ID: PMRREP3435| 175 Pages | 8 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

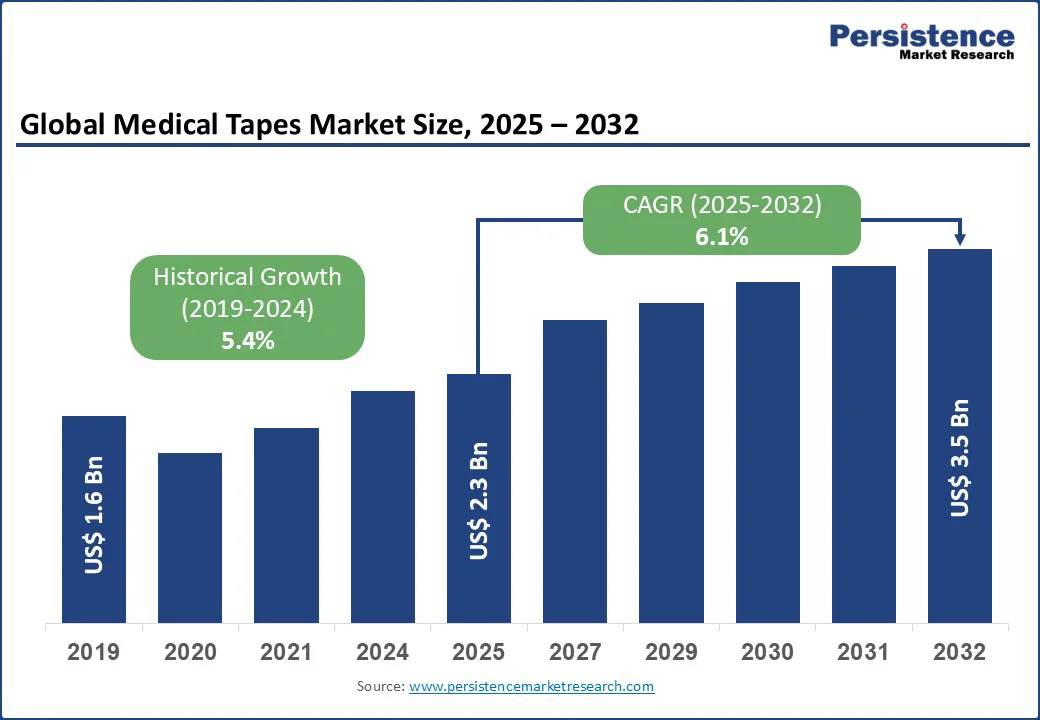

The medical tapes market size is likely to be valued at US$ 2.3 Bn in 2025 and is estimated to reach US$ 3.5 Bn in 2032, growing at a CAGR of 6.1% during the forecast period 2025 - 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Medical Tapes Market Size (2025E) | US$ 2.3 Bn |

| Market Value Forecast (2032F) | US$ 3.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.4% |

The medical tapes market growth is being spurred by rising demand for wound care, post-operative management, and surging use of wearable medical devices. Increasing prevalence of chronic diseases, rising number of surgical procedures, and shift toward home-based care are augmenting growth.

Manufacturers are pursuing strategies such as product differentiation with developments in silicone, paper, and smart adhesive tapes. At the same time, they are planning geographic expansion into developing regions such as Asia Pacific to gain large consumer bases.

The increasing volume of cataract and other elective surgeries is pushing demand for medical tapes. It is because these procedures require precise and secure fixation of delicate surgical dressings and medical devices. In eye surgeries such as cataracts, tapes are used to hold small and sensitive dressings over the eyelid without causing irritation or compromising the sterile field. Elective surgeries also often involve multiple post-operative dressings that must remain intact for several days.

In orthopedic or cosmetic elective procedures, for instance, tapes are used to secure compression pads, drains, or surgical incisions while allowing patients to move comfortably. The rise in elective procedures is further correlated with outpatient and day-care surgery growth, where patients are discharged soon after surgery. Medical tapes are essential in these settings to ensure that dressings remain secure at home, reducing the risk of complications.

