ID: PMRREP13120| 189 Pages | 10 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

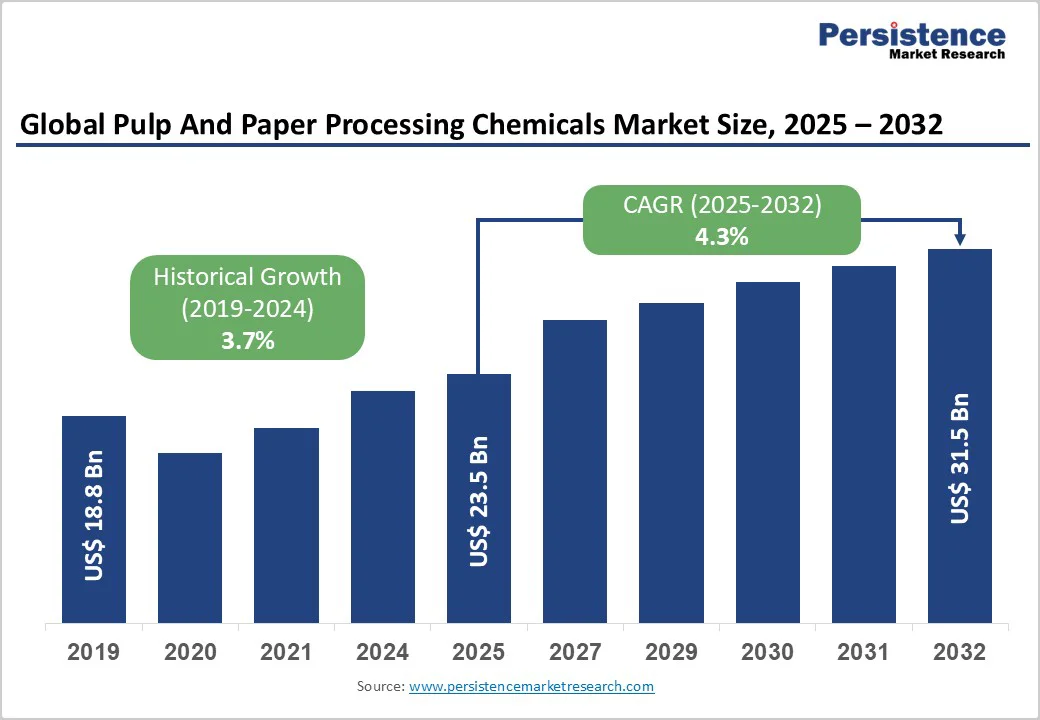

The global pulp and paper processing chemicals market size is likely to value at US$ 23.5 billion in 2025 and is projected to reach US$ 31.5 billion by 2032, growing at a CAGR of 4.3% between 2025 and 2032.

This trajectory reflects the pulp and paper industry's persistent reliance on specialised chemical formulations to enhance production efficiency, improve paper quality, and meet increasingly stringent environmental standards.

| Key Insights | Details |

|---|---|

| Pulp and Paper Processing Chemicals Market Size (2025E) | US$ 23.5 Bn |

| Market Value Forecast (2032F) | US$ 31.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.7% |

The explosive growth of global e-commerce has fundamentally reshaped packaging demand patterns, creating sustained pressure for corrugated and paperboard materials that require specialized chemical treatments. E-commerce gross merchandise value continues to climb in double digits worldwide, with China's 165 cross-border pilot zones alone processing nearly 20 million packages daily in 2024, underscoring how country-level GMV expansion directly fuels corrugated and mailer consumption.

According to the American Forest & Paper Association (AF&PA), U.S. containerboard capacity represents over 50% of total paper and paperboard capacity, with the operating rate reaching 87.5% in 2024 a nearly four-percentage-point increase from 2023 reflecting improved utilization of existing assets.

India's e-commerce business is expected to grow from $29 billion in 2020 to just over $100 billion by 2025, driving a growing need for packaging materials including corrugated boxes, cartons, and wrapping papers.

