ID: PMRREP31858| 195 Pages | 28 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

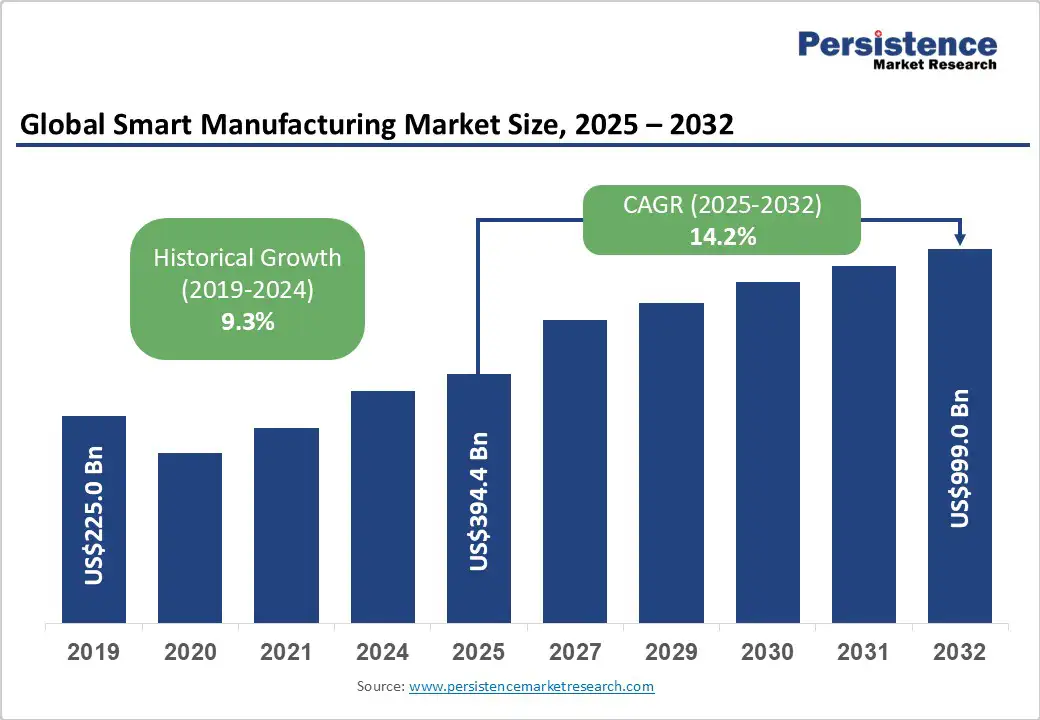

The global smart manufacturing market size is likely to be valued at US$394.4 Billion in 2025, and is estimated to reach US$999.0 Billion by 2032, growing at a CAGR of 14.2% during the forecast period 2025 - 2032, driven by advancements in industrial IoT, AI, and 5G connectivity, which are enabling manufacturers to boost efficiency, minimize downtime, and optimize production processes.

| Key Insights | Details |

|---|---|

| Smart Manufacturing Market Size (2025E) | US$394.4 Bn |

| Market Value Forecast (2032F) | US$999.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 14.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 9.3% |

The rollout of 5G networks is revolutionizing IoT ecosystems in manufacturing by providing ultra-low latency, high bandwidth, and massive device connectivity. With 5G’s ability to deliver speeds of several gigabits per second and latencies under 1 millisecond, manufacturers can implement real-time monitoring and control systems that were previously impossible.

5G adoption is driving smart factory efficiencies by supporting integrated sensors and mobility at high speed, allowing predictive maintenance and increased automation. This advancement is expected to boost the market growth significantly between 2025 and 2032, especially in smart asset management and AI-driven analytics.

Governments worldwide, including those of India, Germany, and the U.S., are actively investing in technologies such as 3D printing, AI, and digital twins for manufacturing modernization. These investments aim to enhance manufacturing resilience and production efficiency post-pandemic.

For instance, NASA’s funding for 3D printing research supports aerospace manufacturing innovations. The proactive regulatory environment and funding by international bodies accelerate Industry 4.0 adoption, forecasting robust market expansion, especially in North America and Asia Pacific.

AI integration with IIoT platforms enables manufacturers to harness big data for predictive maintenance, quality control, and supply chain optimization. AI-driven automation is reducing unplanned downtime by 20-25%, according to industry studies, translating into substantial cost savings.

