ID: PMRREP33085| 199 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

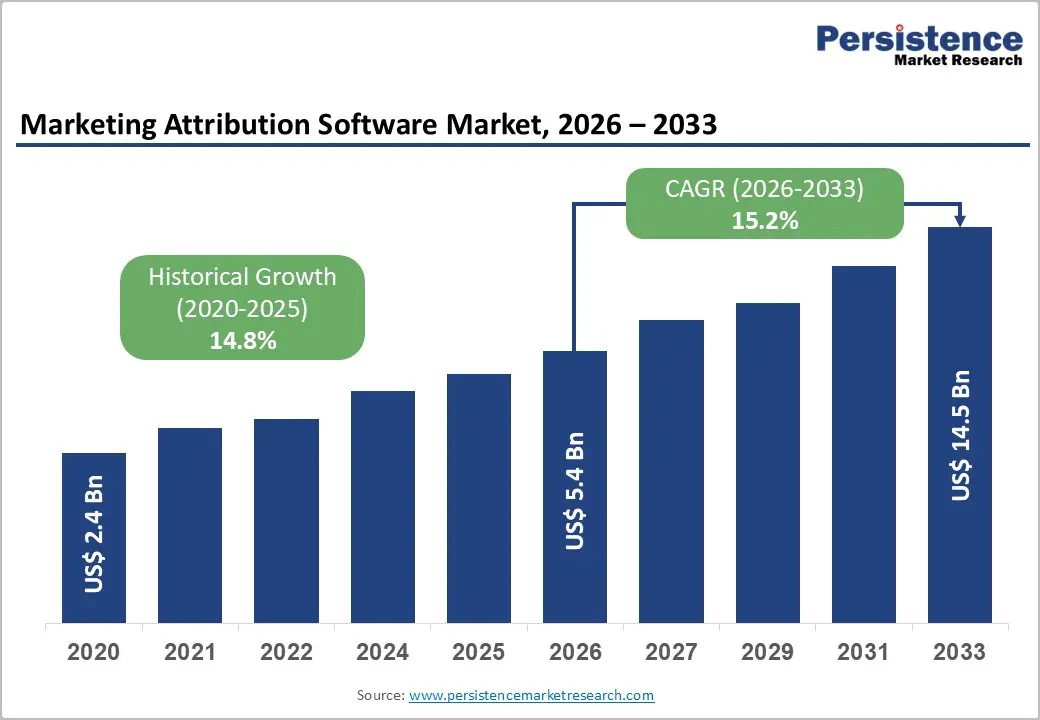

The global marketing attribution software market size is likely to be valued at US$ 5.4 billion in 2026 and is expected to reach US$ 14.5 billion by 2033, growing at a CAGR of 15.2% during the forecast period from 2026 to 2033.

As digital channels are driving online buying, businesses are moving beyond single-touch models toward advanced attribution tools to measure ROI accurately. Rising AI-driven capabilities, growing ecommerce interactions across multiple touchpoints, and the increasing adoption of data-led decision-making are collectively propelling demand, helping marketers optimize campaigns, improve customer acquisition efficiency, and unlock measurable performance gains.

| Key Insights | Details |

|---|---|

| Marketing Attribution Software Market Size (2026E) | US$ 5.4 Billion |

| Market Value Forecast (2033F) | US$ 14.5 Billion |

| Projected Growth CAGR (2026 - 2033) | 15.2% |

| Historical Market Growth (2020 - 2025) | 14.8% |

The explosive expansion of digital advertising spending has reshaped marketing strategies, pushing organizations to invest in sophisticated attribution systems. As companies distribute budgets across search, social, email, ecommerce platforms, and display networks, accurately tracing which touchpoints truly influence conversions has become increasingly challenging. Without structured attribution frameworks, marketers risk inefficient spending and inconsistent ROI measurement across campaigns and channels.

