ID: PMRREP35541| 180 Pages | 1 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

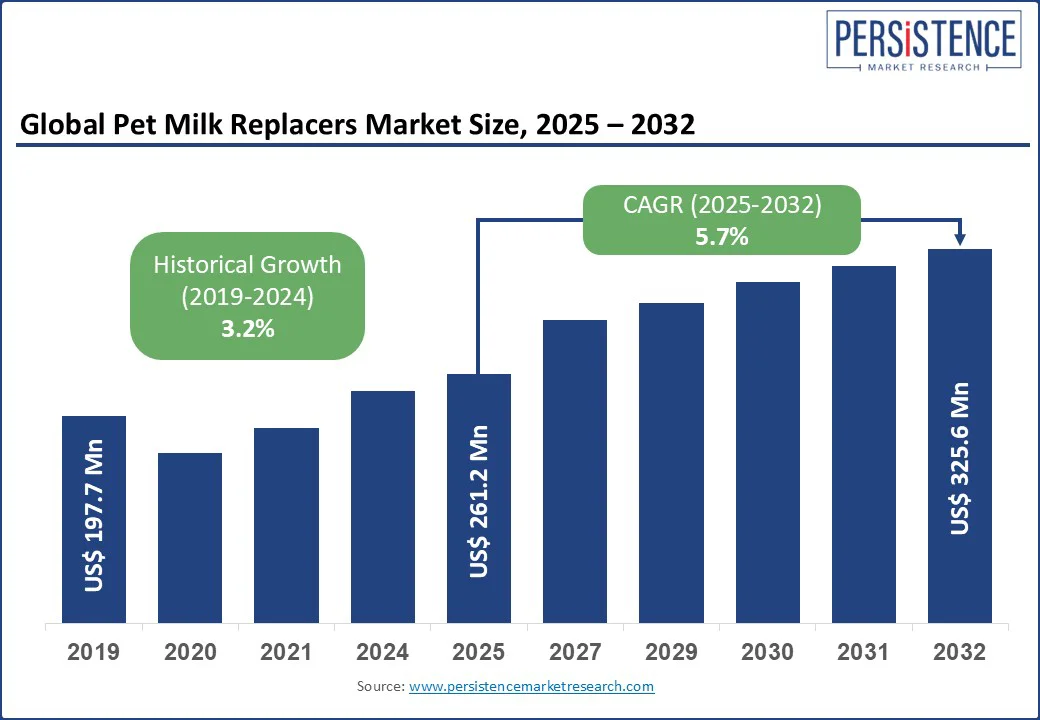

The global pet milk replacers market size is likely to be valued at US$ 261.2 Mn in 2025 and is estimated to reach US$ 325.6 Mn in 2032, growing at a CAGR of 5.7% during the forecast period 2025 - 2032. The pet milk replacers market growth is driven by innovations in species-specific formulations, functional enrichment with immunological agents, and evolving consumer preferences for convenience. Pet milk replacers are emerging as a key sub-segment in the companion animal nutrition market, pushed by the surging demand for neonatal care solutions for pets in both household and institutional settings.

As adoption rates rise and animal rescue operations expand across the globe, demand for nutritionally balanced alternatives to maternal milk has skyrocketed. Key players are now investing in premium and vet-endorsed offerings to gain a competitive advantage.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Pet Milk Replacers Market Size (2025E) |

US$ 261.2 Mn |

|

Market Value Forecast (2032F) |

US$ 325.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.2% |

Rising prices of cow and goat milk globally have made pet milk replacers a more cost-effective and accessible alternative for breeders, shelters, and pet parents caring for newborn animals. In 2024, global milk prices surged due to feed cost inflation, extreme weather disruptions in milk producing areas, and export restrictions from countries, including India. According to the Food and Agriculture Organization (FAO) Dairy Price Index, dairy prices rose by over 5% year-on-year in early 2024. These made it economically unsustainable for several consumers to rely on fresh milk for orphaned or rejected litter, mainly in multi-animal households or shelters.

