ID: PMRREP35538| 200 Pages | 31 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

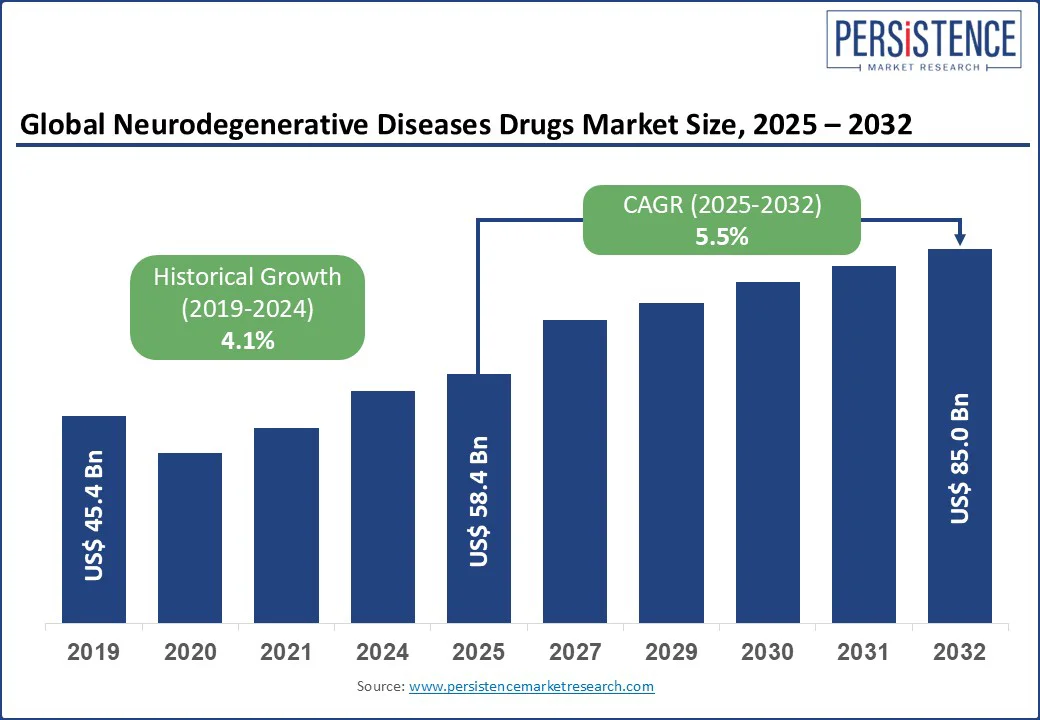

The neurodegenerative diseases drugs market size is likely to be valued at US$ 58.4 Bn in 2025 and is estimated to reach US$ 85.0 Bn in 2032, growing at a CAGR of 5.5% during the forecast period 2025-2032. Breakthrough regulatory approvals, biomarker-based precision targeting, and rising demand for disease-modifying therapies have encouraged the development of drugs for neurodegenerative diseases. An aging population is pushing incidence rates across Alzheimer’s, Parkinson’s, and multiple sclerosis. Hence, pharmaceutical companies are adjusting their research and development priorities to capitalize on high-value biologics, immunomodulators, and regenerative platforms. Increasing investment, cross-border collaborations, and payer engagement are further positioning neurodegeneration as a key growth frontier in the global neurology market.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Neurodegenerative Diseases Drugs Market Size (2025E) |

US$ 58.4 Bn |

|

Market Value Forecast (2032F) |

US$ 85.0 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.1% |

Increasing emphasis on early diagnosis and intervention is accelerating the neurodegenerative diseases drugs market growth by expanding the eligible treatment population. The approval of lecanemab in the U.S., Japan, and certain European countries for early-stage Alzheimer’s disease has increased demand for early screening. It is prompting healthcare facilities to invest in PET imaging, CSF biomarker assays, and blood-based diagnostics. This shift has resulted in an increasing demand for drugs that target pathophysiological mechanisms before irreversible neuronal damage occurs.

Eli Lilly’s donanemab showed a 35% slowing of cognitive decline in early-stage Alzheimer’s in its TRAILBLAZER-ALZ 2 trial. This demonstrated that efficacy is powerful when administered during preclinical or mild cognitive impairment phases. Hence, payers and healthcare institutions are becoming more willing to reimburse such therapies when supported by biomarker-confirmed diagnoses. This is directly pushing pharmaceutical companies to focus their pipelines on prodromal-stage treatments.

