ID: PMRREP20380| 190 Pages | 5 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

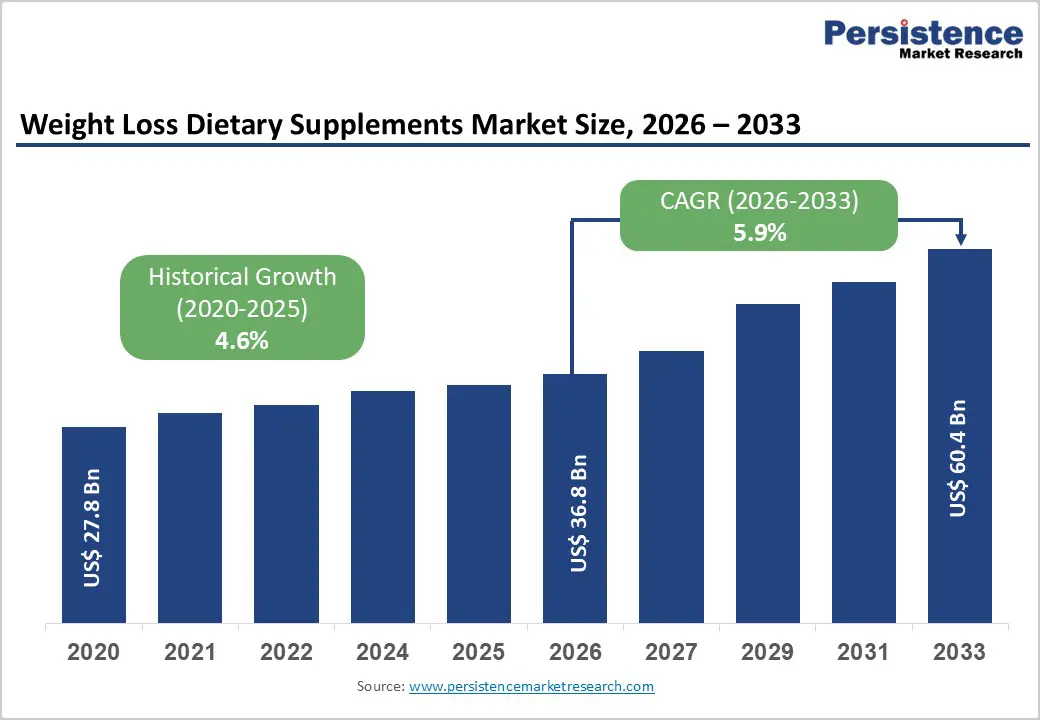

The global weight loss dietary supplements market size is estimated to grow from US$ 36.8 Bn in 2026 to US$ 60.4 Bn by Bn 2033. The market is projected to record a CAGR of 5.9% during the forecast period from 2026 to 2033.

The global demand for weight loss dietary supplements is rising steadily, driven by the increasing prevalence of obesity, overweight conditions, and lifestyle-related metabolic disorders worldwide. Sedentary lifestyles, unhealthy dietary habits, rising stress levels, and reduced physical activity are significantly expanding the consumer base seeking effective weight management solutions. Growing awareness of the long-term health risks associated with excess weight, including diabetes, cardiovascular diseases, and hormonal imbalances, is encouraging proactive adoption of dietary supplements as part of preventive and wellness-focused routines.

Rising participation in fitness programs, gym memberships, and digital wellness platforms is further accelerating supplement consumption across both developed and emerging economies. The rapidly aging global population is also contributing to demand, as older adults increasingly seek nutritional support for metabolism, muscle maintenance, and weight control. Growth in home-based wellness practices and self-managed health routines is supporting higher uptake of convenient supplement formats. Continuous advancements in formulation, including clean-label ingredients, plant-based extracts, protein blends, and metabolism-supporting nutrients, are improving product acceptance and perceived efficacy. Expanding retail and e-commerce access, rising healthcare spending, and increasing health awareness in emerging markets continue to support long-term global market expansion.

| Report Attribute | Details |

|---|---|

|

Weight Loss Dietary Supplements Market Size (2026E) |

US$ 36.8 Bn |

|

Market Value Forecast (2033F) |

US$ 60.4 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.9% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.6% |

Driver – Rising Obesity Prevalence, Lifestyle Disorders, and Preventive Health Awareness Driving Market Growth

The increasing global prevalence of obesity, overweight conditions, and lifestyle-related disorders is a primary driver supporting the sustained growth of the weight loss dietary supplements market. Sedentary lifestyles, unhealthy dietary habits, rising stress levels, and urbanization have contributed to higher incidences of obesity, type 2 diabetes, cardiovascular diseases, and metabolic disorders across both developed and emerging economies. As excess body weight is increasingly recognized as a major health risk, consumers are proactively seeking weight management solutions that complement diet and physical activity.

Growing awareness of preventive healthcare and wellness has significantly expanded the target consumer base, particularly among young adults and middle-aged populations aiming to improve physical appearance, energy levels, and long-term health outcomes. Weight loss dietary supplements are widely perceived as convenient, non-invasive, and accessible tools to support metabolism, appetite control, and fat reduction. Additionally, increasing participation in fitness programs, gym memberships, and digital wellness platforms is reinforcing supplement adoption. Strong marketing, influencer endorsements, and availability across retail and online channels are further accelerating consumption. Together, rising obesity rates, health-conscious consumer behavior, and expanding wellness ecosystems continue to drive consistent growth in the global weight loss dietary supplements market.

Restraints – Regulatory Scrutiny, Safety Concerns, and Product Efficacy Challenges Limiting Market Expansion

Despite strong demand fundamentals, the weight loss dietary supplements market faces several restraints that limit its growth potential. One of the primary challenges is increasing regulatory scrutiny related to product safety, labeling accuracy, and health claims. Regulatory bodies across major markets are tightening oversight to prevent misleading claims, unapproved ingredients, and adulteration, which can delay product approvals and increase compliance costs for manufacturers. Concerns regarding the safety and efficacy of certain weight loss supplements, particularly stimulant-based or poorly regulated products, have led to consumer skepticism and reputational risks for the industry. Adverse effects, inconsistent results, and lack of long-term clinical validation reduce consumer trust and hinder repeat purchases.

Price sensitivity also acts as a constraint, especially in developing regions where supplements are often paid for out-of-pocket and considered non-essential expenditures. Additionally, intense competition from low-cost local brands and unregulated online sellers exerts pricing pressure on established players. Limited professional guidance and misinformation surrounding supplement usage can further restrict adoption. These regulatory, safety, and perception-related challenges continue to moderate faster market expansion despite growing consumer interest.

Opportunity – Expansion of Personalized Nutrition, Natural Ingredients, and E-commerce, Creating New Growth Avenues

The growing shift toward personalized nutrition and clean-label wellness solutions presents a significant growth opportunity for the global weight loss dietary supplements market. Consumers are increasingly seeking tailored formulations based on age, gender, metabolic profile, and lifestyle preferences, creating demand for customized and condition-specific weight management products. Advances in digital health tools, nutrition tracking apps, and AI-driven wellness platforms are enabling brands to offer personalized supplement recommendations, enhancing consumer engagement and retention.

Rising preference for natural, plant-based, and botanical ingredients is opening new avenues for product innovation, particularly among health-conscious and label-aware consumers. Herbal extracts, probiotics, fiber-based formulations, and protein blends are gaining traction as safer and more sustainable alternatives to synthetic compounds. The rapid expansion of e-commerce and direct-to-consumer channels is further improving market accessibility, allowing brands to reach a broader audience while leveraging digital marketing and subscription models. In emerging economies, increasing disposable incomes, urbanization, and exposure to global fitness trends are supporting long-term demand growth. Collectively, personalization, natural formulations, and digital distribution are positioning the market for sustained expansion and differentiation.

