ID: PMRREP17908| 199 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

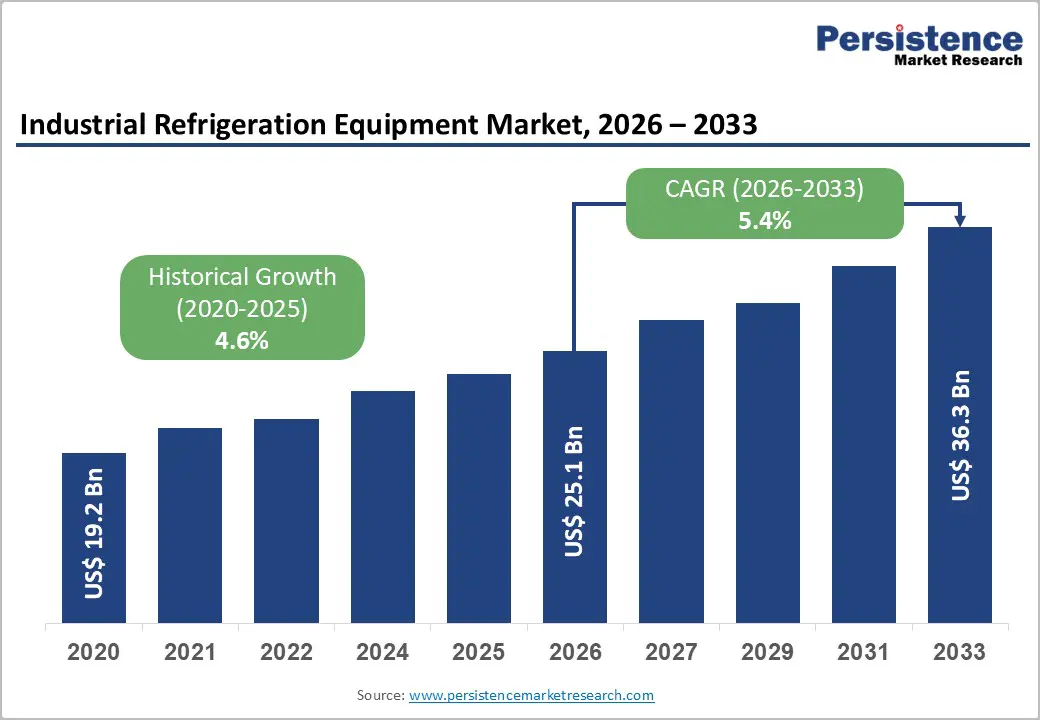

The global industrial refrigeration equipment market size is likely to be valued at US$ 25.1billion in 2026 and is projected to reach US$ 36.3 billion by 2033, growing at a CAGR of 5.4% between 2026 and 2033.

