ID: PMRREP19369| 218 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

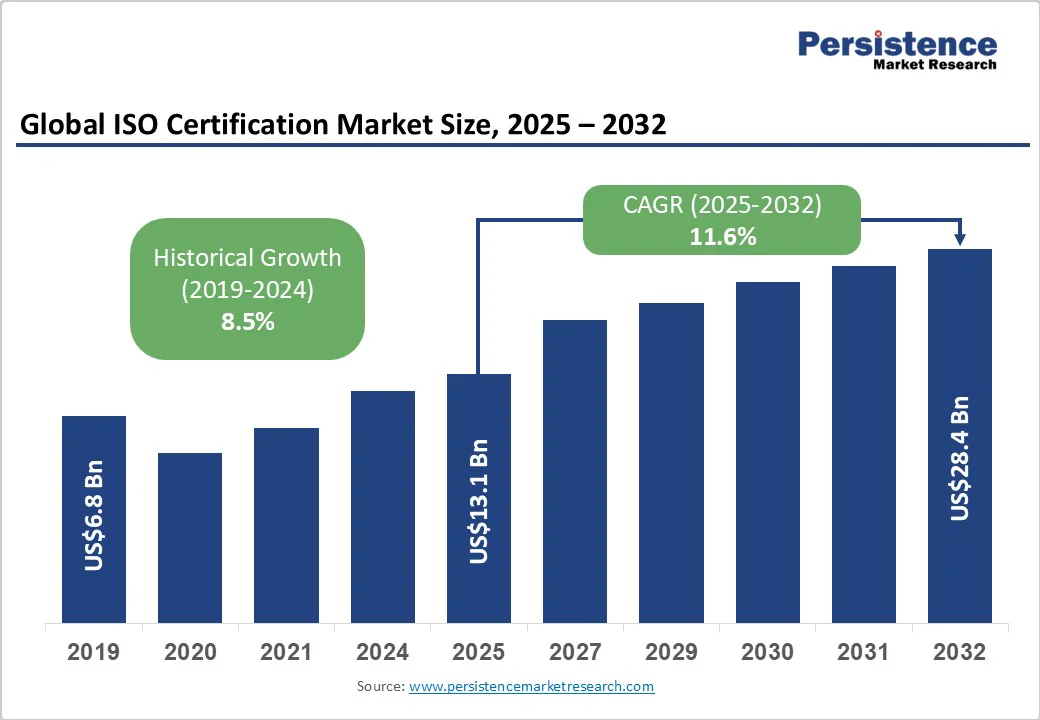

The global ISO certification market size is likely to be valued at US$13.1 Billion in 2025 and is estimated to reach US$28.4 Billion by 2032, growing at a CAGR of 11.6% during the forecast period 2025 - 2032, driven by increasing regulatory compliance requirements and growing emphasis on quality assurance across industries.

The expansion is driven by globalized supply chains and rising demand for standardized management systems.

Advances in technology and evolving regulations boost the adoption of ISO standards in information security, environmental responsibility, and health. The market is shifting from mere compliance to strategic use of ISO certifications as a key to competitiveness and risk management worldwide.

| Key Insights | Details |

|---|---|

| ISO Certification Market Size (2025E) | US$13.1 Bn |

| Market Value Forecast (2032F) | US$28.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 11.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.5% |

Governments and international bodies are amplifying regulatory oversight, mandating compliance with ISO standards in sectors such as manufacturing, healthcare, and information technology. For instance, the International Organization for Standardization’s (ISO) consistent updates to standards such as ISO 9001, ISO 27001, and ISO 45001 motivate organizations to seek certification to maintain market access and legal conformity.

Regulatory initiatives such as the European Union (EU)’s GDPR have also heightened demand for information security certifications. Government procurement policies increasingly favor certified suppliers, with studies showing a 15%-20% procurement premium for certified firms in regulated industries. These regulations collectively create an environment where certification is not auxiliary but critical for operational continuity and competitiveness.

The exponential growth in digitalization across industries is provoking deeper adoption of ISO standards aimed at ensuring information security and operational resilience. Technologies such as cloud computing, IoT, and AI compound business risks, elevating the strategic importance of certifications such as ISO 27001 (Information Security Management) and ISO 22301 (Business Continuity Management).

Market data reveals that over 60% of enterprises undergoing digital transformation globally are prioritizing ISO certifications to address cybersecurity risks and comply with data governance mandates. Integration of certification management with emerging software platforms is also streamlining acquisition and renewal processes, reducing time-to-certification by approximately 25.0%.

