ID: PMRREP3541| 178 Pages | 28 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

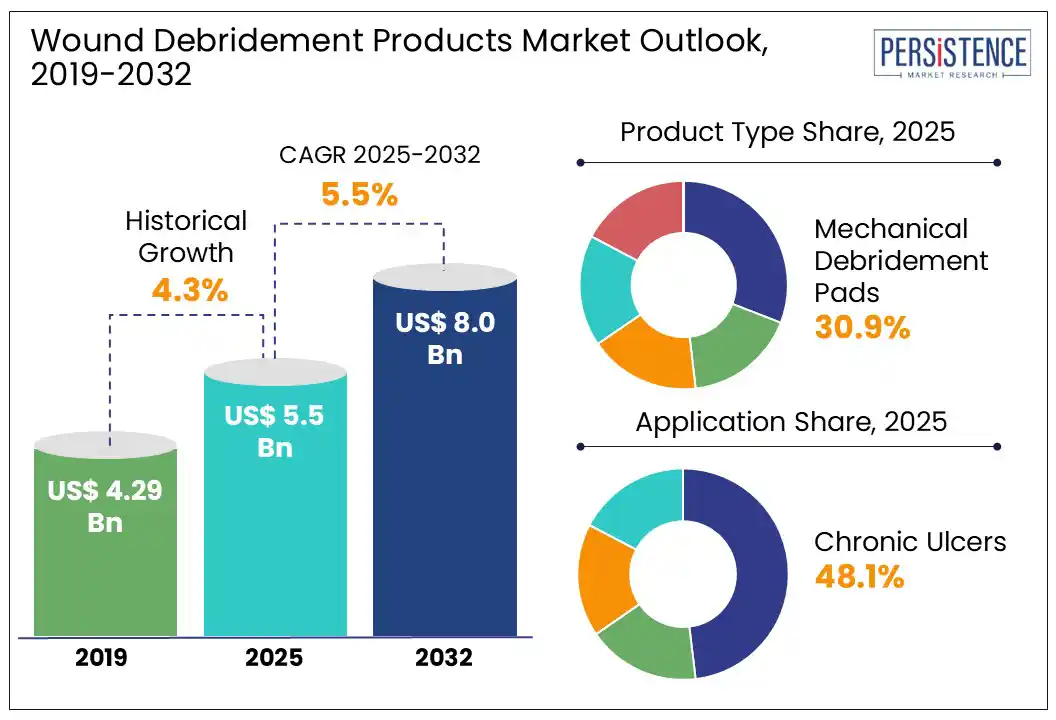

The global wound debridement products market size is set to reach US$ 8.0 Bn by 2032 from US$ 5.5 Bn in 2025. It is anticipated to surge at a CAGR of 5.5% in the forecast period from 2025 to 2032.