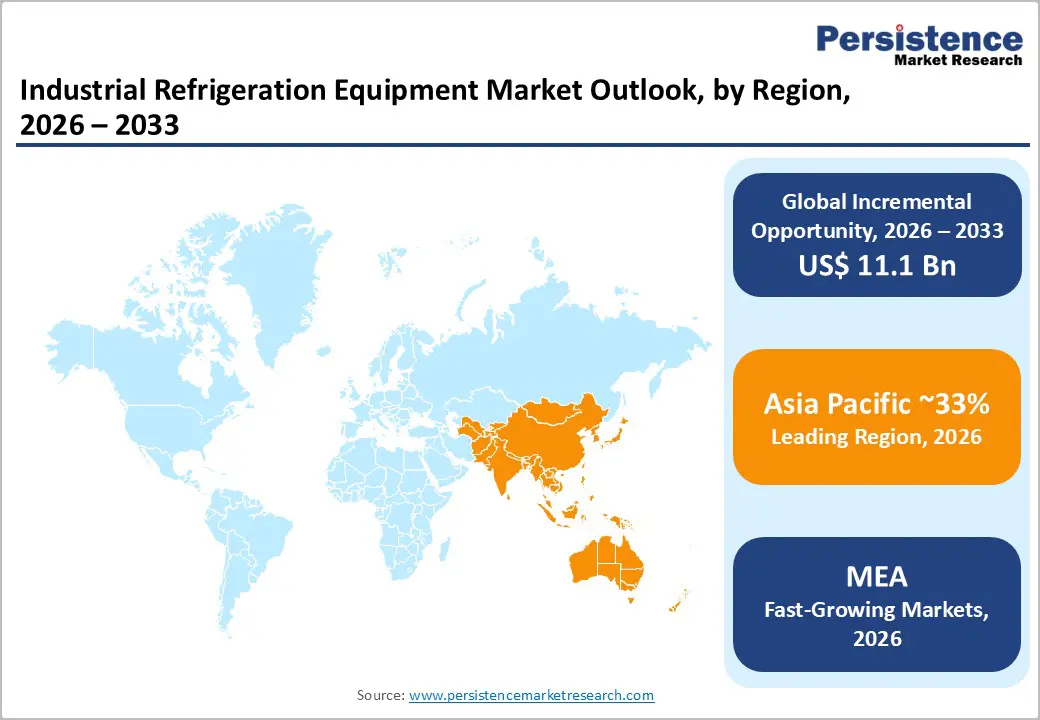

Market expansion is driven by food and beverage demand supporting cold chain modernization, data center cooling investments driven by artificial intelligence workloads, and regulations mandating the use of natural refrigerants. Europe holds 29% share through regulatory leadership, Asia Pacific leads with 33% via infrastructure expansion, while North America contributes 27% supported by innovation.

| Key Insights | Details |

|---|---|

| Industrial Refrigeration Equipment Market Size (2026E) | US$ 25.1 billion |

| Market Value Forecast (2033F) | US$ 36.3 billion |

| Projected Growth CAGR (2026 - 2033) | 5.4% |

| Historical Market Growth (2020 - 2025) | 4.6% |

Rising global food consumption and supply chain complexity are systematically driving industrial refrigeration equipment demand, with global frozen and processed food applications commanding around 40-44% of the cold chain market share, supporting sustained investment in advanced cooling infrastructure, automated warehouses, and temperature-controlled logistics networks. The expansion of the e-commerce grocery sector is creating demand for rapid fulfillment and micro cold hubs that require specialized refrigeration. U.S. cold storage infrastructure exceeding 156 million cubic meters in 2024, demonstrating a massive installed base requiring equipment replacement and upgrades. Emerging market food production expansion, particularly in Asia, is supporting cold chain infrastructure development. The proliferation of ready-to-eat and convenience meals is driving demand for high-capacity refrigeration systems. Stringent food safety regulations globally require advanced temperature control and monitoring systems. Supply chain modernization with over 78% of major U.S. food retailers deploying IoT-integrated monitoring systems supporting technology-driven refrigeration adoption.

Stringent environmental regulations, including Montreal Protocol amendments and Kigali Agreement requirements, are systematically mandating transition toward low-GWP and zero-GWP refrigerants, supporting equipment replacement cycles and technology advancement. HCFC phase-out completion deadlines globally eliminate high-ozone-depleting-potential refrigerants. HFC restrictions under the Kigali Amendment mandate the transition to low-GWP alternatives, including ammonia and CO2. Government incentive programs supporting sustainable technology adoption and energy efficiency investments. Corporate sustainability commitments are driving the adoption of natural refrigerants across food processing and cold storage operations. Ammonia (NH3) refrigerant adoption acceleration. Low-charge ammonia system innovations enabling safety improvements and broader commercial applicability. CO2 transcritical system deployment expansion supporting enhanced energy efficiency and a superior sustainability profile.

