ID: PMRREP35590| 172 Pages | 4 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

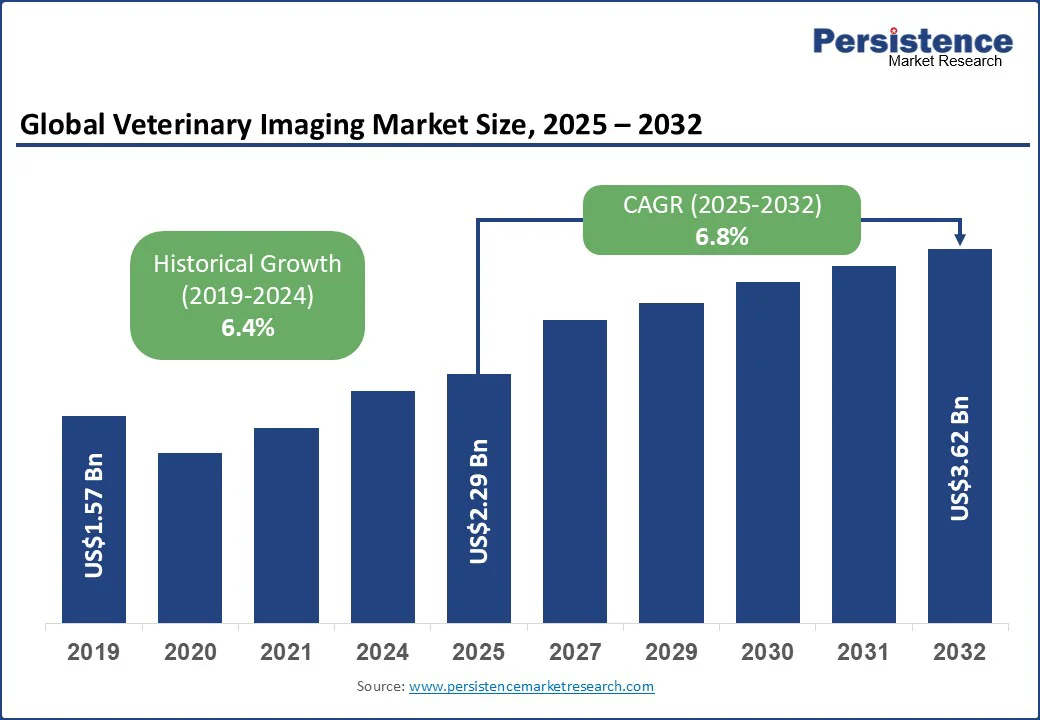

The global veterinary imaging market size is likely to be valued at US$2.29 Bn in 2025 and is expected to reach US$3.62 Bn by 2032, growing at a CAGR of 6.8% during the forecast period from 2025 to 2032.

The veterinary imaging market is experiencing steady growth, driven by rising pet ownership, increasing expenditure on animal healthcare, and rapid technological advancements in diagnostic imaging.

Veterinary imaging systems, including X-ray, ultrasound, MRI, and CT scanners, are becoming essential tools for accurate diagnosis and treatment in both companion and livestock animals. Growing awareness of animal health, coupled with the adoption of advanced imaging solutions, is fueling market demand across regions.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Veterinary Imaging Market Size (2025E) |

US$2.29 Bn |

|

Market Value Forecast (2032F) |

US$3.62 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.4% |

The veterinary imaging market is gaining momentum due to the integration of artificial intelligence (AI) into veterinary diagnostic imaging. AI-powered imaging systems can accurately analyze X-rays, CT scans, and ultrasounds to detect abnormalities such as fractures, tumors, and internal lesions.

This technology reduces diagnostic errors and accelerates clinical decision-making, which is especially critical in emergency care and complex cases. Veterinary clinics that adopt AI-enabled imaging tools can provide faster and more precise treatment, thereby boosting the overall efficiency in animal healthcare.

Another key driver is the advancement of portable and mobile veterinary imaging technologies. Compact X-ray, ultrasound, and digital radiography devices allow veterinarians to perform on-site diagnostics in rural areas, animal shelters, and emergencies.

These portable imaging solutions enhance accessibility and reduce the time needed for transporting animals to specialized facilities. The increasing adoption of high-resolution veterinary imaging systems and collaboration with human healthcare infrastructure further strengthen diagnostic capabilities, driving significant market growth.

The veterinary imaging market faces challenges stemming from the absence of standardized imaging protocols across veterinary practices. This lack of uniformity can lead to variations in diagnostic accuracy and treatment outcomes. Without standardized procedures, interpreting imaging results becomes inconsistent, potentially affecting the reliability of diagnoses and the effectiveness of treatments.

