ID: PMRREP17995| 170 Pages | 29 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

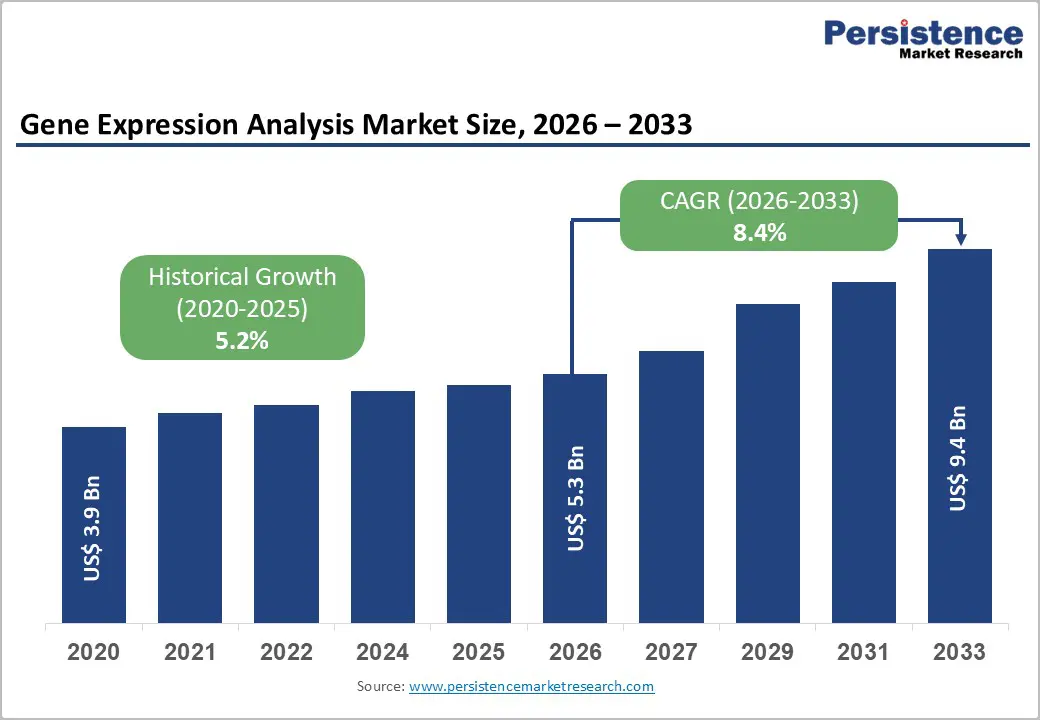

The global gene expression analysis market size is expected to be valued at US$ 5.3 billion in 2026 and projected to reach US$ 9.4 billion by 2033, growing at a CAGR of 8.4% between 2026 and 2033.

Advancements in genomics technologies and the accelerating adoption of personalized medicine are major factors propelling growth in the gene expression analysis market. Rising global prevalence of chronic diseases has intensified the need for precise diagnostic and monitoring tools, with expression profiling playing a central role in biomarker identification, patient stratification, and therapy selection. Continuous improvements in sequencing accuracy, automation, and data analytics further enhance research productivity and clinical applicability.

Drug-development programs increasingly rely on transcriptomic insights to understand disease pathways and validate therapeutic targets. High-throughput platforms such as next-generation sequencing have transformed biological discovery by enabling comprehensive molecular profiling at scale. Public-sector support, including NIH-backed initiatives, continues to expand research infrastructure and translational adoption, reinforcing long-term demand across academic, pharmaceutical, and clinical settings.

| Global Market Attributes | Key Insights |

|---|---|

| Gene Expression Analysis Market Size (2026E) | US$ 5.3 billion |

| Market Value Forecast (2033F) | US$ 9.4 billion |

| Projected Growth CAGR (2026-2033) | 8.4% |

| Historical Market Growth (2020-2025) | 5.2% |

Rapid innovation in next-generation sequencing (NGS) and single-cell RNA sequencing has fundamentally reshaped gene expression analysis by enabling ultra-high resolution, scalability, and faster turnaround times. These platforms allow simultaneous profiling of tens of thousands of transcripts, accelerating biomarker discovery, disease pathway mapping, and therapeutic target validation. NIH-funded research indicates that adoption of NGS in genomics studies has risen sharply since 2020, reflecting its growing indispensability in translational medicine. Automation, declining sequencing costs per base, and cloud-enabled bioinformatics pipelines further improve laboratory efficiency and throughput. Such advances support complex applications including tumor microenvironment characterization, immune-cell mapping, and rare-cell detection. Collectively, these factors expand utilization across pharmaceutical research, academic institutes, and clinical laboratories, positioning high-throughput sequencing as a core growth engine for the global gene expression market.

