ID: PMRREP35904| 200 Pages | 25 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

The global PET preform market size is likely to be valued at US$19.2 billion in 2025 and is expected to reach US$24.3 billion by 2032, growing at a CAGR of 3.4% during the forecast period from 2025 to 2032, driven by accelerating demand for lightweight, cost-effective packaging solutions across the beverage, pharmaceutical, food, and personal care industries.

The market is propelled by rising demand for packaged, on-the-go beverages, stricter recycled-content regulations, and advancements in lightweighting technologies. Structural resilience stems from stable consumption patterns, regulatory harmonization, and growing investments in recycling infrastructure across major regions.

| Key Insights | Details |

|---|---|

|

PET Preform Market Size (2025E) |

US$19.2 Bn |

|

Market Value Forecast (2032F) |

US$24.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.9% |

Stringent global regulations on plastic waste are reshaping the market, with mandatory recycled-content thresholds creating stable, predictable demand. The EU’s Single-Use Plastics Directive requires 25% rPET in bottles by 2025 and 30% by 2030, while India mandates 30% rPET in all PET beverage bottles from April 2025. These policies have spurred nearly INR 8,000 crore (US$950 million) in recycling investments, raising India’s PET recycling capacity to 400,000 metric tons annually.

Major players such as ALPLA Group are scaling output, targeting a rise from 350,000 to 700,000 metric tons of recycled material capacity by 2030. This regulatory momentum underpins the market’s projected 3.4% CAGR through 2032, sustaining demand for compliant preforms and advanced material inputs.

Rising populations, urbanization, and income growth across Asia Pacific, Latin America, and Africa are driving sustained beverage consumption and high PET preform demand. China’s expanding HRI sector and India’s growing packaged food market reinforce long-term volume requirements.

Southeast Asia’s middle-class growth further accelerates the adoption of portable beverage packaging. With beverages accounting for roughly 58% of PET preform consumption, driven by bottled water, CSDs, juices, and sports drinks, global utilization rates remain strong, supporting continuous manufacturing investment.

Manufacturing innovations are transforming the market by reducing material use while preserving strength, delivering both cost and environmental advantages. SIPA’s XFORM Renew system enables production of 100% rPET preforms in a single energy cycle, marking a major shift toward circular sourcing.

Lightweight designs cut transportation costs by 15–20%, while injection-compression moulding achieves 15–20% thinner walls without compromising barrier performance, critical for CSDs and hot-fill products. These efficiencies lower unit production costs, boost manufacturer margins, and accelerate conversion from glass, metal, and carton. Enhanced quality control through sensors and real-time monitoring also reduces waste by 8-12%, improving throughput and reinforcing supplier competitiveness.

Despite regulatory mandates for recycled-content integration, the market faces significant constraints on rPET availability and consistency. Food-grade rPET suitable for beverage applications requires advanced mechanical or chemical recycling processes that ensure contamination removal and polymer chain integrity, capabilities concentrated among a limited pool of specialized recyclers, mainly in the Asia Pacific and North America.

Quality variability in recycled material disrupts production efficiency, as fluctuations in polymer viscosity require mold recalibration and wall-thickness adjustments, increasing complexity and slowing output. India’s 30% rPET mandate further intensifies supply-demand imbalances, as domestic capacity struggles to meet surging demand. As a result, beverage brands import rPET at premiums of 8-15% above virgin PET, compressing preform supplier margins.

The integration of the PET preform market into circular-economy frameworks is driving differentiation and premium-pricing opportunities for manufacturers adopting design-for-recycling principles. Tetra Pak’s 2025 launch of packaging with 5% ISCC PLUS-certified recycled polymers demonstrates market readiness for mixed-source recycled content and brand-owner willingness to adopt interoperable recycling solutions. Neck-finish standardization, particularly PCO and ROPP formats, enhances mechanical sorting efficiency and enables automated recycling workflows, boosting material recovery rates from 85-92% to over 95% in advanced facilities.