By Form Insights

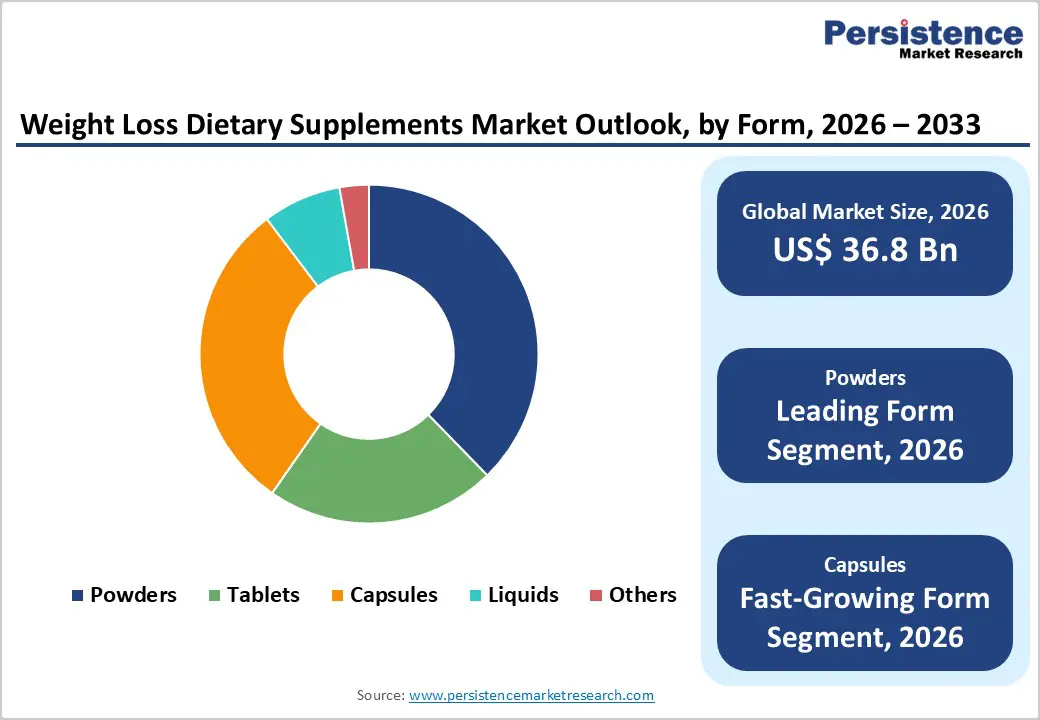

The powders segment is projected to dominate the global weight loss dietary supplements market in 2026, accounting for a revenue share of 37.7%. Segment leadership is driven by the widespread use of powdered supplements in protein shakes, meal replacements, and metabolism-boosting formulations, particularly among fitness-focused consumers and weight management programs. Powders offer flexible dosing, easy blending with beverages, and rapid absorption, making them suitable for daily consumption. Their strong adoption across gyms, wellness centers, and online platforms, combined with broad flavor variety and cost efficiency per serving, further supports market dominance.

By Ingredients Insights

The vitamins and minerals segment is expected to lead the global weight loss dietary supplements market in 2026, capturing a revenue share of 54.7%. This dominance is supported by their affordability, widespread consumer familiarity, and suitability for long-term use in weight management regimens. These ingredients are commonly used to support metabolism, energy balance, and nutritional adequacy during calorie-restricted diets. Strong physician and nutritionist recommendations, broad regulatory acceptance, and availability across mass-market retail and pharmacy channels continue to reinforce leadership.

By Distribution Channel Insights

The drug stores segment is projected to dominate the market in 2026, accounting for a revenue share of 30.0%. Leadership is driven by high consumer trust, easy accessibility, and the availability of pharmacist guidance, which is particularly important for first-time and medically supervised supplement users. Drug stores remain a preferred channel for regulated and branded weight loss supplements. In addition, strong presence in both urban and semi-urban locations ensures consistent consumer footfall and repeat purchases. Partnerships with leading supplement brands and compliance with regulatory standards further strengthen drug stores as a reliable point of sale for weight management products.