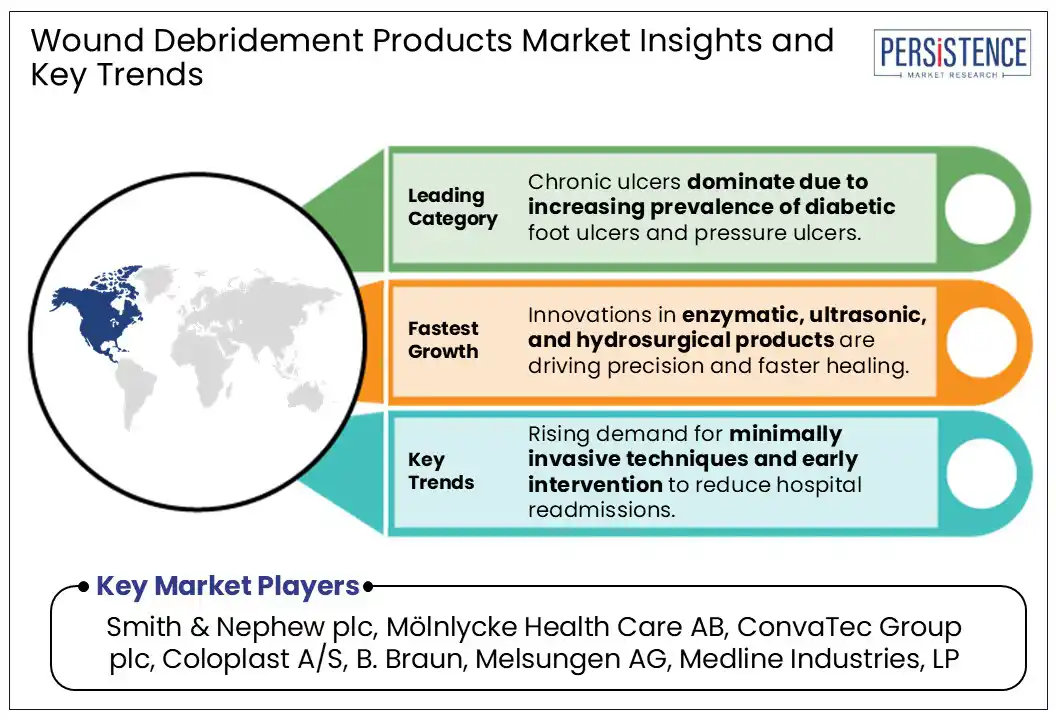

The global market is surging due to the increasing prevalence of chronic wounds, creating demand for effective wound management solutions. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, often develop biofilms and necrotic tissue, which delay healing and raise the risk of infection.

Wound debridement products help remove dead tissue, prevent complications, and promote faster tissue regeneration. Additionally, healthcare guidelines emphasize early and effective wound debridement to reduce hospital readmissions and improve patient outcomes, further boosting the adoption of these products.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

| Wound Debridement Products Market Size (2025E) | US$ 5.5 Bn |

| Market Value Forecast (2032F) | US$ 8.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.3% |

Chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are seeing a rising prevalence globally, influenced by factors such as diabetes, poor blood circulation, and the adoption of a sedentary lifestyle. These conditions pose significant healthcare challenges, often leading to long-term treatment and recovery times. Non-healing ulcers, in particular, can lead to severe complications, including infections and limb amputation.

As per studies, diabetic foot ulcers affect an estimated 40 to 60 Mn people worldwide yearly, while venous leg ulcers account for approximately 600,000 cases annually in the U.S. alone. The healthcare burden of these conditions is substantial, with up to 33% of treated venous ulcer patients experiencing recurrence.

The cost of treating these ulcers is estimated at US$ 3.5 Bn annually in the U.S. and £941 Mn in the U.K. Given the aging global population, effective prevention and advanced wound care solutions are essential for reducing recurrence rates and healthcare expenses.

Increasing awareness and developments in healthcare systems are set to drive demand for advanced wound care treatments. This, in turn, is likely to fuel the adoption of innovative wound debridement products, such as enzymatic debridement, ultrasonic debridement, and smart dressings, which promote faster and more effective healing. These enhanced treatment options are anticipated to improve patient recovery outcomes, lower recurrence rates, and propel growth in the global market.

A key restraint is the variability in wound characteristics, as factors like infection severity, tissue composition, and patient health conditions affect treatment outcomes. In chronic wounds, biofilm formation and poor vascularization hinder the penetration of debridement agents, reducing treatment efficacy. Additionally, enzymatic and autolytic debridement methods require extended treatment durations, delaying wound closure.

The high cost of novel debridement products, including ultrasonic and hydrosurgical debridement systems, further limits their adoption, particularly in low-resource settings. While developments in wound care technology are improving treatment precision, ensuring consistent effectiveness across diverse wound types remains a challenge. It is anticipated to restrict the market potential for wound debridement products.

Rising focus on personalized wound management presents a significant opportunity for wound debridement product manufacturers. Innovations in advanced wound care technologies are transforming treatment by enabling tailored approaches based on wound type and severity. The integration of smart wound care solutions, including biosensors, further enhances the precision of debridement techniques.

AI is revolutionizing wound care through imaging systems that analyze wound images, track healing, and predict infection risks. These technologies help enhance accuracy, reduce human error, and optimize treatment plans. For instance, Net Health’s Tissue Analytics, a unique mobile solution, leverages machine learning and computer vision to ensure consistent wound assessments, minimizing variability and improving patient outcomes.

Governments worldwide are further recognizing the growing burden of chronic wounds and investing heavily in research and development to improve treatment options. Various educational and research institutions are also partnering with key healthcare companies to initiate in-depth studies on specific wound debridement products.

In December 2024, for instance, Michigan State University (MSU) secured a US$ 200,000 grant through its collaboration with Corewell Health to develop an innovative biomimetic dressing for chronic wounds. The institution focuses on creating an oxygen-generating, cell-based dressing designed to revolutionize wound care, particularly for patients with diabetes or poor blood flow.

The non-surgical wound debridement devices segment is predicted to generate a share of 60.1% in 2025. Under this segment, mechanical debridement pads are likely to account for 30.9% of the total share in 2025. It is attributed to their high effectiveness in removing necrotic tissue and debris.