The escalating global burden of chronic illnesses such as cancer, cardiovascular disease, and autoimmune disorders is intensifying demand for advanced gene expression technologies. With more than 1.7 billion individuals affected worldwide, healthcare systems increasingly rely on molecular profiling to identify disease-specific signatures, stratify patients, and monitor therapeutic response. Gene expression analysis plays a central role in pharmacogenomics, enabling clinicians to tailor treatments based on individual biology rather than population averages. Regulatory momentum also supports this trend, as numerous companion diagnostics linked to targeted therapies have been approved in recent years. These tests depend heavily on transcriptomic data to guide drug selection and dosing. As personalized medicine frameworks become embedded into oncology and rare-disease management, adoption of expression-based assays in hospitals and diagnostic laboratories is expected to rise steadily, expanding long-term commercial opportunities.

Despite technological progress, the substantial capital investment required for modern sequencing systems and analytical infrastructure continues to restrain market penetration. A full NGS laboratory setup including instruments, automation platforms, servers, and bioinformatics software can exceed half a million dollars, while ongoing maintenance contracts and reagent expenses further elevate operational costs. The need for highly trained personnel in molecular biology, data science, and regulatory compliance compounds financial pressure, particularly for smaller research centers and hospitals. In emerging economies, limited funding and reimbursement mechanisms create disproportionately high barriers to adoption, slowing deployment beyond major urban institutions. These cost constraints often favor established multinational suppliers with bundled solutions and service networks, while restricting uptake among price-sensitive customers. Until affordable, decentralized sequencing platforms and streamlined analytics become widely available, infrastructure-intensive technologies will continue to limit broader market expansion.?

Inconsistent protocols, platform variability, and reagent batch effects remain significant obstacles for widespread clinical adoption of gene expression technologies. Differences in sample preparation, library construction, sequencing chemistry, and bioinformatics pipelines can generate substantial variability in transcript quantification across laboratories. Multi-site studies have demonstrated wide discrepancies in expression measurements, raising concerns about data comparability and regulatory reliability. Initiatives such as the FDA’s Sequencing Quality Control (SEQC) project have highlighted these reproducibility gaps and emphasized the need for harmonized workflows and validated reference standards. Such uncertainty complicates regulatory submissions for diagnostics and slows physician confidence in transcriptomic-based clinical decisions. Without industry-wide consensus on quality metrics, reporting formats, and analytical algorithms, laboratories may hesitate to scale implementation beyond research use. This lack of standardization ultimately constrains commercialization in regulated diagnostic and companion-testing markets.?

