ID: PMRREP34778| 193 Pages | 23 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

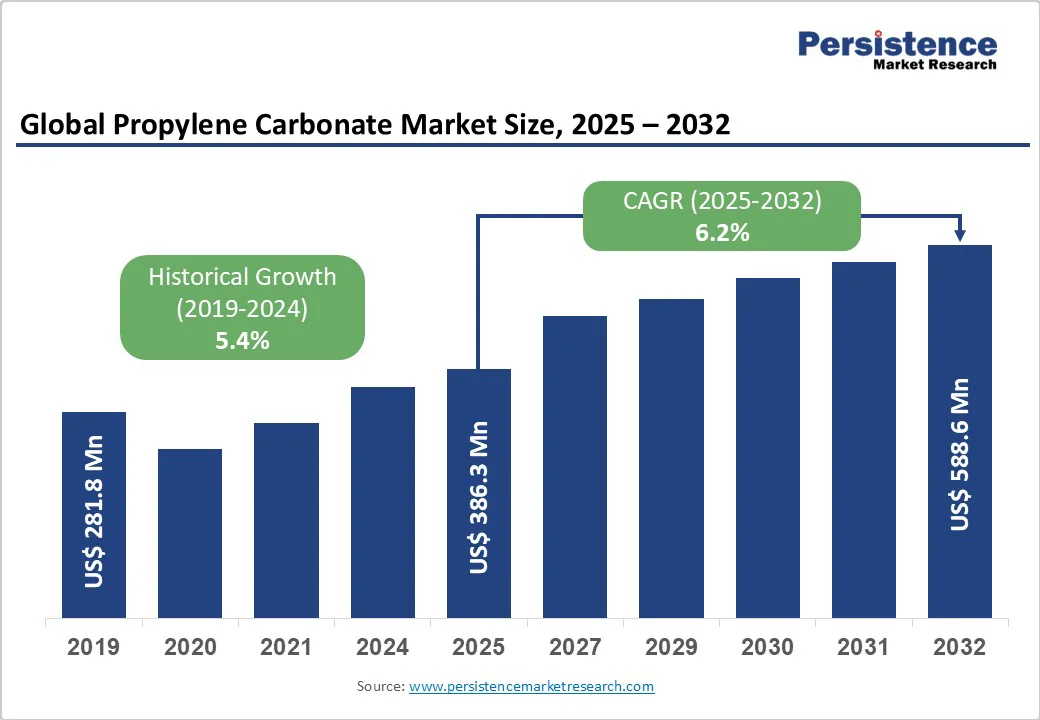

The global propylene carbonate market size is likely to value at US$ 386.3 Million in 2025 and is projected to reach US$ 588.6 Million by 2032, growing at a CAGR of 6.2% between 2025 and 2032.

Propylene carbonate’s exceptional solvency, high dielectric constant, and low toxicity have positioned it as a preferred solvent across multiple high-growth industries.

Its demand is driven by rapid expansion in the electric vehicle sector, where it serves as a critical electrolyte solvent, and by stringent environmental regulations that favor greener alternatives in coatings, cleaning fluids, and personal care formulations.

| Key Insights | Details |

|---|---|

| Propylene Carbonate Market Size (2025E) | US$ 386.3 Million |

| Market Value Forecast (2032F) | US$ 588.6 Million |

| Projected Growth CAGR (2025-2032) | 6.2% |

| Historical Market Growth (2019-2024) | 5.4% |

The proliferation of lithium-ion batteries for electric vehicles has been the foremost driver for the Propylene Carbonate Market. As global EV sales exceeded 10 million units in 2024, a 40% year-on-year increase, battery manufacturers have prioritized high-performance electrolyte solvents with superior dielectric properties and oxidative stability.

Propylene carbonate, with its wide electrochemical window and low viscosity, enhances ion transport and thermal stability. Consequently, demand for propylene carbonate in battery applications grew by over 8% annually between 2021 and 2024, and is expected to maintain similar momentum as EV production capacity expands to meet targets set by major automakers by 2030.

Environmental regulations in key markets, notably the U.S. Environmental Protection Agency’s VOC limits and the European Chemicals Agency’s REACH restrictions, have accelerated the shift from chlorinated and high-toxicity solvents toward greener options.

Classified under REACH as a low-toxicity, biodegradable solvent, propylene carbonate has been widely adopted in industrial cleaning, paints, and coatings. This regulatory tailwind prompted a 6% annual increase in propylene carbonate usage in regulated segments during 2022 - 2024, as formulators reformulated products to comply with stricter environmental standards.

Propylene carbonate production relies on propylene oxide, itself a derivative of petroleum feedstocks. Volatile crude oil prices, which fluctuated between US$ 50 and US$ 90 per barrel during 2022-2024, have translated into raw material cost swings, pressuring margins for propylene carbonate producers. Sudden price hikes can delay contract renewals or prompt end users-particularly in cost-sensitive sectors like textiles and dyes-to seek cheaper alternatives, thereby restraining market growth.

