ID: PMRREP30533| 191 Pages | 24 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

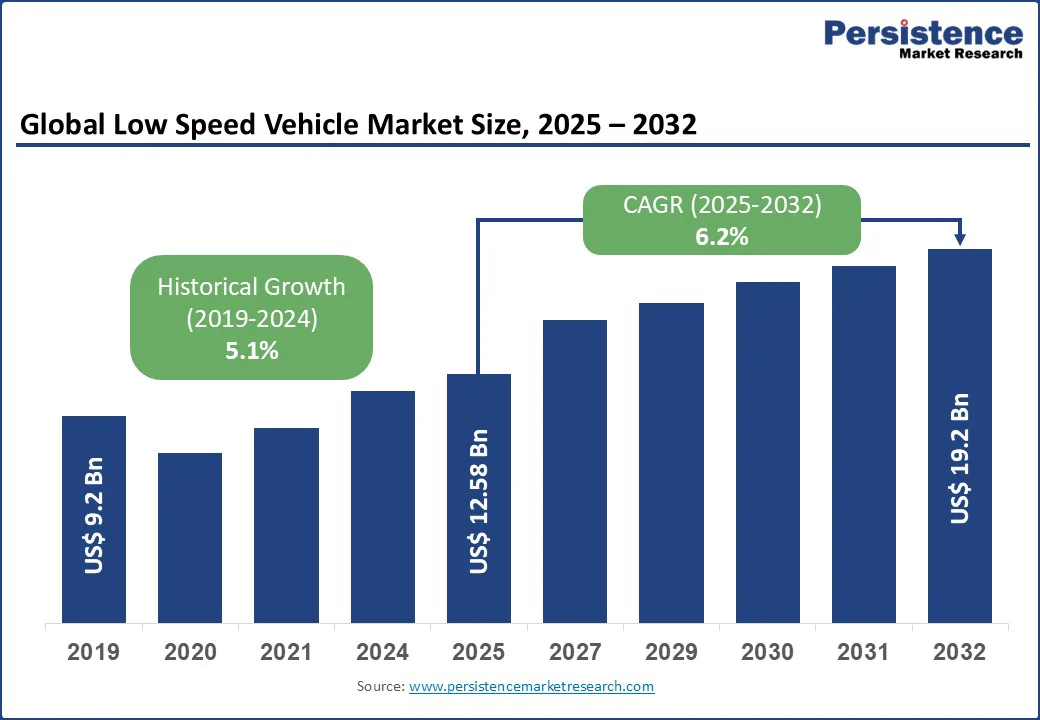

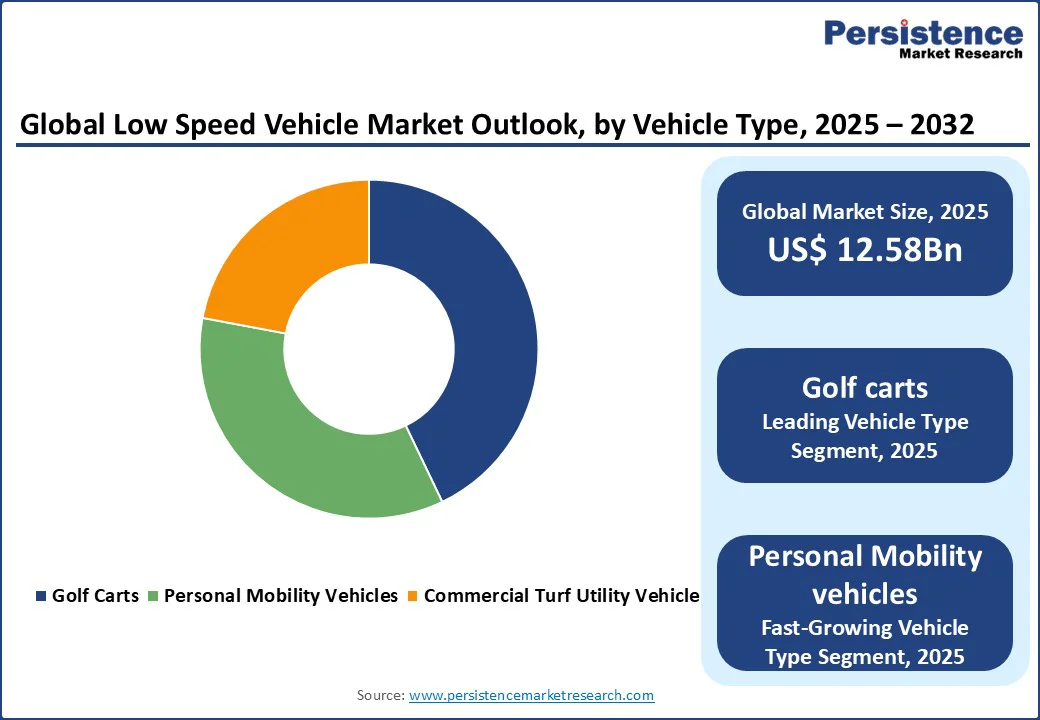

The global low speed vehicles market size is likely to value at US$ 12.6 Bn in 2025 and reach US$19.2 Bn by 2032, growing at a CAGR of 6.2% during the forecast period from 2025 to 2032. The LSV market is experiencing robust growth, fueled by increasing demand for eco-friendly, cost-efficient transport solutions in controlled environments such as golf courses, resorts, and industrial facilities.

