ID: PMRREP35676| 191 Pages | 6 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

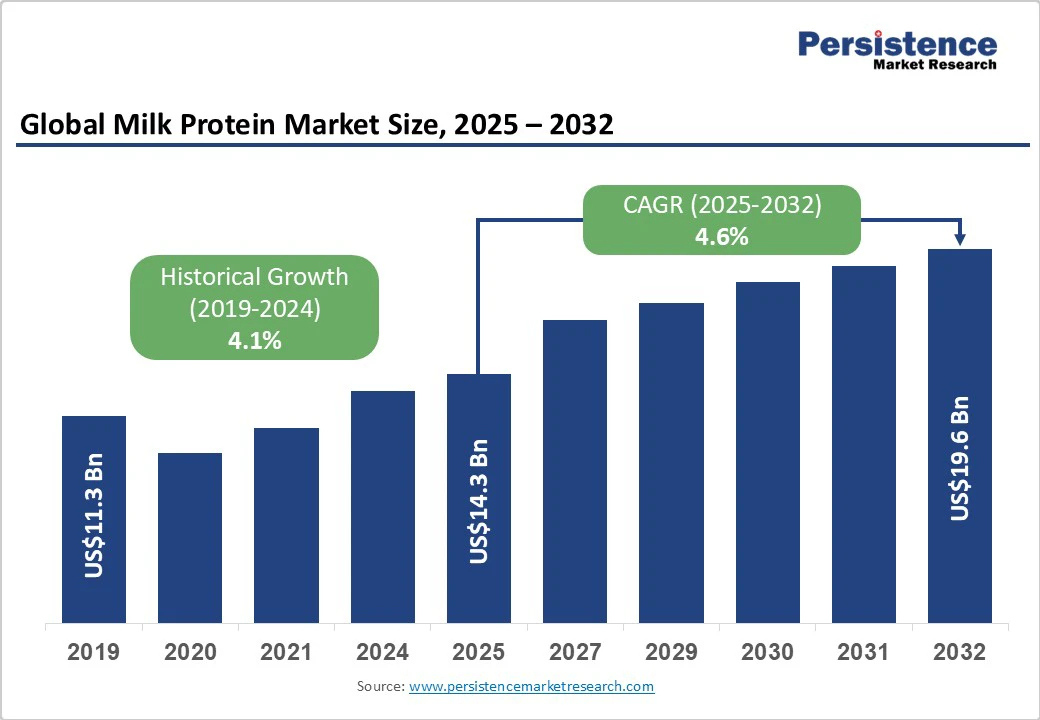

The global milk protein market size is likely to be valued at US$14.3 billion in 2025. It is expected to reach US$19.6 billion by 2032, growing at a CAGR of 4.6% during the forecast period from 2025 to 2032, driven by increasing consumer adoption of high-protein diets, expansion of infant and clinical nutrition markets, and investments in advanced protein processing technologies. Rising demand for protein-fortified beverages and functional foods, coupled with urbanization and higher disposable incomes in emerging markets, further supports market expansion.

| Key Insights | Details |

|---|---|

|

Milk Protein Market Size (2025E) |

US$14.3 Bn |

|

Market Value Forecast (2032F) |

US$19.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.1% |

Consumer preference for protein-rich diets and functional nutrition has increased demand for milk-derived proteins such as whey protein isolates and hydrolysates. The global protein supplement market is expanding steadily, particularly in North America and China, driven by increasing gym participation, wellness trends, and the growth of e-commerce. This trend has fueled demand for value-added protein fractions, which command premium pricing and justify investment in advanced processing facilities.

Milk proteins are essential for infant formula and clinical nutrition due to their high-quality amino acid profile and digestibility. Rapid urbanization and rising per-capita food consumption in the Asia Pacific, coupled with regulatory approvals and supplier quality certifications, have strengthened demand. Specialized milk protein concentrates and isolates are increasingly used in toddler and medical nutrition formulations, supporting higher margins for certified suppliers.

Investments in fractionation and advanced processing enable manufacturers to produce tailored protein fractions, such as high-leucine whey isolates and reduced-lactose milk protein isolates. These innovations enhance yield efficiency, minimize waste, and expand their application in clean-label beverages and medical nutrition. They also support the launch of premium products, improving competitive positioning and profitability.