The IoT market is growing at a high CAGR over the next decade, reinforcing smart manufacturing's technological backbone. This symbiosis between AI and IoT is a key enabler for sustainable growth in smart manufacturing, supporting operational scalability and flexibility across sectors.

The high upfront costs associated with implementing smart manufacturing solutions, including robotics, sensors, software platforms, and infrastructure upgrades, pose a significant adoption barrier, especially for small & medium enterprises (SMEs).

Capital expenditures can run into several million dollars, with payback periods often extending beyond five years. This financial burden is exacerbated by limited access to financing and uncertainty regarding ROI timelines, delaying technology adoption and digital transformation projects. Post-pandemic budget constraints have further tightened investment capacities in key regions.

Smart manufacturing ecosystems require interoperability among diverse legacy systems and new digital technologies, creating integration challenges. These complex integrations often lead to operational disruptions and increased project costs. Moreover, the extensive data connectivity increases vulnerability to cyberattacks; data breaches can result in intellectual property theft or operational downtime. The need for multilayered security protocols and continuous monitoring adds operational overhead, constraining faster smart manufacturing deployment.

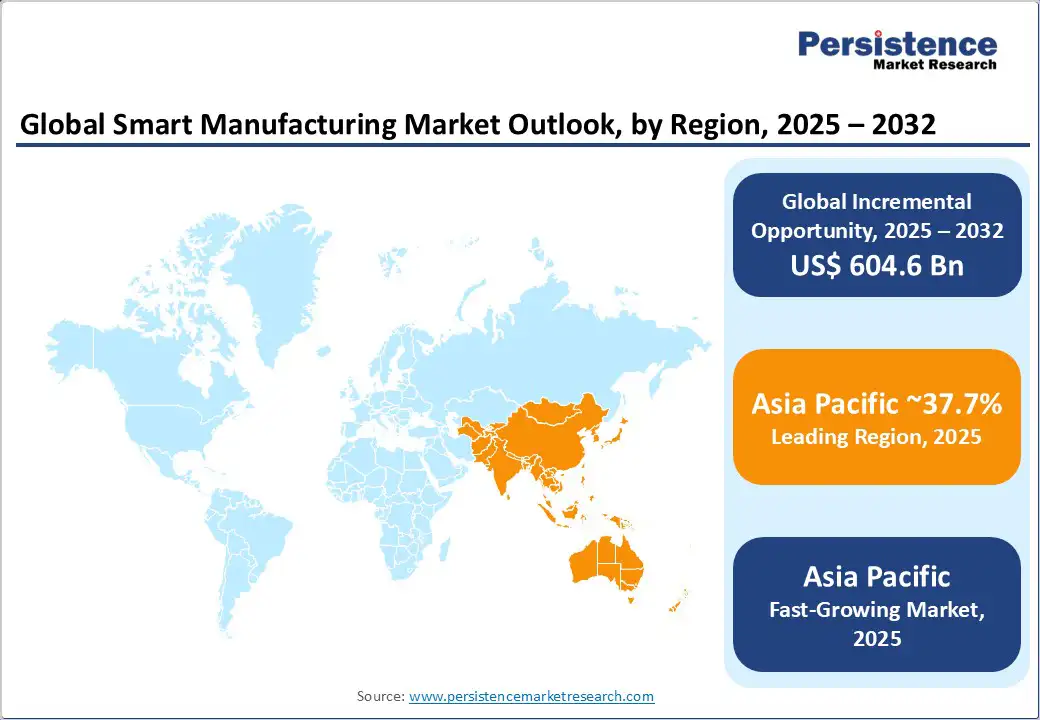

Asia Pacific is poised to be the fastest-growing region, fueled by industrialization in China, India, and Japan and rising government investments in manufacturing infrastructure. The presence of numerous SMEs in the region also accelerates demand for scalable, cost-effective smart manufacturing solutions. This represents a US$1 Trillion and above growth opportunity by 2032, supported by enhanced cloud adoption and technology partnerships.

The blend of AI, edge computing, and digital twin technology enables real-time, autonomous decision-making on factory floors, optimizing resource utilization and reducing production waste. Market players leveraging these converging technologies are positioned to seize substantial competitive advantages, addressing unmet customer needs for customized, flexible manufacturing. This convergence is opening new avenues in predictive maintenance and quality assurance segments projected to expand at a high CAGR over the forecast period.

