ID: PMRREP35576| 190 Pages | 22 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

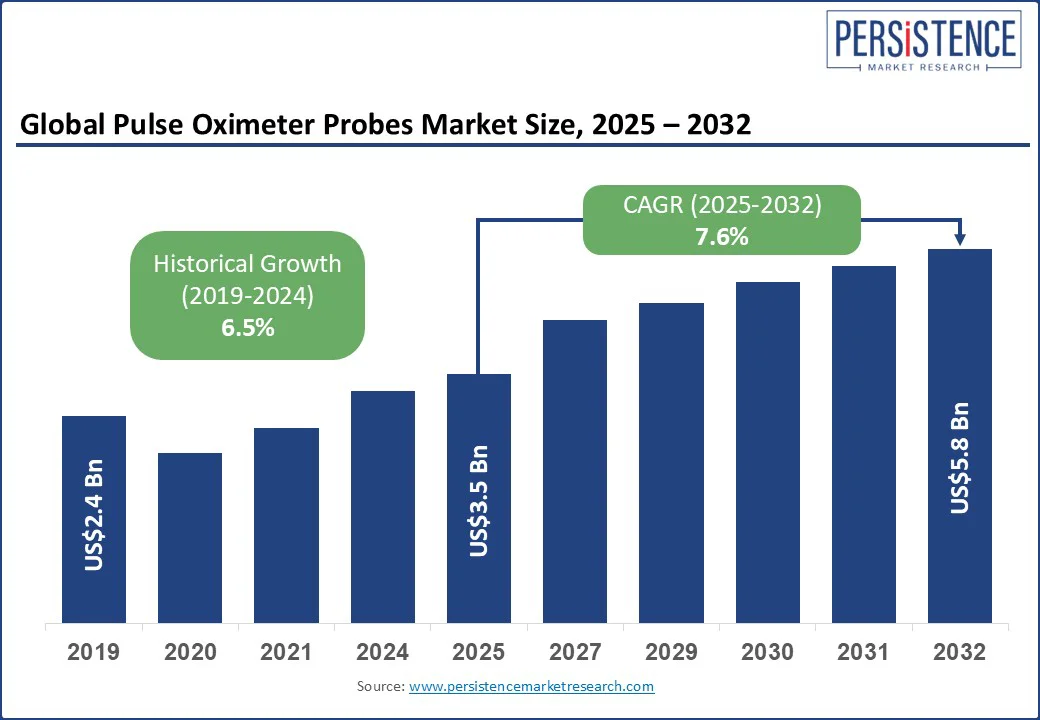

The global pulse oximeter probes market size is projected to rise from US$3.5 Bn in 2025 to US$5.8 Bn by 2032. It is anticipated to witness a CAGR of 7.6% during the forecast period from 2025 to 2032.

The pulse oximeter probes industry is witnessing steady growth due to the rising prevalence of respiratory and cardiovascular conditions, along with increasing demand for continuous patient monitoring in clinical and home care settings. Advancements in non-invasive monitoring technologies and the growing shift toward remote healthcare solutions are further driving adoption.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Pulse Oximeter Probes Market Size (2025E) |

US$3.5 Bn |

|

Market Value Forecast (2032F) |

US$5.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.5% |

Healthcare facilities prefer durable, cost-efficient probes for intensive care and surgical units, ensuring continuous monitoring while minimizing disposable inventory waste. This targeted demand for these hospital-grade reusable sensor probes boosts investment in probe durability and compatibility.

The rise of telemedicine and remote patient monitoring has increased the need for easy-to-use, connected devices that can send the peripheral capillary oxygen saturation level (SpO2) data to digital platforms. This trend reflects a strong demand for Bluetooth-enabled SpO2 probes for home use, particularly among patients with chronic respiratory conditions and post-discharge recovery needs.

The demand for neonatal-compatible pulse oximeter probes is rising due to an increase in premature births and NICU admissions. Manufacturers are focusing on developing soft-tip pulse oximeter probes for neonates that reduce skin damage while delivering accurate SpO2 readings. This demand for gentle, size-specific designs is driving innovation in pediatric sensor technologies, especially in high-volume maternity hospitals and specialized pediatric centers.