Preform manufacturers offering modular, tooling-agnostic designs compatible with virgin PET, rPET, and chemically recycled materials provide operational flexibility across diverse regulatory environments. Extended Producer Responsibility (EPR) schemes in India, the EU, and emerging markets further support innovation by assigning collection and recycling costs to brand owners. India’s upcoming 30% rPET mandate, scheduled for 2025-2026, will generate captive demand for compliant preforms. Manufacturers capable of scaling rPET processing can secure premium service fees and long-term contracts, mitigating commodity PET pricing pressures. Initiatives such as Huhtamaki India’s “Think Circle” forums signal growing industry momentum toward standardized, commercially viable recycling infrastructure.

Innovation in compression-molding technology and automated preform design optimization is driving competitive differentiation and margin expansion in the market. SIPA’s XTREME Sincro system exemplifies this, integrating injection-compression molding with stretch-blow technology to achieve production speeds of 2,250 bottles per hour per cavity while reducing energy consumption by roughly 10% through lower processing temperatures and pressures. Multi-cavity capabilities and simultaneous preform variation production expand customization options, enabling brand owners to create unique bottle designs without sacrificing efficiency.

Precision engineering supports the adoption of lighter-weight preforms in pharmaceutical and personal care applications, where regulatory and shelf-life requirements previously demanded heavier materials. Preform designs accommodating higher rPET content maintain clarity, barrier performance, and mechanical strength, supporting regulatory compliance and reducing reliance on virgin PET. Advanced quality-assurance technologies, including 100% camera-based inspection and real-time process monitoring, lower defect rates and improve consistency, enabling scalable integration of rPET feedstock while meeting stringent food-safety standards.

Virgin PET is anticipated to dominate, commanding 74% market share in 2025. Food and pharmaceutical applications prioritize virgin PET due to regulatory safety compliance, superior optical clarity required for product visibility, and established manufacturing consistency across global production facilities. Virgin PET's deployment spans beverage carbonation applications (carbonated soft drinks, sparkling water) where pressure resistance and burst strength specifications necessitate unfractured polymer chains, restricting the adoption of recycled material in critical applications.

Recycled PET is the fastest-growing material category, propelled by EU and Indian mandatory recycled-content legislation and brand-owner sustainability commitments. The rPET segment's superior growth rate reflects regulatory momentum, brand-owner ESG commitments, and consumer preference acceleration for verifiable sustainability attributes, positioning recycled material as the preform market's highest-potential expansion opportunity through 2032.