Milk prices remain volatile due to fluctuations in feed costs, energy, and global demand. Sudden price spikes can compress margins, delay investment plans, and affect revenue projections. Commodity price swings of 20–30% can impact profitability, particularly for processors focused on volume-based products, requiring risk management through hedging and diversification.

Advanced protein production relies on specialized equipment and high-quality milk inputs. In emerging markets, fragmented dairy farming and inconsistent milk composition increase processing costs and lead times, particularly for custom protein solutions. Lead times for specialized products can be three to six months longer than those for commodity proteins, potentially delaying market entry or order fulfillment.

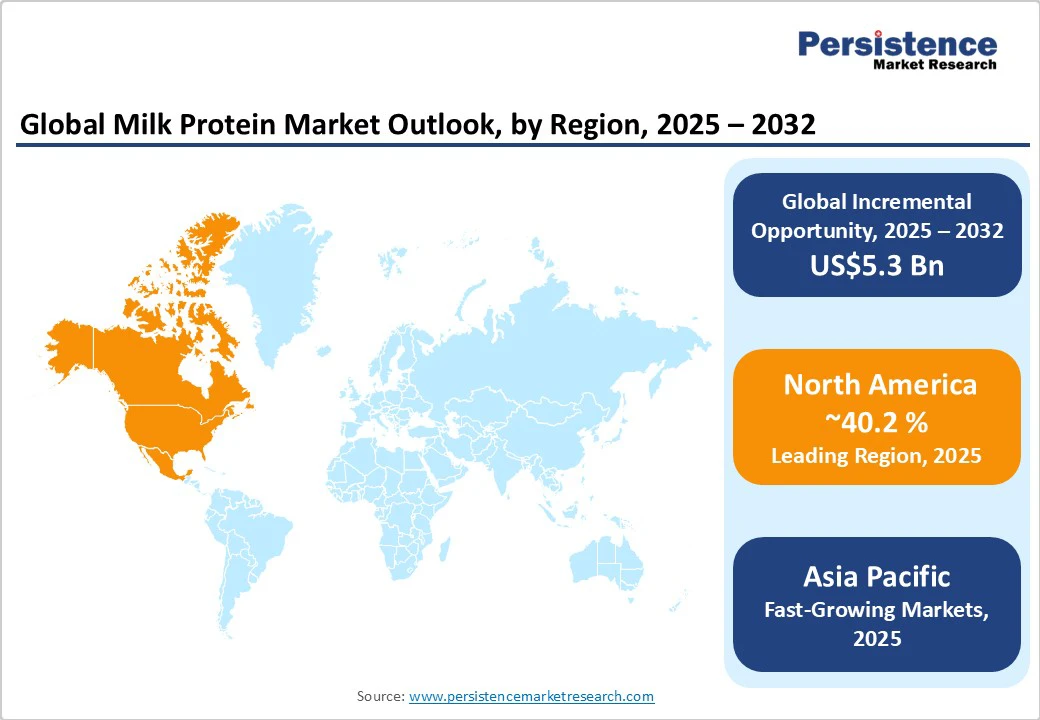

The Asia Pacific region is a major growth driver due to rising middle-class incomes and urbanization. The increasing demand for infant formula, fortified dairy, and clinical nutrition products is projected to contribute 30–40% of the incremental global milk protein demand by 2032. Localized supply, regulatory compliance, and strategic partnerships offer significant potential for ingredient producers seeking premium margins.

Technologies that extract high-value protein fractions while minimizing acid-whey waste can improve yields and generate premium products for functional foods, sports nutrition, and medical applications. These innovations offer 15–40% higher selling prices than standard milk protein concentrates, creating opportunities to improve profitability and sustainability.

Whey proteins remain the largest segment of the market, accounting for 57% of market share, due to their versatility, functional properties, and widespread adoption across multiple industries. Whey protein concentrates, isolates, and hydrolysates are commonly used in sports nutrition powders, protein bars, meal replacements, bakery products, and dairy beverages. Companies, such as Glanbia, Arla Foods Ingredients, and Leprino Foods, have large-scale whey processing operations that supply both industrial customers and consumer-facing brands. Whey proteins are valued for high solubility, complete amino acid profile, and bioavailability, which make them ideal for high-protein beverages, yogurt fortification, and bakery applications where protein enrichment and texture improvement are critical.