Industrial refrigeration equipment market growth is constrained by substantial upfront capital requirements and premium pricing for advanced natural refrigerant systems, with ammonia and CO2 systems commanding 15-25% price premiums relative to traditional HFC equipment, limiting adoption particularly among cost-sensitive mid-size operators in emerging markets. Ammonia system infrastructure requirements, including specialized piping and containment systems, increase installation complexity. Technology transition costs require system redesign and installation complexity. The lower initial cost advantage of legacy HFC systems remains attractive to cost-focused operators. Financing barriers in emerging markets are limiting technology adoption despite energy efficiency benefits. Skilled technician requirements for specialized refrigerant systems create operational expense constraints.

The expansion of the industrial refrigeration equipment market is constrained by supply chain disruptions affecting the availability of specialized compressors, condensers, and control system components, with semiconductor shortages impacting the deployment of IoT-enabled monitoring and control systems, limiting the adoption of advanced diagnostic and predictive maintenance capabilities. Compressor manufacturing capacity constraint, particularly for advanced variable-speed drive systems. Semiconductor supply constraints are affecting the availability of control system components. Specialized materials sourcing complexity for natural refrigerant system components. Global shipping delays are affecting equipment delivery timelines and project completion. Supply concentration risks with limited alternative suppliers for critical components.

Emerging market refrigeration expansion represents a substantial market opportunity driven by Asia Pacific, commanding 33% global market share, with India and Southeast Asia demonstrating accelerated food production and logistics growth, supporting infrastructure investment and technology deployment across developing economies. India's refrigeration market growth is supporting agricultural production and the expansion of food processing. China's food retail and e-commerce expansion is driving the development of cold chain infrastructure. ASEAN region food production scaling supporting regional refrigeration demand. Government cold chain development programs support infrastructure investment. Technology localization opportunities that enable competitive pricing in price-sensitive markets. Manufacturing cost advantages support competitive equipment pricing in emerging markets.

Immersion cooling technology standardization represents an emerging market opportunity driven by AI infrastructure scaling and by liquid cooling approaching mainstream deployment, with hyperscale data center operators committing to immersion-cooling facility deployments, supporting equipment demand and advancing technology. Liquid cooling technology maturation is enabling reliable high-density deployments. Cost-reduction trajectory of immersion-cooling systems through volume production. Ecosystem partnerships including semiconductor vendors, cooling solution providers, and infrastructure operators. Standardization initiatives are reducing technology risk and customer adoption barriers. Energy efficiency advantages support operational cost justification and sustainability goals. Competitive differentiation opportunity for cooling equipment manufacturers specializing in immersion technologies.