Alternative carbonate solvents such as ethylene carbonate and dimethyl carbonate often cost 10-15% less than propylene carbonate. In 2023, dimethyl carbonate averaged US$ 1,200/ton, compared to propylene carbonate’s US$ 1,400/ton, leading some manufacturers in non-critical applications to opt for substitutes. While performance trade-offs exist, the cost differential remains a key barrier to broader adoption in price-sensitive end uses.

The global stationary energy storage market, valued at US$ 15 billion in 2024, is forecast to expand at a 20% CAGR through 2030. Propylene carbonate’s superior electrochemical stability and wide voltage window make it well-suited for large-format battery systems used in renewable energy integration. Partnerships between propylene carbonate suppliers and battery developers, along with government incentives for utility-scale storage projects, present significant growth avenues through co-development of optimized electrolytes.

Consumer preferences for non-irritating, eco-friendly ingredients have elevated propylene carbonate’s role as a solvent and penetration enhancer in cosmetics. Studies show formulations with propylene carbonate improve active ingredient delivery by up to 25%, driving adoption in premium skincare lines. With global beauty industry revenues surpassing US$ 500 billion in 2024, clean-beauty trends offer a lucrative opportunity for propylene carbonate producers to collaborate on high-margin, specialized formulations.

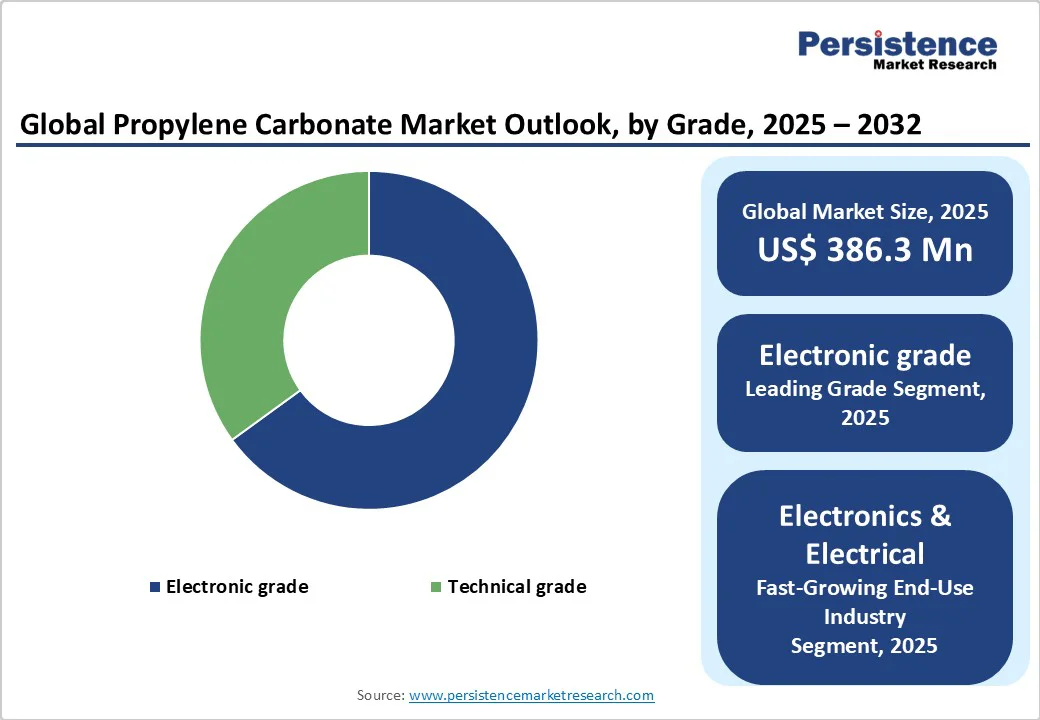

Electronic grade propylene carbonate, characterized by moisture content below 20 ppm and impurity levels under 5 ppm, commands approximately 65% market share. Its use in high-purity applications, notably battery electrolytes and precision electronics cleaning fluids, underpins this dominance. Technical grade, while more affordable, suits industrial manufacturing and solvent applications where ultra-low impurity levels are less critical, capturing the remaining share.

Electrolyte solvent leads with around 55% share of the application segment, supported by the surging lithium-ion battery market. Battery electrolyte formulations accounted for over 60% of global carbonate solvent consumption in 2024. Other applications-such as electronics cleaning fluids, pharmaceutical intermediates, and cosmetics-collectively constitute the balance, each projected to grow at mid-single-digit rates as industries refine product performance and safety profiles.

The electronics & electrical sector represents the largest end-use, with 45% share, reflecting stringent cleanliness and performance requirements for printed circuit boards, semiconductors, and component assembly. Pharmaceutical intermediates follow at 20%, where propylene carbonate acts as a key reaction medium for synthesizing APIs under controlled conditions. Growth in medical device and drug manufacturing, supported by rising global healthcare expenditure, further boosts this segment.