The absence of standardization also complicates the integration of advanced technologies, such as AI-driven diagnostic tools, into clinical workflows. This inconsistency hinders the widespread adoption of innovative imaging solutions and affects the overall quality of veterinary care.

Another significant restraint is the limited availability of specialized veterinary imaging professionals. The demand for skilled radiologists and imaging technicians in veterinary settings often exceeds supply, leading to staffing shortages.

This shortage can result in delayed diagnostics, increased workloads for existing staff, and potential burnout. Moreover, the lack of specialized professionals hampers the effective utilization of advanced imaging technologies, such as MRI and CT scans, which require expert interpretation to ensure accurate diagnoses. Addressing this gap is crucial for optimizing the benefits of veterinary imaging advancements.

The veterinary imaging market is poised for significant growth, driven by the increasing adoption of AI in veterinary diagnostic imaging. AI algorithms enhance the precision and efficiency of image analysis, enabling early detection of conditions such as fractures, tumors, and internal lesions. This technological advancement not only improves diagnostic accuracy but also facilitates timely interventions, leading to better patient outcomes.

The rise of telemedicine in veterinary care presents a transformative opportunity for the imaging market. Remote consultations and teleradiology services allow veterinarians to access expert opinions and share imaging results with specialists, regardless of geographical barriers. This integration of telemedicine enhances accessibility to advanced diagnostic services, particularly in underserved regions, and streamlines the overall healthcare delivery process.

The expansion of 3D and advanced multimodal veterinary imaging systems offers a strong growth avenue for the market. These technologies allow veterinarians to combine CT, MRI, and ultrasound data into detailed anatomical models for complex surgical planning and precise treatment monitoring. Such capabilities are gaining traction in specialty clinics and academic veterinary hospitals, creating new revenue streams and elevating the standard of animal care.

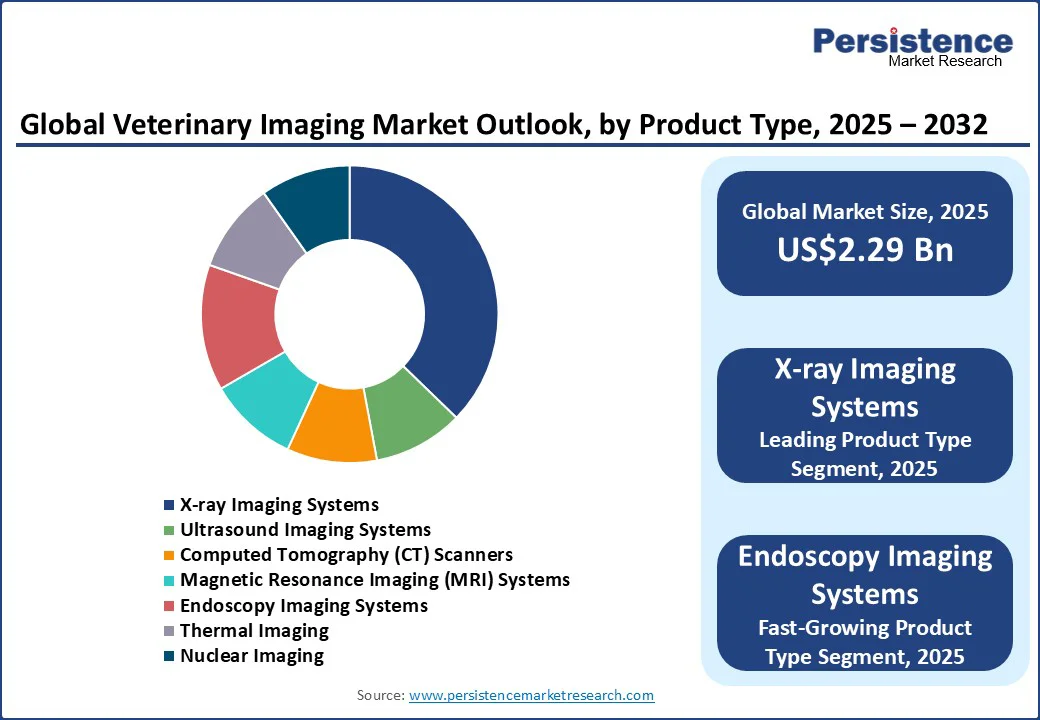

X-ray imaging systems is anticipated to dominate, accounting for approximately 37.5% of the market share in 2025. Digital radiography has become the default first-line diagnostic tool for small-animal orthopedics, dentistry, and thoracic or abdominal examinations.

It is valued for its speed, ease of use in clinical settings, and broad coverage under pet insurance plans, which keeps utilization rates consistently high. Continuous upgrades in DR panels and portable X-ray units from leading manufacturers also sustain steady replacement cycles across veterinary clinics and mobile practices, reinforcing their dominant market position.