The historical reliance on symptomatic treatments in neurodegenerative diseases has hampered the adoption of new and potentially disease-modifying drugs. Most existing therapies such as donepezil for Alzheimer’s or levodopa for Parkinson’s, provide temporary relief without altering the disease pattern. This treatment model has created skepticism among clinicians and patients regarding the long-term value of the latest drugs. The tendency to manage symptoms rather than intervene early in disease biology has also limited investment in diagnostic infrastructure necessary for disease-modifying therapies.

Various such treatments require biomarker-confirmed diagnoses. However, a 2024 survey by the Alzheimer’s Association found that fewer than 30% of neurologists in the U.S. routinely order amyloid PET scans or CSF tests. It is mainly due to cost, limited access, and uncertainty over actionable outcomes. Hence, even when disease-modifying drugs are approved, real-world implementation falters in the absence of supporting systems. In addition, reimbursement frameworks in several regions still favor low-cost and established symptomatic drugs.

The exploration of stem cell therapy as a regenerative approach in neurodegenerative diseases is creating new opportunities for drug developers. It is gradually shifting the treatment focus from symptomatic relief to actual neuronal restoration. Stem cell-based interventions aim to repopulate damaged neural circuits and offer long-term disease modification. This is prompting pharmaceutical and biotech companies to co-develop drugs that improve stem cell efficacy. At the same time, they are focusing on creating combination regimens involving immunomodulators or small molecules to refine the host environment for cell engraftment.

Recent trials emphasize this potential. In 2024, for example, BlueRock Therapeutics, a Bayer subsidiary, initiated Phase 2 trials of its dopamine-producing iPSC-derived cell therapy for Parkinson’s disease in the U.S. and Canada. Early results from its Phase 1 trial showed not only safety but also signs of improved motor function in participants. Such results have spurred interest in developing adjunctive drugs that reduce neuroinflammation and oxidative stress.