North America Weight Loss Dietary Supplements Market Trends

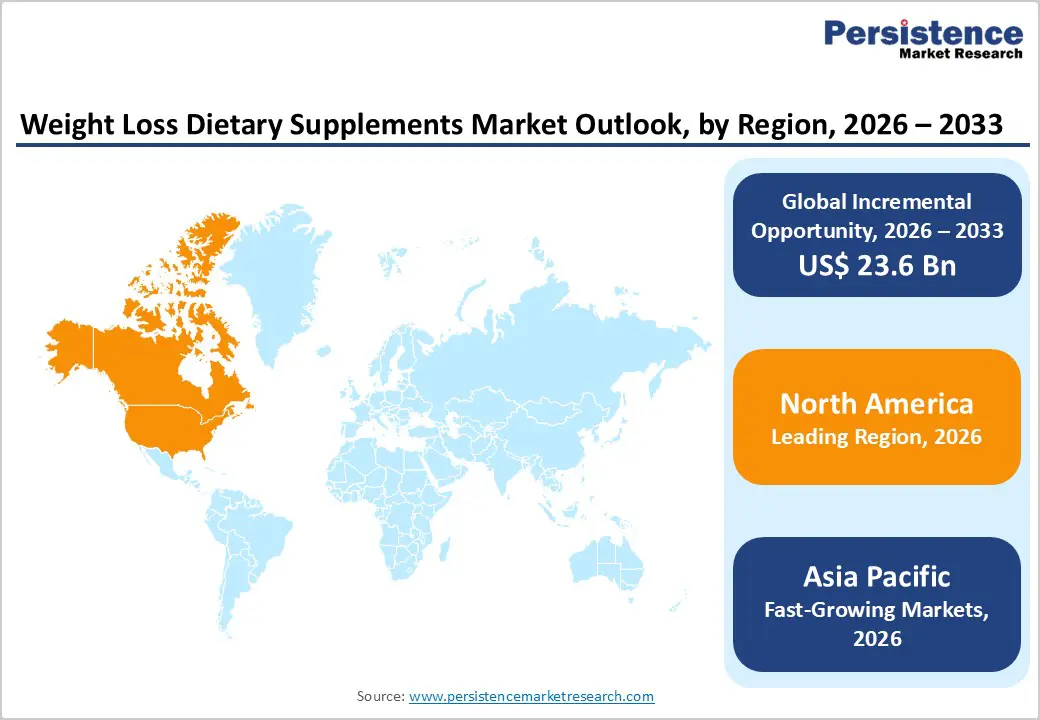

The North America weight loss dietary supplements market is expected to dominate globally with a value share of 48.5% in 2026, led primarily by the United States. The region benefits from a highly developed consumer wellness ecosystem, strong fitness culture, and widespread awareness of obesity-related health risks. High prevalence of overweight and obesity, combined with growing demand for preventative healthcare solutions, continues to drive consistent consumption of weight loss supplements.

North America also demonstrates strong adoption of protein-based, vitamin-enriched, and botanical supplements, supported by aggressive marketing, influencer-driven promotions, and digital health platforms. Regulatory oversight by agencies such as the FDA encourages product standardization and consumer confidence, while established retail and e-commerce infrastructure ensures broad product availability. Additionally, rising interest in personalized nutrition, clean-label products, and medically supervised weight management programs is expanding usage beyond traditional fitness consumers. The presence of leading supplement manufacturers, continuous product innovation, and strong disposable income levels further reinforce North America’s leadership in the global market.

Europe Weight Loss Dietary Supplements Market Trends

The Europe weight loss dietary supplements market is expected to grow steadily, supported by increasing health consciousness, aging populations, and rising obesity rates across both Western and Eastern Europe. Countries such as Germany, the U.K., France, Italy, and the Nordic nations are key contributors due to well-established retail pharmacy networks and strong emphasis on preventive healthcare. European consumers demonstrate a growing preference for clinically supported, natural, and plant-based weight management solutions.

Strict regulatory frameworks governing dietary supplements promote product quality and transparency, fostering consumer trust and long-term adoption. Increasing participation in fitness activities, weight management programs, and lifestyle disease prevention initiatives is driving consistent demand. Growth in online pharmacies and cross-border e-commerce is improving access, particularly in urban areas. Additionally, public health campaigns addressing obesity, diabetes, and cardiovascular risks are indirectly supporting supplement usage. Expansion of home wellness routines and sustainable, clean-label formulations is expected to support stable long-term market growth across the region.

Asia Pacific Weight Loss Dietary Supplements Market Trends

The Asia Pacific weight loss dietary supplements market is expected to register a relatively higher CAGR of around 7.9% between 2026 and 2033, driven by rapid urbanization, changing dietary patterns, and increasing health awareness. Countries including China, India, Japan, South Korea, and Southeast Asian nations are witnessing rising obesity rates alongside growing disposable incomes and exposure to global fitness trends.

Improving access to modern retail, online platforms, and digital health information is accelerating adoption across both urban and semi-urban populations. Younger demographics, in particular, are driving demand for protein powders, herbal supplements, and metabolism-enhancing formulations. Government initiatives promoting healthy lifestyles, combined with expanding private healthcare and wellness industries, are supporting market penetration. Additionally, increasing affordability of locally manufactured supplements and strong cultural acceptance of herbal and botanical ingredients are sustaining long-term growth. The rise of e-commerce, influencer marketing, and cross-border brands is expected to further strengthen Asia Pacific’s position as the fastest-growing regional market.

The global weight loss dietary supplements market is highly competitive, with key players including Abbott Laboratories, Glanbia Plc., GSK Plc., Stefan Company, and GNC Holdings Inc. These companies benefit from diversified nutrition portfolios covering proteins, meal replacements, functional vitamins, and botanical-based supplements, supported by strong brand recognition and extensive global distribution across retail, pharmacy, and e-commerce channels.

Competitive strategies focus on expanding clean-label and plant-based offerings, strengthening product efficacy through clinically supported ingredients, and enhancing convenience and consumer engagement via digital platforms. Ongoing innovation, geographic expansion in emerging markets, and investments in personalized nutrition and sustainable packaging continue to intensify competition and drive market evolution.

Key Developments:

The global weight loss dietary supplements market is projected to be valued at US$ 36.8 Bn in 2026.

Rising global obesity prevalence and health/fitness awareness, increasing demand for natural/plant-based supplements, booming e-commerce/online distribution channels, and growing emphasis on preventative wellness as consumers seek convenient weight management solutions.

The global market for weight loss dietary supplement has a value of US$ 60.4 Bn by Bn 2033.

The top players in the global weight loss dietary supplement market includes Herbalife Nutrition Ltd., Amway, GNC Holdings Inc., Nu Skin Enterprises, Inc., Forever Living, USANA Health Sciences, Inc., Melaleuca Inc.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Form

By Ingredients

By User

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author