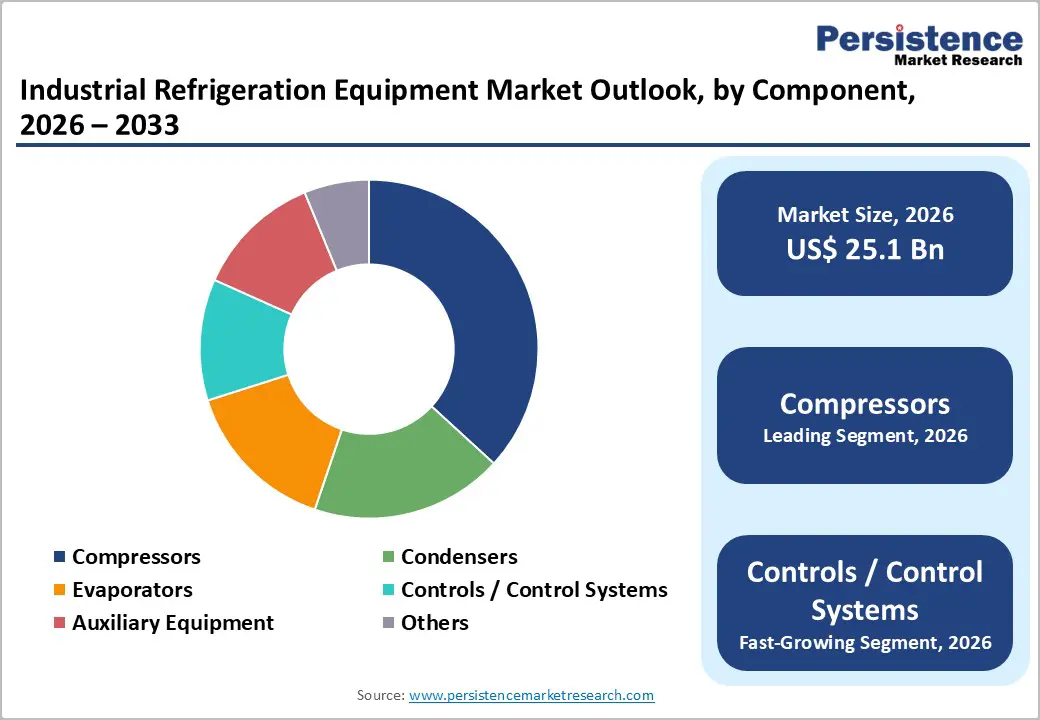

Compressor components command ~37% of the industrial refrigeration equipment market in 2024, making them the dominant component due to the fundamental criticality of the cooling cycle and an energy-efficiency focus that supports sustained demand across diverse applications and technology types. Variable-speed drive compressor adoption enables energy optimization and reduced operating costs. Two-stage compression supports higher efficiency in large-scale systems. Oil-free technology reduces maintenance and operational complexity. High-efficiency standards compliance accelerates adoption across developed markets, while established manufacturing infrastructure supports competitive pricing, scalability, and reliable global supply availability for industrial refrigeration system deployments worldwide.

Controls and control systems are the fastest-growing component, growing at a 7.3% CAGR, driven by IoT integration, AI-driven optimization, and advanced monitoring that enable predictive maintenance. Cloud connectivity, automation, and real-time diagnostics improve efficiency, safety, lifecycle performance, and cross-facility operational visibility.

Ammonia refrigerant holds a dominant market position with around 41% share, reflecting a long industrial history, proven efficiency, and cost-effectiveness, supporting wide adoption across food processing, cold storage, and industrial applications. In 2024, the USD 7.9 billion market is projected to reach USD 15.9 billion by 2034. Low-charge ammonia system innovations enable safety improvements and broader applicability. Efficiency advantages versus alternatives persist. Cost-effectiveness supports diverse applications. Environmental sustainability delivers zero ozone-depleting potential and a low global warming potential. Established infrastructure ensures technical expertise, mature supply chains, and global service networks.

Carbon dioxide refrigerant expands as fastest-growing at an 8.8% CAGR, driven by sustainability, transcritical efficiency, and regulatory advantages. System innovations improve safety. Zero ozone depletion, minimal global warming potential, and hybrid ammonia-CO2 architectures enhance performance, compliance certainty, and adoption momentum.

Food and beverage processing and preservation commands a dominant market position with ~35% share, reflecting critical refrigeration requirements across food production, processing, and distribution. Approximately 44% of cold chain applications serve frozen and processed food, supporting sustained equipment demand across diverse food sectors. Dairy facilities drive milk collection and processing needs. Meat processing ensures compliance with quality and safety standards. Seafood preservation supports global logistics. Frozen bakery and ready-to-eat growth drives specialized cooling systems. Quality preservation imperatives encourage investment in premium equipment and the adoption of advanced technology across industrial food value chains globally.

Data center cooling represents the fastest-growing application with an 8.6% CAGR, driven by artificial intelligence computing and extreme heat density. GPU loads require specialized infrastructure. Liquid and immersion cooling adoption accelerates among hyperscalers, improving energy efficiency, sustainability outcomes, and scalability.