Certification involves significant costs, including audits, consultancy, and ongoing surveillance, that pose barriers for SMEs. Initial fees range from US$10,000 to over US$50,000, with annual maintenance at 15-20% of these costs. This financial burden limits SME adoption, despite regulatory pressures, especially in developing markets, slowing overall growth.

The market is further challenged by a fragmented certification ecosystem, with varying service quality and credibility. Competitive pressures lead to price sensitivity and sometimes reduced audit rigor, risking industry reputation and complicating client decisions, which hinders stronger market confidence and expansion.

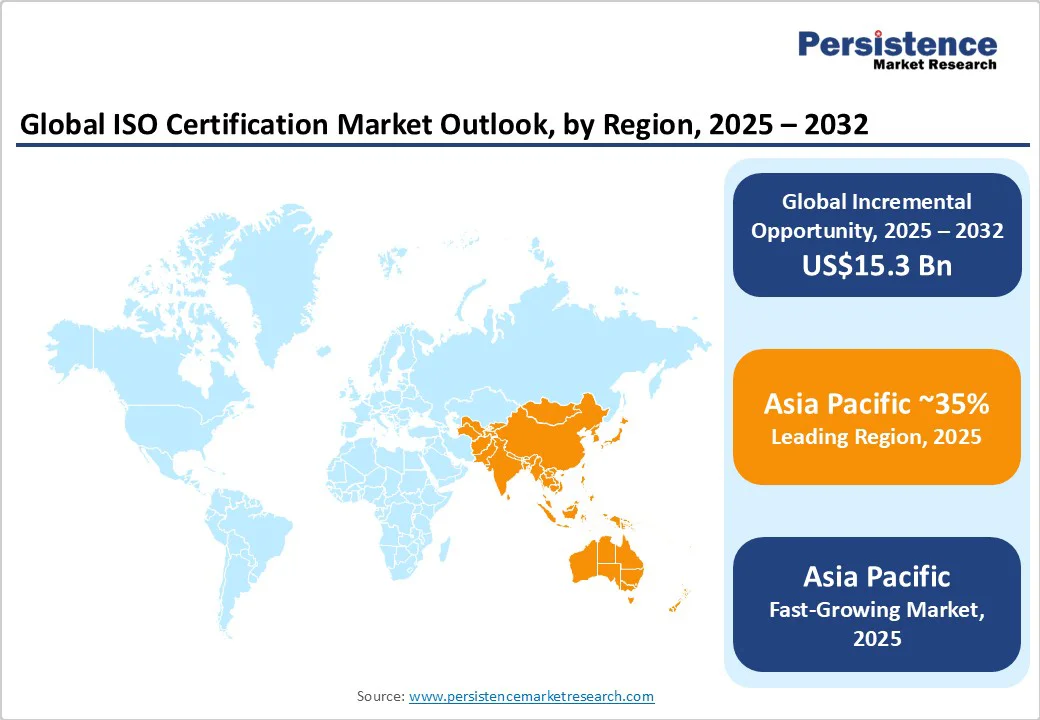

Emerging markets in Asia Pacific, Latin America, and Africa are witnessing rapid industrialization parallel to increased regulatory sophistication, creating substantial growth potential for ISO certification providers. For example, governments across Asia Pacific are enforcing stricter environmental and quality compliance laws, stimulating the demand for ISO 14001 and ISO 9001 certifications across the manufacturing and construction sectors.

Forthcoming government incentives designed to encourage certifications among local SMEs suggest a market opportunity estimated to grow by US$4 Billion by 2032. Market players positioning early in these regions can leverage regulatory transitions and capacity-building initiatives to capture large underserved client bases, bolstering revenue streams sustainably.

Advances in digital platforms, AI-enabled audit tools, and blockchain-based certification tracking are facilitating more efficient, transparent, and cost-effective certification service delivery. These innovations enable remote assessments, real-time compliance monitoring, and enhanced traceability, aligning with evolving customer expectations for agility and transparency.

Pilot implementations indicate that next-generation certification solutions reduce turnaround times by up to 30%, while improving audit accuracy. Market forecasts project that technology-enabled offerings will constitute over 25% of total certification services by 2032, attracting tech-savvy and cost-conscious customer segments. Companies investing in these capabilities are poised for differentiation, market share gains, and stronger customer loyalty.