The pads are widely used in both hospital and home care settings due to their ease of use and ability to promote wound healing. Developments in pad design, including the incorporation of antimicrobial properties and moisture-retention features, are anticipated to enhance their adoption across various healthcare settings through 2032.

Biological debridement products, on the other hand, are set to see steady demand through 2032. These include maggot therapy that helps in gently removing the necrotic tissue while preserving healthy tissue, promoting quick healing.

Chronic ulcers are set to hold around 48.1% of the global wound debridement products market share in 2025, driven by the growing prevalence of diabetes. Effective wound debridement is essential in managing chronic conditions like diabetic foot ulcers.

The International Diabetes Federation (IDF), for instance, estimated that 537 Mn adults were living with diabetes in 2021, a number projected to rise to 783 Mn by 2045. Also, diabetic foot ulcers occur in 15 to 25% of diabetic patients, making debridement a significant step in wound management.

Aging individuals and diabetic patients are more susceptible to chronic wounds such as pressure ulcers. Aging slows the body's natural healing processes, while diabetes can lead to poor circulation and neuropathy, increasing the risk of non-healing wounds. This drives demand for advanced wound care solutions, including enzymatic and autolytic debridement, to enhance healing and prevent complications. Surgical wounds, on the other hand, are projected to witness a considerable CAGR through 2032. To avoid bacterial colonization and encourage the best possible healing, post-surgical wounds, especially those resulting from significant procedures like orthopedic surgeries, cesarean sections, and cancer-related surgeries, need to be carefully managed.

North America is set to generate a share of nearly 45.1% in 2025. The U.S. wound debridement products market is anticipated to create new opportunities in the region.

According to Scientific Research Publishing (SCIRP), the U.S. remains a key contributor, with over 8.2 Mn patients affected by chronic wounds annually. Increasing preference for minimally invasive debridement techniques and subsequent product launches by manufacturers is bolstering market expansion. For instance, In March 2024, Smith & Nephew launched an enzymatic wound debridement gel in the U.S. to improve chronic wound healing outcomes. With continuous technological developments and increasing healthcare spending, the U.S. is poised for further growth, particularly in debridement solutions aimed at improving patient recovery rates.

Europe is anticipated to account for a share of 28.1% in 2025. Increasing burden of diabetic foot ulcers, venous leg ulcers, and pressure ulcers, along with a strong regulatory framework and surging research collaborations, is fueling market growth. In March 2024, for example, Sweden-based Mölnlycke Health Care partnered with leading Europe-based wound care centers to develop next-generation enzymatic debridement solutions, thereby improving treatment efficacy.

Germany is anticipated to lead the region due to the high prevalence of chronic wounds and diabetic foot complications. Nearly four million people are affected by chronic wounds, with annual frequency steadily increasing in the country, says a latest study. As of 2024, there are around 786,407 prevalent cases and 196,602 incident cases of chronic wounds cases in the country. This rising burden is projected to augment demand for effective wound care solutions, including wound debridement products in Germany.

Asia Pacific will likely hold a share of 20.3% in the global market in 2025, fueled by increasing cases of traumatic injuries in densely populated countries like China and India. In China, growing healthcare investments and government-backed initiatives are accelerating the adoption of innovative debridement solutions. Additionally, biotech companies are actively developing novel wound care products, supported by a favorable regulatory environment.

For instance, in 2024, China’s National Medical Products Administration (NMPA) allocated US$ 150 Mn to support biotech firms specializing in advanced wound care solutions. It aims to foster innovation in hydrogel-based and bioactive debridement products. In India, apart from diabetes, the number of burn and trauma injuries is significantly high. The National Crime Records Bureau (NCRB) mentioned that every year, around 1.2 Mn road accidents occur in the country, many of which result in chronic wounds that require innovative debridement to promote healing by eliminating necrotic tissue. Severe burns can also cause eschar formation, boosting the need for enzymatic or surgical debridement to prevent sepsis.

The global wound debridement products industry is highly competitive, with key players focusing on innovation and product development through strategic partnerships. Several companies are conducting clinical trials to find out the efficacy of their products for treating certain types of wounds. The global market is also projected to see various research institutions coming forward with new studies, mainly to reduce the healing period for those suffering from chronic wounds.

The global market is set to reach US$ 5.5 Bn in 2025.

By application, chronic ulcers are projected to dominate the global market in 2025.

Smith+Nephew, Maveramedical, Arobella Medical LLC, Bioevopeak Co., Ltd., and EZDebride are a few key players.

The industry is estimated to rise at a CAGR of 5.5% through 2032.

North America is projected to hold the most prominent market share in 2025.

| Report Attribute | Detail |

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Application |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Product

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author