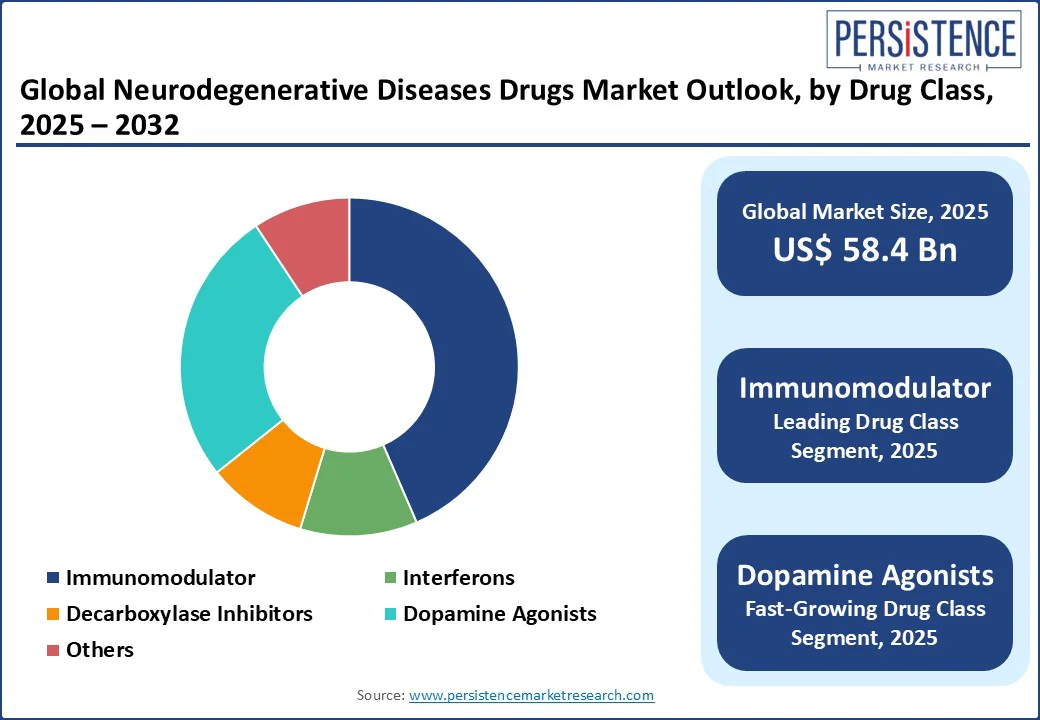

In terms of drug class, the market is segregated into immunomodulator, interferons, decarboxylase inhibitors, dopamine agonists, and others. Out of these, immunomodulators are poised to hold nearly 43.5% of the neurodegenerative diseases drugs market share in 2025 with their ability to target core disease mechanisms involving neuroinflammation and immune dysregulation. In multiple sclerosis, which has a well-defined autoimmune basis, immunomodulators are the backbone of therapy. The class’s appeal is also supported by regulatory precedent and biomarker-enabled patient stratification.

Dopamine agonists are gaining momentum in the treatment of Parkinson’s disease. This is attributed to their expanding therapeutic utility, improved delivery mechanisms, and reduced long-term complications compared to conventional levodopa-based regimens. While levodopa remains the gold standard for symptomatic relief, long-term use is associated with motor fluctuations and dyskinesias. Dopamine agonists, including pramipexole, ropinirole, and rotigotine, are being used in early-stage Parkinson’s to delay levodopa initiation.

Based on disease indication, the market is divided into multiple sclerosis, Parkinson’s disease, Alzheimer's disease, Spinal Muscular Atrophy (SMA), and others. Among these, multiple sclerosis is projected to hold around 62.6% of share in 2025 owing to its well-characterized autoimmune pathology, accessible biomarkers, and the presence of clear clinical endpoints. It is characterized by demyelination and neuroinflammation, making it responsive to immunomodulatory therapies. This has resulted in the approval of more than 20 Disease-Modifying Therapies (DMTs) globally.

Alzheimer’s disease stands out as a key disease indication backed by its immense patient burden, political visibility, and the commercial incentives linked to disease-modifying breakthroughs. According to Alzheimer’s Association, more than 7 Mn individuals in the U.S. are living with the disease and by 2050, the number is estimated to surge to approximately 13 Mn. This epidemiological pressure has pushed it to the forefront of both public health agendas and pharmaceutical pipelines.