Nosocomial infections are limiting the demand for medical tapes as improperly applied or low-quality tapes can become vectors for bacterial growth. It is evident in hospital environments where patients are already vulnerable. In intensive care units, for instance, frequent use of adhesive tapes on IV lines or catheters tends to create micro-environments where bacteria thrive if tapes are not breathable or replaced appropriately. Reports from 2023 in hospitals across Europe showed that certain acrylic tapes, when used continuously in high-moisture areas, contributed to localized skin infections.

Skin damage caused by adhesives is another key hindrance. Traditional tapes with superior synthetic adhesives can cause skin stripping, irritation, or allergic reactions. It is usually seen in neonates, elderly patients, or those with compromised skin integrity. These risks compel hospitals and caregivers to limit tape usage or choose only specialized options, which restricts demand for conventional medical tapes.

The emergence of multipurpose specialty tapes is creating new opportunities for medical tape manufacturers. These products go beyond traditional adhesion and address multiple clinical requirements simultaneously. New silicone-based tapes with integrated antimicrobial coatings help secure dressings while actively reducing the risk of infection. These allow hospitals to combine two functions into a single product. This reduces inventory complexity and improves patient outcomes, giving manufacturers a powerful value proposition.

Another area of development is smart or sensor-integrated tapes. Various leading players are developing adhesive tapes that can monitor vital signs, detect moisture levels, or track patient movement. These tapes are primarily useful for chronic wound management or continuous monitoring devices, creating a niche where traditional tapes cannot compete.

Multipurpose tapes are further augmenting demand in home care and outpatient settings. Tapes that combine breathable, stretchable, and hypoallergenic properties allow patients to manage dressings themselves without professional assistance.

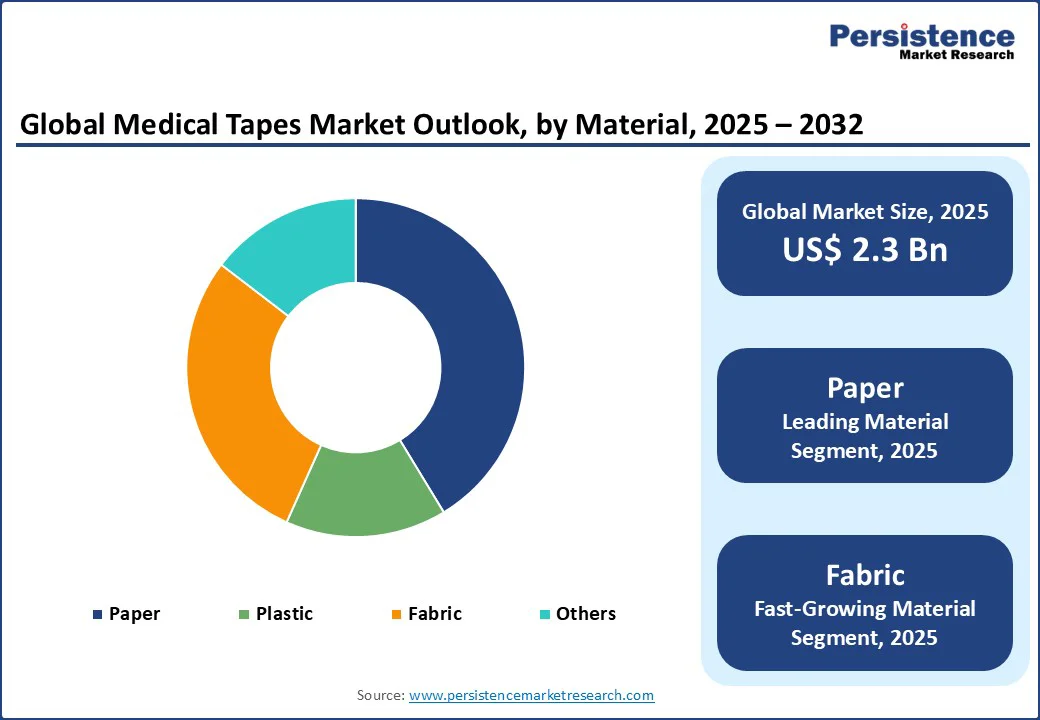

By material, the market is segregated into paper, plastic, fabric, and others. Out of these, paper medical tapes are projected to account for nearly 41.3% share in 2025 owing to their skin-friendly and hypoallergenic properties. These are extremely gentle and suitable for patients with sensitive or compromised skin, such as neonates, elderly patients, and burn victims.

