ID: PMRREP35526| 198 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

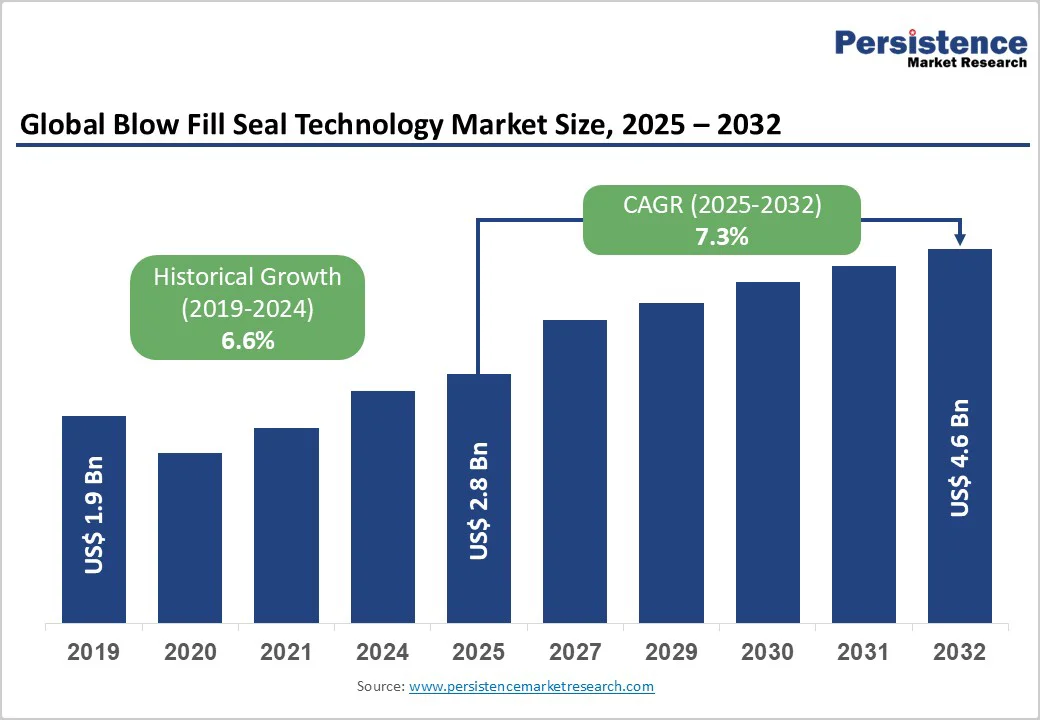

The global blow fill seal technology market size is likely to be valued at US$2.8 billion in 2025 and is projected to reach US$4.6 billion, growing at a CAGR of 7.3% between 2025 and 2032.

This robust growth trajectory reflects the accelerating adoption of aseptic packaging solutions across the pharmaceutical, food and beverage, and cosmetics industries worldwide. Stringent regulatory requirements for sterile product packaging, coupled with rising demand for contamination-free manufacturing processes, represent the primary catalysts driving market expansion.

| Key Insights | Details |

|---|---|

| Blow Fill Seal Technology Market Size (2025E) | US$ 2.8 Bn |

| Market Value Forecast (2032F) | US$ 4.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.6% |

According to global pharmaceutical industry data, the injectable drug market segment comprises approximately 35% of all parenteral drugs packaged using BFS technology, with demand accelerating at approximately 8-9% annually in emerging markets.

India's pharmaceutical sector, valued at US$354.5 billion in 2024 and projected to reach US$535 billion by FY26, demonstrates the foundational role of manufacturing capacity in driving BFS adoption. The U.S. food and beverage manufacturing sector employed approximately 1.7 million workers and represented 16.8% of total manufacturing sales as of 2021, creating a derivative demand for advanced packaging solutions in pharmaceutical-grade filling operations.

BFS technology addresses the critical need for sterile, contaminant-free environments, with modern machines achieving throughput rates exceeding 1,200 containers per minute, enabling manufacturers to scale production efficiently while maintaining aseptic integrity.

Regulatory mandates from the FDA and EMA requiring validated sterilisation procedures under Good Manufacturing Practices (GMP) have made BFS technology indispensable for companies seeking expedited regulatory approval and market access across North America and Europe.

The rising prevalence of chronic diseases such as diabetes, autoimmune disorders, and cancer has intensified demand for convenient, single-dose pharmaceutical delivery systems that BFS technology facilitates through prefilled syringe production and specialized container formats.