With multichannel journeys now dominating ecommerce, nearly half of brands rely heavily on cross-channel campaigns, yet many still face guesswork when allocating budgets. Multi-touch attribution adoption continues to accelerate, with 45% of organizations deploying it to improve performance clarity. Intelligent attribution platforms automate data collection, analyze interactions at scale, and assign credit more accurately, enabling smarter optimization, improved visibility into customer paths, and stronger marketing returns.

Cloud-based marketing attribution platforms are rapidly becoming the preferred deployment model as organizations prioritize flexibility, scalability, and faster implementation cycles. More than 70% now favor cloud solutions because they enable real-time data access, seamless integrations, and lower maintenance costs. These benefits are especially important in dynamic digital environments where continuous campaign monitoring and rapid decision-making are essential.

At the same time, AI and machine learning are transforming attribution accuracy and usability. Algorithmic and probabilistic AI-powered models analyze millions of interactions, uncover patterns beyond simple rule-based approaches, and reduce manual configuration complexity. This evolution democratizes sophisticated attribution capabilities, making them accessible to enterprises and mid-market users alike. The combined strength of cloud infrastructure and intelligent analytics delivers greater insight, automation, and predictive power, significantly accelerating market adoption.

Stringent global data privacy regulations such as GDPR and CCPA have significantly increased compliance pressure on attribution software providers and users. These frameworks require tighter controls on consent management, data transparency, and user rights, directly influencing how attribution tools gather, store, and process customer information. As organizations adopt first-party data strategies, they must ensure lawful collection practices and secure cross-border transfers, adding layers of oversight and documentation.

Compliance obligations raise implementation timelines and operating costs, especially for enterprises handling high-volume consumer data across multiple channels. The use of AI-driven attribution introduces added difficulty, as businesses must explain algorithmic decisions to regulators and customers. With penalties reaching up to 4% of global revenue, regulatory risk discourages smaller vendors, increases the total cost of ownership, and slows broader market expansion.

A persistent shortage of professionals capable of deploying and managing advanced attribution systems continues to hinder adoption. Many organizations, especially SMEs, lack the analytics maturity and data science resources needed to configure multi-touch or algorithmic models effectively. Integrating attribution platforms across fragmented martech stacks adds complexity, while data silos and inconsistent data quality undermine reliability and outcomes.

Research shows that only a fraction of companies believe they fully utilize existing marketing technologies, highlighting operational inefficiencies. Continuous model calibration, reporting customization, and governance requirements further strain internal teams. The steep learning curve involved choosing suitable attribution approaches, interpreting outputs, and aligning insights with business strategy creates hesitation, particularly in cost-sensitive environments. As a result, skill gaps and integration hurdles remain major restraints on market growth.

The growing need for hyper-personalized marketing is creating a major opening for attribution software providers. Consumers now expect experiences tailored to preferences, behavior, timing, and intent and brands that fail to deliver risk losing engagement. Attribution platforms help marketers understand which channels, creatives, and messages resonate with specific audiences, replacing guesswork with measurable, behavior-driven insights that guide targeting and content strategies.

When combined with AI, attribution tools can dynamically optimize campaigns in real time, adjusting copy, offers, and product recommendations based on predictive signals. Integrations with CDPs and CRM systems create unified customer views, enabling seamless omnichannel execution. With personalization shown to significantly improve ROI and retention, organizations are accelerating investments in attribution-powered personalization, creating strong monetization potential for innovative vendors.

Healthcare is rapidly emerging as a high-growth application area for attribution software as digital patient journeys expand across telehealth, mobile apps, portals, and search. Providers increasingly need visibility into which touchpoints drive appointment bookings and engagement, while navigating strict regulatory expectations. Attribution platforms help measure impact, improve outreach efficiency, and support compliant decision-making, encouraging wider adoption across hospitals, clinics, and digital health platforms.