This structural shift necessitates higher consumption of functional chemicals such as wet-strength resins, sizing agents, retention aids, and coating binders that enhance paper durability, printability, and moisture resistance essential properties for protective packaging applications in last-mile delivery logistic.

Regulatory frameworks across developed and emerging economies are imposing increasingly rigorous standards on effluent discharge, emissions control, and chemical safety, compelling pulp and paper manufacturers to adopt environmentally compliant processing chemicals.

The Central Pollution Control Board (CPCB) in India has established Charter 3.0 norms for treated effluent quality, setting limits for Total Suspended Solids (TSS) at less than 30 mg/l, Biochemical Oxygen Demand (BOD) at less than 20 mg/l, and Chemical Oxygen Demand (COD) at less than 200 mg/l for integrated pulp and paper industries producing chemical pulp.

The U.S. Environmental Protection Agency's Pulp and Paper Production MACT standards require mills to collect and incinerate pulping process vent emissions, control bleaching process vent emissions with caustic scrubbers, eliminate certain bleaching chemicals, and treat process condensate streams through biological treatment or steam stripping.

The Confederation of European Paper Industries (Cepi) emphasizes the sector's commitment to resource efficiency, recycling, and circular practices, increasingly integral to European policy frameworks.

Canada's modernization of the Pulp and Paper Effluent Regulations was initiated because Environmental Effects Monitoring studies submitted under the PPER have shown that effluents from 70% of pulp and paper mills are impacting fish and/or fish habitat, with impacts at 55% of these mills posing potentially higher risk to the environment.

These regulatory pressures are driving ubstantial investment in bio-based sizing chemicals, enzymatic deinking agents, oxygen-based bleaching sequences, and closed-loop water treatment systems that minimize environmental footprints while maintaining production efficiency.

Heightened hygiene awareness, particularly accelerated by the COVID-19 pandemic, has catalyzed sustained demand for tissue and hygiene paper products across residential, commercial, and institutional sectors driving the demand for the pulp and paper processing chemicals.

Asia Pacific dominated the tissue paper market with a share of around 35% in 2024, reflecting increased consumer spending on tissue paper and personal care products driven by rising disposable incomes and exposure to Western lifestyles and cleanliness standards.

During the COVID-19 outbreak, the World Health Organization released guidelines in March 2020 advising pre-ordering sufficient quantities of tissue products to maintain hygiene practices, which led to higher consumption for personal hygiene, cleaning, and sanitization purposes.

This sustained growth trajectory has intensified demand for specialty chemicals, including wet-strength resins, softness additives, lotions, creping adhesives, and yankee coating formulations that enhance tissue product performance.

The pulp and paper processing chemicals industry faces significant margin pressure from volatile raw material pricing and energy cost fluctuations that impact both chemical manufacturers and end-user paper mills.

Energy prices remain a critical input for resins and other raw materials, and while extreme price spikes of 2021 - 2022 have largely subsided, the overall cost basis for chemical formulators remains elevated compared to pre-pandemic levels, with energy costs sensitive to geopolitical instability and OPEC+ output decisions.

In 2024, cost inflation affected the pulp and paper supply chain during the first half of the year, waning somewhat in the third quarter before regaining strength in the fourth quarter due to rising fiber and energy costs across Latin America.

The cost pressures compress operating margins for specialty chemical suppliers and force paper mills to balance between maintaining product quality and controlling input costs, potentially delaying investments in advanced chemical programs or prompting substitution with lower-cost alternatives.

The transition toward sustainable, renewable feedstocks for paper processing chemicals presents substantial market opportunities as manufacturers develop bio-based alternatives to traditional petroleum-derived formulations.

Kemira has introduced a new bio-based sizing chemical made from renewable sunflower oil instead of fossil-based olefins, providing resistance against moisture and liquid while improving physical properties of fiber-based materials such as strength, dimensional stability, and coating properties.

