ID: PMRREP3374| 210 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

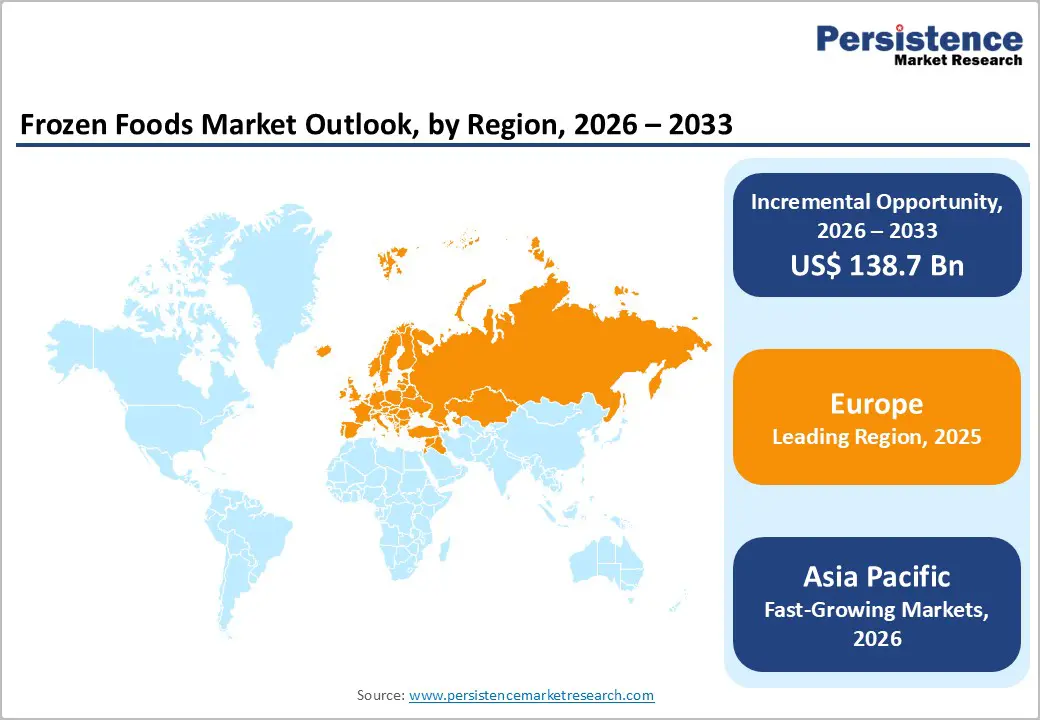

The global frozen foods market size is likely to be valued at US$ 311.6 billion in 2026 and is projected to reach US$ 450.3 billion by 2033, growing at a CAGR of 5.4% during the forecast period from 2026 to 2033.

Frozen foods are moving beyond convenience to become a lifestyle-driven category, blending nutrition, global flavors, and ready-to-eat solutions for modern, time-pressed consumers. Innovation, premiumization, and digital-first strategies are shaping the competitive landscape, while subscription models and plant-based offerings unlock new growth avenues.

| Key Insights | Details |

|---|---|

| Global Frozen Foods Market Size (2026E) | US$ 311.6 Bn |

| Market Value Forecast (2033F) | US$ 450.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.6% |

Morning routines, work-from-home schedules, and time-compressed lifestyles are reshaping how meals are chosen, pushing frozen foods into everyday consumption rather than emergency use. Consumers increasingly seek nutritious, ready-to-eat options that deliver balanced meals without lengthy preparation, driving demand for frozen bowls, protein-rich entrées, and vegetable-forward sides. Single-serve formats appeal strongly to urban households, students, and professionals who value portion control, reduced food waste, and predictable nutrition in busy routines.

Product innovation is strengthening this shift as brands upgrade recipes with cleaner labels, improved textures, and better nutrient retention through advanced freezing technologies. Health-focused frozen meals now align with fitness goals, calorie management, and special diets, expanding relevance beyond convenience alone. Retailers are allocating more freezer space to premium, wholesome offerings, reinforcing frozen foods as a practical solution for modern, nutrition-aware consumers.

Temperature integrity sits at the heart of frozen food safety, and even minor cold-chain lapses can trigger major operational setbacks. Breaks during storage, transportation, or last-mile delivery raise the risk of microbial growth, texture degradation, and compromised shelf life. Once temperature abuse is detected, brands face immediate product withdrawal, damaging retailer trust and disrupting supply continuity across multiple channels.

Processing failures further amplify recall exposure, especially when automation errors, packaging seal defects, or sanitation gaps go unnoticed. Recalls generate cascading costs linked to reverse logistics, product disposal, regulatory compliance, and crisis communication. Beyond direct financial losses, brand credibility suffers long-term erosion as consumers associate frozen foods with safety concerns. These risks force manufacturers to invest heavily in monitoring systems and redundancy, raising operating costs and limiting margin flexibility.

Freezer aisles are evolving into lifestyle destinations as consumers seek premium, plant-based, and function-forward meals that match wellness goals without sacrificing convenience. Introducing frozen ranges built around clean ingredients, bold global flavors, and targeted benefits such as high protein, gut health, or calorie control creates strong differentiation for brands. These products appeal to flexitarians, busy professionals, and health-driven households willing to pay for quality, taste, and nutritional intent packed into ready meals.