Continuous innovation in Blow Fill Seal Technology infrastructure has catalysed market expansion through enhanced automation, precision dosing, and real-time quality monitoring capabilities.

Modern BFS machines incorporate advanced inspection systems that electronically measure ampoule wall thickness, opening and separation forces, and fill-volume accuracy, enabling inline trending and rapid identification of process deviations.

The global pharmaceutical packaging market's shift toward high-speed aseptic lines with capacities above 48,000 bottles per hour reflects the competitive imperative for throughput optimisation. BFS technology's inherent flexibility enables the production of bottles, ampoules, vials, and prefilled syringes within unified platform architectures, reducing capital expenditure requirements for manufacturers seeking to diversify their product portfolios.

Capital efficiency improvements, reflected in reduced equipment footprints and streamlined cleaning-in-place (CIP) and sterilisation-in-place (SIP) cycles, have enhanced Return on Investment (ROI) profiles for BFS installations, particularly in contract manufacturing organisations (CDMOs) serving multiple customer programs simultaneously.

The blow-fill-seal technology market faces structural challenges, including substantial equipment acquisition costs and manufacturing complexity, which particularly disadvantage smaller pharmaceutical companies and emerging market entrants.

Initial capital expenditure for BFS systems typically ranges from US$2-4 million per production line, with supporting cleanroom infrastructure, sterilization equipment, and quality assurance systems adding multiples to the total project investment. Smaller pharmaceutical manufacturers in India and other emerging markets have shown hesitation to adopt BFS technology due to uncertainty about demand sufficient to justify capital allocation, thereby limiting market penetration in price-sensitive regions.

The pharmaceutical packaging market's fragmented competitive structure comprises numerous small converters alongside integrated corporations, yet only larger entities possess the capital resources necessary to invest in BFS infrastructure. Validation and qualification procedures required for regulatory approval of BFS systems consume 12-18 months and generate substantial consulting and testing costs, creating entry barriers for companies lacking in-house pharmaceutical expertise.

Substantial opportunities exist within emerging markets, particularly India and China, where government-backed pharmaceutical development initiatives and rising healthcare expenditure are catalyzing aseptic manufacturing infrastructure investment.

India's Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) and Pradhan Mantri Kisan Sampada Yojana (PMKSY) represent policy frameworks supporting domestic pharmaceutical manufacturing modernisation, with direct implications for BFS adoption among indigenous manufacturers.

China's pharmaceutical market expansion, supported by government initiatives promoting pharmaceutical quality standards and biological drug production activities, has generated incremental demand for sophisticated sterile packaging capabilities, with BFS technology adoption accelerating through 2035.

Biopharmaceutical companies developing monoclonal antibodies, recombinant proteins, and gene therapies have demonstrated a strong preference for prefilled syringe packaging formats, which facilitate patient self-administration and enhance adherence to complex therapeutic regimens.

BFS technology's inherent capability to produce prefilled syringes with precise dosing accuracy and minimal headspace has established it as the preferred manufacturing approach for specialty pharmaceutical companies launching premium injectable products.

The chronic disease management market, encompassing diabetes, autoimmune disorders, and oncology indications, drives pharmaceutical manufacturers' investment in convenient, patient-centric delivery systems that prefilled syringes enable.

Government-mandated health programs, including India's Ayushman Bharat initiative and expansion of telemedicine services, are generating derivative demand for portable, shelf-stable pharmaceutical packaging solutions compatible with BFS technology platforms.

Government policy initiatives supporting domestic vaccine and biopharmaceutical production, including India's PLI scheme with an investment of Rs 15,000 crores (US$1.8 billion) through 2029, directly incentivise the adoption of blow-fill-seal technology among indigenous pharmaceutical manufacturers.