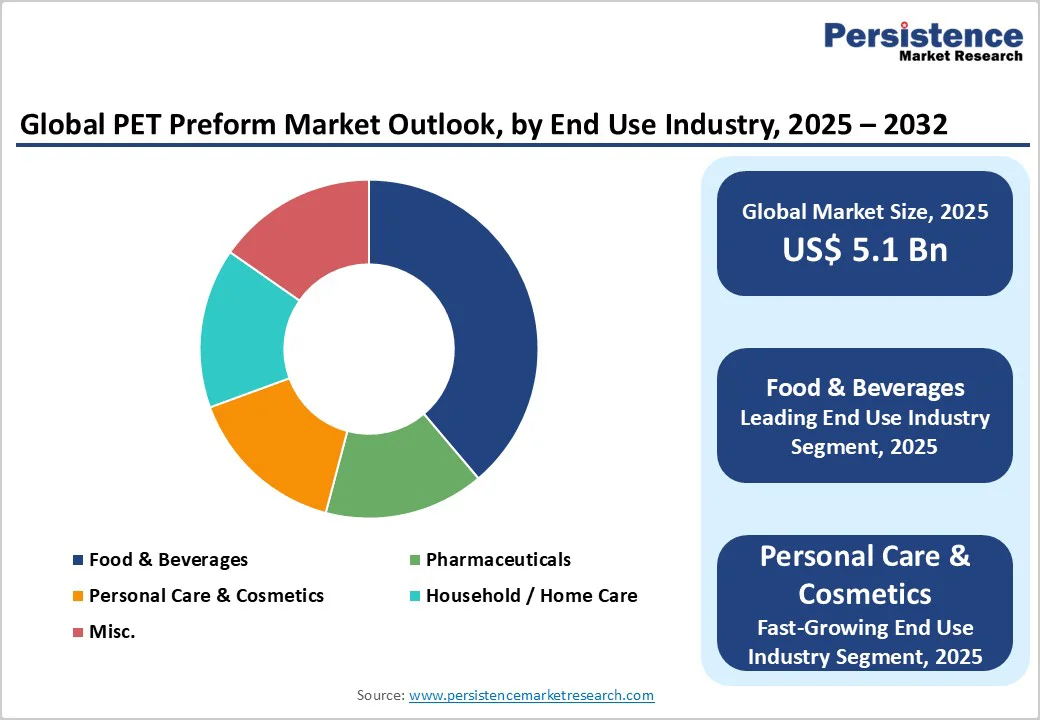

The food & beverages segment is the market's dominant end-user category, accounting for 55% of the market in 2025, encompassing carbonated soft drinks, bottled water, juices, energy drinks, sports beverages, and ready-to-drink tea and coffee products. Carbonated soft drinks remain the single largest application, accounting for 28-32% of total global preform output due to pressure containment requirements and brand packaging standardisation across Coca-Cola, PepsiCo, Fanta, and regional manufacturers. Bottled water category consumption accelerated across emerging markets, with global per capita bottled water consumption reaching 10.6 liters in 2024, directly correlating with the demand for preforms.

The personal care & cosmetics segment emerges as the fastest-growing end-use category, driven by urbanization, middle-class expansion, and category penetration in emerging markets. PET transparency facilitates product visualization, which is critical for colored cosmetics (nail polish, body washes, and serums), enabling consumers to assess quality and make purchase decisions. Perform manufacturers developing specialized neck finishes for cosmetic pump integration (24-28mm finishes with collar support) and incorporating light-barrier additives for UV-sensitive actives (serums, sunscreens) capture premium supply positioning in the fastest-expanding segment.

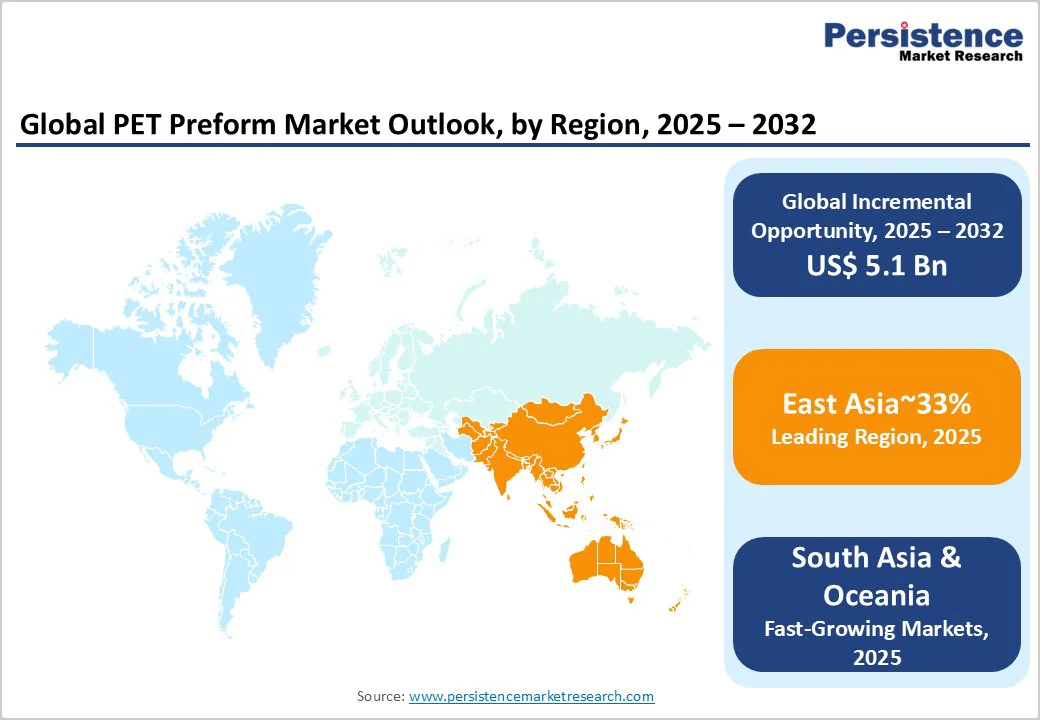

North America accounts for 17% of the market, supported by mature beverage consumption, well-developed recycling infrastructure, and increasingly stringent state-level recycled-content regulations. The U.S. flexible packaging industry generated US$41.5 billion in 2022, representing the second-largest segment and 21% of the nation’s US$180.3 billion packaging market. Food packaging dominates, accounting for roughly 50% of shipments, followed by medical and pharmaceutical applications (16%), beverages (6%), and personal care products (5%), highlighting a diversified preform end-use base.

