ID: PMRREP8797| 220 Pages | 16 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

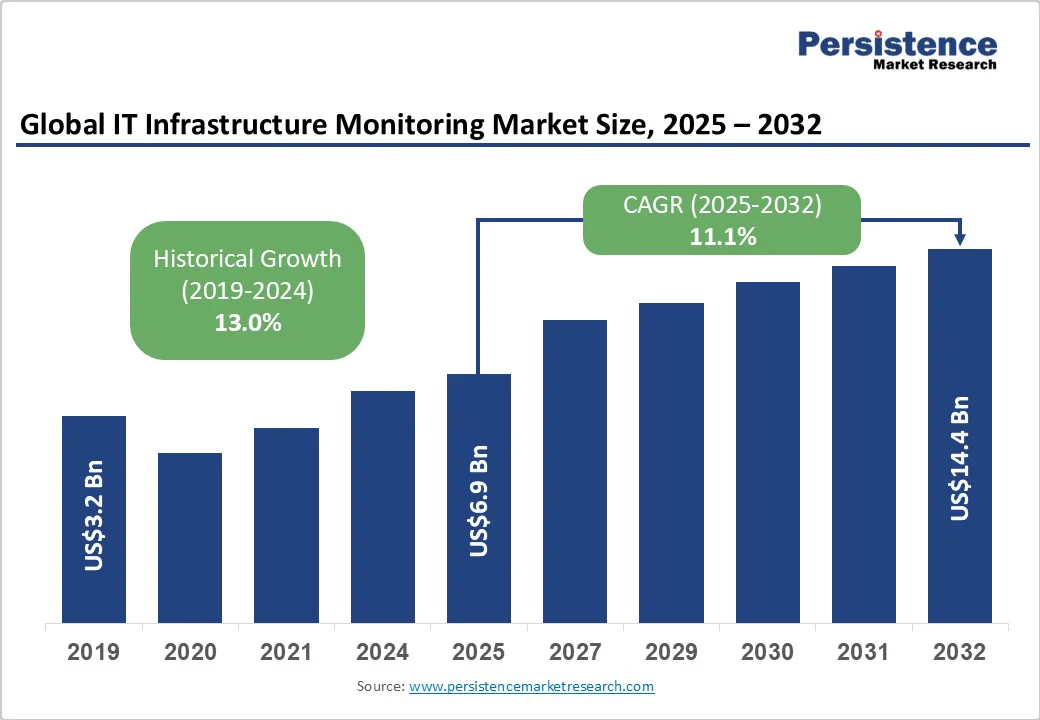

The global IT infrastructure monitoring market size is likely to be valued at US$6.9 Billion in 2025, and is estimated to reach US$14.4 Billion by 2032, growing at a CAGR of 11.1% during the forecast period 2025-2032, driven by widespread digital transformation initiatives and increasing adoption of cloud-based monitoring solutions. Increasingly complex IT infrastructures that demand advanced monitoring tools for seamless operations and performance optimization will drive market growth. Rising compliance requirements further boost investments in hybrid and multi-cloud monitoring solutions.

| Key Insights | Details |

|---|---|

|

IT Infrastructure Monitoring Market Size (2025E) |

US$6.9 Bn |

|

Market Value Forecast (2032F) |

US$14.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

11.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

13.0% |

Enterprises are increasingly adopting hybrid and multi-cloud models to enhance agility, scalability, and operational resilience, leading to significantly greater IT environment complexity. According to the International Data Corporation (IDC), by 2025, 75% of enterprises will deploy applications across multiple clouds and on-premises infrastructures. This multi-faceted landscape is driving unprecedented demand for integrated IT infrastructure monitoring solutions that offer real-time visibility and analytics across heterogeneous environments. The complex interplay of on-premise systems, private clouds, and public cloud services requires consolidated monitoring platforms capable of detecting anomalies, optimizing resource utilization, and ensuring compliance across infrastructure silos.