Motion can cause SpO2 readings to drift, especially when probes are placed on body parts with poor blood flow, such as cold or constricted fingers. This problem is common in critical care, where low perfusion reduces fingertip probe accuracy. Movement causes the sensor to mix signals from both veins and arteries, leading to inaccurate or inconsistent oxygen readings and frequent false alarms. Even the latest probes struggle with this issue, despite advanced software corrections.

Reflectance probes, which can be placed more flexibly, face another problem: they are sensitive to ambient light. In high-intensity settings such as operating rooms, external light sources, such as surgical lights or light from nearby sensors, can interfere with pulse oximetry readings. This interference causes noise and reduces accuracy. While filtering helps somewhat, the problem persists unless careful optical shielding is used to block unwanted light.

AI-powered anomaly detection through continuous SpO2 monitoring is opening new avenues in chronic care. Probes that send real-time oxygen levels to machine learning models can spot early warning signs in patients with COPD or those recovering from surgery. This enables faster response from healthcare providers, improving patient outcomes in both clinics and at home.

A breakthrough in sleep apnea screening combines millimeter-wave radar with SpO2 sensors for more accurate and non-invasive detection. This hybrid system offers a contact-free way to detect apnea events with sleep lab-level accuracy, offering greater comfort and ease for home use. This innovation is paving the way for new types of sleep health diagnostic tools.

Wearable fingertip pulse oximeters are gaining popularity in fitness tech. Companies are integrating continuous SpO2 sensors into smart rings, watches, and training devices. These products appeal to athletes training at high altitudes, sleep trackers, and biohackers seeking real-time oxygen data without using medical equipment. The need for comfortable, skin-friendly sensors designed for all-day wear is creating new business opportunities for sensor makers.

The adult pulse oximeter probes segment is anticipated to hold approximately 62.3% of the market share in 2025. The high prevalence of chronic conditions such as COPD, obstructive sleep apnea, and cardiovascular disorders among adults primarily drives this dominance.

As healthcare systems worldwide prioritize early detection and continuous monitoring, the demand for adult-compatible sensor probes remains robust in both hospital and outpatient settings. The rise in remote patient monitoring among aging populations further boosts the adoption of adult pulse oximeter probes, especially in home healthcare environments where long-term tracking of blood oxygen saturation is essential.

The pediatric pulse oximeter probes segment is emerging as the fastest-growing category. This growth is fueled by increasing NICU admissions, rising cases of pediatric respiratory disorders, and a surge in early-life screening protocols for congenital heart defects. Manufacturers are developing ultra-soft, hypoallergenic probes specifically designed for infants and children, offering enhanced comfort and safety.