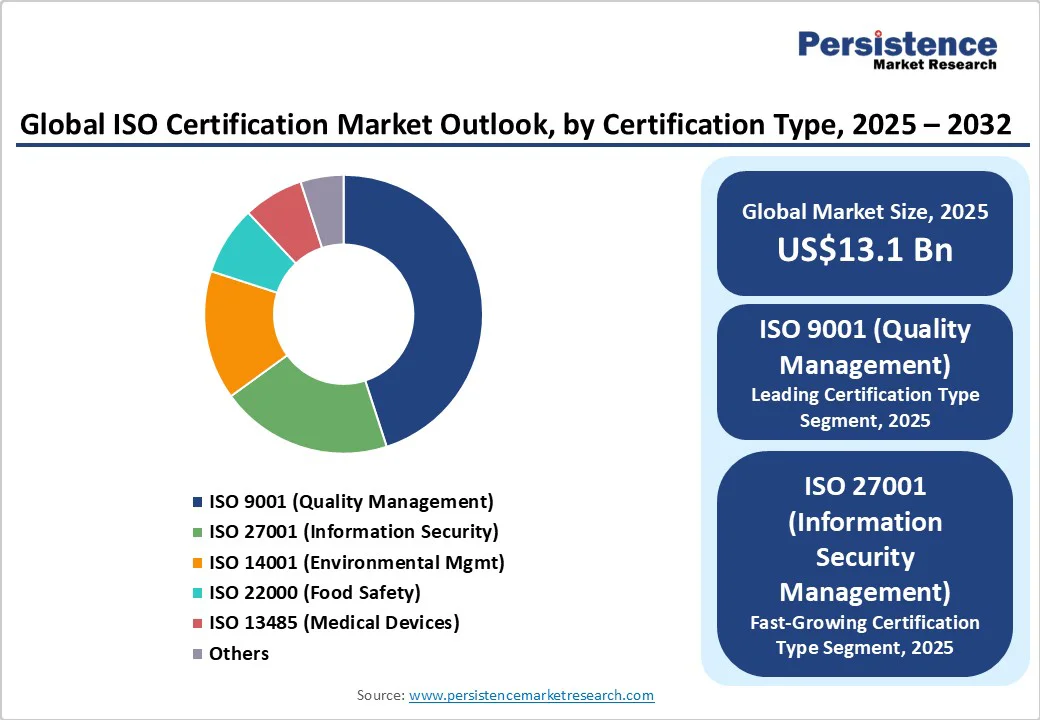

ISO 9001 (Quality Management) is slated to remain the most widely adopted certification type, commanding an estimated market share of 45% in 2025. Its universal applicability across diverse industries, from manufacturing to services, underpins its leadership position.

Organizations seeking to demonstrate consistent product and service quality to clients, regulatory bodies, and partners are fueling steady demand for ISO 9001. This certification also benefits from long-standing global recognition and integration into procurement and vendor management systems, reinforcing its dominant status.

ISO 27001 (Information Security Management) is positioned as the fastest-growing certification type, forecasted to achieve an impressive CAGR of 14.2% during 2025 - 2032. This growth is rapidly propelled by increasing cybersecurity threats, heightened data privacy regulations such as GDPR in Europe and CCPA in California, and widespread digital transformation initiatives.

As organizations increasingly digitize operations and manage vast volumes of sensitive data, ISO 27001 certification is becoming critical for risk mitigation and regulatory compliance. The dynamic cybersecurity landscape continues to drive enterprise adoption, compelling certification bodies to innovate audit processes tailored to the unique challenges of information security.

The manufacturing industry is likely to sustain its lead in the ISO certification market revenue share, with an estimated 38% in 2025. This dominance is grounded in stringent quality, safety, and environmental regulations impacting sub-sectors such as automotive, electronics, and consumer goods manufacturing.

Complex supply chains within manufacturing further necessitate certified management systems to ensure product compliance and traceability. The ongoing digitalization of this sector is also compelling manufacturers to pursue certifications that support data security and operational continuity, reinforcing robust demand.

The healthcare industry is emerging as the fastest-growing certification market segment with a projected CAGR of 13.5% from 2025 to 2032. Stringent regulatory standards related to patient safety, medical device manufacturing, and pharmaceutical quality management systems are primary growth drivers.

The global expansion of healthcare infrastructure in emerging economies, coupled with rising consumer expectations for safety and quality assurance, accelerates certification adoption. Healthcare providers and manufacturers increasingly view certifications as strategic assets for gaining market access and enhancing operational excellence in a highly regulated environment.