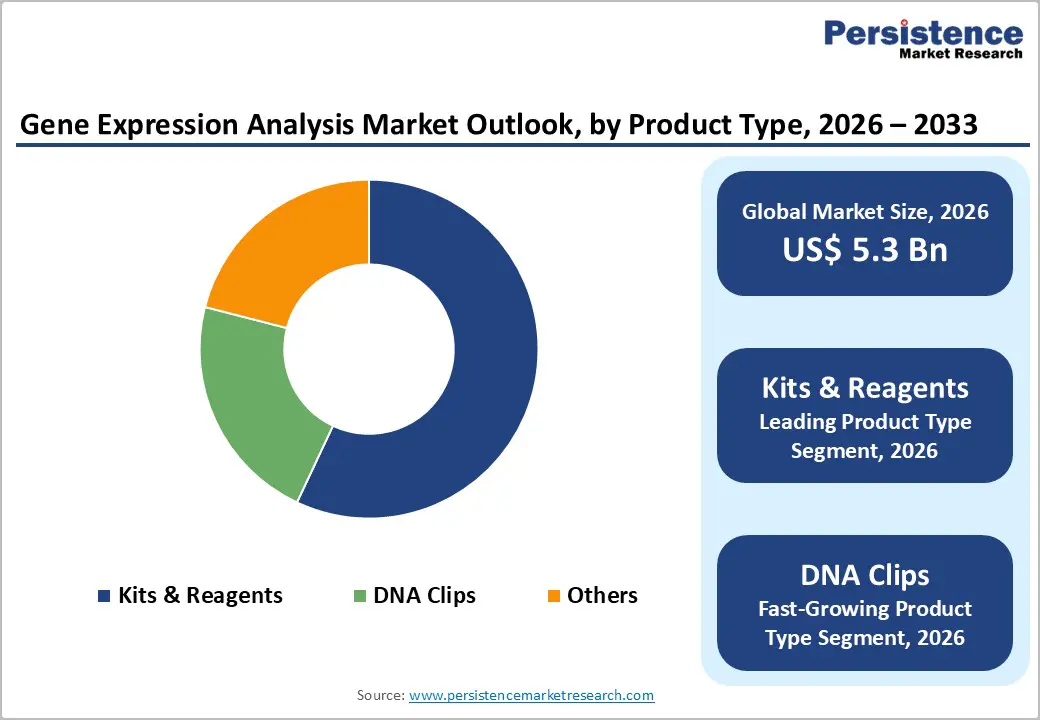

Single-cell and spatial transcriptomics represent one of the most promising growth avenues within the gene expression landscape. These technologies allow researchers to dissect cellular heterogeneity, map tissue architecture, and identify rare disease-driving populations that bulk RNA methods cannot resolve. Their relevance is particularly strong in oncology, immunology, and regenerative medicine, where understanding cell-to-cell interactions guides therapeutic development. High-plex platforms capable of measuring hundreds of transcripts simultaneously are increasingly applied in CRISPR screening, drug-response profiling, and tumor-microenvironment studies. Research output in this domain has surged in recent years, signaling acceleration adoption across academia and industry. As costs decline and workflows mature, DNA chips and spatial-omics consumables are expected to emerge as the fastest-growing product categories. Vendors that deliver scalable, automation-ready solutions stand to capture meaningful share in this expanding segment.

Drug-development programs targeting neurodegenerative, autoimmune, and rare genetic disorders are increasingly dependent on transcriptomic profiling to uncover novel targets and validate biological pathways. Gene expression tools support multi-omics integration, enabling pharmaceutical companies to correlate RNA signatures with genomic and proteomic data for more informed candidate selection. Clinical research activity in Asia Pacific and other emerging regions is expanding rapidly, driven by rising healthcare investment, government incentives, and growing biotech ecosystems. Regulatory initiatives such as accelerated approval pathways for gene- and cell-based therapies further stimulate demand for high-resolution expression platforms during preclinical and clinical evaluation. These dynamics create attractive revenue opportunities for DNA chip manufacturers and sequencing-solution providers focused on precision oncology and complex disease modeling. Companies that localize manufacturing, offer cost-efficient platforms, and collaborate with regional research networks are well positioned to benefit from this geographic and therapeutic expansion.

Kits and reagents dominate the gene expression analysis market, accounting for an estimated 57% share in 2025, primarily because they are indispensable to routine experimental workflows in both research and clinical laboratories. These consumables form the backbone of techniques such as quantitative PCR, microarrays, and next-generation sequencing by ensuring consistent sample preparation, amplification, labeling, and detection. Their standardized formulations reduce technical variability and improve reproducibility across experiments, making them critical for regulatory-compliant studies and multi-site collaborations. High-throughput laboratories drive recurring demand, as reagents must be replenished frequently for large sample volumes and longitudinal studies. Continuous product innovation including improved enzymes, multiplex-ready master mixes, and contamination-resistant chemistries further sustains uptake. As sequencing throughput rises and molecular testing expands into diagnostics, sustained consumption of kits and reagents is expected to remain the largest revenue contributor.

Pharmaceutical and biotechnology companies represent the leading end-user segment in the gene expression analysis market, supported by substantial investments in genomic-driven research and development. These organizations rely heavily on transcriptomic profiling to identify therapeutic targets, evaluate drug mechanisms, stratify patients, and assess safety during preclinical and clinical stages. Internal research laboratories increasingly integrate high-throughput sequencing platforms and automated expression workflows to accelerate discovery timelines and improve decision-making efficiency. Demand is further reinforced by the expansion of biologics, cell therapies, and precision oncology pipelines, which depend on molecular-level insights for regulatory submissions and companion diagnostics development. Strategic collaborations with academic institutes and technology vendors also enhance adoption of advanced expression tools. As competition intensifies in complex disease areas, sustained spending on molecular analytics positions pharmaceutical and biotechnology firms as the primary revenue drivers across global markets.