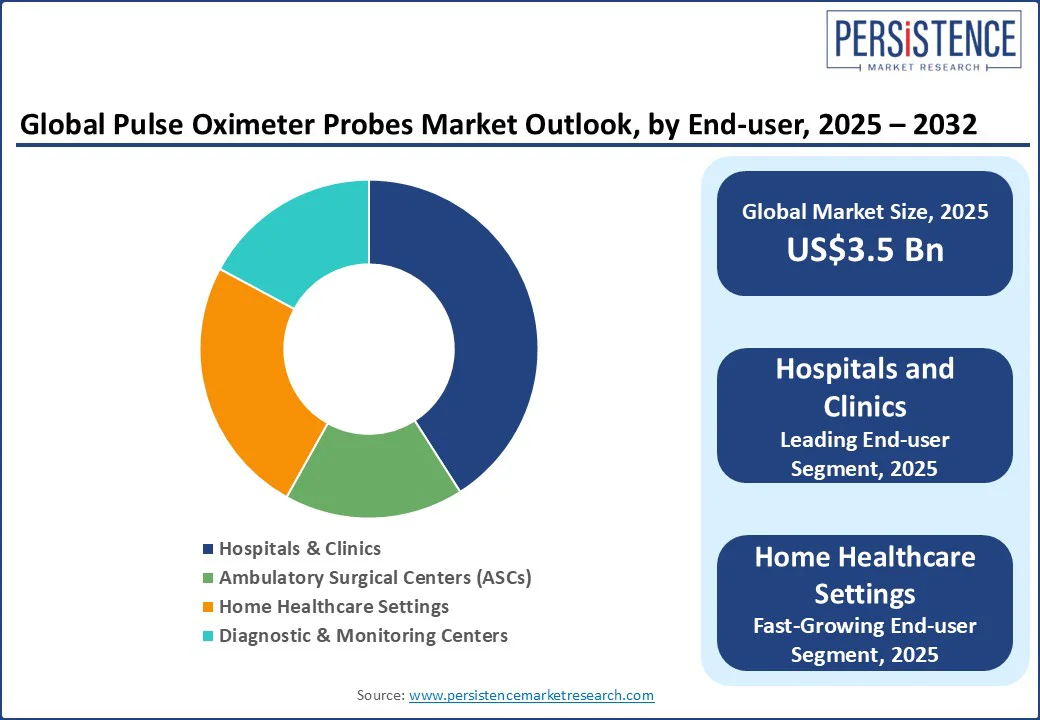

Hospitals and clinics are expected to account for approximately 42.7% of the global market share in 2025. Their dominance is attributed to high patient volumes, widespread use of pulse oximetry during surgeries, critical care monitoring, and the availability of both reusable and disposable probe infrastructure. In hospitals, these probes are integrated into centralized monitoring systems across ICUs, operating rooms, emergency departments, and general wards, driving sustained demand.

In contrast, home healthcare settings are projected to be the fastest-growing segment throughout the forecast period. The shift toward decentralized care, supported by advances in wearable technologies and Bluetooth-enabled probes, has enabled patients with chronic respiratory and cardiovascular conditions to monitor oxygen saturation from home.

Post-COVID awareness, increased telehealth penetration, and the growing elderly population are further fueling the segment growth. Manufacturers are increasingly focusing on consumer-grade pulse oximeter probes that are compact, easy to use, and compatible with smartphones, positioning the home care segment as a key frontier for future expansion.

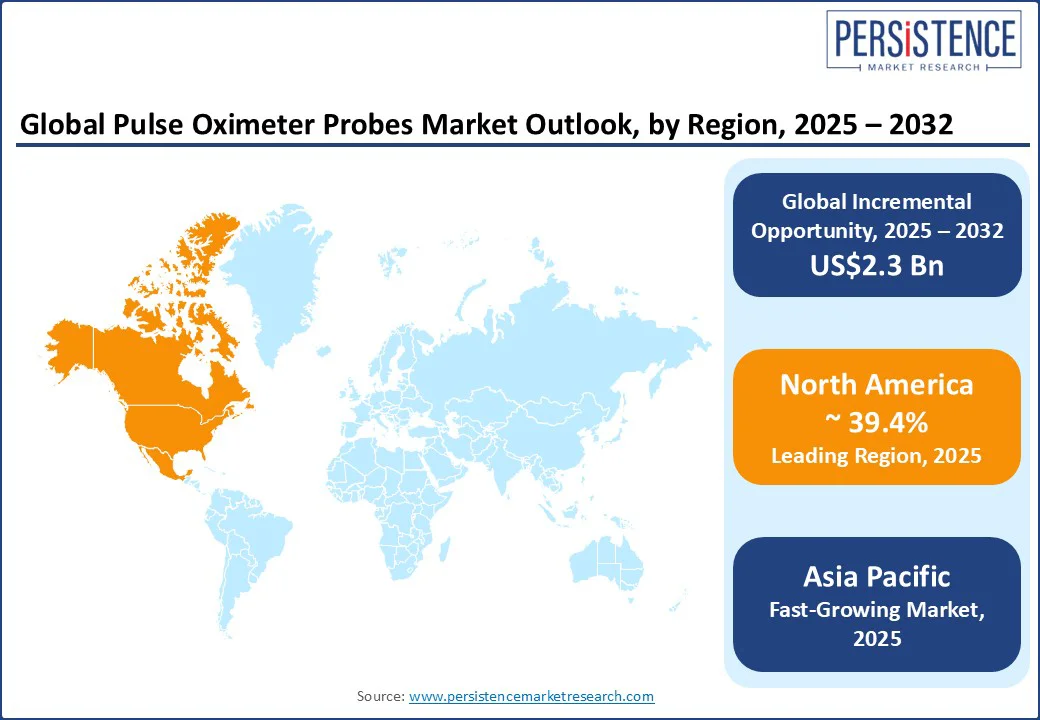

North America is projected to dominate the market, accounting for nearly 39.4% of the total revenue in 2025. The region benefits from strong reimbursement frameworks, early technology adoption, and widespread use of remote patient monitoring.