SNF and Mitsubishi Chemical Corporation partnered in a pioneering project to produce N-vinylformamide (NVF), an advanced monomer essential for polymers used in the paper industry, with the NVF facility fully operational in December 2024, utilizing cutting-edge technology to deliver high-performance NVF polymers and their PVAM derivatives that enhance paper products' strength, durability, and recyclability, making it a key enabler of circular economy practices.

BASF has developed biomass balance products where renewable resources such as bio-naphtha, pyrolysis oil, or biogas derived from organic waste or vegetable oils are used as feedstock, with all products certified according to the REDcert² scheme for the chemical industry, offering customers a quantifiably improved CO2 footprint and savings of fossil resources while maintaining identical product quality and performance.

Lignin, a by-product from the pulp and paper industry with more than 50 million tons generated worldwide annually, is proving to be a promising renewable resource for producing bio-based products including dispersants, binders, and additives for bricks, chipboards, and recycled packaging.

These innovations align with circular economy frameworks that emphasize resource conservation, waste minimization, and lifecycle optimization, positioning bio-based chemical suppliers to capture premium market segments while meeting increasingly stringent regulatory requirements and corporate sustainability commitments.

Rapid industrialization, urbanization, and rising consumer spending across Asia Pacific countries present substantial growth opportunities for pulp and paper processing chemical suppliers.

India ranks as the 15th largest paper producer globally, contributing approximately 5% to the world's paper market and recognized as the fastest-growing paper market worldwide, with projections suggesting that an additional 1 million tonnes per annum of integrated pulp, paper, and paperboard capacity will be required to meet growing domestic demand.

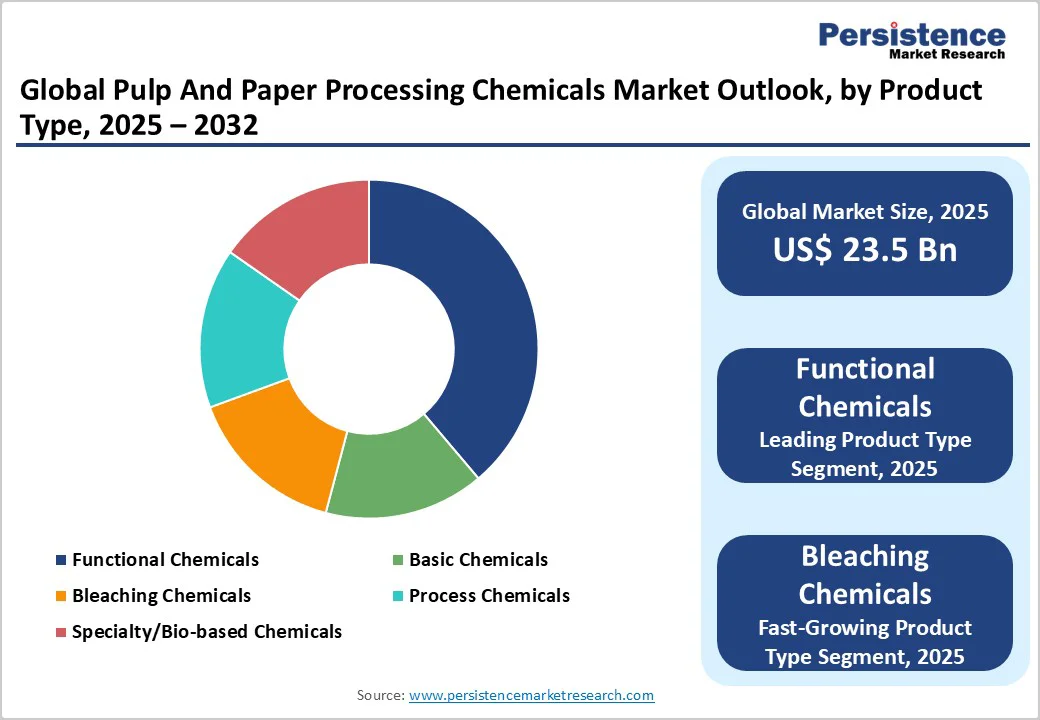

Functional chemicals dominate the global pulp and paper processing chemicals market with a commanding 42.4% market share in 2025, driven by their essential contribution to improving the physical, aesthetic, and performance attributes of paper products across packaging, printing, and specialty applications.

