ID: PMRREP28252| 200 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

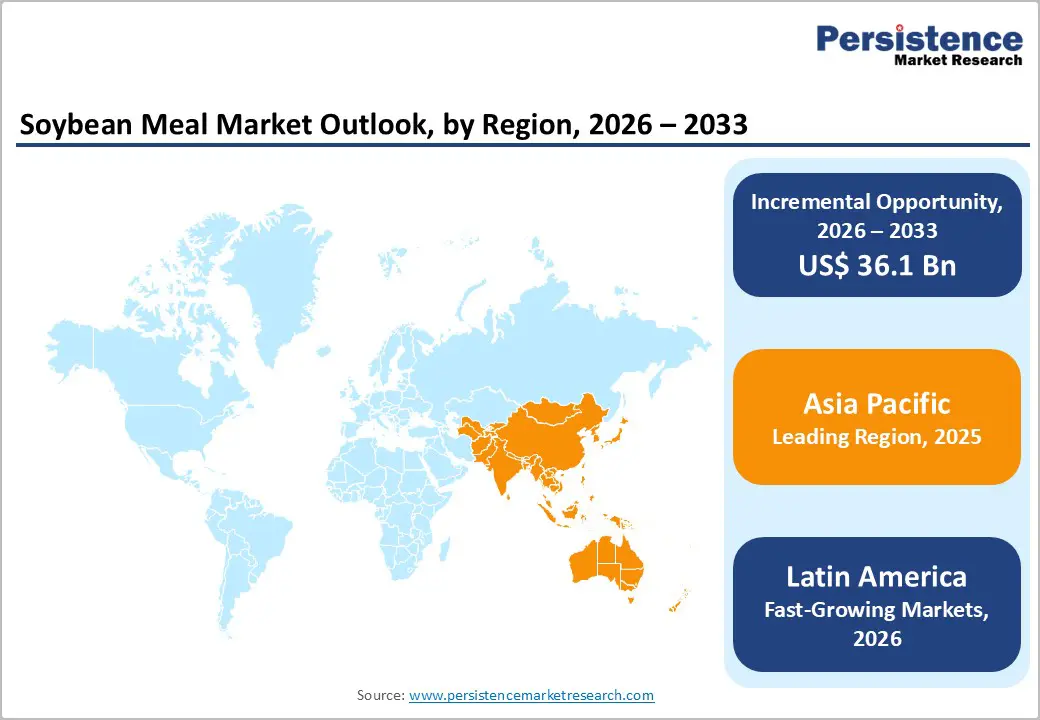

The global soybean meal market is estimated to grow from US$ 102.6 billion in 2026 to US$ 139.7 billion by 2033. The market is projected to record a CAGR of 4.4% from 2026 to 2033.

The global market continues to evolve as protein demand accelerates across poultry, livestock, and aquaculture systems. Expanding production capacities, sustainability compliance, and clean-label expectations are reshaping how processors, feed manufacturers, and exporters compete.

| Global Market Attributes | Key Insights |

|---|---|

| Global Soybean Meal Market Size (2026E) | US$ 102.6 Bn |

| Market Value Forecast (2033F) | US$ 138.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.5% |

An accelerating appetite for animal protein is reshaping global feed markets, directly driving demand for soybean meal. As populations expand and dietary preferences shift toward poultry, livestock, and farmed seafood, producers are under pressure to supply nutrient-rich feed that supports rapid growth, improved feed conversion ratios, and overall animal health. Soybean meal, with its high protein content and balanced amino acid profile, has emerged as a preferred choice for formulators seeking consistent quality and efficiency in feed formulations. The surge in protein consumption, particularly in emerging economies, creates a sustained need for reliable and scalable feed ingredients.

This growing demand extends across commercial poultry farms, aquaculture operations, and livestock facilities, compelling feed manufacturers to secure dependable soybean meal supplies. Intensifying production of meat, eggs, and farmed fish increases feed demand, prompting integrated supply chain strategies and import diversification. As sustainability concerns rise alongside global protein consumption, soybean meal offers both nutritional value and adaptability, reinforcing its critical role in meeting the animal feed sector's evolving needs.

Volatility in global soybean meal supply is increasingly linked to the heavy reliance on climate-sensitive production regions. Key soybean-producing countries frequently experience unpredictable weather patterns, including droughts, excessive rainfall, and temperature extremes, which can significantly impact crop yields. These fluctuations create uncertainty for processors and feed manufacturers who depend on steady, high-quality soybean meal for formulating animal feed. The susceptibility of core production zones to climate events underscores a critical vulnerability in the supply chain, where even minor disruptions can ripple through international trade and affect pricing stability.

Additionally, reliance on concentrated geographic regions exposes the market to geopolitical and logistical risks, as well as environmental factors. Crop failures or reduced harvests in major exporting countries can tighten global supply, elevate costs, and compel buyers to seek alternative feed protein sources. Such instability challenges long-term planning for feed producers and necessitates strategic diversification, including investment in storage, alternative sourcing, or climate-resilient cultivation practices to mitigate potential shortages.

