ID: PMRREP33422| 190 Pages | 15 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

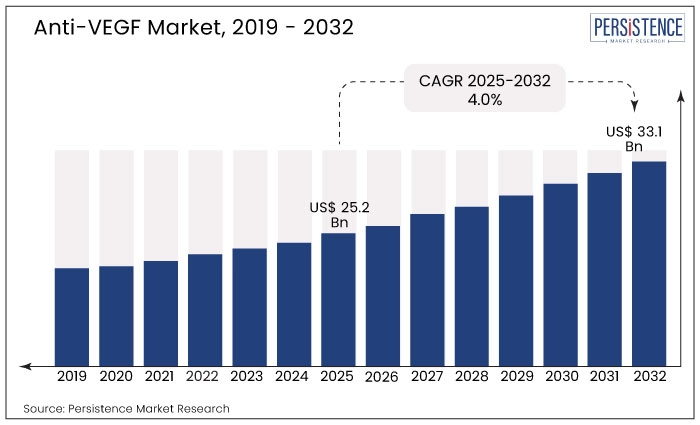

The Global Anti-Vascular Endothelial Growth Factor Market was valued at US$ 25.2 Billion in 2025 and is forecasted to grow at a CAGR of 4.0% to reach US$ 33.1 billion by the end of 2032.

Anti-VEGF, also known as vascular endothelial growth factor (VEGF) inhibitors, is a type of targeted therapy used in the treatment of cancer. These inhibitors work by blocking the activity of VEGF, a protein that stimulates the growth of blood vessels. VEGF inhibitors can prevent the growth of new blood vessels, which can limit the supply of nutrients and oxygen to cancer cells, ultimately leading to their death.

VEGF inhibitors are used to treat several types of cancer, including kidney cancer, colorectal cancer, ovarian cancer, and non-small cell lung cancer. They are typically used in combination with other cancer therapies, such as chemotherapy or radiation therapy, to improve patient outcomes. From 2019 to 2032, sales of VEGF inhibitors increased significantly, driven by the rising prevalence of cancer and the extensive use of targeted therapies in cancer treatment.

The United States has been a significant market for VEGF inhibitors, accounting for a large share of the global market. Sales of VEGF inhibitors in other regions, such as Europe, Asia Pacific, and Latin America, have also been growing rapidly. This growth is due to increasing access to cancer treatments, growing awareness about the benefits of targeted therapies, and improving healthcare infrastructure in developing countries.

| Report Attributes | Details |

|---|---|

|

Anti-VEGF Market Size (2025) |

US$ 25.2 Billion |

|

Estimated Market Value (2032) |

US$ 33.1 Billion |

|

Value-based CAGR (2025 to 2032) |

4.0% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

3.2% |

“Increasing Regulatory Approvals Validating Use of VEGF Inhibitors”

Manufacturers comply with the regulatory approval process to obtain licenses for introducing Vascular Endothelial Growth Factor inhibitors to the global market. Such approvals comply with clinically evaluated guidelines, ensuring their safety for marketing and clinical utilization.

New product approvals are expected to drive product sales and provide prospects for manufacturers to present a diverse and innovative product portfolio. Rise in the popularity of combination medicines and the expansion of clinical trials to address associated problems will have a favorable effect on sales of VEGF inhibitors in the coming years.

Advancements in ocular drug delivery will boost demand for these inhibitors during the forecast period. Cutting-edge developments such as dendrimer-encapsulated drug molecules, which allow for a controlled release in the intraocular space, have entered preclinical trials.

Liposomes can encapsulate various types of molecules despite their physiochemical properties, and liposome intravitreal injections for retinal disorders have been investigated. All the above factors will contribute to the demand for VEGF inhibitors during the forecast period.

“Adverse Effects Associated with Utilization of VEGF Inhibitors”

While anti-angiogenic drugs, particularly those that target the vascular endothelial growth factor (VEGF), have been added to the clinical inventory against cancer, their use has been associated with adverse effects.

The occurrence and severity of these effects vary significantly between studies. Bleeding is one of the most serious and challenging to treat. Epistaxis, hemoptysis, and gastrointestinal bleeding are the problems that occur most frequently with the use of bevacizumab. Because these side effects are at least partially inherent to the effectiveness of the treatment and there is an increase in the risk of thrombosis, both arterial and venous, managing bleeding in patients using VEGF inhibitor medications is challenging.

Vascular endothelial growth factor inhibitors are the main treatment for neovascular age-related macular degeneration (AMD). There are now four biologics approved for the treatment of neovascular AMD: Aflibercept, ranibizumab, brolucizumab-dbll, and bevacizumab, which is used off-label. Despite significant clinical advantages, VEGF inhibitors are expensive.

Off-label bevacizumab has replaced on-label bevacizumab as the norm in many hospitals in the United States and several European nations due to these price disparities, which will negatively affect the market.

Why Makes the United States a Lucrative Market for Manufacturers of VEGF Inhibitors?