Industry estimates suggest that organizations investing in unified monitoring tools for multi-cloud environments will reduce downtime incidents by up to 30%, translating to substantial cost savings. This driver is niche but highly relevant, emphasizing technology convergence trends and operational imperatives that compel enterprises to expand monitoring investments. Vendors capitalizing on this need are differentiating through artificial intelligence (AI)/machine learning (ML)-powered analytics and enhanced automation, which enhances predictive maintenance and root cause analysis capabilities, delivering actionable intelligence that aligns with business outcomes.

Elevated deployment and integration costs remain a structural restraint for many small & medium enterprises (SMEs) seeking to adopt advanced IT infrastructure monitoring solutions. Industry analyst Forrester reports that integrating monitoring tools into existing heterogeneous infrastructures can incur upfront costs ranging from US$500,000 to over US$2 Million, depending on scale and complexity.

Prolonged implementation timelines and the need for specialized IT personnel also increase the total cost of ownership and present barriers to entry. This challenge is particularly pronounced in regulated industries where customization and compliance adherence inflate costs further; for example, healthcare firms must ensure monitoring solutions meet HIPAA standards, adding layers of complexity and expense. Legacy system incompatibilities and lack of standardized integration frameworks also exacerbate difficulties, increasing risk and operational disruptions. Vendors targeting this segment are increasingly offering modular, scalable solutions and SaaS-based deployment models to mitigate cost and complexity issues, but cost sensitivity remains a critical hurdle influencing purchasing decisions.

Emerging economies, especially within the Asia Pacific region, represent a lucrative growth frontier for IT infrastructure monitoring due to rapid digitalization, industrial automation adoption, and favorable government policies promoting technology investments. According to the World Bank, the Asia Pacific region has seen annual GDP growth rates averaging 5.1% over recent years, with countries such as India and ASEAN members investing heavily in digital infrastructure modernization. This macroeconomic environment is stimulating demand for intelligent monitoring tools to support manufacturing digitization, smart city deployments, and cloud adoption. Aiding this are regulatory initiatives such as India’s Digital India program and China’s Industrial Internet policies that are incentivizing infrastructure upgrades, and increasing demand for real-time monitoring.

Vendors expanding local presences and customizing offerings to address regional network architectures, compliance requirements, and cost structures are well-positioned to capitalize. This presents an attractive avenue for stakeholders, given the availability of scalable cloud-based solutions that reduce upfront investment and accelerate time to value, making advanced monitoring accessible to organizations previously constrained by budget or technology limitations.

Cloud deployment is anticipated to dominate with an estimated 72.4% of the IT infrastructure monitoring market revenue share in 2025, attributable to the marked advantages cloud solutions provide, including enhanced scalability, cost-effective resource utilization, and rapid deployment capabilities. Organizations shifting toward digital transformation increasingly prioritize cloud-based monitoring to effectively manage the complexity of hybrid and multi-cloud environments. Cloud deployments also enable real-time analytics through centralized data aggregation across geographically dispersed infrastructure, supporting proactive incident management and operational agility.

The hybrid cloud monitoring segment is forecasted to be the fastest growing within deployment modes, with a strong CAGR expected from 2025 to 2032. The hybrid approach addresses the limitations of single-environment management by enabling seamless visibility across both cloud and traditional data centers. This growth is stimulated by multi-cloud adoption trends, where enterprises deploy workloads across various cloud service providers to avoid vendor lock-in and optimize cost and performance. Vendors are innovating to integrate native monitoring tools of different clouds with centralized dashboards and AI-based analytics to offer consolidated insights. As enterprises invest in next-generation hybrid architectures, the demand for cohesive monitoring solutions that reduce operational silos and provide end-to-end observability will accelerate.

Among components, software solutions are set to be the leading segment, holding approximately 77% market share in 2025. This dominance reflects the foundational role monitoring software plays in network surveillance, server health assessment, application performance tracking, and endpoint management. Software advancements centered on AI/ML-powered analytics, automation of routine tasks, and predictive anomaly detection are redefining monitoring capabilities, enabling enterprises to preempt outages and optimize infrastructure proactively.