Paper tapes are also biodegradable and environmentally friendly, catering to the high demand for sustainable healthcare products in Europe and North America. In addition, these tapes are increasingly preferred for ease of application and removal.

Fabric-based tapes are seeing steady growth due to their high flexibility and comfort. Unlike rigid or plastic-based tapes, fabric tapes conform easily to body contours, making them ideal for joints, elbows, knees, and other moving areas. This flexibility reduces the risk of tape peeling off during movement and minimizes skin irritation. These also allow air circulation, reducing moisture buildup under the tape, which is essential for wound healing and preventing maceration.

By application, the market segmentation includes post-operative care, wound care, IV set placement, and others. Among these, wound care is estimated to hold nearly 34.6% share in 2025, backed by the ability of medical tapes to protect and secure dressings, which directly impacts healing outcomes.

Medical tapes are designed to hold gauze, bandages, and advanced wound coverings in place without causing additional skin trauma. Patients with burns, ulcers, or diabetic wounds often require dressings that stay in place for extended periods. Novel tapes are specifically engineered to adhere securely yet remove gently, lowering pain and skin damage.

Post-operative care is a key application as medical tapes help ensure the stability and protection of surgical dressings immediately after procedures. Maintaining sterile coverage is important to prevent infections, and these tapes deliver secure adhesion while minimizing the movement of bandages or drains. Medical tapes are also valued in post-operative care for their skin-friendly and low-irritation properties. These tend to reduce discomfort when dressings require frequent replacement.

