ID: PMRREP35544| 200 Pages | 4 Aug 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

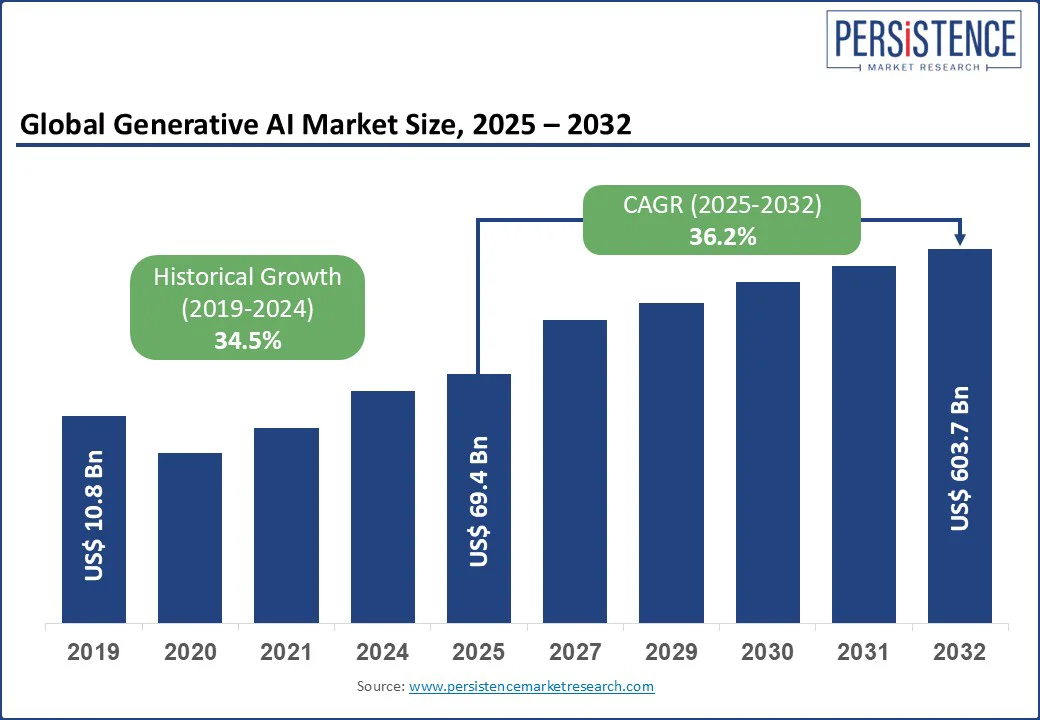

The global Generative AI market size is projected to rise from US$69.4 Bn in 2025 to US$603.7 Bn by 2032. It is anticipated to witness a CAGR of 36.2% during the forecast period from 2025 to 2032. The generative AI market has witnessed rapid growth in recent years, driven by advancements in machine learning models, particularly large language models (LLMs) and diffusion models, that enable the creation of highly realistic text, images, audio, and video. This technology is transforming industries by automating content creation, personalizing user experiences, and enhancing creative workflows. Companies are accelerating acquisitions and partnerships to build proprietary AI ecosystems, while data privacy, model efficiency, and responsible AI use are becoming key priorities.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Generative AI Market Size (2025E) |

US$69.4 Bn |

|

Market Value Forecast (2032F) |

US$603.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

36.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

34.5% |

The rise of generative AI, transforming industries from healthcare to entertainment, is driven by a leap in high-performance computing capabilities. Since 2019, AI supercomputing performance has doubled roughly every nine months, enabling breakthroughs in LLMs, diffusion models, and multi-modal systems. For instance, as of March 2025, xAI’s Colossus system, powered by over 200,000 AI chips and consuming 300 megawatts of energy, with projections suggesting that by 2030, top-tier AI systems could require 2 million chips to operate. This shows how essential high-performance computing has become for training frontier AI models.

The World Economic Forum notes AI computing demands are doubling every 100 days, accelerating GenAI capabilities. In response, governments worldwide are recognizing the strategic importance of this computational race and taking significant steps for AI growth. For instance, in the U.K., the government has committed to expanding sovereign AI compute capacity by at least 20 times by 2030, with plans to deploy exascale-class supercomputers capable of performing quintillions of calculations per second.

Hallucinations occur when large language models (LLMs) produce outputs that are factually incorrect or not grounded in their training data, often appearing credible to users. This issue, coupled with the potential for AI to generate and spread misinformation, creates challenges for industries relying on accurate and trustworthy outputs.