Pet milk replacers offer controlled pricing and longer shelf stability. These are available in powdered or canned formats with extended shelf life, offering better value. Veterinary professionals increasingly recommend them over diluted cow milk, not just for cost but also due to their nutritional precision. This shift is primarily noticeable in developing markets, where high milk inflation has made traditional feeding methods prohibitively expensive. In Southeast Asia, for instance, local pet product retailers have increased the inventory of milk replacers from both domestic brands and global players.

The potential for bacterial contamination in pet milk replacers has emerged as a significant deterrent to adoption, specifically among breeders and veterinarians dealing with neonatal animals. Contamination can occur during manufacturing, packaging, or improper storage and handling post-purchase. Though less commonly reported than in infant human formula, such incidents raise serious concerns among pet caregivers about product safety.

Another issue arises from inadequate sterilization practices by end-users, mainly in shelters or rural households lacking veterinary guidance. Unlike fresh maternal milk, replacers must be reconstituted with clean water and fed through sanitized bottles. However, a 2024 online survey found that over 40% of first-time pet owners were unaware of proper milk replacer preparation guidelines, increasing the risk of bacterial proliferation. This becomes dangerous when feeding immunocompromised neonates, who lack the gut microbiota defenses to withstand even mild contamination.

The inclusion of functional ingredients such as colostrum, prebiotics, and probiotics in pet milk replacers is creating new opportunities, mainly in the premium and veterinary-recommended segments. Colostrum, rich in immunoglobulins, is being increasingly added to mimic maternal immunity transfer and reduce early-stage mortality in puppies and kittens. Prebiotics, including fructooligosaccharides and mannan-oligosaccharides, are being used to promote beneficial gut flora, which is essential for immune development and nutrient absorption in neonates.

The addition of these ingredients also helps reduce incidences of diarrhea, one of the most common complications in bottle-fed young animals. These functional enhancements are also creating space for premium pricing and subscription models in the e-commerce segment. Platforms such as Chewy and Zooplus have begun categorizing enriched milk replacers under ‘advanced nutrition,’ enabling brands to market them for recovering animals and orphaned neonates.