Key Industry Highlights

| Key Insights | Details |

|---|---|

|

Low Speed Vehicles Market Size (2025E) |

US$12.6 Bn |

|

Market Value Forecast (2032F) |

US$19.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The global low speed vehicles market is experiencing significant growth due to increasing demand for sustainable and cost-effective mobility solutions across various sectors. LSVs, primarily electric-powered, offer low carbon emissions and reduced operational costs compared to traditional vehicles, aligning with global sustainability goals. In the Global EV Outlook 2024 report, under the Stated Policies Scenario (STEPS), global EV sales (excluding two?/three?wheelers) are projected to reach 43?million units in 2030, driven by government incentives and environmental policies.

In the U.S., the Inflation Reduction Act of 2022 provides tax credits for electric vehicle adoption, boosting LSV use in golf courses and resorts. Companies such as Club Car and E-Z-GO reported sales growth in electric LSVs in 2024, driven by demand in tourism and industrial applications. Growing environmental awareness and cost efficiency ensure sustained demand, positioning LSVs as a key driver for market growth through 2032.

The low speed vehicles market faces challenges due to the limited range of electric LSVs and stringent regulatory frameworks. Most LSVs, with power outputs below 15 KW, have a range of 30–50 miles per charge, limiting their use in large-scale applications or extended travel. This constraint impacts adoption in industrial facilities requiring long-distance transport. Additionally, varying regulations across regions create compliance challenges. For instance, the U.S. National Highway Traffic Safety Administration restricts LSVs to roads with speed limits of 35 mph or less, limiting their versatility.

In Europe, homologation standards for LSVs vary by country, increasing production costs for manufacturers such as Yamaha Motor Company. Competition from faster, conventional vehicles and limited charging infrastructure in emerging markets further restrains growth, particularly in cost-sensitive regions, impacting the overall market expansion.

The expanding tourism sector and increasing industrial automation present significant opportunities for the low speed vehicles market. LSVs, such as golf carts and commercial turf utility vehicles, are widely used in hotels, resorts, and airports for efficient passenger and cargo transport. In 2024, international tourism receipts totaled a record USD 2.0 trillion, as per the World Tourism Organization, with a focus on sustainable travel driving LSV adoption in resorts and eco-tourism destinations. In industrial settings, automation trends are increasing the demand for LSVs in material handling and logistics.

Government incentives, such as the EU’s Sustainable and Smart Mobility Strategy, promote electric LSVs in urban and industrial settings. Manufacturers such as Polaris Industries are innovating with high-capacity batteries and smart navigation systems, aligning with automation trends and creating opportunities for advanced, eco-friendly LSVs to meet evolving industry needs through 2032.