Functional chemicals encompass a diverse portfolio including sizing agents, coating binders, retention aids, wet and dry strength resins, dyes, and surface treatment additives that collectively enhance durability, printability, brightness, strength, and moisture resistance of paper materials.

The segment's leadership is fundamentally underpinned by increasing demand for high-quality paper in various end-use industries such as publishing, packaging, and specialized printing, which directly fuels growth. Kemira launched ISCC-certified biomass-balanced wet-strength resins in 2024, illustrating the trend toward sustainable, high-performance solutions that enhance durability and recyclability in packaging and tissue paper applications.

The packaging & board commands the largest market share at 38.9% in 2025, reflecting the structural shift toward sustainable packaging solutions, e-commerce logistics expansion, and the global movement to reduce plastic packaging in favor of recyclable paper-based alternatives.

The packaging and industrial papers segment are likely to account for a growing share, reflecting e-commerce momentum and consumer preference for recyclable substrates, with corrugated and containerboard mills consuming significant volumes of starch adhesives, retention polymers, and barrier coatings that enable lighter board grades without sacrificing compressive strength.

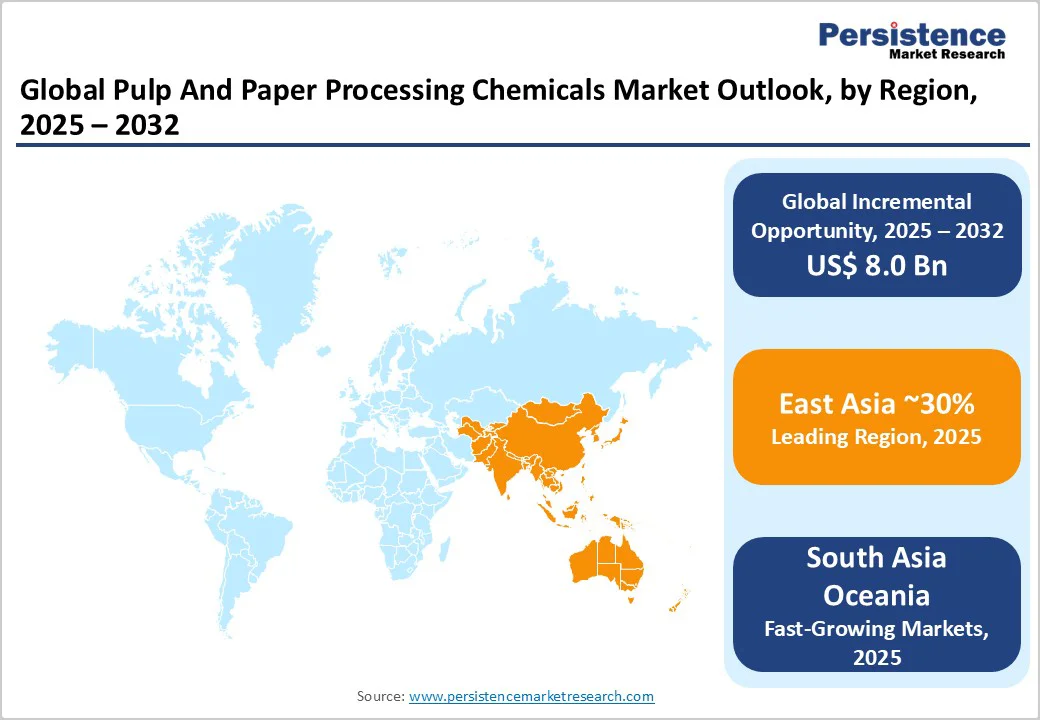

North America maintains an 18% share of the global pulp and paper processing chemicals market, characterized by mature infrastructure, advanced technological adoption, strong regulatory frameworks mandating environmental compliance, and strategic emphasis on operational efficiency and sustainability initiatives.