Endoscopy imaging systems is projected to be the fastest-growing product segment in 2025. This minimally invasive technology is increasingly used as an alternative to exploratory surgery for gastrointestinal, respiratory, and urogenital cases.

Advances in flexible scopes, high-definition and 4K imaging, and the availability of single-use accessories are expanding its clinical applications. By reducing recovery times and anesthesia risks, video endoscopy is gaining rapid adoption in specialty centers and advanced general practices, making it the fastest-expanding technology in the market.

Small companion animals is projected to be the largest animal-type segment in the veterinary imaging market, holding approximately 51% of the total market share. Dogs and cats account for the majority of veterinary visits, driven by their large global population, higher frequency of clinical check-ups, and significant insurance coverage. Most veterinary clinics focus on small-animal diagnostics, such as digital radiography, ultrasound, and dental X-rays, driving market growth centered on companion animals.

This small companion animals segment is also expected to register the fastest growth rate in 2025, supported by rising expectations among pet owners for human-grade healthcare standards. The adoption of advanced diagnostic solutions such as CT, MRI, cardiology-focused ultrasound, and endoscopy is increasing, even in first-opinion veterinary practices. Expanding pet insurance coverage and the proliferation of specialty and emergency veterinary hospital networks further drive case volumes, keeping small-animal imaging growth ahead of livestock, wildlife, and exotic species segments.

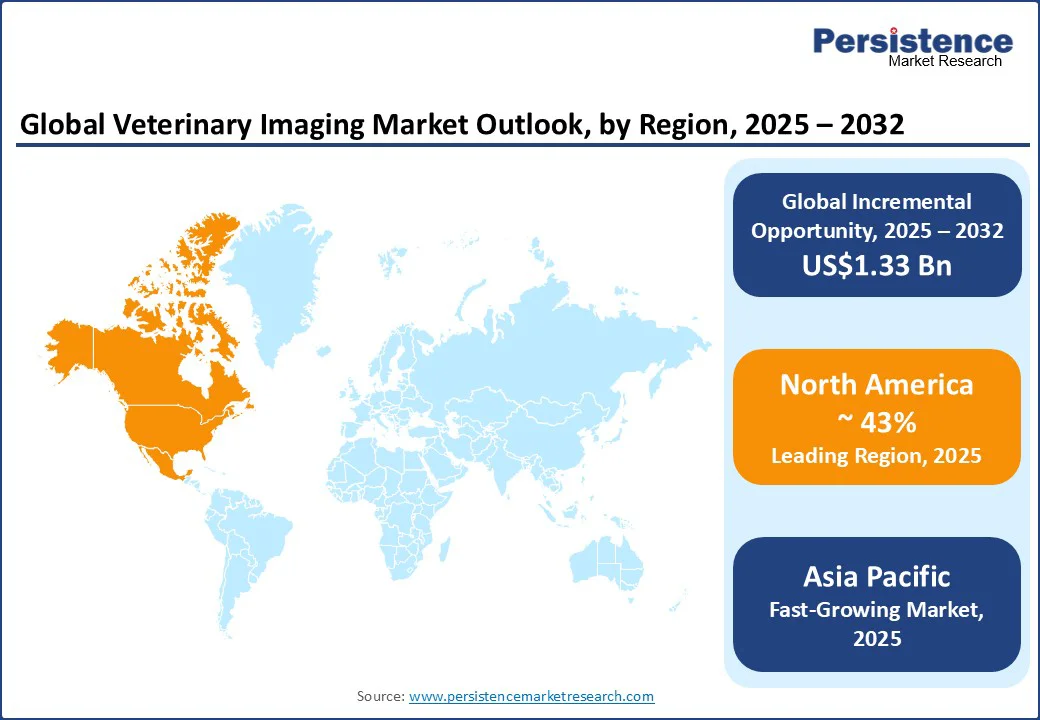

North America is likely to be the leading market with a market share of 43% for advanced veterinary imaging, supported by rising pet insurance coverage that enables greater case approval for CT, MRI, cardiology ultrasound, and dental radiography.

According to NAPHIA, there are 7.03 million insured pets across the U.S. and Canada, with rapid premium growth directly linked to increased use of imaging-intensive care plans in small-animal hospitals. In the U.S., modality upgrade cycles are gaining momentum.

For instance, 2024-2025 marked the installation of the first helium-free 1.5T small-animal MRI at Wisconsin Veterinary Neurology & Surgical Center. This shift toward lower-maintenance, high-field MRI systems is making advanced neuro and soft-tissue imaging more accessible to referral hospitals. At the same time, the introduction of portable, cloud-connected ultrasound systems, such as handheld consoles launched in 2025, has accelerated the adoption of point-of-care imaging in first-opinion practices.