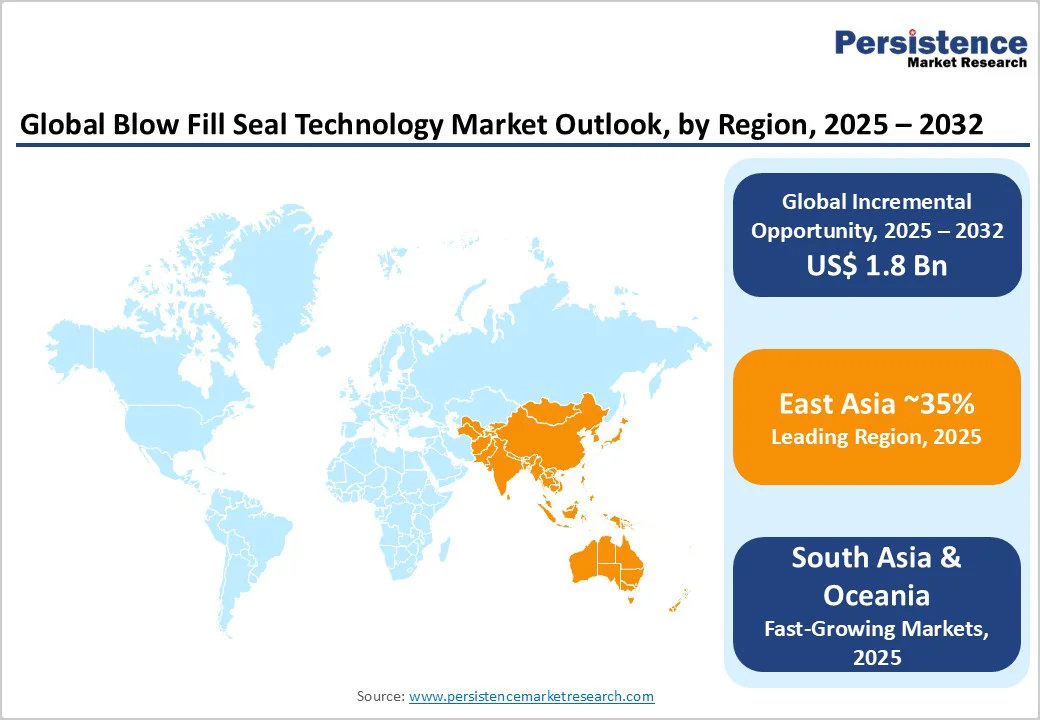

Asia Pacific is designated as the fastest-growing pharmaceutical packaging region with parenteral segment growth accelerating at approximately 6-7% annually, representing a substantial long-term opportunity for BFS technology suppliers and contract manufacturers.

Companies such as Terumo Corporation, Nipro Corporation, and regional CDMO specialists operating across Asia Pacific have committed capital to expanding BFS manufacturing capacity, generating incremental equipment demand, and creating competitive advantages for technology providers in these markets.

Bottles represent the dominant product segment, commanding 38.0% market share in 2025. This market leadership reflects bottles' versatility across pharmaceutical, food and beverage, and cosmetic applications, accommodating diverse fill volumes ranging from 0.1 millilitres to 10 litres.

The pharmaceutical sector's reliance on bottle-based packaging for ophthalmic solutions, inhalational anaesthetics, and lavaging agents has established bottles as the foundational BFS application, with regulatory precedent and manufacturing expertise concentrated within this format.

The U.S. flexible packaging industry's structure, comprising both small converters and large integrated corporations across 58% of facilities concentrated in the top 10 states, demonstrates the geographic concentration of bottle manufacturing infrastructure capable of supporting BFS technology implementation.

Pre-filled syringes are the fastest-growing product segment in the blow-fill-seal technology market, reflecting the accelerating adoption of patient-centric, convenience-oriented pharmaceutical delivery systems.

Polyethylene (PE) maintains market leadership in the blow-fill-seal technology segment, commanding approximately 58.0% share in 2025. Polyethylene's widespread adoption stems from its well-established biocompatibility profile, demonstrated through extensive regulatory precedent across the pharmaceutical and food industries.

The material's thermal processing characteristics enable efficient extrusion of thin-walled parisons within BFS systems, reducing material consumption and manufacturing cycle times compared to alternative polymers. The scalability advantages of polyethylene production, supported by global petrochemical infrastructure and established supply chains, have enabled sustained cost leadership relative to specialty polymers.

India's pharmaceutical packaging sector, comprising over 861 paper mills with 526 operational units and attracting 100% FDI through automatic regulatory routes, demonstrates the ecosystem support enabling the implementation of polyethylene-based BFS technology.

Polypropylene (PP) is the fastest-growing material segment in the blow-fill-seal technology market, driven by its superior heat resistance, chemical inertness, and emerging applications in biologics manufacturing.

Pharmaceuticals are the dominant application, commanding approximately 75% of the blow-fill-seal technology market in 2025. Injectable drug manufacturing has established BFS technology as the preferred production methodology, with approximately 35% of parenteral drugs globally packaged through BFS processes.

The pharmaceutical sector's investment in advanced BFS systems has exceeded US$ 2 billion cumulatively over the preceding decade, establishing sustained, substantial demand for BFS equipment and contract manufacturing services.