“Rising Prevalence of Cancer and Patients’ Access to Advanced Treatment Options”

The United States accounted for 95.2% of the North American anti-VEGF market in 2024. Sales of VEGF inhibitors in the United States are increasing due to several factors.

The incidence of cancer is on the rise in the United States, and it remains one of the primary causes of death, especially in the aging population. VEGF inhibitors play a crucial role in cancer treatment, and their efficacy in treating various types of cancer has fueled the demand for these drugs.

The healthcare system in the country is one of the most advanced in the world, with access to the latest diagnostic tools and treatment options. This allows patients to receive the best available care, including VEGF inhibitors, which are often expensive.

Presence of key players in the country is contributing to the growth of the market for anti-VEGF drugs.

How is the Demand for Anti-VEGF Drugs Shaping Up in China?

“Increasing Government Funding for Efficient Healthcare Systems Boosting Demand for Anti-VEGF Drugs”

China accounted for 48.7% of the East Asia anti-VEGF market in 2024.

China is emerging as a prominent market for VEGF inhibitors due to several factors. China has a large aging population, which has led to an increase in the incidence of cancer. Cancer is a leading cause of death in China, with lung, liver, and stomach cancers being the most common. There is a growing demand for effective cancer treatments, including VEGF inhibitors.

The Chinese government has taken steps to improve access to healthcare and reduce the cost of medical treatments, including cancer therapies.

What is the Demand Outlook for Anti-VEGF Drugs in Australia?

“Increasing Utilization of Combination Therapies Involving VEGF Inhibitors for Cancer Treatment”

Australia held a 72.1% share of the Oceania anti-VEGF market in 2024.

Australia is a developed country with a strong healthcare system and a high incidence of cancer, making it a potential market for VEGF inhibitors. The country has one of the highest cancer incidence rates in the world. VEGF inhibitors have been approved for the treatment of several types of cancer in Australia, including kidney cancer, colorectal cancer, ovarian cancer, and non-small cell lung cancer. The use of VEGF inhibitors in combination with other cancer therapies has been shown to improve patient outcomes.

Why is There High Demand for Biologics?

“Biologics Popular Due to Their High Specificity and Longer Half-life”

Biologics held a 73.3% share of the global market in 2024. Growing demand for biologics can be attributed to various factors such as their efficacy, specificity, and longer half-life.

Manufacturers of biologics are often granted patents, which provide them with exclusive rights to the market for a certain period, enabling them to charge premium prices and recover their R&D costs. The regulatory approval process for biologics is usually more complicated and time-consuming compared to small molecule inhibitors, making it difficult for competitors to enter the market, which contributes to the sustained high demand for biologics.

Which VEGF Inhibitor Accounts for High Sales?

“Growing Demand for VEGF-A Inhibitors Due to Their High Efficacy in Treating Multiple Cancer Types”

VEGF-A inhibitors accounted for a market share of 49.1% in 2024. VEGF-A is a well-known and well-studied form of VEGF, and it plays a key role in the formation of new blood vessels, which is important in cancer growth and metastasis.

Various VEGF-A inhibitors are available in the market, such as ranibizumab, aflibercept, and the widely used bevacizumab (Avastin), which is approved for treating several types of cancer.

Ranibizumab, sold under the brand name Lucentis, is indicated for the treatment of age-related macular degeneration, diabetic macular edema, and other eye diseases. Aflibercept, marketed under the brand name Eylea, is approved for the treatment of age-related macular degeneration, macular edema, and some types of cancer.

What are the Reasons for the Widespread Use of VEGF Inhibitors in the Field of Oncology?

“High Incidence and Prevalence of Cancer”

Anti-VEGF drugs for oncology held a market share of 95.5% in 2024.

VEGF is known to play a key role in tumor growth and metastasis by promoting the formation of new blood vessels. By inhibiting VEGF, anti-VEGF drugs can slow or halt the growth and spread of cancer.

The high prevalence of cancer, the well-established role of VEGF inhibitors in cancer treatment, regulatory approvals, robust clinical evidence, and a large market opportunity are all factors that have contributed to making oncology a dominant disease indication segment.

The competition landscape in this market is in a perpetual state of flux, as novel drugs are being formulated and endorsed for various categories of cancer. Leading contenders in this field are prioritizing licensing agreements and obtaining approval from regulatory entities to sustain their current market position, while also augmenting and diversifying their range of products.

Persistence Market Research has tracked recent developments related to companies in the anti-VEGF market, which are available in the full report.

It is expected to reach US$ 33.1 Billion by 2032.

The market was valued at US$ 25.2 Billion in 2025.

The market is projected to grow at a CAGR of 4.0%.

Biologics dominated with a 73.3% market share.

VEGF-A inhibitors lead with a 49.1% market share.

| Attributes | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

Value: US$ Bn, Volume: As applicable |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Covered |

|

| Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

By Drug:

By Type:

By Disease Indication:

By Distribution Channel:

Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author