts per aircraft. Premium economy cabin adoption is expanding across 63+ carriers representing 84% aircraft fleet increase since 2022, with United Airlines reporting a Premium Plus cabin delivery of 4-6% PRASM uplift on equipped flights, while Air France-KLM achieved 27% year-over-year premium cabin revenue growth with 80% quarter-over-quarter increases.

Emirates' premium economy fleet retrofit program is operating at a breakneck pace, completing one aircraft every three weeks, with 67 aircraft completed and 219 aircraft retrofit target, including 110 A380s and 109 777s, projecting 2 million premium economy seat annual availability exceeding 1.8 million current supply. First-class segment maintaining exclusive luxury positioning, attracting high-net-worth individuals with limited seat availability and premium amenities including private suites, on-board shower facilities, and chef-inspired dining supporting substantial per-seat revenues.

Restraints - Stringent Regulatory Requirements and Certification Complexity

Aircraft seating manufacturing, subject to comprehensive regulatory compliance including FAA, EASA, and IATA fire resistance standards, crashworthiness requirements, and structural specifications creates extended development timelines, substantial R&D investment, and supply chain complexity constraining market entry for emerging manufacturers. Certification requirements demanding full-scale fire resistance testing, crash impact simulation, and structural load analysis necessitate specialized testing facilities and regulatory expertise available only to established manufacturers, creating 18–24-month development cycles and $5-15 million certification costs per seat design. Supply chain vulnerability affecting specialized components including actuators, mechanisms, and covers sourced from limited suppliers, creates procurement risks and pricing pressures during supply disruptions, with current industry experiencing extended lead times for customized actuator systems.

Economic Sensitivity and Fleet Utilization Pressures

Aircraft seating represents substantial OEM capital investment and airline operational expense, creating economic sensitivity where fuel price spikes, demand shocks, or economic recessions compress airline profitability and defer fleet expansion decisions reducing new aircraft orders and seating demand. Airline industry demonstrated vulnerability to demand shocks including COVID-19 pandemic impact with passenger traffic collapsing 80% and fleet retirements reducing new aircraft requirements, while current geopolitical tensions and Middle East conflicts create uncertainty affecting international route expansion. Leasing market dynamics affecting aircraft availability and pricing impact airline fleet decisions, with reduced lease rates during economic downturns incentivizing fleet retention rather than modernization limiting seating replacement demand.

Opportunities

Emerging Market Aviation Growth and Regional Connectivity Expansion

Rapidly expanding aviation networks across Asia Pacific, Latin America, and Middle East supporting emerging market economic growth create substantial aircraft seating opportunities with narrow-body and regional aircraft representing 85%+ of new aircraft requirements in developing regions. India aviation sector expansion requiring 1,750 new aircraft over 20 years supporting domestic connectivity and international expansion creates proportional seating demand from domestic carriers including Air India, Indigo, and SpiceJet prioritizing cost-effective solutions. Philippines, Thailand, Vietnam market growth forecast expanding passenger traffic 8.8% CAGR creates untapped seating opportunities as emerging carriers upgrade fleets and establish long-haul connectivity. LATAM premium economy retrofit program committing 41 sets of RECARO PL3530 seats for Boeing 787 fleet demonstrates emerging market carrier willingness to invest in premium offerings, with first deliveries commencing H1 2027. Market opportunity for emerging market aircraft seating estimated at $5-8 billion by 2032 as regional aviation expands.

Customization and Modular Seating Platform Development

Emerging demand for customizable modular seating architectures enabling airlines to rapidly reconfigure cabin layouts supporting dynamic market conditions, route changes, and passenger preference shifts creates opportunities for manufacturers developing flexible platforms supporting multiple cabin classes from single modular base. Modular design approaches enabling component reuse across narrow-body and wide-body platforms reduce certification complexity while supporting cost-effective customization, with Geven S.p.A. emphasizing modular architecture and customization differentiating competitive positioning. Seat actuation system integration enabling automated recline, entertainment control, and position adjustment creates premium differentiation supporting business and first-class segments, with market projected reaching USD 769 million by 2033 at 4.38% CAGR. Market opportunity for customized seating systems estimated at $3-5 billion by 2032 as airline operators seek competitive differentiation.

Aircraft Type Insights

Wide-body aircraft command strong market presence with a 36.8% revenue share, driven by long-haul operations, higher passenger capacity, and multi-class cabin layouts that support premium seating expansion. Platforms like the Boeing 777, Airbus A350, and 787 Dreamliner enable flexible configurations, while Middle Eastern carriers such as Emirates continue prioritizing wide-body fleets, projected to represent 42% of regional aircraft through 2044.