According to OpenAI’s internal tests reported by Live Science in June 2025, newer models such as o3 and o4-mini still exhibit high hallucination rates up to 79% on certain tasks despite advancements in reasoning capabilities. A 2024 study from UC Berkeley’s Sutardja Center highlights that hallucinations are unavoidable fundamental limitations in LLMs’ ability to learn all computable functions.

Industry-specific generative AI tools are emerging as a major growth catalyst by addressing the unique context, workflows, and regulatory requirements of sectors such as healthcare, legal, finance, manufacturing, and education. In healthcare, these solutions are being applied to clinical documentation, summarizing patient histories, and assisting in diagnostics while complying with HIPAA regulations. By September 2024, nearly 70 AI-developed drugs had advanced to clinical trials, highlighting GenAI’s expanding role in accelerating life sciences innovation.

Administrative burden is another area where GenAI is driving transformation, with clinicians spending over a third of their week on paperwork. A 2024 Google Cloud–Harris Poll found that 91% of healthcare providers believe GenAI can significantly reduce this workload. Institutions like Cleveland Clinic and Kaiser Permanente have deployed ambient AI scribe tools, cutting after-hours documentation by up to 60%, thereby enhancing patient care and reducing physician burnout.

Retrieval-augmented generation has gained prominence, particularly in response to the ongoing challenge of hallucinations, where language models generate plausible but incorrect or unverifiable information. RAG improves factual accuracy by enabling language models to retrieve relevant documents or data from external sources before generating responses. This approach grounds AI outputs in real-time, verifiable information, making it highly valuable for sectors such as healthcare, legal, education, and enterprise search.

For example, by mid-2024, the growing reliance on RAG was reflected in the rapid expansion of vector database companies such as Pinecone, which scaled from a few hundred to over 5,000 enterprise clients. This surge shows how organizations are integrating proprietary datasets with large language models (e.g., GPT-4) to build trustworthy and responsive knowledge retrieval systems. In 2025, Snowflake’s global survey of 1,900 business and IT leaders reported 92% of early AI adopters achieving a positive ROI of 87% within the first year, and many attributed this directly to generative AI use cases like RAG.

Based on component, the segmentation includes hardware, software, and services. Hardware is expected to lead with around 40% share due to high-performance computing needs for large-scale AI model training and deployment. Generative AI models such as GPT-4 and DALL·E needs immense computing power, met by advanced GPUs and custom chips such as TPUs. In 2024 –2025, firms such as NVIDIA, AMD, Intel, and Google have expanded their AI hardware. NVIDIA’s H100 and GH200 chips, built on the Hopper and Grace-Hopper architecture that are central to AI data centers. These chips support training complex multimodal models while improving energy efficiency.

Generative AI services are scaling rapidly as organizations across industries increasingly seek external expertise to operationalize models, customize deployments, and ensure compliance, particularly where internal AI talent is scarce. This growth is driven by the rising demand for consulting, fine-tuning, prompt engineering, deployment support, and ethical governance in regulated sectors such as finance, healthcare, and public institutions.

Based on end-user, the segmentation comprises individuals and enterprises. The enterprises are further segmented into various industries such as BFSI, media & entertainment, healthcare & life sciences, automotive, manufacturing, IT & telecommunication, and more. Among these, media & entertainment dominate, accounting for over 30%, share of market revenue. Generative AI enables rapid production of scripts, videos, music, and visual effects, significantly reducing time and costs compared to traditional methods. The rising popularity of AI-driven tools for animation, dubbing, and localization also boosts adoption.

The healthcare and life sciences sector is rapidly expanding its use of AI. For example, a recent ServiceNow survey reports 77% of healthcare and life sciences organizations plan to increase AI investment in the next fiscal year. This momentum is propelled by advances in clinical imaging, drug discovery, and personalized medicine, where AI/GenAI leverage large, multimodal datasets (EHRs, imaging, –omics) to improve diagnostics, treatment planning, and R&D productivity.