In the U.S., the market is driven by both institutional use and growing consumer demand. Innovations such as Medtronic’s FDA-cleared Nellcor OxySoft SpO2 sensor, designed to minimize skin trauma in fragile patients, reflect the push toward high-precision monitoring in intensive care units.

Masimo’s expansion into wearable pulse oximeters and UCSF’s FDA-cleared Evie Ring, which demonstrated strong accuracy under hypoxic conditions, underscores the region’s focus on integrating medical-grade sensors into wearable platforms.

In Canada, although the market is smaller, it is expanding steadily. A 2024 pilot project at Dartmouth General Hospital deployed wearable oximeters in emergency care, highlighting how Canadian healthcare systems are incorporating connected devices into hospital workflows and post-discharge monitoring.

Asia Pacific is the fastest-growing region in the pulse oximeter probes market. Large patient populations, rising respiratory illness rates, and increasing investments in local manufacturing drive market growth. Growth in the sensor segment is especially prominent due to government-led initiatives supporting medical technology innovation and public-private partnerships.

For instance, the GX Foundation’s 2022 project in Hong Kong distributed pulse oximeters to caregivers supporting elderly patients at home, extending the utility of these devices beyond pandemic-era emergency care. In India, demand is rapidly accelerating due to the high burden of chronic respiratory diseases and a strong telehealth ecosystem.

Indian manufacturer Mitocon Biomed introduced the affordable Oxysat pulse oximeter in response to supply gaps during COVID-19, boosting domestic production. Government efforts through the Make in India program are promoting local manufacturing, driving adoption in both urban hospitals and rural clinics.

Europe holds a mature but steadily advancing market share in pulse oximeters. Strong healthcare infrastructure, aging populations, and robust regulatory oversight support growth. In Germany, recent reforms now allow pulse oximeter devices to be reimbursed through statutory health insurance, leading to wider use in elder care and remote patient management programs. The country is also integrating oximetry into hospital-at-home and outpatient models, reinforcing its digital health trajectory.

In the U.K., health equity has become a focal point. In March 2024, the Department of Health and Social Care mandated that all pulse oximeter suppliers to the NHS demonstrate device accuracy across different skin tones, following clinical findings of racial bias in standard sensors.

At the same time, virtual ward initiatives and remote monitoring protocols continue to expand, incorporating pulse oximeters into chronic care and post-acute recovery plans. These changes reflect Europe's strong commitment to both innovation and equitable access.

The global pulse oximeter probes market is moderately consolidated, with a handful of established medical device manufacturers holding significant market share. However, the competitive environment is becoming increasingly dynamic due to growing demand from both clinical and consumer health segments.

The market is witnessing a notable shift from hospital-centric procurement to diversified, decentralized usage, including home monitoring, telehealth, and fitness applications. This shift is lowering the entry barrier for smaller players and opening opportunities for niche innovators focused on wearable sensors, software analytics, and cost-effective manufacturing.

The pulse oximeter probes market is expected to reach approximately US$ 3.5 Bn in 2025.

By 2032, the market is projected to grow to approximately US$ 5.8 Bn.

Key trends include the rise of AI-integrated and Bluetooth-enabled probes, increasing preference for wearable and consumer-grade sensors, growth in neonatal and pediatric-specific designs, and a strong shift toward home-based remote monitoring platforms.

The adult pulse oximeter is the leading segment, accounting for approximately 62.3% of the market share.

The market is anticipated to grow at a CAGR of 7.6% from 2025 to 2032.

Key players include Masimo Corporation, Medtronic (Nellcor), Philips Healthcare, Nonin Medical, and Nihon Kohden.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Probe Type

By Technology

By Patient Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author