Narrow-body aircraft dominate with a 46.8% share and the fastest growth, supported by 200-seat configurations, 80% regional fleet penetration, and expanding low-cost carrier networks. The Boeing 737 and Airbus A320 families account for 70% of global single-aisle fleets, with A321neo/LR models enabling longer routes. Premium cabin adoption on narrow-bodies is rising as major U.S. airlines expand premium seating on 737 and A321 platforms.

Seat Class Analysis

Economy class leads the aircraft seating market with a 37.5% share, supported by the highest passenger volume and widespread deployment across all fleet types. High-density cabin layouts maximize revenue per flight, while standardized economy seat designs reduce manufacturing and installation complexity. Airlines differentiate offerings through pitch variations of 28–34 inches and seat widths of 17–18 inches, balancing comfort with regulatory compliance. Low-cost carrier growth further strengthens economy seating demand, contributing 41.7% of 2025 segment revenue.

Premium economy is the fastest-growing segment, rising 27% year-over-year as 63 airlines adopt it for its 6% PRASM uplift and strong passenger willingness to pay. With 38–40-inch pitch, wider seats, and upgraded services, premium economy retrofit programs—such as LATAM’s 41-aircraft initiative underscore accelerating market momentum.

Standard Outlook Insights

16G Standard – Market Dominant Configuration

16G seating standard commanding 79.09% market share reflecting mature aircraft certification baseline and widespread original equipment manufacturer deployment across narrow-body and regional aircraft platforms. 16G standard designation reflecting European standardization supporting EASA certification and regulatory harmonization enabling cross-operator fleet flexibility and spare parts commonality.

21G standard configuration emerging as fastest-growing segment supporting next-generation aircraft including Boeing 787 and Airbus A350 with enhanced weight reduction, advanced materials, and integrated technologies enabling premium cabin deployment and fuel efficiency improvements. 21G advanced certification baseline incorporating composite structures, integrated electronics, and lighter mechanisms reduces aircraft weight 40-60% supporting modern efficiency requirements.

End-user Insights

OEM segment commands 64.2% market share through primary demand from commercial aircraft production, with leading manufacturers Boeing and Airbus generating proportional seating procurement for new aircraft delivery. OEM partnerships enabling integrated logistics, just-in-time installation, and lifecycle management support factory standard interiors from aircraft delivery supporting predictive maintenance and enhanced passenger experience.

Aftermarket segment grows 6-8% annually independent of new aircraft delivery supporting fleet modernization, premium cabin retrofits, and sustainability upgrades, with 25,000+ active aircraft fleet creating substantial retrofit opportunity. Airlines conducting major retrofit programs, including Emirates' $5 billion fleet modernization demonstrate substantial aftermarket investment scale.