Increasing regulatory focus on carbon footprint reduction and sustainability is encouraging manufacturers to adopt smart manufacturing solutions to optimize energy consumption and waste management. Governments are rolling out initiatives and incentives for green manufacturing, making smart technologies the key enablers of compliance. This regulatory tailwind drives solution adoption in energy management and environmental monitoring sub-segments, expected to grow significantly in the next decade.

The software segment leads the market with an expected share of 55% in 2025, owing to the increasing adoption of manufacturing execution systems (MES), digital twin technologies, and enterprise resource planning (ERP) solutions.

This segment is critical as it enables seamless integration of IoT, AI, and big data analytics into manufacturing processes, facilitating real-time operational insights and predictive maintenance. Software adoption is particularly strong in industries aiming to optimize efficiency and agility, such as automotive and electronics, where process automation and customization demand robust software frameworks.

The services segment, comprising system integration, consulting, and ongoing maintenance, is the fastest-growing category in the components space, predicted to exhibit a high CAGR from 2025 to 2032. As manufacturers adopt complex smart manufacturing systems, demand for professional and managed services is increasing to ensure smooth implementation and operation.

Growth in cloud-based service offerings further accelerates this trend, enabling scalable, flexible support especially valuable to SMEs. The services segment is thus anticipated to grow rapidly alongside hardware and software expansions.

PLC and SCADA systems currently dominate smart manufacturing technology adoption, holding just over 16% of the market revenue share in 2025, due to their foundational role in industrial automation. PLCs provide precise control over manufacturing equipment, while SCADA systems enable supervisory data collection and analysis, critical for operational efficiency.

In 2025, these technologies collectively account for the largest share of technology revenues by providing enhanced process control, reliability, and integration capabilities across industries such as automotive, chemicals, and pharmaceuticals.

3D printing is likely to be the fastest-growing segment from 2025 to 2032, as a result of rapid digitization and Industry 4.0 adoption, enhancing its applications across sectors such as automotive, aerospace, and healthcare. The technology enables fast production of complex, customized parts, reducing supply chain disruptions through localized manufacturing.

Advances in materials, automation, and AI-driven design optimization further boost efficiency and capabilities. Governments and industries are heavily investing in 3D printing R&D, contributing to the projected growth trajectory of the segment.