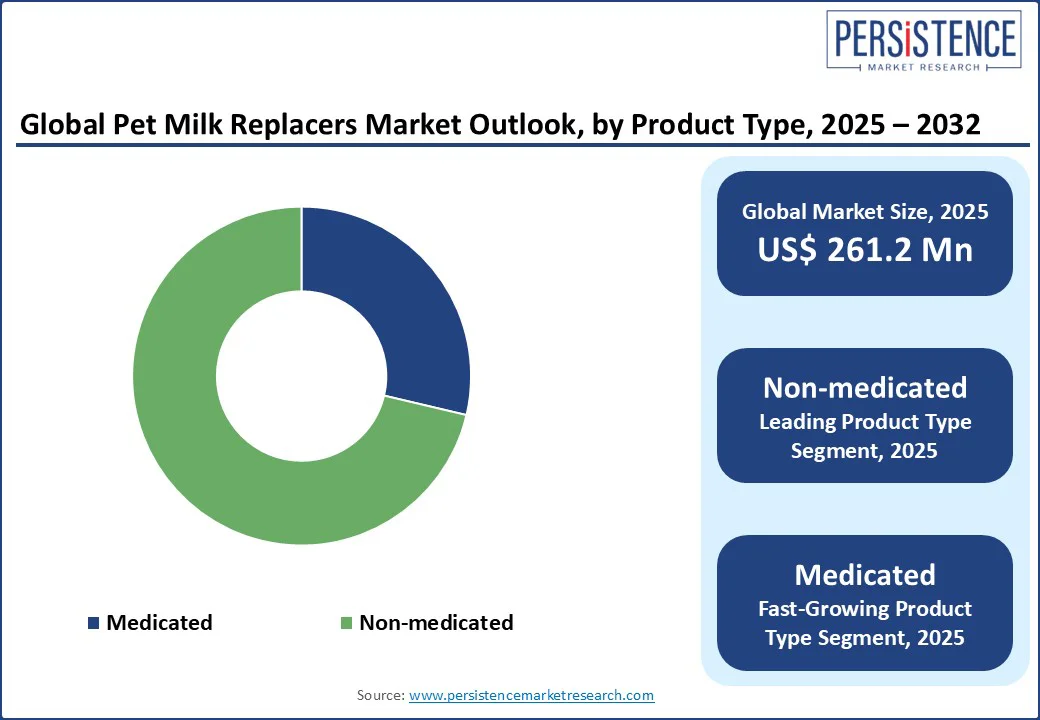

Based on product type, the market is bifurcated into medicated and non-medicated. Among these, the non-medicated segment is estimated to hold approximately 71.3% of the pet milk replacers market share in 2025 due to their versatility, safety for routine use, and low risk of antimicrobial resistance or adverse reactions in neonatal animals. These formulations are designed to mimic maternal milk without interfering with the pet’s natural microbiota or immune development. It makes them ideal for use in healthy orphaned neonates, foster care settings, and early weaning stages.

Medicated pet milk replacers are witnessing steady growth owing to their targeted therapeutic applications in neonatal care, particularly for animals with compromised immunity, poor birth weight, or high risk of infection. Veterinary clinics and rescue shelters increasingly rely on these formulations during critical early-life interventions. It is mainly used for puppies and kittens with congenital weaknesses or those rescued from unsanitary conditions. Also, neonatal animals undergoing procedures such as cleft palate correction or recovering from sepsis are often fed specialized medicated milk replacers to ensure minimal digestive stress.

By form, the market is bifurcated into powder and liquid. Out of these, powdered pet milk replacers are anticipated to account for nearly 89.2% of the share in 2025, backed by their extended shelf life, storage convenience, and cost-effectiveness. These formulations can be stored for up to 12 to 18 months unopened and reconstituted in precise volumes, reducing waste. These are beneficial in regions with inconsistent electricity access or where multiple litters are being raised concurrently.

Liquid pet milk replacers are witnessing decent growth amid rising adoption among urban pet parents with limited experience or time for formula preparation. These replacers eliminate the requirement for precise mixing and sterilization of water, reducing preparation errors, which is an important advantage in first-time pet-owning households. These products are also gaining traction in emergency foster care or veterinary settings where time-sensitive feeding is significant.