Canada reflects similar trends with notable growth in teleradiology and the establishment of regional imaging hubs, allowing veterinary clinics to access MRI and CT services without owning the hardware. The expanding inventory of advanced modalities across provinces has strengthened cross-referral networks and boosted specialty caseloads. Throughout the region, veterinary hospitals and clinics remain the dominant end users by spending, indicating that infrastructure upgrades and the expanding scope of specialty care are driving growth in North America.

Asia Pacific is anticipated to be the fastest-growing region in 2025, fueled by increasing companion-animal ownership and a rapid expansion of specialty care infrastructure. Japan, one of the most pet-dense countries in the region, continues to see growth in both pet ownership and veterinary spending.

This trend supports high usage rates of ultrasound for cardiology and abdominal diagnostics, alongside digital radiography for routine imaging. Referral centers are also investing in CT and MRI capabilities for oncology and neurology cases, reflecting a shift toward more advanced diagnostics.

In India, veterinary imaging capacity is expanding beyond metropolitan hubs into tier-2 and tier-3 cities, aided by state-backed programs. Recent district-level initiatives have equipped hospitals with digital X-ray systems, ultrasonography units, telemedicine services, and mobile veterinary clinics.

Plans for large-animal imaging facilities are also underway to reduce the need for long-distance transfers for basic imaging. Indian veterinarians are increasingly collaborating with human diagnostic centers to access CT and MRI services for small animals, enabling advanced diagnostics without duplicating costly equipment investments. Additionally, the region is experiencing a rapid build-out of teleradiology networks and AI-powered triage tools, which are helping resource-limited clinics manage growing caseloads and improve diagnostic turnaround times.

Europe is maintaining steady mid-single-digit growth, with the U.K. acting as a hub for veterinary imaging services and innovation. The country has become a leader in teleradiology and equine imaging expertise, with service providers such as VetCT offering 24/7 pay-per-case diagnostic reporting that integrates directly with common PACS systems. This model enables general veterinary practices to escalate complex CT, MRI, and ultrasound cases to board-certified radiologists, effectively expanding access to advanced imaging beyond the referral network.

Germany illustrates the evolving modality mix in Europe. While X-ray imaging remains the revenue leader, video endoscopy is emerging as the fastest-growing segment, with strong demand for MRI and CT in neurology, orthopedics, and oncology as clinics upgrade their facilities.

Across the continent, investments in clinic-friendly MRI systems, including zero-helium designs, and the adoption of updated digital radiography panels are improving throughput and supporting more complex case management. New training programs and radiology education pipelines are also addressing the shortage of specialized veterinary radiologists, further strengthening the region’s diagnostic capabilities.

The global veterinary imaging market is moderately consolidated, with a mix of global leaders and regional specialists competing across modalities such as digital radiography, ultrasound, CT, MRI, and endoscopy. Established players such as IDEXX Laboratories, Esaote, Hallmarq Veterinary Imaging, Sound Technologies, and FUJIFILM Sonosite maintain strong positions through expansive product portfolios, integrated software solutions, and global distribution networks.

Their competitive edge is reinforced by continuous product upgrades, such as helium-free MRI systems, portable high-resolution ultrasound, and AI-assisted diagnostic tools, which align with the industry’s push for faster, more accurate imaging in both referral and first-opinion settings.

Regional manufacturers and niche technology providers are intensifying competition by targeting underserved segments, particularly portable imaging for field veterinarians, mobile units for large-animal care, and cloud-based teleradiology services.

Partnerships with veterinary hospital chains, specialty clinics, and telemedicine providers are also reshaping the competitive dynamics, enabling faster adoption of advanced modalities in emerging markets. Ongoing mergers, acquisitions, and joint ventures are common as companies seek to expand geographic reach, diversify product lines, and integrate AI-driven workflows, solidifying their market presence while responding to evolving clinical demands.

The global veterinary imaging market is projected to reach US$2.29 Bn in 2025, driven by higher adoption of advanced modalities and the rising caseload in small-animal practices.

By 2032, the veterinary imaging market is expected to be valued at US$3.62 Bn, reflecting the impact of expanding specialty care, portable imaging systems, and AI-enabled diagnostics.

Key trends include the rapid integration of AI-assisted image interpretation, wider deployment of portable and handheld imaging devices, increased uptake of video endoscopy in minimally invasive procedures, and a strong push toward teleradiology networks to address radiologist shortages.

By product type, X-ray imaging systems are anticipated to dominate the market with around 37.5% of the market share, primarily due to their role as the first-line diagnostic modality across companion animal clinics.

The market is forecast to expand at a CAGR of 6.8% from 2025 to 2032.

Key players include IDEXX Laboratories, Inc., Esaote S.p.A., Hallmarq Veterinary Imaging Ltd., GE HealthCare Technologies Inc., and FUJIFILM Holdings Corporation.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Animal Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author