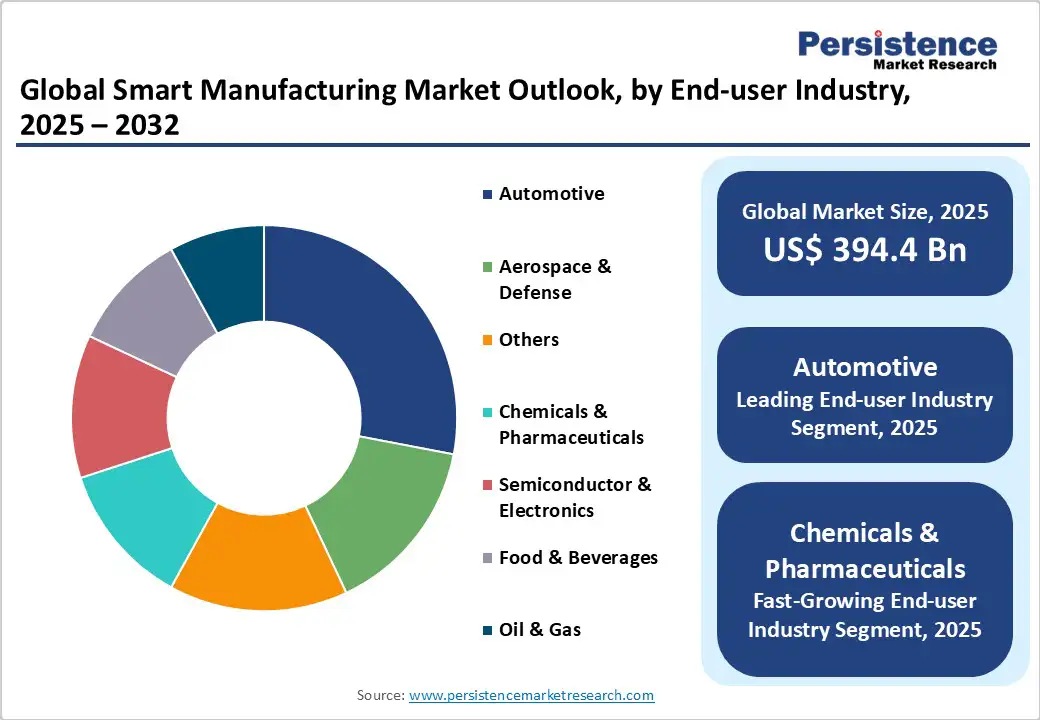

The automotive industry remains the largest end-user segment, expected to account for about 28% of the revenue share in 2025. High demand for smart factory solutions is driven by the need for increased automation, quality control, and customized vehicle production. The integration of robotics, AI, and IoT-enabled predictive maintenance enhances operational efficiency and reduces downtime in automotive manufacturing plants, facilitating cost-effective production-scale flexibility.

The chemicals & pharmaceuticals segment is anticipated to be the fastest-growing during 2025 - 2032, propelled by regulatory compliance demands and the necessity for batch precision and traceability.

Growth in these sectors is underpinned by the adoption of digital quality management systems, automation of chemical processes, and AI-powered monitoring to ensure safety and efficiency. Increasing investments in smart manufacturing are transforming these traditionally complex sectors, delivering higher throughput and tighter control over manufacturing environments.

North America is set to hold approximately 29.4% of the market share in 2025, steered by the leadership of the U.S. in technology innovation and substantial manufacturing investments. The regulatory environments of the U.S. and Canada encourage digital transformation through tax incentives and technology grants. The automotive and aerospace sectors are the key adopters due to stringent quality standards and the drive for sustainable manufacturing practices.

Government programs, including NASA’s 3D printing initiatives, boost R&D investment pipelines. Strategic collaborations between technology companies, such as Honeywell, Rockwell Automation, and GE, underpin innovation ecosystems. Investment flows are expected to grow further, emphasizing digital twin technology and AI integration.

Europe is forecast to account for about 25.3% global market share in 2025, with Germany, the U.K., France, and Spain as primary drivers. Growth is powered by comprehensive regulatory harmonization focused on Industry 4.0 and sustainability compliance, along with high labor costs incentivizing automation. Germany's automotive sector leads adoption, supported by government initiatives facilitating digital factory upgrades.

The competitive landscape is moderately consolidated with Siemens, ABB, and Schneider Electric as prominent players. Increased cross-border collaborations support innovation diffusion, while regional economic policies promote investments in smart infrastructure and IoT-enabled manufacturing.

Asia Pacific is anticipated to be the largest and fastest-growing market, commanding around 37.7% of the market share in 2025. China's expansive industrial base, alongside rapid technological adoption in Japan and India, fuels this growth. A burgeoning SME sector embraces cost-effective smart manufacturing solutions, supported by government incentives and infrastructure digitization.

The regional market benefits from low labor costs and a skilled workforce, attracting foreign direct investments. Cloud adoption and Industry 4.0 initiatives are fostering ecosystem development, powered by leading manufacturing clusters in Southeast Asia. The competitive landscape is fragmented with increasing participation from local technology providers and global incumbents.

The global smart manufacturing market landscape is moderately fragmented with several large multinational corporations and numerous regional specialists. Leading players such as ABB Ltd., Siemens, Honeywell International, Emerson Electric, Rockwell Automation, and General Electric collectively capture over 45% of the market share globally in 2025.

The remainder is divided among specialized technology firms and local integrators. This fragmentation presents both challenges and opportunities for market entrants and established companies, as collaboration and consolidation efforts continue to reshape the competitive environment.

The smart manufacturing market is projected to reach US$394.4 Billion in 2025.

Advancements in industrial IoT, AI, and 5G connectivity are driving the market.

The smart manufacturing market is poised to witness a CAGR of 14.2% from 2025 to 2032.

Key opportunities include the convergence of AI, edge computing, and digital twin technologies, along with stronger policy support for sustainable and energy-efficient manufacturing.

ABB Ltd., Siemens AG, and Honeywell International Inc. are some of the key players in the smart manufacturing market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Technology

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author