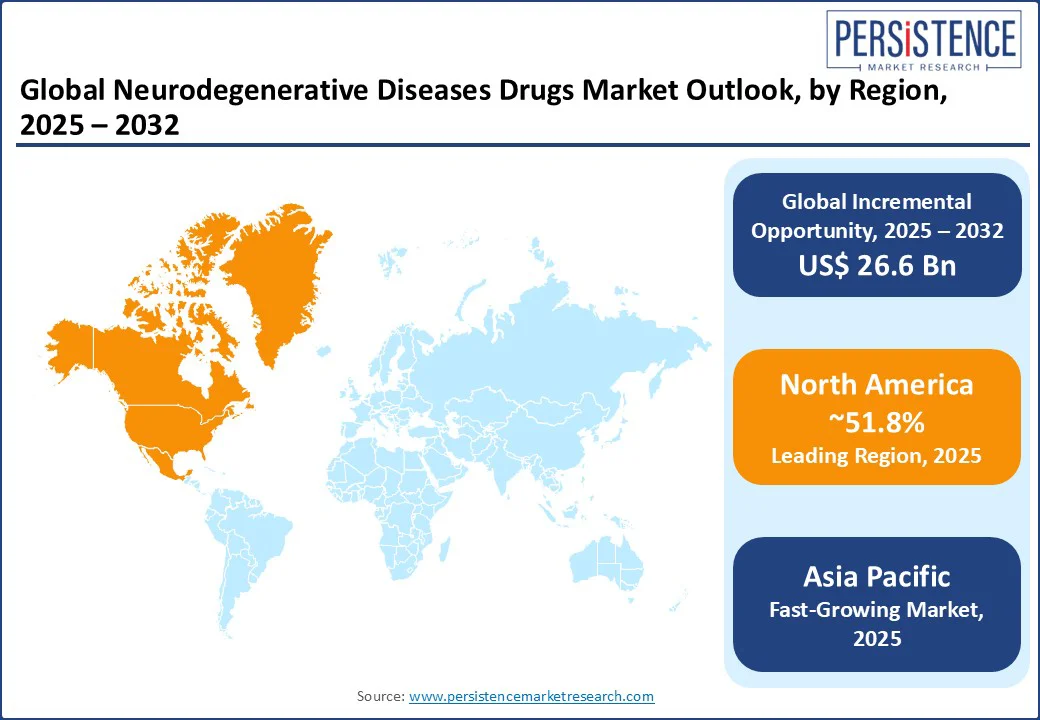

In 2025, North America is predicted to account for approximately 51.8% of share due to rising public funding, accelerated regulatory pathways, and high unmet clinical requirement. The U.S. neurodegenerative diseases drugs market is estimated to witness steady growth with the Food and Drug Administration’s (FDA) approval of Eisai and Biogen’s Leqembi. It marked a key milestone as the first fully approved anti-amyloid drug for early-stage Alzheimer’s under the traditional pathway.

The Centers for Medicare & Medicaid Services (CMS) followed with expanded coverage. It propelled policy support for disease-modifying therapies, which has started to influence investment flows and pricing strategies in the U.S. Canada has also exhibited increased openness toward novel treatments. Health Canada approved Leqembi in late 2023 but with limited reimbursement guidelines compared to the U.S. This shows the country’s stringent cost-effectiveness thresholds.

Europe’s market is characterized by rigorous regulatory standards, cost-effectiveness thresholds, and increasing public sector involvement. The European Medicines Agency (EMA) granted conditional marketing authorization to Biogen and Eisai’s Leqembi in November 2024. However, Germany and France have been slower to integrate it into national reimbursement systems due to unresolved concerns over clinical benefit and long-term economic value. The German Federal Joint Committee (G-BA) evaluated Leqembi in early 2025 and assigned it a ‘minor additional benefit’ rating. It further affected pricing negotiations and access timelines.

Europe is also seeing increasing investment in decentralized clinical trials and Real-World Data (RWD) infrastructure to better assess treatment outcomes in aging populations. The Innovative Health Initiative (IHI), launched in 2022 under Horizon Europe, has funneled over €100 Mn into neurodegenerative research. It includes projects such as NEUROCURE and the European Platform for Neurodegenerative Diseases (EPND). These aim to boost biomarker validation and harmonize data sharing across borders.

Asia Pacific is evolving rapidly with demographic pressure, government-backed research incentives, and increasing local development. Japan remains the regional frontrunner, both in drug development and regulatory agility. In September 2023, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) approved lecanemab (Leqembi) for early-stage Alzheimer’s, just months after the U.S. PMDA also included it under the National Health Insurance scheme, which was considered a swift decision to address the country's urgent focus on dementia.

China is investing in neurodegenerative drug discovery under its Healthy China 2030 initiative. Players such as Green Valley Pharmaceuticals have gained traction with GV-971, a marine algae-derived drug for Alzheimer’s. The company announced in early 2025 that it is now conducting a global Phase 3 trial across Asia Pacific, North America, and Europe. South Korea is emerging as a precision medicine hub, with biotech firms such as Peptron and Medytox developing peptide and botulinum-based therapies for neurodegenerative disorders.

The neurodegenerative diseases drugs market is highly fragmented with rising burden of Alzheimer's, Parkinson's, ALS, and Huntington’s disease. Large pharmaceutical firms dominate the market with late-stage pipeline assets and FDA-approved treatments. Small-scale companies are boosting candidates with unique modalities, including blood-brain barrier-penetrant biologics and small molecules that modulate lysosomal function. There is also a surging interest in gene therapies and antisense oligonucleotides, mainly for rare and genetically defined disorders. Strategic collaborations are also gaining momentum among big pharma and small biotech firms to develop next-generation drugs.

The neurodegenerative diseases drugs market is projected to reach US$ 58.4 Bn in 2025.

High unmet demand for disease-modifying treatments and regulatory support for neurology-focused research activities are the key market drivers.

The neurodegenerative diseases drugs market is poised to witness a CAGR of 5.5% from 2025 to 2032.

The development of precision therapies and companion diagnostic co-development are the key market opportunities.

Biogen, Pfizer, Inc., and Hoffmann-La Roche Ltd. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Drug Class

By Disease Indication

By Route of Administration

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author