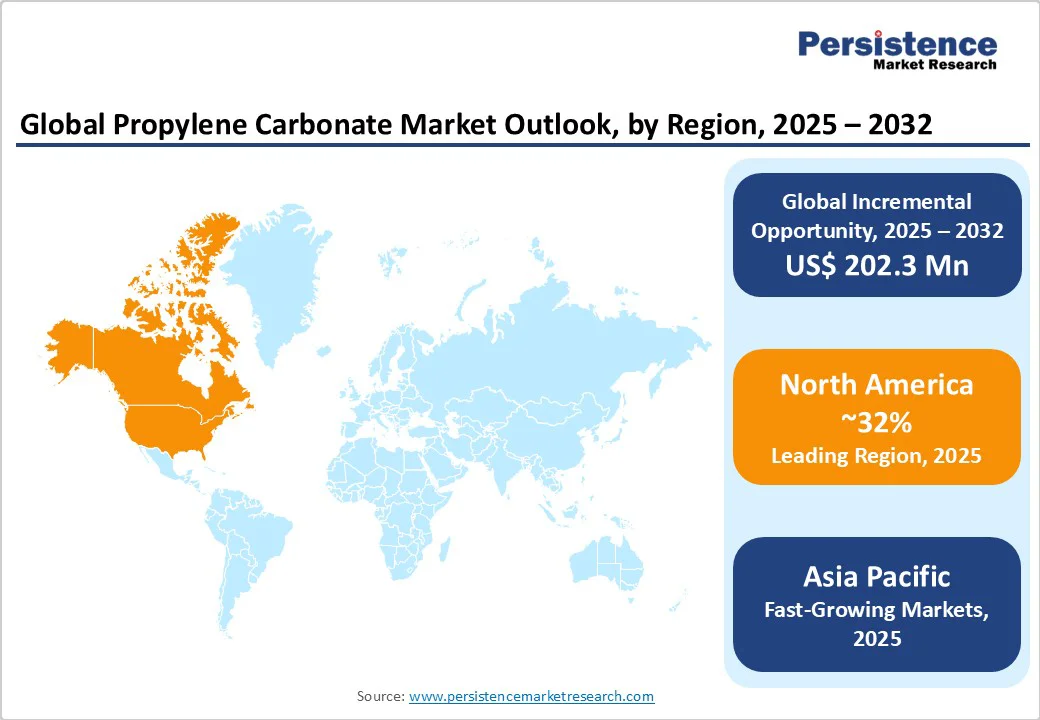

North America’s leadership stems from robust investment in battery R&D and stringent environmental regulations. The U.S. Department of Energy allocated US$ 200 million in grants for advanced electrolyte research in 2024, incentivizing new propylene carbonate formulations.

Major producers such as LyondellBasell Industries expanded U.S. capacity by 15% to serve domestic EV and grid storage markets. Meanwhile, EPA VOC regulations have driven coatings and cleaning fluid manufacturers to adopt propylene carbonate, bolstering regional demand.

Europe’s market growth is underpinned by regulatory harmonization via REACH and significant automotive battery manufacturing. Germany, accounting for 30% of regional consumption, hosts several gigafactories backed by government incentives. The EU Green Deal’s net-zero targets by 2050 have spurred €50 million research grants in France for sustainable electrolyte materials. This regulatory and funding environment accelerates propylene carbonate adoption in battery and industrial applications.

Asia Pacific leads global production, representing over 60% of output in 2024. China’s battery manufacturing capacity exceeded 500 GWh in 2024, driving domestic electrolyte demand. Government subsidies and favorable labor costs support rapid capacity expansions by producers such as Shandong Depu Chemical. Japan and India are also scaling production to cater to regional electronics and automotive sectors, while ASEAN nations emerge as export hubs for industrial solvent applications.

The global propylene carbonate Market is moderately consolidated, with top players such as LyondellBasell Industries, BASF SE, and Shandong Depu Chemical together holding over 50% share. Companies differentiate through proprietary purification technologies, integrated propylene oxide production, and sustainability initiatives like bio-based feedstock sourcing. Toll-manufacturing partnerships and backward integration strategies are gaining traction as firms seek supply security and cost efficiencies.

The propylene carbonate market was valued at US$ 386.3 Million in 2025 and is forecast to reach US$ 588.6 Million by 2032 at a 6.2% CAGR.

The expansion of the lithium-ion battery sector in electric vehicles and grid storage, where propylene carbonate is used as a high-performance electrolyte solvent, drives primary demand.

The electrolyte solvent segment dominates with approximately 55% share, propelled by soaring global battery production capacities.

North America leads, due to significant EV battery R&D investments and stringent environmental regulations favoring green solvents.

Growth in grid-scale energy storage systems presents the foremost opportunity, with stationary battery deployments projected to grow positively in the coming years.

Top players include LyondellBasell Industries, BASF SE, and Shandong Depu Chemical, renowned for integrated production capabilities, high-purity offerings, and capacity expansions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Grade

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author