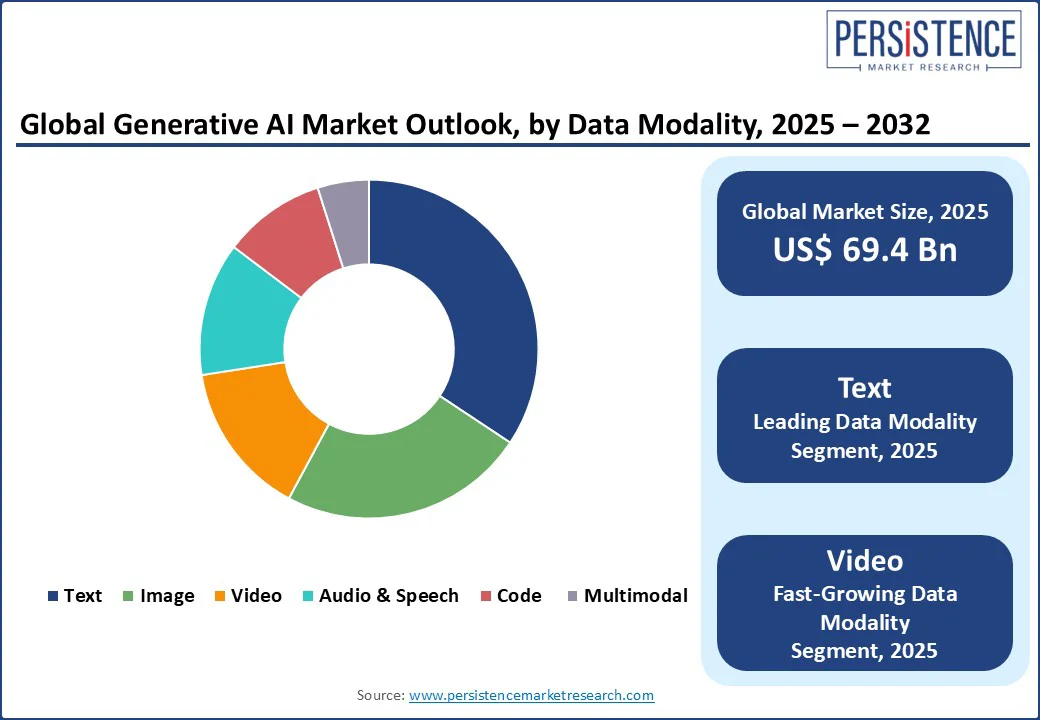

Based on data modality, the gen AI market is segmented as text, image, video, audio & speech, code, and multimodal. Among these, text dominates, accounting for over 35% share in 2025. Text-based generative AI is easier to implement compared to image or video generation, requiring less computational power and lower costs. The demand for chatbots, virtual assistants, personalized recommendations, and automated documentation is driving the dominance of text generation. The availability of massive text datasets for training further strengthens its market leadership.

The video segment is expected to grow at the highest rate due to rising demand for AI-driven video creation, editing, and personalization across entertainment, advertising, and social media platforms. Generative AI models, such as diffusion models and GANs, enable the production of high-quality, realistic videos with minimal manual effort, significantly reducing time and cost. Industries such as gaming, virtual production, and e-learning are increasingly leveraging generative AI for immersive video experiences.