Recent regulatory initiatives, including California’s AB 793, Washington’s SB 5022, and New Jersey’s A4676/S2515, introduce escalating rPET content requirements through 2030–2031, driving near-term growth in recycled preform demand. Multinational brand owners in beverages, pharmaceuticals, and personal care prioritize harmonized packaging specifications across North American operations, enabling standardized preform designs, reduced customization complexity, and cost efficiencies via shared tooling and coordinated production planning. Manufacturing capacity is concentrated among integrated producers such as Plastipak Holdings and Husky Injection Moulding Systems subsidiaries, as well as regional converters, reflecting entrenched market positions and long-standing customer relationships.

East Asia dominates the market, commanding approximately 33% of total market value, driven by China's manufacturing scale and emerging market consumption expansion across the region. China's beverage market leadership, combined with world-scale preform manufacturing infrastructure, establishes East Asia as the primary supply hub servicing both domestic and international demand.

The region's production capacity exceeds 6 million tonnes annually across integrated facilities operated by major manufacturers, including Indorama Ventures subsidiaries, RETAL Industries operations, and domestic Chinese producers.

Mature consumption patterns, advanced manufacturing capabilities, and stringent regulatory frameworks drive Europe. Key EU regulations, including the Single-Use Plastics Directive, Packaging and Packaging Waste Regulation, and Extended Producer Responsibility schemes, establish some of the world’s most demanding recycled-content and plastic-waste reduction mandates. These rules require 30% recycled content by 2030 and 50% by 2040 for non-food packaging, creating sustained demand for preform technologies capable of incorporating higher rPET percentages.

European beverage consumption emphasizes premium positioning and sustainability, concentrating performance demand in high-specification applications rather than commodity volumes. Germany, France, and the U.K. are the largest markets, supported by strong per capita beverage consumption and disposable incomes that enable the adoption of premium packaged products. Retail consolidation and centralized supply chains among European packagers create concentrated customer bases, intensifying competitive pressures for preform manufacturers and placing margin optimization at the forefront of operational strategy.

The global PET preform market is moderately consolidated, with a few major players holding significant shares while numerous regional and local manufacturers maintain market fragmentation. Leading firms, ALPLA, Indorama, Plastipak, Resilux, Retal, and Hon Chuan, dominate through production scale, technological investment, and global presence, creating high entry barriers for smaller competitors. Local converters and preform molders in emerging markets sustain a competitive fringe, resulting in an oligopolistic core complemented by a long tail of smaller players. This structure balances scale advantages with regional diversity.

The global PET preform market is projected to be valued at US$19.2 Billion in 2025.

The food & beverages segment is expected to hold around 55% market share by end-user industry in 2025 in the PET preform market.

The PET preform market is expected to witness a CAGR of 3.4% from 2025 to 2032.

The market is driven by strict recycled-PET mandates, rising recycling investments, growing beverage and packaged-food demand in emerging markets, and technological innovations enabling lightweight, high-quality preforms that lower material use, transportation costs, and support sustainability compliance.

Key opportunities include the transition to a circular economy through post-consumer rPET integration, alongside technological advancements in lightweight and complex preform designs that enhance regulatory compliance, reduce costs, and enable product differentiation.

The leading global players in the PET preform market include ALPLA, Indorama Ventures, Plastipak Holdings, RESILUX, and RETAL Industries.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data/Actuals |

2019 to 2024 |

|

Market Analysis |

US$ Bn |

|

Segmental Coverage |

|

|

Geographical Coverage |

|

|

Competitive Landscape |

|

|

Report Coverage |

|

By Material Type

By Neck Finish

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author