North America maintains a prominent 27% global market share, driven by sophisticated technology infrastructure, an advanced food processing sector, data center concentration, and regulatory excellence that support market leadership and sustained growth momentum, fostering innovation and premium technology adoption. U.S. market dominance with 156 million cubic meters refrigerated warehouse capacity. Stringent EPA regulations are driving the rapid adoption of natural refrigerants. Data center concentration supporting cooling technology innovation and deployment. Advanced food safety standards are driving sophisticated temperature monitoring and control systems. Technology innovation leadership attracting R&D investment and talent.

The North American market is characterized by technology leadership and regulatory excellence, with established players including Danfoss, Johnson Controls, and Emerson maintaining competitive positions. Food processing sophistication is driving advanced equipment investment. The data center sector provides an emerging growth opportunity. Supply chain modernization supporting IoT integration and advanced monitoring systems.

Europe commands 29% global market share with a 4.3% CAGR, driven by strict environmental regulations, sustainability consciousness, advanced manufacturing heritage, and strong emission-reduction commitments that support technology advancement and premium product positioning, thereby supporting market leadership. Germany's manufacturing strength supports its leadership in industrial refrigeration equipment. UK regulatory framework driving adoption of low-GWP refrigerants. France's sustainability focus supports natural refrigerant technology investment. Spain food sector expansion driving regional refrigeration demand. EU F-Gas Regulation enforcing HFC phase-down supporting technology transition. Energy efficiency standards are driving VSD and advanced controls adoption. Corporate sustainability commitments supporting premium technology adoption.

European market characterized by regulatory excellence and sustainability leadership with manufacturers focusing on natural refrigerant systems and energy-efficient technologies. Strong environmental policy enforcement accelerating technology transition. Advanced manufacturing capabilities supporting specialized equipment production. Premium positioning reflecting quality standards and regulatory compliance.

Asia Pacific commands a significant 33% market share, driven by rapid infrastructure development, expanding food production, emerging middle-class populations, and accelerating e-commerce logistics adoption, supporting market growth exceeding global averages and reflecting emerging market momentum. China's food retail and e-commerce expansion is driving cold chain infrastructure development. India's agricultural production growth supports investment in food processing facilities. Japan's technology leadership in refrigeration innovation and efficiency. ASEAN region logistics expansion supporting the development of cold storage facilities. Mobile commerce growth is driving demand for temperature-controlled last-mile delivery. Government infrastructure investment supporting cold chain development programs. Manufacturing cost advantages enable competitive equipment pricing.

The Asia Pacific market is characterized by rapid infrastructure development and emerging market opportunities with growth exceeding global averages. Cost-conscious procurement supporting mid-range equipment adoption. Manufacturing presence attracting equipment supplier investment. Government infrastructure programs supporting systematic capacity development.

The global industrial refrigeration equipment market is consolidated, led by multinational players including Danfoss, MAYEKAWA, Emerson Copeland, Johnson Controls, and Daikin, which have broad portfolios and global reach. They are complemented by regional and specialized suppliers such as Bitzer, Carrier, GEA Refrigeration, and Heatcraft, while emerging players, including Unic Air and immersion cooling specialists, capture niche, technology-driven opportunities globally.

The industrial refrigeration equipment market was valued at US$25.1 billion in 2026 and is projected to reach US$36.3 billion by 2033, driven by cold chain expansion, AI-led data center cooling, and natural refrigerant regulations, with Asia Pacific leading demand.

Growth is driven by food and beverage cold chain demand, rapid expansion of AI-driven data center cooling, and regulatory mandates accelerating the adoption of sustainable refrigerants.

The market is expected to grow at a 5.37% CAGR from 2026 to 2033.

Key opportunities include Asia Pacific cold chain infrastructure growth, rising adoption of immersion cooling in data centers, and IoT-enabled predictive maintenance services.

Leading companies include Danfoss, MAYEKAWA, Johnson Controls, Emerson, and Daikin, supported by Bitzer, Carrier, GEA Refrigeration, and emerging technology-focused players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Refrigerant Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author