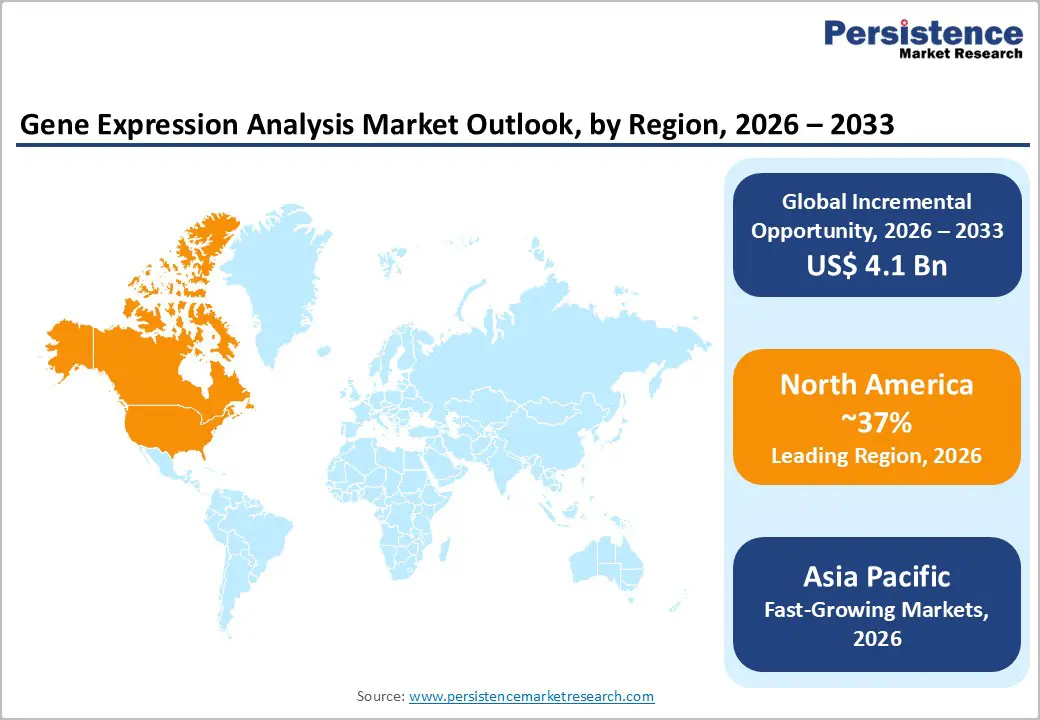

North America continues to represent a mature and high-value market for gene expression analysis, supported by strong research infrastructure, substantial healthcare spending, and early adoption of advanced genomics platforms. The region benefits from extensive funding from public agencies such as the National Institutes of Health, alongside private-sector investment from pharmaceutical companies and biotechnology startups. Widespread integration of next-generation sequencing, microarrays, and quantitative PCR into clinical research and diagnostics has strengthened routine usage across hospitals and reference laboratories. Regulatory frameworks encouraging precision medicine and companion diagnostics further stimulate demand for transcriptomic profiling in oncology and rare-disease programs. Academic–industry collaborations and large-scale population genomics initiatives contribute to sustained sample volumes and technology upgrades. Additionally, the presence of leading instrument manufacturers and reagent suppliers enables rapid commercialization of innovations, reinforcing North America’s position as a central hub for gene expression research and translational applications.

Asia Pacific is emerging as the fastest-expanding region in the gene expression analysis market, driven by rising healthcare investment, expanding pharmaceutical manufacturing, and growing adoption of precision-medicine approaches. Countries such as China, India, Japan, and South Korea are strengthening genomic research capabilities through government-backed programs, national biobanks, and funding initiatives aimed at biotechnology development. Increasing incidence of cancer and metabolic disorders is accelerating clinical demand for molecular diagnostics and expression-based testing. Multinational pharmaceutical companies are also expanding research operations and clinical trials in the region, boosting local utilization of high-throughput sequencing platforms. Improvements in laboratory infrastructure, workforce training, and regulatory clarity further support market growth. Local reagent production and partnerships with global technology providers are reducing costs and improving accessibility, positioning Asia Pacific as an increasingly important contributor to global revenue expansion over the forecast period.

The gene expression analysis market exhibits a moderately consolidated competitive structure, characterized by the presence of several multinational life-science companies alongside specialized genomics technology providers. Large players dominate through broad product portfolios spanning instruments, consumables, and bioinformatics platforms, enabling end-to-end workflow integration for research and clinical users. Continuous investment in R&D, strategic acquisitions, and licensing agreements strengthens technological differentiation and expands geographic reach. Smaller innovators focus on niche areas such as single-cell sequencing, spatial transcriptomics, and automation-ready reagents, intensifying competition in high-growth segments. Partnerships with pharmaceutical firms, academic institutes, and clinical laboratories further shape competitive positioning, while regulatory expertise and service capabilities remain key barriers for new entrants seeking large-scale adoption.?

The global gene expression analysis market is valued at US$ 5.3 billion in 2026.

Rising chronic disease prevalence, personalized medicine adoption, high-throughput sequencing innovation, biomarker discovery needs, expanding clinical diagnostics usage globally.

North America leads with 37% share in 2025.

Growth in single-cell and spatial transcriptomics applications, drug discovery expansion, emerging-market research investment, and precision oncology development worldwide.

Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., General Electric Company, Illumina, Inc., Luminex Corporation, Oxford Gene Technology IP, PerkinElmer, Inc., QIAGEN NV, Roche Holding AG, and Thermo Fisher Scientific, Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 2025 |

| Forecast Period | 2026 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Product Type

Capacity

Application

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author