Milk protein isolates and specialized fractions are experiencing the fastest growth due to increasing demand for high-protein, low-lactose, and functional formulations. MPI is widely used in infant formula, clinical nutrition products, protein-fortified beverages, and nutritional supplements. Advanced fractions, such as high-leucine whey isolates and alpha-lactalbumin-enriched proteins, are particularly attractive in sports nutrition and medical nutrition, since they enhance muscle protein synthesis and meet specific dietary needs. The higher functional performance, clean-label appeal, and premium pricing of these fractions encourage manufacturers to invest in high-efficiency fractionation facilities and UHT-stable protein solutions to serve emerging markets and value-added product lines.

Powdered milk proteins dominate the market, accounting for 66.5% of the market share, due to their long shelf life, stability during transport, and ease of incorporation into diverse industrial and consumer formulations. Powdered formats are heavily used in bakery products, confectionery, meal replacement powders, protein-fortified beverages, and dairy applications. For example, whey protein powder is commonly used in protein bars by brands such as Optimum Nutrition and Myprotein, while milk protein concentrates are included in high-protein yogurts and baked goods by companies such as Nestlé and Danone. Powdered milk proteins also allow manufacturers to control dosage and mix formulations accurately, making them indispensable in large-scale industrial production.

Liquid and RTD protein formats are rapidly gaining popularity, especially in developed markets with robust cold-chain infrastructure. Ultra-filtered whey and milk protein beverages, protein shakes, and fortified RTD drinks are driving this growth. For instance, Premier Protein, Fairlife, and Muscle Milk have successfully leveraged UHT and cold-chain technologies to offer high-protein beverages with extended shelf life. Consumers increasingly prefer convenient, on-the-go protein options, including RTD smoothies and dairy-based meal replacements. Additionally, innovations in flavored protein beverages, plant-dairy hybrid formulations, and protein-enhanced coffee drinks are expanding the addressable market, making this product form the fastest-growing category in terms of CAGR.

The food and beverage segment remains the largest consumer of milk proteins due to their functional and nutritional benefits. Milk proteins are widely incorporated into bakery products, dairy-based beverages, yogurts, cheese products, desserts, and snack bars. For example, milk protein concentrates are used in high-protein bread and biscuits for enhanced texture and protein content, while whey proteins fortify yogurts and ready-to-drink beverages for added nutrition. Large-scale contracts with food manufacturers ensure consistent demand, providing stability to ingredient suppliers. This segment’s dominance is underpinned by the increasing consumer focus on protein-enriched daily foods and the incorporation of milk proteins as both functional and nutritional ingredients.

Sports nutrition and clinical/medical nutrition are the fastest-growing application segments, driven by rising health awareness, aging populations, and targeted dietary needs. Milk proteins are used in protein powders, performance bars, post-workout recovery drinks, clinical nutrition supplements, and therapeutic medical foods. For example, products such as Ensure Plus, Abbott’s Glucerna, and Optimum Nutrition whey protein powders leverage milk proteins for high bioavailability and complete amino acid profiles. The growth is fueled by clean-label positioning, functional claims such as muscle recovery and immune support, and premium pricing in both developed and emerging markets. Consumer willingness to pay for specialized protein nutrition solutions accelerates adoption and drives higher margins for ingredient suppliers.

North America is the largest milk protein market, accounting for approximately 40.2%. High per-capita consumption of protein supplements, functional foods, and fortified beverages drives consistent demand. The region benefits from a mature dairy processing infrastructure, advanced cold-chain logistics, and well-established distribution networks. Health and wellness trends, increasing gym participation, and higher consumer awareness of high-protein diets further stimulate market growth.

The U.S. infant nutrition and clinical nutrition markets are also significant contributors, supported by FDA regulations that ensure safety and consistency. For instance, Abbott Nutrition and Nestlé Health Science actively develop infant formulas and medical nutrition products with milk protein isolates. Recent developments include Glanbia’s 2024 acquisition of Flavor Producers, enhancing formulation capabilities for protein powders and beverages, and Leprino Foods’ expansion of whey protein isolate production in Colorado to meet growing North American demand.