Simultaneously, SMEs present another compelling growth frontier as attribution technology becomes easier and more affordable to deploy. Integration with low-code marketing tools enables smaller firms to analyze ROI, reduce acquisition costs, and scale intelligently without a deep analytics team. As vendors simplify onboarding, automation, and integrations, attribution becomes accessible to small and mid-sized enterprises, unlocking broad market expansion opportunities across sectors.

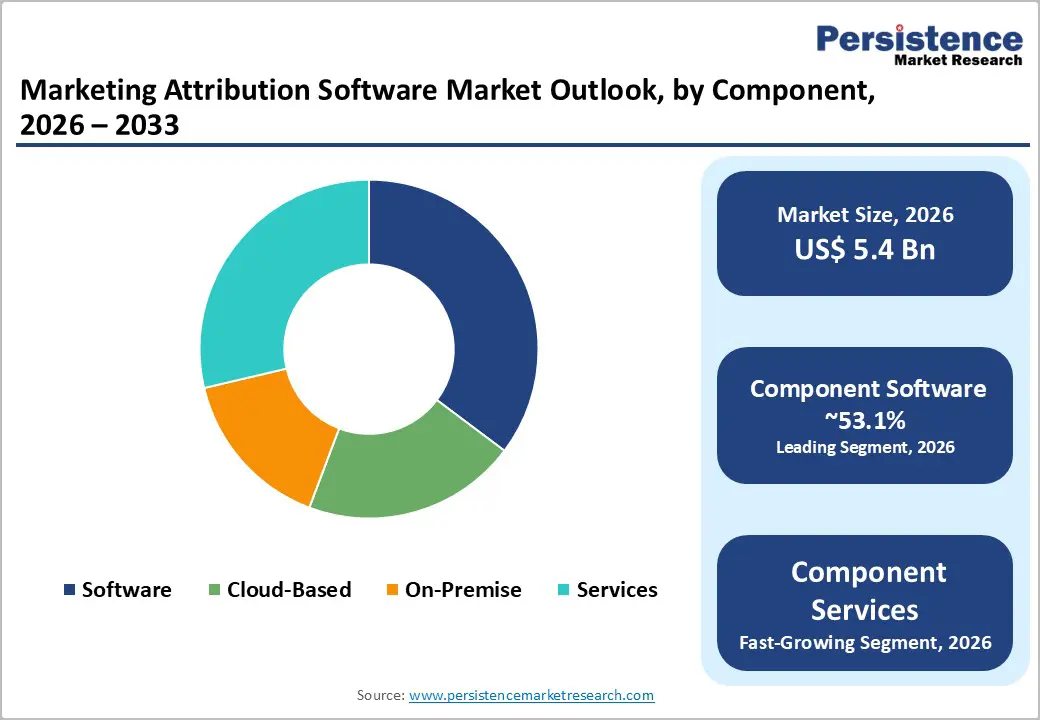

The Software segment leads the Marketing Attribution Software market with about 53.1% share, significantly ahead of the Services segment. Its dominance is fueled by its role in data integration, attribution modeling, visualization, and automated reporting. Cloud-based deployment now accounts for most implementations, as organizations prioritize scalability, cost efficiency, and faster rollout through SaaS-based platforms that reduce infrastructure dependence and broaden adoption across enterprise and mid-market users.

The fastest-growing opportunity lies in intelligent, service-assisted platforms that pair software with managed analytics support. As organizations struggle with integration, customization, and interpretation of attribution outputs, demand is rising for advisory, onboarding, and optimization services embedded into software subscriptions. Vendors offering hybrid delivery technology plus guided enablement are increasingly positioned to expand revenue and deepen customer relationships.

Multi-touch attribution currently holds the largest share at roughly 48.2%, reflecting a decisive move away from outdated first-touch and last-touch approaches. By distributing credit across all interactions in the journey, MTA enables accurate ROI measurement and smarter resource allocation. Organizations increasingly depend on these models to decode complex, cross-channel behavior and align budgets with the touchpoints that truly influence conversions.