The fastest-growing segment is likely to be services, propelled by the increasing inclination of enterprises toward outsourcing infrastructure monitoring to specialized third-party providers that leverage cloud-native tools. Managed services address challenges such as talent shortages, rising complexity, and cost containment, offering 24/7 monitoring, expert diagnostics, and proactive remediation without in-house resource expansion. This model also aligns with digital transformation roadmaps that favor operational expenditure (OpEx) over capital expenditure (CapEx). Notably, SMEs and expanding large enterprises find managed services attractive due to scalability and reduced management burden.

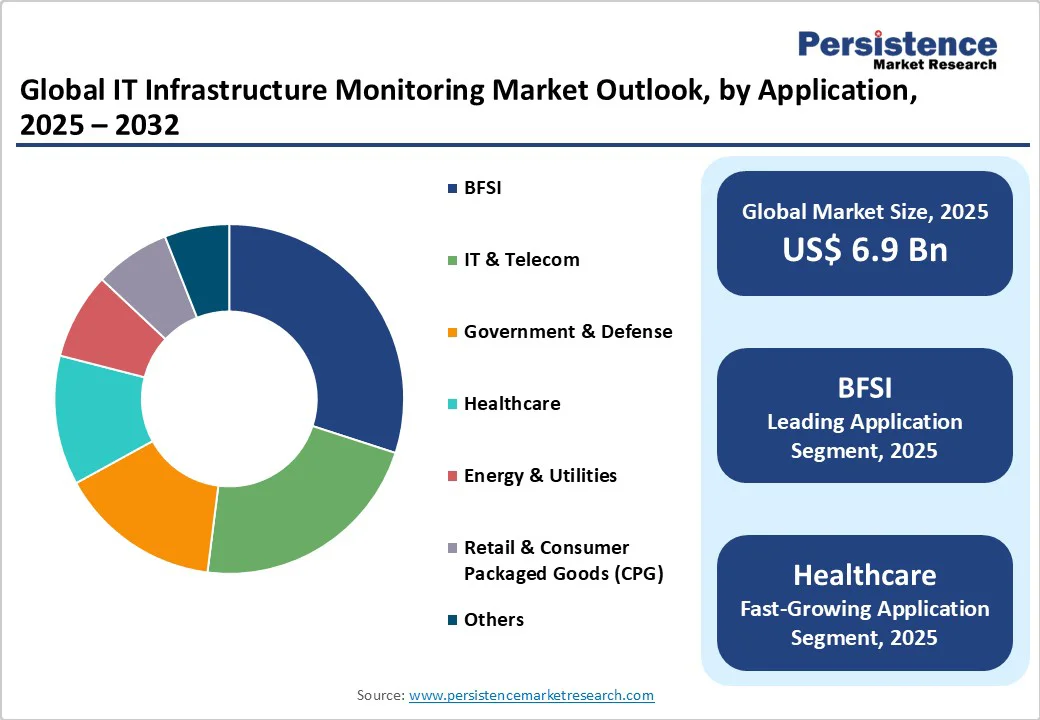

The banking, financial Services, & insurance (BFSI) vertical is expected to capture an estimated 30% market share in 2025. The BFSI sector’s entrenched regulatory framework, such as mandates on system uptime, risk management, and audit trails, significantly amplifies demand for robust, real-time monitoring. The surge in fintech innovation and digital payment ecosystems necessitates infrastructure that ensures seamless transaction processing, fraud detection, and customer experience optimization. Investments focused on hybrid cloud infrastructure monitoring are particularly pronounced in BFSI, with banks and insurers adopting integrated platforms that consolidate visibility across legacy and cloud environments.