The U.S. dominates the regional market due to high protein supplement penetration, widespread retail channels (e-commerce, convenience stores, and health-food retailers), and strong R&D infrastructure for functional proteins. Consumer demand for ready-to-drink (RTD) protein beverages, protein bars, and fortified dairy products is especially high in urban areas and among millennials.

Europe represents a mature and diverse market, led by Germany, France, the U.K., and Spain. Germany and France have strong dairy cooperatives and ingredient companies producing caseinates, whey protein concentrates, and milk protein isolates for both domestic and international clients. The U.K. and Spain show growing adoption of protein-fortified beverages and bakery products. Regulatory harmonization under EFSA (European Food Safety Authority) ensures consistent safety standards, though compliance costs for labeling, traceability, and fortification may impact smaller manufacturers.

European players are increasingly investing in sustainability, product differentiation, and specialized protein lines. For example, Arla Foods Ingredients recently launched alpha-lactalbumin-enriched milk proteins for infant formula, while FrieslandCampina Ingredients invested in environmentally friendly fractionation technology in the Netherlands to improve protein yield and reduce whey waste. Cross-border consolidation and acquisitions are shaping the competitive landscape, with companies seeking to capture high-margin functional nutrition segments.

Germany is the largest European market due to its robust dairy industry, high per-capita consumption of functional foods, and R&D-driven product development. Key segments include sports nutrition powders, fortified yogurts, and clinical nutrition products. Local dairy cooperatives are also exporting high-quality milk proteins to neighboring EU countries and Asia, leveraging EU-standard compliance as a market advantage.

Asia Pacific is the fastest-growing market, led by China, India, Japan, and ASEAN countries. Rising incomes, urbanization, and increasing awareness of protein intake are major drivers. China’s growing middle class and emphasis on functional nutrition drive demand for infant formula, clinical nutrition, and premium protein beverages. India’s market growth is supported by government initiatives targeting protein deficiency and rising demand for dairy-enriched packaged foods. Japan focuses heavily on clinical nutrition and R&D-driven innovations, particularly high-purity milk proteins and hydrolysates.

Regional growth is also facilitated by strategic partnerships, localized production, and regulatory approvals. For example, Fonterra expanded its Studholme plant in New Zealand in 2024 to supply high-quality milk proteins to Asia Pacific markets, while Arla Foods opened a new R&D facility in Singapore to develop protein-fortified infant formulas and functional beverages for ASEAN markets. Local content requirements and compliance with food safety authorities, such as CFDA in China and FSSAI in India, are key considerations for new entrants.

China represents the largest APAC market with strong growth in infant formula, protein-fortified dairy products, and sports nutrition. Rising e-commerce adoption allows brands to reach urban and semi-urban consumers efficiently. Premium products, such as UHT whey protein drinks and fortified milk powders, are increasingly popular among middle-class families seeking convenience and high-quality nutrition.

The global milk protein market is moderately concentrated at the advanced ingredient level, with leading global players controlling high-value isolate production. Commodity MPC trade remains fragmented. Leading companies combine processing scale, access to milk supply, and formulation/innovation capabilities to strengthen their market position.

Market leaders focus on vertical integration, innovation-led premiumization, and geographic expansion. Differentiation is achieved through advanced fractionation, regulatory certifications, and integrated flavor/formulation capabilities.

The milk protein market size in 2025 is estimated at US$14.3 Billion.

By 2032, the milk protein market is projected to reach approximately US$19.7 Billion.

Key trends include growing demand for protein-fortified foods, rise in sports and clinical nutrition, increased use of milk protein isolates, expansion of ready-to-drink protein beverages, and advancements in protein processing technologies.

Whey proteins are the leading segment, accounting for around 57% of total revenue, driven by widespread use in sports nutrition, bakery, and beverage applications.

The milk protein market is expected to grow at a CAGR of 4.6% from 2025 to 2032.

Major players include Arla Foods Ingredients, Glanbia plc, Fonterra Co-operative Group, Leprino Foods, and FrieslandCampina Ingredients.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Protein Type

By Product Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author