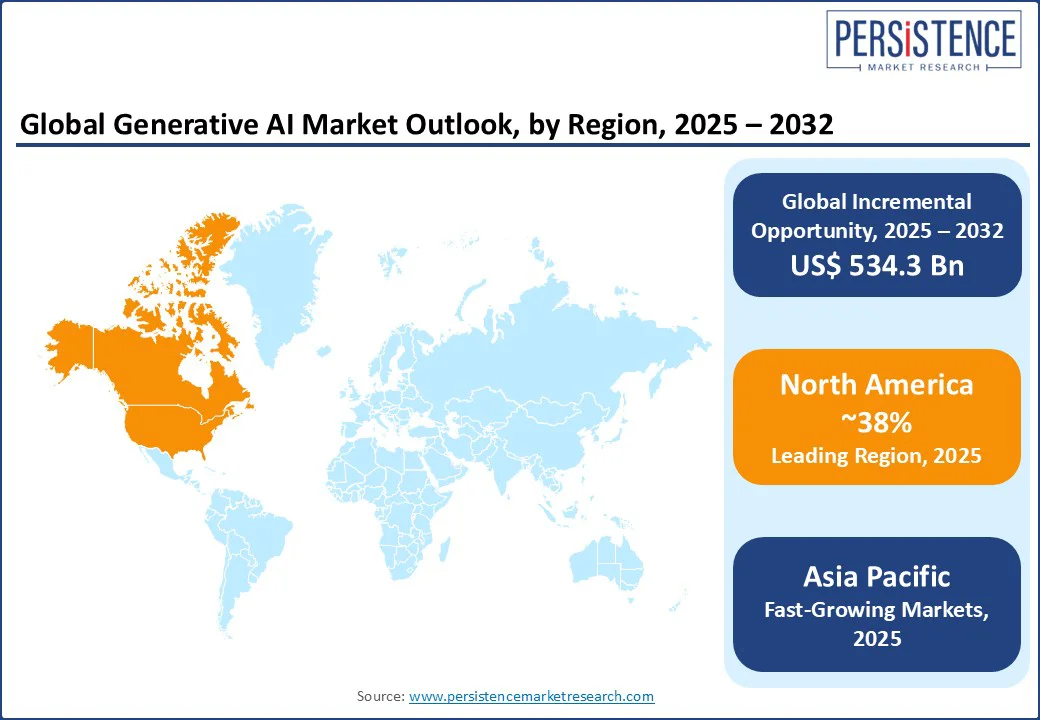

North America is expected to account for approximately 38% of the Generative AI market in 2025, due to its robust technological infrastructure, significant investments, and concentration of leading AI research institutions and companies. The region’s dominance is driven by a combination of government support, academic excellence, and private sector innovation, raising an ecosystem conducive to AI development. Businesses seek AI-driven content creation, predictive insights, and process optimization to enhance efficiency and competitiveness.

The region also benefits from a robust startup ecosystem and access to venture capital. Generative AI startups in the region have attracted huge funding from investors, with over US$ 48 billion in funding raised in 2024 alone. That’s 20 times the amount raised in 2020, and almost as much as all venture capital raised in Europe in 2024.

With rapid urbanization, growing internet penetration, and large datasets, Generative AI helps improve operational efficiency, personalization, and innovation. Countries across the region have launched national AI strategies to scale innovation. India’s MeitY approved the IndiaAI Mission in April 2025, boosting compute access for startups. The surge in data availability and cloud infrastructure provides a strong foundation for generative AI applications.

Singapore introduced its National AI Strategy 2.0 in December 2023 to triple AI talent, open public data, and accelerate public-sector AI use. Malaysia is investing in a digital backbone through its national AI office and cloud policy, supported by a $2 billion Google data center projected to create 26,500 jobs by 2030. Regional efforts are also aligned, with ASEAN adopting unified frameworks for responsible AI. The ASEAN Digital Masterplan 2025 laid the groundwork, and in January 2025, a dedicated Generative AI governance guide was introduced. These efforts are reinforced through cross-border workshops by the AI Asia Pacific Institute, fostering responsible growth across the region.

Europe has emerged as a strategically significant region due to its pioneering regulatory framework, coordinated investment, and public-sector integration. In 2024, the European Union became the first jurisdiction to enact a comprehensive AI law, the AI Act, which came into force in August 2024, setting global benchmarks for transparency, safety, and accountability in general-purpose AI. Backed by over €1 billion annually through Horizon Europe and Digital Europe, the region is also investing in AI Factories, supercomputing infrastructure, and GenAI4EU to accelerate innovation and market deployment.

European businesses face rising pressure to enhance productivity and automation, and generative AI offers cost-effective solutions by streamlining workflows and reducing time-to-market. Europe is also scaling AI infrastructure via the InvestAI initiative, launched during the 2025 AI Action Summit in Paris. This €200 billion investment includes €20 billion for building AI gigafactories, each housing over 100,000 advanced AI chips, to rival U.S. and Chinese capabilities and support large-scale generative model training.

The generative AI market is moderately consolidated at the infrastructure and model layers, whereas the application layer is highly fragmented, driven by startups and vertical-focused players. Hyperscalers are integrating generative AI into their cloud platforms to drive enterprise adoption. Strategic partnerships such as Microsoft with OpenAI and AWS with Anthropic are expanding access to foundation models across their ecosystems. Companies are also actively pursuing mergers and acquisitions to bring top talent and accelerate innovation.

The global generative AI market is projected to be valued at US$ 69.4 Bn in 2025.

Need for automation, personalized content creation, and advanced human-machine interactions drives the generative AI market.

The generative AI market is poised to witness a CAGR of 36.2% from 2025 to 2032.

Advancements in deep learning models, combined with rising computational power and cloud-based AI infrastructure, are creating significant opportunities for the generative AI market.

OpenAI, Inc., Anthropic, Glean Technologies, Inc., Inflection AI, Inc., Microsoft Corporation, Nvidia Corporation, Google LLC are among the leading key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Component

By Data Modality

By Deployment Mode

By Enterprise Size

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author