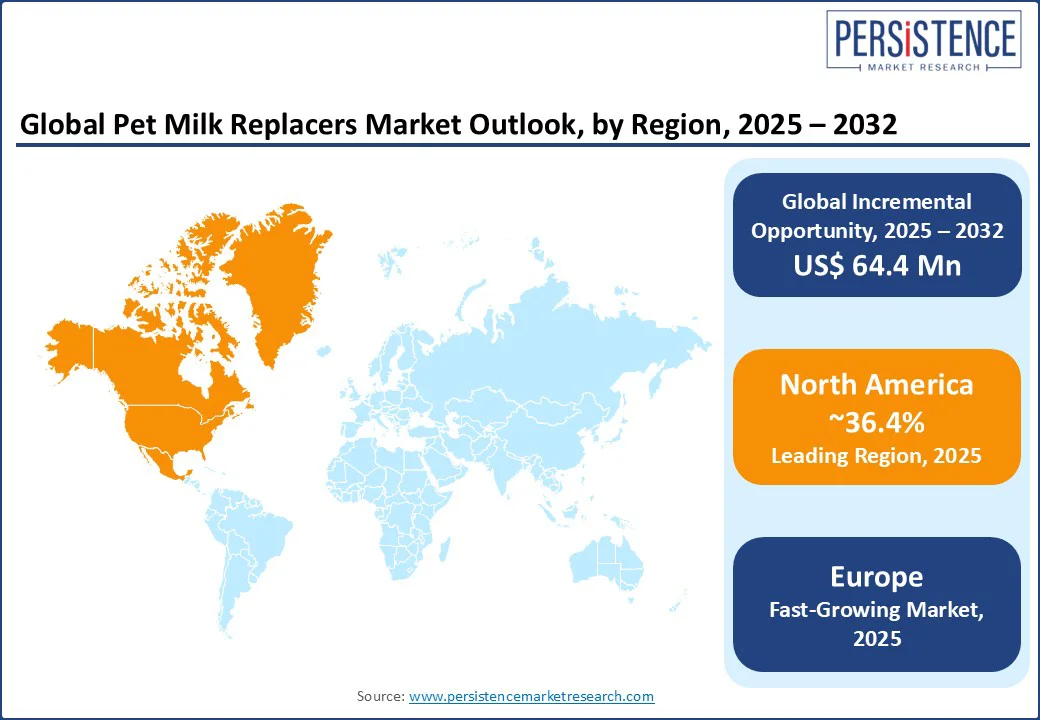

In 2025, North America is expected to account for around 36.4% of share due to increasing adoption of companion animals and surging medicalization of pet care. The U.S. pet milk replacers market is projected to lead, owing to a robust veterinary infrastructure and widespread use of milk replacers in shelters, foster care systems, and breeding facilities. As per the American Pet Products Association (APPA), around 3.2 million cats and 3.1 million dogs enter U.S. shelters annually. Many of them are newborns or nursing-age animals, which is creating sustained institutional demand for milk replacers.

Premiumization is a notable trend in the U.S., with a significant shift toward vet-formulated, colostrum-enriched products. In 2023, PetAg, a leading domestic brand, experienced a substantial increase in demand for its Esbilac and KMR lines, especially for the formulations enriched with DHA and probiotics. New entrants are also launching species-specific formulas that address gut health and immune support to target breeders and rescue organizations. The North America pet food market is further being shaped by e-commerce platforms offering auto-ship and subscription discounts.

Europe’s market is being propelled by strict quality regulations, rising pet rescue and adoption rates, and a strong preference for scientifically validated formulations. The region's regulatory environment, specifically the EU Feed Hygiene Regulation (Regulation EC No 183/2005), has created a high entry barrier for low-quality imports. It is encouraging local and regional brands to focus on precision nutrition and microbial safety. Germany, France, and the U.K. are leading in product innovation and consumption, with several pet shelters and veterinary clinics using fortified replacers to support neonatal survival and reduce morbidity.

Increasing use of goat milk-based replacers, primarily in Germany and the Netherlands, is a key trend. It is due to their hypoallergenic and digestibility advantages. The rise in stray animal rescue programs across Eastern and Southern Europe is also fueling institutional demand. In Romania and Greece, for example, NGOs involved in Trap-Neuter-Return (TNR) and neonatal rescue programs are increasingly sourcing milk replacers in bulk from EU-sourced suppliers. It is attributed to their long shelf life and veterinary backing, which is creating opportunities for regional manufacturers.

In Asia Pacific, pet milk replacers are seeing considerable demand, spurred by increased pet ownership in urban areas and rising awareness of neonatal pet care. China, India, Japan, and South Korea are emerging as high-growth markets, with China alone accounting for over 116 Mn pet dogs and cats as of 2023, reveals the China Pet Industry Association. Increasing trend of rescuing or adopting orphaned or abandoned animals in metropolitan areas such as Shanghai, Mumbai, and Seoul is pushing demand for milk replacers.

A defining characteristic of Asia Pacific is its shift toward localized formulations that address regional breed sensitivities and climate conditions. For example, in India, veterinary professionals are preferring low-lactose, goat milk-based replacers to reduce the incidence of digestive issues in native and mixed-breed puppies. Brands such as Drools and Himalaya Companion Care have entered this niche, providing milk replacers with added calcium and immunomodulators. In Japan and South Korea, consumer preference leans toward premium, fortified replacers with DHA, taurine, and nucleotides.

The global pet milk replacers market houses various well-established animal nutrition brands, specialized pet product manufacturers, and emerging players. Key players dominate with wide distribution networks, strong research capabilities, and a trusted presence in the veterinary channel. They have extended their product lines to cater not only to puppies and kittens but also to orphaned exotic pets and small mammals. A key differentiator in the competitive space is the focus on digestibility and functional ingredients such as probiotics, colostrum, and DHA to mimic the nutritional profile of maternal milk more closely.

The pet milk replacers market is projected to reach US$ 261.2 Mn in 2025.

Increasing awareness of neonatal pet nutrition and rising incidence of orphaned litter are the key market drivers.

The pet milk replacers market is poised to witness a CAGR of 5.7% from 2025 to 2032.

Surging use of AI-based pet health apps for product recommendations and local manufacturing partnerships are the key market opportunities.

CHS Inc., Cargill, Incorporated, and Pet-Ag, Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Pet Type

By Product Type

By Form

By Nutritional Content

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author