Subscription-led D2C frozen boxes unlock a parallel growth engine by bypassing retail constraints and building direct consumer relationships. Curated monthly menus, limited-edition drops, and personalization based on dietary preferences increase repeat purchases and data-driven innovation. Startups gain speed and brand intimacy, while established players extend margins, test concepts faster, and future-proof portfolios through predictable demand and loyalty-driven scale.

Meat & Seafood holds approx. 33% market share as of 2025, anchoring the global frozen food market through its strong association with protein intake, meal satisfaction, and culinary versatility. Consumers trust frozen meat and seafood for consistent quality, longer shelf life, and portion control, especially in busy households and foodservice operations. Advances in freezing, glazing, and packaging preserve texture and flavor, making frozen formats a reliable substitute for fresh proteins across retail and horeca channels.

Fruits & vegetables benefit from convenience and reduced waste, supporting everyday cooking needs. Dairy products remain relevant through frozen cheese and dessert applications. Ready meals continue gaining traction for time-poor consumers seeking complete solutions. Bakery & confectionery leverage frozen dough and desserts for freshness on demand. Snacks and appetizers thrive on indulgence and social eating occasions, rounding out a diverse yet protein-led frozen ecosystem.

Ready to Eat frozen foods are projected to grow at a CAGR of 8.8% during the forecast period in the global Frozen Foods market, reflecting a decisive shift toward convenience-led eating habits. Time-pressed consumers are increasingly choosing heat-and-serve meals that eliminate preparation without compromising taste or nutrition. Urbanization, dual-income households, and evolving work patterns are accelerating demand for dependable meal solutions that fit busy schedules. Improvements in flash-freezing and recipe formulation are enhancing texture, flavor retention, and portion consistency, strengthening consumer confidence in ready meals.

Rising acceptance across foodservice, retail, and online grocery channels is further fueling growth. Brands are expanding menus with global cuisines, balanced nutrition profiles, and cleaner ingredient lists to meet modern preferences. Single-serve packs, family trays, and premium variants are widening appeal, positioning ready-to-eat frozen foods as everyday staples rather than occasional substitutes.

Europe holds approximately 34% market share in the global frozen foods market, shaped by mature consumption habits and accelerating premiumization across retail and foodservice. Demand is shifting toward nutritionally balanced, clean-label frozen meals that balance convenience with quality. Shoppers increasingly expect shorter ingredient lists, reduced additives, and restaurant-style textures, pushing manufacturers to refine recipes and freezing technologies. Sustainability-focused packaging and portion control are influencing purchasing decisions across urban and suburban households.

Germany is driving growth in frozen bakery, plant-based meals, and value-for-money family packs, while France is advancing premium frozen ready meals inspired by culinary tradition. The UK continues to expand frozen snacking, international cuisines, and online grocery-led distribution. Spain shows strong traction for frozen seafood and tapas-style formats, while Italy is blending frozen pasta, pizza, and vegetable dishes with authentic regional flavors to support everyday consumption.

Asia Pacific Frozen Foods Market is expected to grow at a CAGR of 8.6%, driven by rapid urbanization, evolving eating habits, and rising reliance on time-saving meal solutions. Busy lifestyles across major cities are increasing demand for frozen ready meals, snacks, and protein-rich offerings that balance convenience with taste. Improvements in cold-chain infrastructure and wider freezer penetration are expanding access beyond metro areas, supporting steady category penetration.

India is witnessing growing demand for frozen parathas, snacks, and ready gravies, while China is accelerating adoption of frozen dumplings, seafood, and hotpot ingredients through e-commerce. Japan continues to innovate with portion-controlled, premium frozen meals focused on quality and nutrition. South Korea is fueling growth through frozen Korean cuisine and air-fryer-friendly formats. Thailand is expanding frozen seafood and export-oriented ready meals aligned with global taste preferences.

The global frozen foods market reflects a moderately consolidated structure, where multinational brands coexist with agile regional players and fast-scaling startups. Leading companies are strengthening processing capabilities through advanced freezing technologies, automation, and cleaner formulations to extend shelf life while preserving taste. Domestic production expansion is gaining momentum as firms reduce import dependence and respond faster to local preferences shaped by evolving consumption habits.

Startups are entering with niche offerings, digital-first branding, and D2C distribution models that improve margin control and consumer data access. AI-driven demand forecasting and cold-chain optimization are improving inventory efficiency and reducing waste across supply networks. Collaborations between processors, logistics firms, and retailers are accelerating market reach. Governments are tightening food safety, labeling, and cold-storage regulations, pushing players to invest in compliant infrastructure and transparent operations.

The global frozen foods market is projected to be valued at US$ 311.6 Bn in 2026.

Rising consumer demand for nutritious, ready-to-eat meals and single-serve convenience is accelerating the growth of the global Frozen Foods market.

The global Frozen Foods market is poised to witness a CAGR of 5.4% between 2026 and 2033.

Launching premium plant-based frozen meals with subscription D2C models offers strong growth potential and recurring revenue opportunities.

Major players in the global Frozen Foods market include Nestlé, Cargill, Incorporated, Unilever, Associated British Foods plc, Grupo Bimbo, Tyson Foods, Inc., General Mills, Inc., Hormel Foods Corporation, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Nature

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author