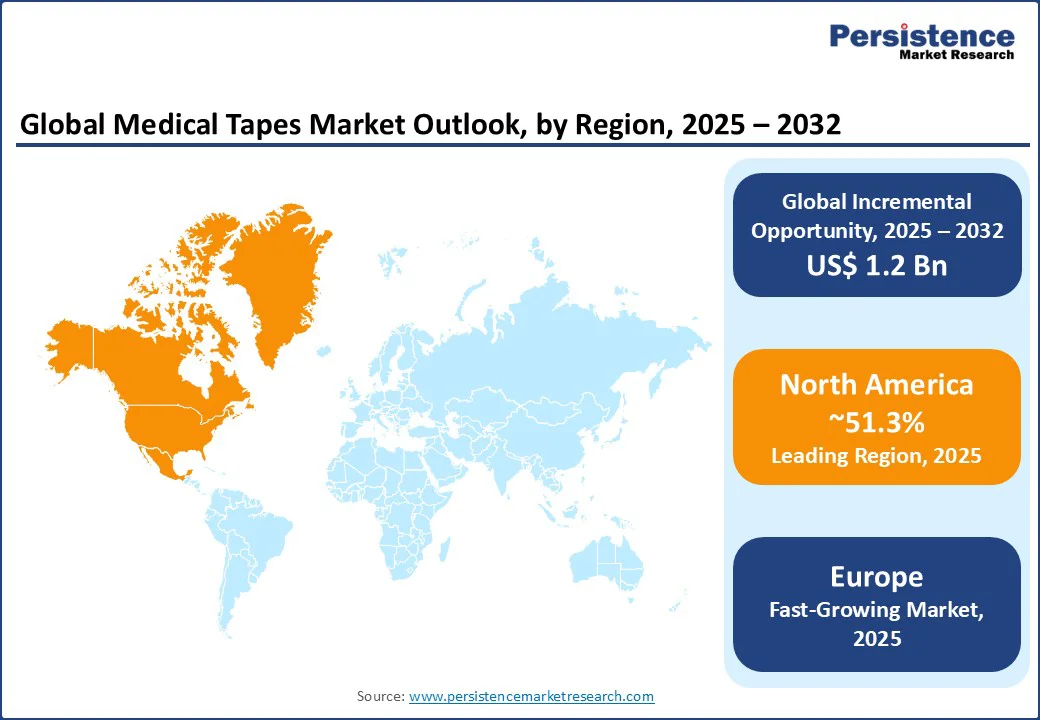

North America is predicted to account for approximately 51.3% of share in 2025 as medical tapes are seeing a shift from traditional products toward skin-friendly and technology-enabled options. Acrylic-based tapes are still widely used because of their superior adhesion. But silicone tapes are becoming popular for patients with sensitive skin or those who require tapes for long wear. This is mainly important in wound care and chronic disease management, where skin irritation is a common issue.

Big healthcare companies such as 3M, Johnson & Johnson, Medline, and Cardinal Health continue to dominate the U.S. medical tapes market, but their strategies are changing. 3M, for instance, recently introduced its 4576 and 4578 tapes that can stay on the skin for 21 to 28 days.

These are highly valuable for patients using wearable devices, including glucose monitors or heart sensors. This shows how medical tapes are no longer just for wound dressings but are also playing a key role in digital health and remote monitoring.

In Europe, the field of medical tapes and bandages is being influenced by EU Medical Device Regulation (MDR), which is stricter than policies in other regions. It has compelled companies to reformulate adhesives and redesign packaging to meet labeling and traceability requirements.

For example, Hologenix, the company behind Celliant-infused textile products, successfully met the EU’s stringent requirements for Class I medical devices in 2023. Hence, the company continues to utilize the CE mark on EU products containing Celliant, including support bandages and adhesive tapes.

Another distinctive trend is the push for sustainability, which is more urgent in Europe than in North America. Germany-based Lohmann & Rauscher and Henkel are experimenting with solvent-free adhesives and tapes made with reduced plastic content.

This directly responds to EU Green Deal targets, making eco-friendly medical tapes not just a marketing advantage but a compliance necessity. The home-care culture is also stronger in Europe compared to other regions. With healthcare systems in the U.K. under strain, patients are being sent home earlier and asked to manage wounds themselves. It is spurring demand for user-friendly and reusable tapes that do not require professional handling.

Medical adhesive tapes are evolving in Asia Pacific as healthcare infrastructure expands and patient requirements change. Japan and China have strict approval rules for adhesives, which makes it difficult for global companies to launch products without extra local testing.

India, on the other hand, has more relaxed rules for low-risk devices, which is encouraging quick entry of new tapes into the market. This uneven regulation means companies must customize their strategies for each country rather than treating Asia Pacific as a single market.

One of the key trends in Asia Pacific is the move toward silicone-based tapes. Government bodies in the region are also supporting research and development activities. In Australia, public funding programs are giving grants to medical device start-ups, including those working on novel tapes. In India, new health initiatives around trauma and burn care are boosting demand for improved adhesive tapes in hospitals. This government backing is helping accelerate adoption of latest solutions.

The global medical tapes market is characterized by the presence of various established multinational corporations and specialized regional players. They are vying for dominance through development, strategic acquisitions, and market expansion.

Key players continue to utilize their extensive distribution networks and brand recognition to maintain market leadership. Several small-scale companies are focusing on specialized product lines such as hypoallergenic medical tapes to cater to the rising demand for skin-sensitive products.

The medical tapes market is projected to reach US$ 2.3 Bn in 2025.

Rising chronic disease prevalence and increasing surgical procedures are the key market drivers.

The medical tapes market is poised to witness a CAGR of 6.1% from 2025 to 2032.

A few key market opportunities include the development of multifunctional tapes and expansion into outpatient settings.

Cardinal Health, Inc., The 3M Company, and Beiersdorf AG are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Material

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author