North America Aircraft Seats Market Trends

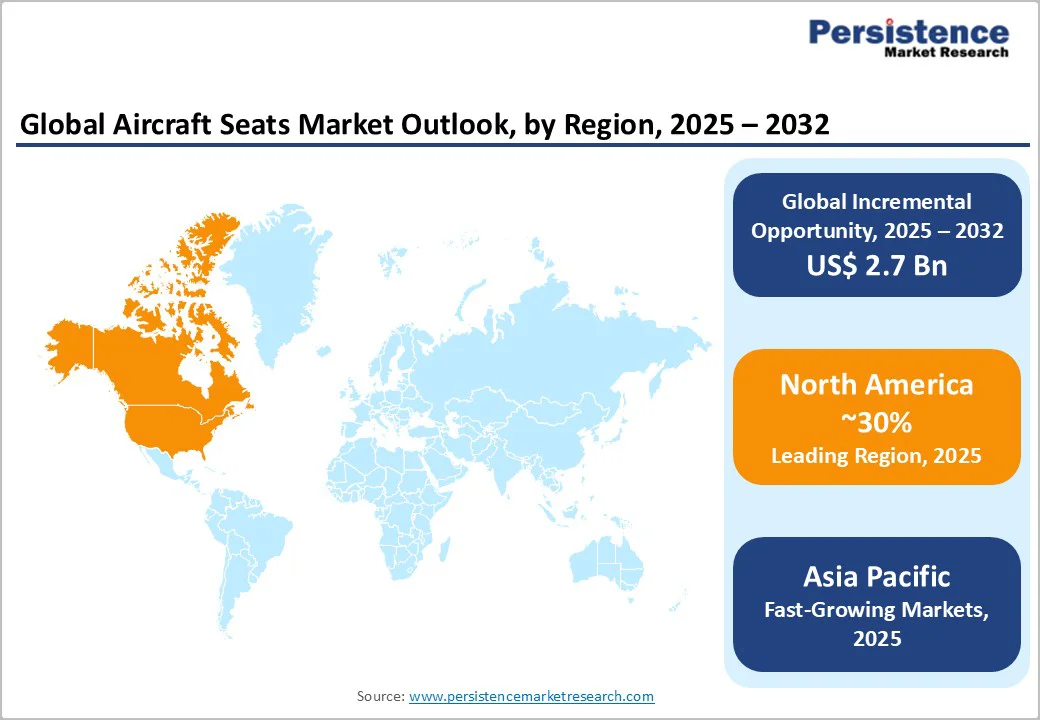

North America generates approximately US$2.5 billion market value in 2025 representing 30% global market share, growing at 5.0% CAGR through 2032, driven by established aviation industry, low-cost carrier dominance, and premium cabin expansion by major carriers. The United States dominates the regional market commanding 77% North American share through fleet leadership of American, United, and Delta airlines, operating 4,000+ commercial aircraft with premium cabin retrofit programs accelerating. U.S. premium seat growth outpacing economy expansion with 14% premium seat increase versus 4% economy growth since 2019 reflects strategic airline positioning on profitable routes. Commercial aircraft manufacturing in Washington State and Arizona supporting Boeing production generates substantial OEM seating procurement providing regional industry strength.

Europe

Europe represents US$5.1.9 billion market in 2025 capturing 22% global market share growing at 4.8% CAGR through 2032, characterized by manufacturing leadership, premium carrier presence, and regulatory harmonization supporting standardized solutions. Germany leads European market with 28% regional share through industrial manufacturing excellence, Airbus production supporting seating procurement, and established seat manufacturers RECARO and Safran Seats headquartered in region.

RECARO Schwäbisch Hall headquarters supporting continuous innovation in ergonomic design and lightweight materials differentiates European positioning. French aviation industry supporting Safran Seats development, manufacturing leadership, and strong partnerships with major carriers including Air France-KLM driving premium cabin expansion.

Asia Pacific

Asia Pacific represents fastest-growing region at approximately 8.2% CAGR through 2032, with estimated market value reaching US$2.1billion by 2032 comprising 25% global market share by 2032, driven by narrow-body fleet dominance, emerging market aviation growth, and manufacturing advantage positioning. China dominates Asia Pacific with 34% regional share through commercial aircraft production supporting 26+ million vehicle global market equivalent seating demand, emerging carrier growth including Chinese carriers, and government support for aviation industry expansion.

India aviation sector expansion at 12% CAGR supporting 1,750 aircraft requirement through 2045 creates proportional seating demand from domestic carriers and regional connectivity emphasis. Southeast Asian passenger traffic expansion at 8.8% CAGR particularly Philippines, Thailand, Vietnam creates sustained seating demand for emerging regional carriers and connectivity network expansion. Japan maintains regional presence through carriers including ANA and JAL operating modern aircraft with premium offerings and regional manufacturing expertise.

The aircraft seats market exhibits high consolidation with leading players commanding approximately 60% combined market share, while regional specialists capture growing segments through specialized applications and geographic coverage.

Safran Seats emerges as the market leader with an estimated 18% global market share through a comprehensive product portfolio, integration capabilities, R&D investment, and worldwide airline partnerships.

Collins Aerospace maintains competitive positioning with an estimated 14% market share through heritage in aircraft interiors, integration with propulsion and avionics systems, and commercial/military applications.

The Aircraft Seats market is estimated to be valued at US$ 5.2 Bn in 2025.

The primary demand driver for the aircraft seats market is the increase in global air passenger traffic, which pushes airlines to expand and modernize their fleets. This growth is driven by rising disposable incomes, rapid urbanization, tourism expansion, and strong air travel adoption in emerging economies.

In 2025, the North America region will dominate the market with an exceeding 30% revenue share in the global Aircraft Seats market.

Among the Standard Outlook, 16G holds the highest preference, capturing beyond 79.1% of the market revenue share in 2025, surpassing other parts.

The key players in the Aircraft Seats market are STELIA Aerospace (Airbus SE), Safran SA, RECARO Holding GmbH and Collins Aerospace (Raytheon Technologies).

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Aircraft Type:

By Seat Class:

By Fit Type:

By Seat Type:

By Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author