The healthcare sector is projecting the fastest-growing application segment. Digital transformation is accelerating in healthcare, fueled by growing telemedicine adoption, digitization of patient records, and AI-driven diagnostics requiring stringent infrastructure monitoring. Regulatory imperatives such as HIPAA in the U.S. and GDPR in Europe drive rigorous compliance and data protection requirements that elevate monitoring solution demand. Healthcare providers prioritize solutions that offer auditability, secure access control, and network integrity in complex infrastructures. Vendors are tailoring offerings to incorporate interoperability with medical devices and healthcare IT systems, addressing unique latency and availability requirements inherent to clinical applications.

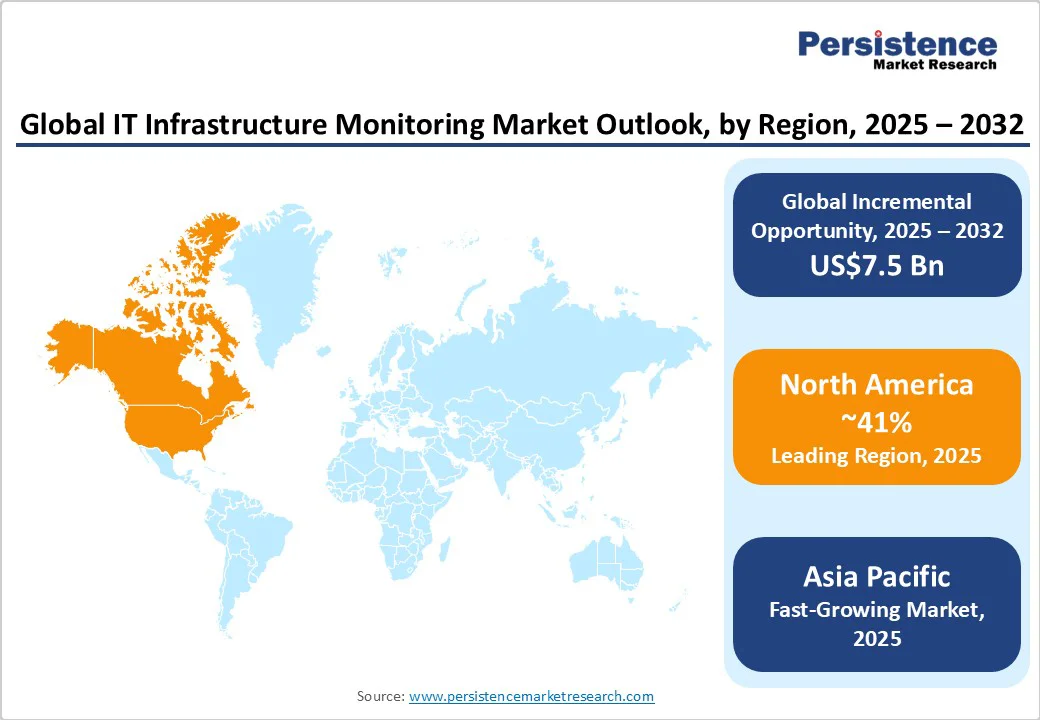

North America is forecast to hold a dominating 41% of the IT infrastructure monitoring market share in 2025, reflecting its mature IT ecosystem and leadership in cloud technology adoption. The United States is the primary market driver due to extensive investments in digital transformation across enterprise sectors such as BFSI, healthcare, and government. Regulatory frameworks, including the Federal Information Security Management Act (FISMA) and Sarbanes-Oxley Act (SOX) enforce rigorous compliance and security standards, compelling organizations to adopt advanced monitoring solutions. The region also boasts a supportive and progressive innovation ecosystem, centered in technology hubs such as Silicon Valley, promoting continuous development of AI-driven and automation-enabled infrastructure monitoring platforms.

Competitive market dynamics are characterized by strategic partnerships between monitoring solution providers and managed service operators, enhancing value propositions through bundled service-delivery models. Furthermore, growing trends of remote work and cybersecurity concerns increase demand for comprehensive infrastructure visibility. Investment activities focus on enhancing security monitoring and compliance features, with venture capital continuing to support companies developing AI-first observability tools. The regulatory environment also incentivizes investments in solutions that facilitate incident response and governance reporting, underscoring the symbiotic relationship between policy and technology adoption.