A growing consumer preference for clean-label and sustainably sourced animal products is driving a notable shift in the feed industry, opening opportunities for non-GMO, organic, and identity-preserved soybean meal. Farmers and feed manufacturers increasingly seek ingredients that meet these higher standards, enabling them to market meat, eggs, and dairy products with traceable, premium-quality feed inputs. This trend allows suppliers to differentiate themselves from commodity players by offering specialized, value-added soybean meal tailored to conscious consumers’ demands, supporting higher-margin product lines and stronger brand positioning.

For startups and established players alike, investing in segregated supply chains, certification processes, and transparent traceability systems can help capture this emerging segment. The opportunity includes forming partnerships with organic farms, enhancing product credibility, and leveraging certification labels to appeal to premium markets while meeting growing regulatory and sustainability expectations.

High-protein soybean meal holds approximately 48% market share as of 2025, reflecting its widespread adoption in animal feed formulations. Its rich protein content and balanced amino acid profile make it the preferred choice for poultry, livestock, and aquaculture feed, supporting rapid growth, improved feed efficiency, and overall animal health. Feed manufacturers rely on high-protein soybean meal to meet stringent nutritional requirements, ensuring consistent performance across diverse production systems. The consistent quality and versatility of high-protein variants allow suppliers to command premium pricing and strengthen long-term contracts with major feed producers.

Low-protein soybean meal is typically used in ruminant feed and specialized formulations where lower nitrogen content is desirable. While it captures a smaller segment of the market, it remains essential for cost-sensitive applications and balancing feed nutrient profiles in mixed diets.

Aquaculture feed is projected to grow at a CAGR of 9.4% in the global soybean meal market during the forecast period, reflecting the rapid expansion of fish and shrimp farming worldwide. Rising consumer demand for protein-rich seafood, coupled with technological improvements in feed formulations, is driving this segment. Producers are increasingly focusing on balanced, nutrient-dense feed to enhance growth rates, improve immunity, and reduce environmental impact.

Other key end-users include poultry feed, swine feed, cattle feed, and pet food, which continue to absorb significant volumes of soybean meal. Innovations in pellet stability, digestibility, and inclusion of functional additives are enhancing performance across these segments. As global aquaculture scales, feed manufacturers are positioning soybean meal as a reliable, high-protein input to support sustainable growth.

Asia Pacific Soybean Meal Market holds approximately 38% market share in the global Soybean Meal Market, driven by strong demand from the region’s rapidly growing livestock and aquaculture sectors. China remains the largest contributor, producing roughly 29% of global soybean meal, according to USDA data, fueled by expansion in the poultry, swine, and aquafeed industries. India is witnessing rising adoption of soybean meal in poultry and dairy feed, supported by government initiatives to strengthen domestic protein production and improve farm productivity.

In ANZ, technological advancements in feed formulation and growing exports of high-quality soybean meal are shaping market dynamics. Japan is focusing on optimized livestock nutrition and functional feed applications, emphasizing sustainability and efficiency. Across the region, integrated supply chains and modern processing facilities are enhancing availability, quality, and consistency.

Latin America Soybean Meal Market is expected to grow at a CAGR of 9.3%, driven by increasing livestock and aquaculture production across the region. Brazil continues to dominate with large-scale soybean cultivation, supporting strong feed demand for poultry, swine, and cattle. Argentina is expanding its processing capacity to produce high-protein soybean meal for both domestic feed use and exports. Mexico is witnessing rising adoption of soybean meal in commercial poultry and pig farms, supported by modern feed mills and nutritional programs that enhance animal growth and productivity.

Across the region, investments in mechanized processing, quality control, and supply chain integration are strengthening market stability. Manufacturers are increasingly offering specialty soybean meals tailored for livestock nutrition, while exporters focus on consistent protein content and traceable sourcing to meet global standards.

The global Soybean Meal market exhibits a moderately consolidated structure, with a few dominant processors shaping large-scale supply while numerous regional players and startups drive innovation. Leading companies are expanding crushing and extraction facilities, integrating solvent-free and high-efficiency processing technologies to improve protein yield and consistency. Startups focus on specialty soybean meals enriched with amino acids and tailored for aquaculture and poultry nutrition. R&D efforts target improving digestibility, reducing anti-nutritional factors, and developing clean-label, non-GMO products. Government regulations on food safety, animal feed standards, and traceability influence production practices. Companies are emphasizing transparency, high protein content, and sustainable sourcing to align with consumer and industrial demand for nutrition-rich, safe, and eco-conscious feed solutions.

The global Soybean meal market is projected to be valued at US$ 102.6 Bn in 2026.

Increasing global demand for protein-rich feed ingredients, fueled by the growth of poultry, livestock, and aquaculture production, is driving the expansion of the global Soybean Meal market.

The global Soybean meal market is poised to witness a CAGR of 4.5% between 2026 and 2033.

The accelerating move toward non-GMO, organic, and identity-preserved feed ingredients is opening a clear pathway for premium, differentiated product lines, creating a strong growth opportunity for companies in the soybean meal industry.

Major players in the global Soybean meal market include Cargill, Incorporated, ADM, SVF Soya, Manat Group, Patanjali Foods Ltd., Satavie, Afrizon Pte Ltd, Nordic Soya, and others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Nature

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author