Third-party certification bodies are expected to maintain their leading position, with an estimated 55% market share in 2025. The credibility of these bodies is largely attributed to their international accreditations, impartiality, and comprehensive audit standards, making them preferred partners for multinational corporations operating across multiple regulatory regimes. Their ability to provide globally recognized certifications supports sustained adoption by enterprises seeking cross-border compliance and risk management.

National certification bodies represent the fastest-growing segment, expected to achieve a high CAGR through 2032. Driven largely by emerging markets, these organizations benefit from localized regulatory frameworks, government endorsements, and culturally tailored service models.

Their growth is further enabled by regional policy shifts encouraging formalized certification among SMEs to enhance market competitiveness. The alignment of national bodies with domestic regulatory objectives positions them well to capture expanding demand in strategically significant markets such as Asia Pacific, Latin America, and Africa.

Asia Pacific is the fastest expanding regional market, projected to command over 35% of the global market share in 2025 and maintain a vigorous CAGR through 2032. The key economies of China, Japan, India, and ASEAN nations are driving growth fueled by rapid industrialization, expanding manufacturing output, and increasing regulatory enforcement for quality, environment, and safety standards. Urbanization and government initiatives encouraging certification adoption among SMEs are additional momentum drivers.

Regulatory reforms that enhance accreditation infrastructure and growing awareness about international compliance standards are strengthening the prospects of the market. The region's competitive landscape is dynamic, with established global certifiers partnering or acquiring local entities, while indigenous certification bodies are also gaining ground. Investment in digital transformation and capacity building is significant, as market participants seek to improve audit quality and service delivery responsiveness, positioning Asia Pacific as a critical growth engine in the global ISO certification ecosystem.

North America is estimated to command approximately 30% of the market share in 2025, attributed predominantly to the United States’ mature industrial ecosystem and comprehensive regulatory environment.

Regulations such as OSHA, FDA quality mandates, and cybersecurity laws significantly fuel the demand for various ISO certifications. The U.S. is also a hub for technological innovation, facilitating early adoption of advanced digital certification platforms integrating AI and cloud computing.

Regional market growth is further supported by increasing digital transformation initiatives and evolving regulatory frameworks emphasizing information security and environmental sustainability. The competitive landscape includes major international and national certifiers focused on technological partnerships and service expansion. '

Investment opportunities in North America concentrate on developing scalable certification solutions for SMEs and enhancing audit automation capabilities. This region’s regulatory rigor, combined with strong innovation capacity, underpins its continued leadership in market evolution.

Europe is forecast to hold an estimated 28% share of the ISO certification market as of 2025, led by economic powerhouses including Germany, the U.K., France, and Spain.

The regional market benefits from regulatory harmonization under EU frameworks, such as CE marking requirements and widespread adoption of environmental and occupational health standards such as ISO 14001 and ISO 45001. This harmonization simplifies certification for cross-border trade and elevates demand. Steady but measured growth of the market here is also due to comprehensive regulatory coverage and saturation in established sectors.

European governments continue to support certification adoption through funding programs targeting SMEs and digital audits, enhancing accessibility and efficiency. The competitive scene is diverse, with strong presences of national bodies complemented by international certifiers. Investment focuses on integrating digital technologies into audit processes and expanding eco-certification services, reinforcing Europe’s role as a high-standard market for ISO certifications.

The global ISO certification market structure is moderately fragmented, with no single player exceeding 10% market share, reflecting a diverse competitive configuration. The top ten certification bodies collectively control approximately 50% of the market, balancing between international conglomerates and nationally focused entities.

This fragmentation encourages competitive differentiation based on service quality, technological innovation, and geographic reach. Market leaders maintain positions through extensive accreditation networks and strategic partnerships, while smaller players focus on niche industry segments, creating a competitive balance that fosters innovation and customer-centric service evolution.

The ISO certification market is projected to reach US$13.1 Billion in 2025.

Increasing regulatory compliance requirements and growing emphasis on quality assurance across industries are driving the ISO certification market.

The ISO certification market is poised to witness a CAGR of 11.6% from 2025 to 2032.

Globalization of supply chains, heightened stakeholder demand for standardized management systems, and evolving regulatory frameworks for ISO standards related to information security, environmental responsibility, and occupational health are key market opportunities.

SGS S.A., Bureau Veritas, and Intertek Group are some of the key players in the ISO certification market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ B |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Certification Type

By Industry

By Certification Body

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author