Europe holds a significant portion of the market, likely to hold an estimated 28% share in 2025, predominantly contributed by Germany, the U.K., France, and Spain. Regulatory harmonization efforts under the European Union directives, such as the General Data Protection Regulation (GDPR), exert a strong influence on monitoring solution architecture and deployment. These regulations require transparent data processing and robust security, driving demand for solutions that provide comprehensive audit logs and real-time alerts. Germany’s Industrie 4.0 initiative has stimulated the adoption of smart manufacturing and digital infrastructure monitoring, becoming a catalyst for growth in the regional industrial segment. The U.K. and France are emphasizing modernization of public sector IT infrastructure, further supporting market expansion.

The regulatory environment established by the European Union (EU) fosters investment in solutions that enable fine-grained access controls and assist in compliance reporting, making local data residency capabilities a competitive differentiator. The competitive landscape blends established multinational software vendors with innovative regional players focusing on industry-specific monitoring solutions, such as energy and utilities. Investments increasingly prioritize modular, scalable software architectures built for interoperability across heterogeneous IT environments. Public-private partnerships (PPPs) and government digitalization funding streams also contribute to ecosystem vitality, underscoring Europe’s balanced growth approach, emphasizing security and technological advancement.

Asia Pacific represents the fastest-growing regional market for IT infrastructure monitoring, projected to exhibit an impressive CAGR during 2025-2032. Countries such as China, Japan, India, and members of the Association of Southeast Asian Nations (ASEAN) are rapidly digitalizing, driven by expanding enterprise IT infrastructure and government policies supporting smart city initiatives and industrial automation. China’s Industrial Internet policies facilitate widespread adoption of monitoring solutions within manufacturing and telecommunications sectors, accelerating digital infrastructure modernization. India’s Digital India program has propelled IT adoption across public and private sectors, enhancing demand for scalable monitoring platforms. ASEAN countries leverage manufacturing advantages, including cost efficiencies and developing IT ecosystems, fostering regional technology growth hubs.

Regulatory landscapes are evolving rapidly, influenced by data localization laws and emergent cybersecurity policies mandating heightened infrastructure transparency and protection. This evolving environment incentivizes the adoption of localized, compliant monitoring solutions tailored to regional legal frameworks. The region is also witnessing increased activity by both global technology providers expanding their footprint and domestic players innovating with cost-sensitive, cloud-native monitoring offerings. Investment flows are also strengthening, with global firms establishing regional R&D centers and cloud data centers to ensure proximity to customers and compliance with residency requirements.

The global IT infrastructure monitoring market features a moderately consolidated structure dominated by a handful of multinational technology firms holding approximately 65-70% market share collectively. Market leaders include companies such as IBM Corporation, Microsoft Corporation, and Cisco Systems, recognized for their extensive product portfolios and comprehensive service offerings.

The remaining market comprises numerous smaller and mid-sized vendors specializing in niche monitoring segments or regional markets, contributing to a fragmented competitive environment. Competitive positioning is shaped by ongoing innovation in AI/ML capabilities, cloud-native product development, and strategic partnerships with managed service providers. Leading players focus on deepening integration with cloud platforms, expanding automation, and enhancing user experience, while disrupting vendors prioritize agility and cost-competitive SaaS offerings to serve emerging customer segments.

The IT infrastructure monitoring market is projected to reach US$6.9 Billion in 2025.

Widespread government-led digital transformation initiatives and increasing adoption of cloud-based monitoring solutions among enterprises are driving the market.

The market is poised to witness a CAGR of 11.1% from 2025 to 2032.

The growing complexity of IT infrastructures, evolving needs among enterprises to proactively manage hybrid and multi-cloud environments, and tightening regulatory compliance requirements are key market opportunities.

IBM Corporation, Microsoft Corporation, and Cisco Systems, Inc. are some of the key players in this market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Deployment Mode

By Component

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author