The American Forest & Paper Association (AF&PA) released its 65th Paper Industry Annual Capacity and Fiber Consumption Survey, offering comprehensive overview of the U.S. paper industry's performance, with the total paper and paperboard operating rate reaching 87.5% in 2024, a nearly four-percentage-point increase from 2023, reflecting improved utilization of existing assets, while production grew by 3.2% year-on-year driven by robust demand across all categories, particularly containerboard

Total U.S. paper and paperboard capacity declined by 2.0% in 2024 to 78.1 million tons, representing a sharper reduction than the average annual decline of 0.9% observed since 2015, suggesting deliberate contraction strategy to optimize efficiency and modernize facilities.

The industry continues to invest in strategic expansions and machine conversions, particularly within packaging and tissue sectors, with four new containerboard machines becoming operational in 2023, a bleached boxboard machine coming online recently with another scheduled for later in the year, and a new tissue machine planned for the second half of 2025.

Europe commands approximately 20% of the global pulp and paper processing chemicals market, distinguished by its leadership in sustainability innovation, circular economy implementation, stringent environmental regulatory frameworks, and transition toward bio-based chemical alternatives aligned with the European Green Deal objectives.

The European Chemical Industry Council (CEFIC) reported that in 2023, Europe maintained its strong presence as the second-largest chemical producer, with the European Union contributing $711 billion and the rest of Europe adding $225 billion, together underscoring Europe's continued strength and diversity in chemical production

East Asia represents the largest regional market with approximately 30% share, driven by China's dominant position as the world's largest paper and cardboard producer, robust industrial expansion across Japan and South Korea, substantial capacity additions, and increasing adoption of advanced specialty chemicals to improve product quality and environmental compliance.

China's processed paper and paperboard production reached 158.469 million tons in 2024, an increase of 8.6% year-on-year, marking the first time China's production exceeded 150 million tons since statistics were available and setting a new record.

The global pulp and paper processing chemicals market exhibits a fragmented competitive landscape, with several large multinational companies and numerous regional players competing across different product segments.

While the market has a few dominant players, such as Ashland, BASF SE, Buckman, Dow Chemical Company, Ecolab, SNF Group, Evonik Industries AG, and Nouryon, smaller specialised firms continue to capture niche applications and regional demand.

The market’s fragmented nature encourages innovation, particularly in sustainable and eco-friendly chemical solutions, while pricing pressures and regional regulations shape competitive dynamics. Large companies leverage global distribution networks, technological expertise, and broad product portfolios to maintain their market positions.

At the same time, emerging players focus on tailored solutions for specific end-use applications. The market is dynamic, with moderate consolidation in certain segments but a generally competitive environment driven by innovation and regional demand variations.

The global Pulp and Paper Processing Chemicals Market is projected to be valued at US$ 23.5 Bn in 2025.

The Functional Chemical segment is expected to hold around 42.4% market share in 2025, driven by its critical role in enhancing paper durability, printability, strength, and moisture resistance across packaging, printing, and specialty applications.

The pulp and paper processing chemicals market is poised to witness a CAGR of 4.3% from 2025 to 2032.

The global Pulp and Paper Processing Chemicals market is driven by rising e-commerce packaging demand, stringent environmental regulations promoting green chemicals, and growing tissue and paper consumption fueled by health consciousness.

Key market opportunities in the Pulp and Paper Processing Chemicals market lie in bio-based and circular economy chemical innovations, digital transformation and process optimization technologies, and expanding production capacity in rapidly growing Asia Pacific markets.

The top key market players in the global Pulp and Paper Processing Chemicals market include Ashland, BASF SE, Buckman, Dow Chemical Company, Ecolab, SNF Group, Evonik Industries AG, and Nouryon.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author