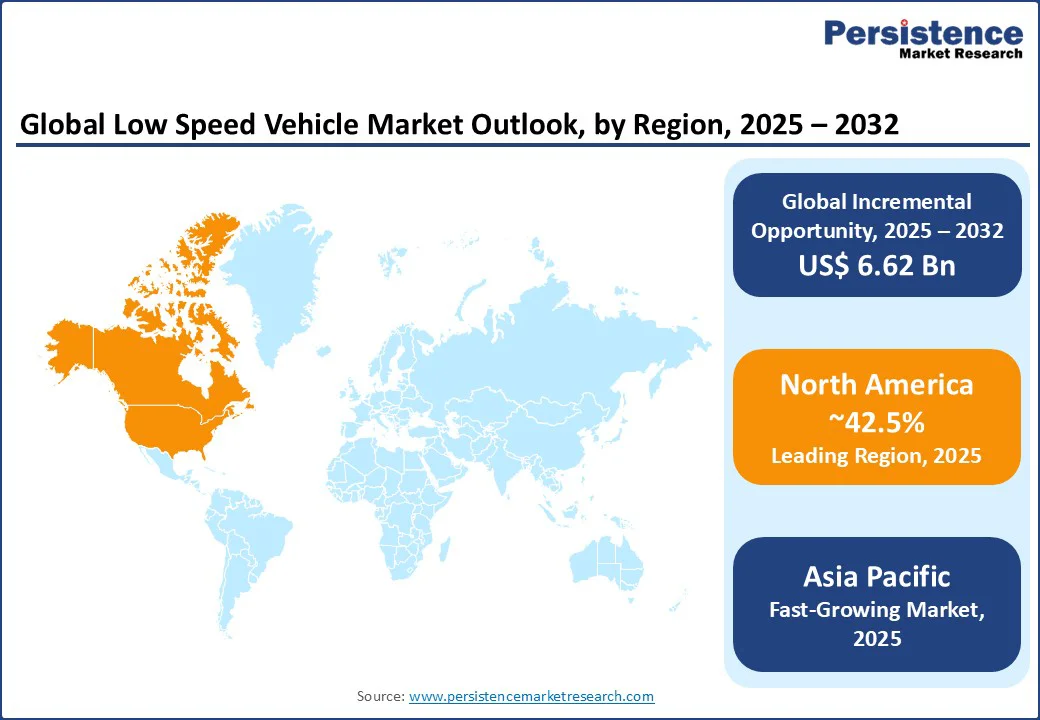

North America holds a commanding 42.5% share of the low-speed vehicle market in 2025, driven primarily by strong demand across golf courses, resorts, and industrial sectors in the U.S. and Canada. The U.S. leisure industry extensively relies on LSVs for golf and resort transportation, valuing their efficiency and environmental benefits. Meanwhile, Canada’s industrial sector fuels demand for high-capacity LSVs used in warehouses, manufacturing facilities, and large-scale operations, supported by insights from Canadian Manufacturers & Exporters. Leading manufacturers such as Polaris Industries and Club Car dominate owing to expansive distribution networks, ensuring broad availability and tailored solutions. These companies are actively involved in sustainable mobility initiatives, offering electric and hybrid LSVs that align with growing environmental awareness.

Consumer preference is increasingly shifting toward electric LSVs, reinforcing North America’s leadership position in the low speed vehicles market. This trend underscores the region’s commitment to sustainable, efficient transportation solutions across recreational and industrial applications.

Asia Pacific is the fastest-growing region, propelled by several dynamic factors. Rapid urbanization fuels demand for efficient, eco-friendly transportation solutions in congested cities and tourist hotspots. China’s 14th Five-Year Plan prioritizes green transportation, investing heavily in electric mobility infrastructure, which accelerates LSV adoption, particularly in resorts and industrial zones where low-emission vehicles align with sustainability goals. In India, the burgeoning tourism sector, supported by government campaigns such as “Incredible India,” drives increased use of golf carts and personal mobility vehicles in heritage sites and resorts.

The region’s role as a global manufacturing hub ensures competitive production costs, attracting major players such as Yamaha Motor Company to expand their footprint. Additionally, rising disposable incomes and a growing eco-tourism trend bolster demand for environmentally friendly, convenient transport options. These combined factors position the Asia Pacific as a sustained powerhouse in the LSV market through 2032.

Europe ranks as the second fastest-growing region in the low-speed vehicle market, propelled by strict environmental regulations and robust demand from tourism and industrial sectors, particularly in Germany and France. The European tourism industry actively supports LSV use in resorts, airports, and other leisure destinations, prioritizing quiet, eco-friendly transportation options that enhance visitor experiences. Germany’s advanced industrial automation sector drives demand for high-power LSVs, with manufacturers such as Garia and Electric Mobility providing specialized electric vehicles tailored to logistics and factory environments.

The European Union’s Green Deal plays a pivotal role in accelerating electric LSV adoption by promoting sustainability across tourism, transport, and supply chains. This regulatory push, combined with growing consumer awareness of environmental issues, fuels steady market growth. Europe’s unwavering commitment to stringent eco-friendly standards and sustainable innovation positions the region for continuous expansion in the LSV market through 2032, supporting a greener, more efficient transportation future.

The global low speed vehicles market is highly competitive, characterized by a fragmented landscape with numerous global and regional players. Leading companies such as Polaris Industries, Club Car, and E-Z-GO dominate through extensive product portfolios and global distribution networks. Regional players focus on localized offerings, particularly in the Asia Pacific. Companies are investing in advanced battery technologies and smart navigation systems to enhance market share, driven by demand for eco-friendly vehicles in tourism and industrial applications.

The low speed vehicles market is projected to reach US$12.58 Bn in 2025.

Rising demand for sustainable mobility and expanding applications in tourism and industrial automation are key market drivers.

The low speed vehicles market is poised to witness a CAGR of 6.2% from 2025 to 2032.

The growth in tourism and industrial automation sectors is the key market opportunity.

Polaris Industries, Club Car, E-Z-GO, and Yamaha Motor Company are key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Vehicle Type

By Power Output

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author