The fastest-growing segment is advanced, algorithmic attribution approaches powered by AI and statistical modeling. These systems analyze vast interaction datasets, uncover hidden patterns, and continuously refine weightings without manual rule setting. Their ability to produce deeper, adaptive insights, reduce bias, and guide strategic decision-making is accelerating adoption among data-driven marketers and technology-forward enterprises.

Large enterprises dominate the market with around 60.1% share, reflecting their extensive digital footprints, complex campaign structures, and ability to invest in enterprise-grade analytics ecosystems. Their global operations generate massive, fragmented data streams that require sophisticated attribution tools capable of high-speed processing, cross-platform integration, and centralized reporting to guide multimillion-dollar marketing decisions.

The fastest-growing momentum is emerging from small and mid-sized businesses. As intuitive SaaS platforms, plug-and-play integrations, and simplified user interfaces expand, SMEs can finally leverage attribution insights without deep technical expertise. This accessibility allows growing companies to control acquisition costs, improve targeting precision, and compete effectively against larger players.

IT & Telecommunications leads the market with approximately 27.2% share, driven by subscription models, digital-first service delivery, and reliance on performance-based marketing. Understanding which online touchpoints influence sign-ups, upgrades, and churn reduction is critical, making attribution central to budgeting and lifecycle optimization. Parallel adoption is evident across e-commerce, retail, and BFSI, where transaction-heavy environments demand transparency in marketing effectiveness.

The fastest-growing opportunity is emerging in Healthcare & Life Sciences, as telehealth, digital consultations, and patient engagement platforms expand. Providers increasingly require visibility into how patients discover services, compare options, and book appointments. Attribution enables smarter outreach strategies while supporting compliance, trust, and better resource planning across rapidly evolving digital care ecosystems.

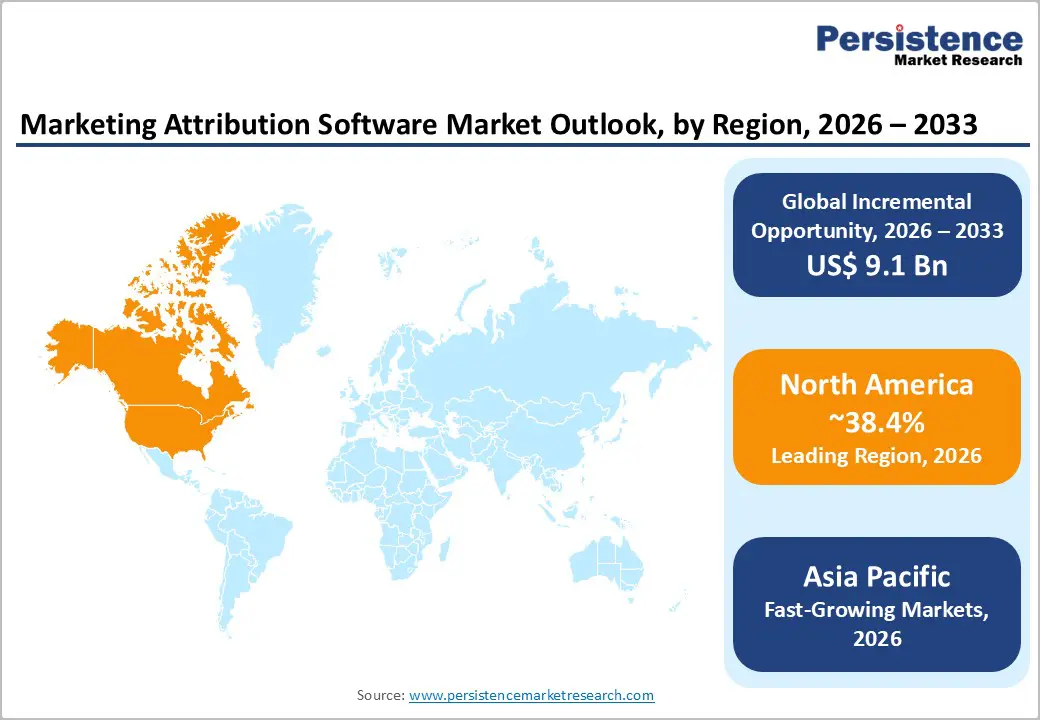

North America remains the leading market for marketing attribution software, accounting for roughly 38.4% of the global share. Strong technological maturity, high digital ad spending, and deep penetration of cloud-based analytics drive continued dominance. The U.S. market benefits from the presence of major vendors, advanced e-commerce ecosystems, and enterprises that actively invest in AI-enabled multi-touch attribution capabilities.

Privacy regulation has also accelerated modernization. With CCPA and expanding state-level frameworks, organizations increasingly deploy compliant, privacy-by-design attribution systems built around first-party data. Competitive pressure across retail, ecommerce, media, and technology sectors reinforces demand for precise journey mapping, budget optimization, and performance transparency, sustaining robust regional adoption.

Europe represents a mature but highly regulated market, shaped by stringent data privacy expectations and growing enterprise emphasis on transparency. The region captures a meaningful portion of global demand, with adoption strongest across the UK, Germany, France, and Spain. Organizations rely on attribution to manage complex multichannel campaigns, improve measurement rigor, and align marketing investments with accountable outcomes.

Although regulatory oversight increases implementation complexity, it also propels platform upgrades. GDPR has accelerated demand for privacy-by-design attribution tools that prioritize consented, first-party data. Supported by vendor consolidation and better interoperability, Europe is projected to expand steadily at a CAGR of about 15.5%, with notable traction across retail, BFSI, travel, and hospitality segments.

Asia Pacific is the fastest-growing regional market, accounting for approximately 30.4% of global share and rising rapidly as digital ecosystems scale. Markets such as China, India, Japan, and Southeast Asia are witnessing strong uptake driven by e-commerce expansion, mobile-first consumer behavior, and growing investment in cloud-based marketing platforms. SMEs increasingly adopt attribution to manage costs and sharpen acquisition efficiency.

AI-enabled, algorithmic attribution models are gaining traction among technology-forward organizations, especially those involved in cross-border commerce and omnichannel retail. Affordable SaaS delivery and localized integrations are democratizing access to analytics, extending adoption beyond large enterprises. As digital services, telecommunications, and emerging online marketplaces expand, the Asia Pacific is expected to remain the primary growth engine for marketing attribution solutions.

The marketing attribution software market is moderately consolidated, with vendors differentiating through AI-driven analytics, integration capabilities, privacy compliance features, and deployment flexibility. Solutions increasingly emphasize real-time measurement, multi-touch attribution, and automated insights that improve decision-making while reducing manual reporting workloads.

Switching dynamics are mixed: standardized environments experience relatively low transition barriers, whereas highly customized, cross-platform implementations create stronger vendor dependency. Competitive strategies are shifting toward ecosystem partnerships, modular architecture, and capability-driven acquisitions, enabling platforms to evolve from standalone attribution tools into broader marketing performance and decision-intelligence solutions.

The global marketing attribution software market is projected to reach US$ 14.5 Billion by 2033, expanding from US$ 5.4 Billion in 2026 at a CAGR of 15.2%.

Market growth is driven by AI-enabled attribution, expanding ecommerce, rising multi-channel marketing complexity, and rapid adoption of scalable cloud platforms.

Multi-touch attribution leads with ~48% share and is expected to remain dominant through 2033.

North America remains the largest regional market with ~38.4% share, supported by mature digital ecosystems and high enterprise spending.

The biggest opportunity lies in personalization and AI-driven optimization, where attribution-led strategies deliver ~30-40% ROI improvement.

Key market players include enterprise software giants Salesforce, Adobe, and Google, Mixpanel, Segment, and AppsFlyer.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Attribution Type

By Enterprise Size

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author