Vaccine manufacturing, particularly following pandemic-era emphasis on distributed manufacturing capacity, has accelerated pharmaceutical sector investment in BFS technology, with government subsidies and public health initiatives supporting capacity expansion.

Cosmetics and personal care are the fastest-growing application segments in the Blow Fill Seal Technology Market, driven by consumer demand for preservative-free, naturally derived cosmetic formulations and premium skincare serums.

North America represents the third-largest market, commanding approximately 24% in 2025 while maintaining the highest technology sophistication and premium pricing positioning within the sector.

FDA regulatory processes, including pre-approval inspections and ongoing compliance monitoring, have created substantial barriers to entry for non-compliant equipment suppliers, establishing competitive advantages for manufacturers demonstrating comprehensive regulatory expertise and comprehensive validation support services.

North American contract manufacturers have demonstrated sustained investment in BFS capacity, with multiple announcements of facility expansions and equipment upgrades supporting anticipated demand growth in biologics, specialty pharmaceuticals, and complex therapeutic formulations.

East Asia holds the largest share, accounting for approximately 35% of the global market value in 2025. China's pharmaceutical market, encompassing both domestic consumption and export manufacturing, has emerged as the primary demand driver in this region, with Chinese manufacturers accounting for approximately 80% of global active pharmaceutical ingredient production and substantial volumes of finished pharmaceutical products.

East Asia's pharmaceutical sector investment climate has attracted over US$ 50 billion in cumulative FDI through 2024, with contract development and manufacturing organizations (CDMOs) capturing significant market share growth within BFS-based manufacturing.

Wuxi STA's inauguration of new parenteral formulation manufacturing facilities in Wuxi City, China, during December 2022 exemplifies ongoing capacity expansion supporting BFS technology adoption.

Japan's established pharmaceutical manufacturing infrastructure, combined with advanced automation and high-precision manufacturing standards, has positioned Japanese companies as premium suppliers of BFS equipment and leading contract manufacturers in the region.

Europe represents the second-largest market in the global blow fill seal technology market, accounting for approximately 18% of the market share while maintaining the highest concentration of equipment manufacturers and the most advanced technological capabilities.

Germany's pharmaceutical packaging sector, anchored by global leaders including Gerresheimer AG and supported by Rommelag's BFS technology pioneering heritage, has established Europe as the global centre of BFS equipment innovation and manufacturing excellence.

The European Union's regulatory frameworks, implemented through European Medicines Agency (EMA) requirements and European Pharmacopoeia (Ph. Eur.) specifications, have established the world's most stringent pharmaceutical packaging standards, driving continuous process innovation and capital investment in advanced BFS systems.

European pharmaceutical manufacturers serving markets with mature healthcare systems and premium pricing structures have demonstrated a sustained willingness to invest in state-of-the-art aseptic manufacturing infrastructure, supporting robust demand for BFS technology.

The global blow fill seal (BFS) technology market is moderately consolidated, with a few major players dominating the market through technological expertise and global manufacturing capacity.

Companies such as Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH, Catalent, Inc., Unither Pharmaceuticals, Weiler Engineering, Inc., Amanta Healthcare Ltd., and Recipharm hold significant market shares due to their strong product portfolios and established client networks in the pharmaceutical packaging sector.

These players focus on innovation, automation, and compliance with aseptic manufacturing standards to strengthen their competitive positions. Strategic collaborations and investments in advanced BFS systems continue to define the competitive landscape, fostering steady technological progress across the industry.

The global blow fill seal technology market is projected to be valued at US$ 2.8 Bn in 2025.

The bottles segment is expected to hold around 38% share by product type. This leadership is driven by bottles’ widespread adoption in pharmaceutical, ophthalmic, and healthcare packaging applications, due to their versatility, cost-effectiveness, and compliance with stringent regulatory requirements for sterile liquid packaging.

The blow fill seal technology market is expected to witness a CAGR of 7.3% from 2025 to 2032.

The blow fill seal technology market growth is driven by the rising demand for sterile injectable formulations, expanding pharmaceutical production capacity, and continuous advancements in automation and aseptic manufacturing technologies.

The blow fill seal technology market offers key opportunities in emerging market pharmaceutical capacity expansion, biologics and prefilled syringe production growth, and government-backed investments in aseptic manufacturing infrastructure across Asia Pacific.

The leading global players in the Blow-Fill-Seal (BFS) Technology market include Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH, Catalent, Inc., Unither Pharmaceuticals, Weiler Engineering, Inc., Amanta Healthcare Ltd., and Recipharm.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Product Type

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author