- Executive Summary

- Global Plant-based Bars Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Chain Analysis

- Supply Chain Analysis

- List of Key Market Players

- Production and Trade Statistics

- Key Producing Countries and Regional Breakdown

- Import Analysis of Plant-based Bars-based Products

- Value Added Insights

- Global Clean Label and Fortified Snack Bar Outlook

- Functional Snack Bar Landscape and Nutritional Positioning

- Plant-based Bars vs Whey-based vs Hybrid Protein Systems

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Trend Analysis, 2019 - 2032

- Pricing Analysis, By Product Type

- Key Factors Impacting Product Prices

- Global Plant-based Bars Market Outlook

-

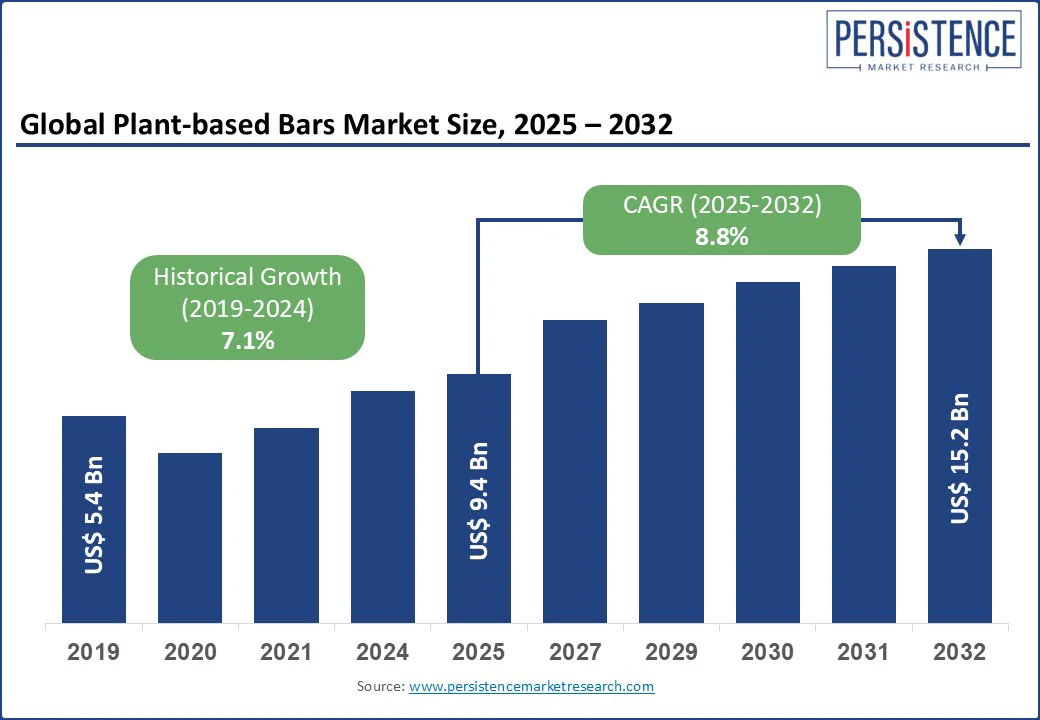

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, 2025-2032

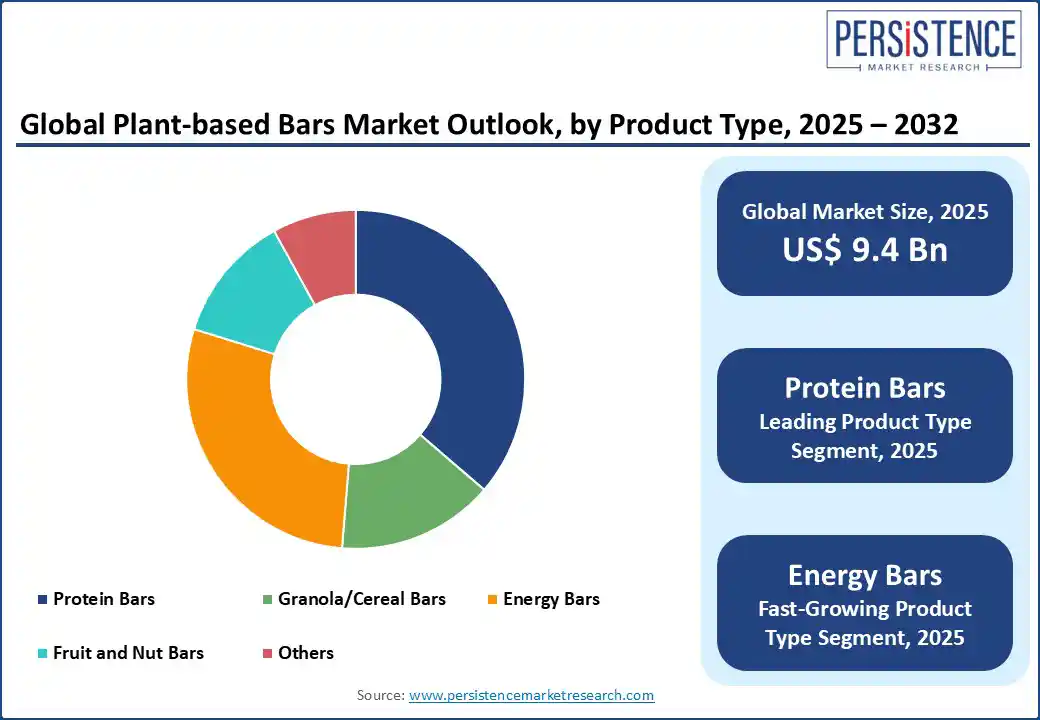

- Global Plant-based Bars Market Outlook: Product Type

- Historical Market Size (US$ Bn) Analysis, By Product Type, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Attractiveness Analysis: Product Type

- Global Plant-based Bars Market Outlook: Nature

- Historical Market Size (US$ Bn) Analysis, By Nature, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Attractiveness Analysis: Nature

- Global Plant-based Bars Market Outlook: Distribution Channel

- Historical Market Size (US$ Bn) Analysis, By Distribution Channel, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis: Distribution Channel

-

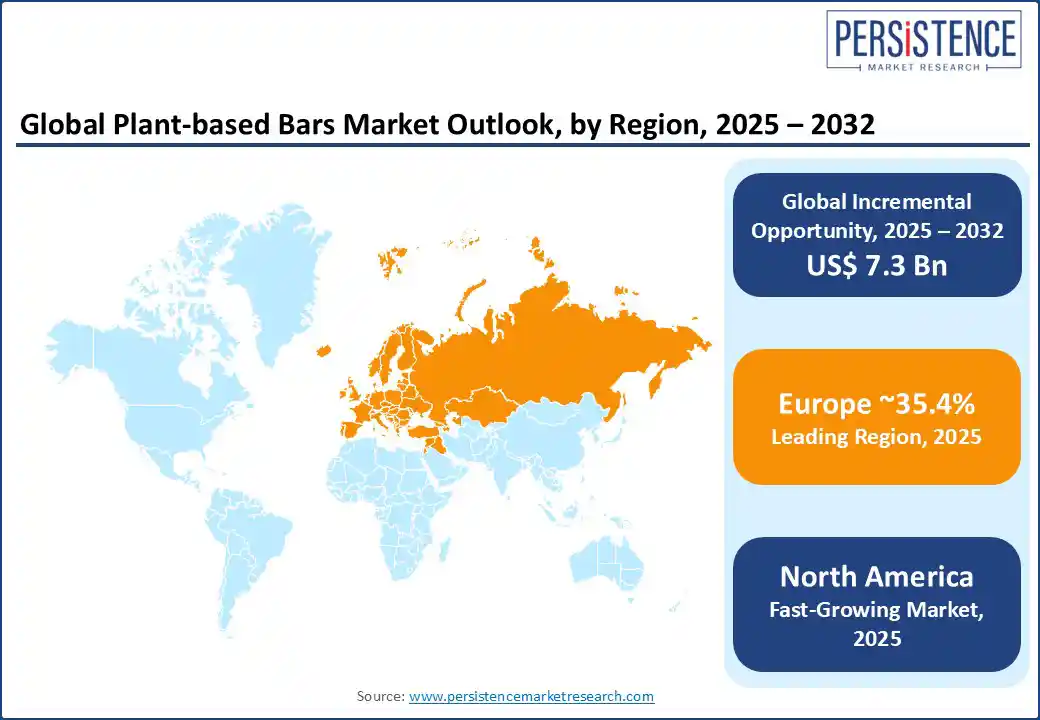

- Global Plant-based Bars Market Outlook: Region

- Historical Market Size (US$ Bn) Analysis, By Region, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Plant-based Bars Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Nature

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- U.S.

- Canada

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Europe Plant-based Bars Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Nature

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- East Asia Plant-based Bars Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Nature

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- China

- Japan

- South Korea

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- South Asia & Oceania Plant-based Bars Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Nature

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Latin America Plant-based Bars Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Nature

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Middle East & Africa Plant-based Bars Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Nature

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Protein Bars

- Granola/Cereal Bars

- Energy Bars

- Fruit and Nut Bars

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Nature, 2025-2032

- Organic

- Conventional

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025-2032

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Kellogg Company

- Overview

- Segments and Product Type

- Key Financials

- Market Developments

- Market Strategy

- Greens Gone Wild, LLC

- 88 ACRES

- General Mills Inc.

- MadeGood

- Rise Bar

- GNC Holdings, LLC

- GoMacro, LLC

- Clif Bar & Company

- Växa Bars

- LoveRaw

- Others

- Kellogg Company

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment