ID: PMRREP34838| 190 Pages | 28 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

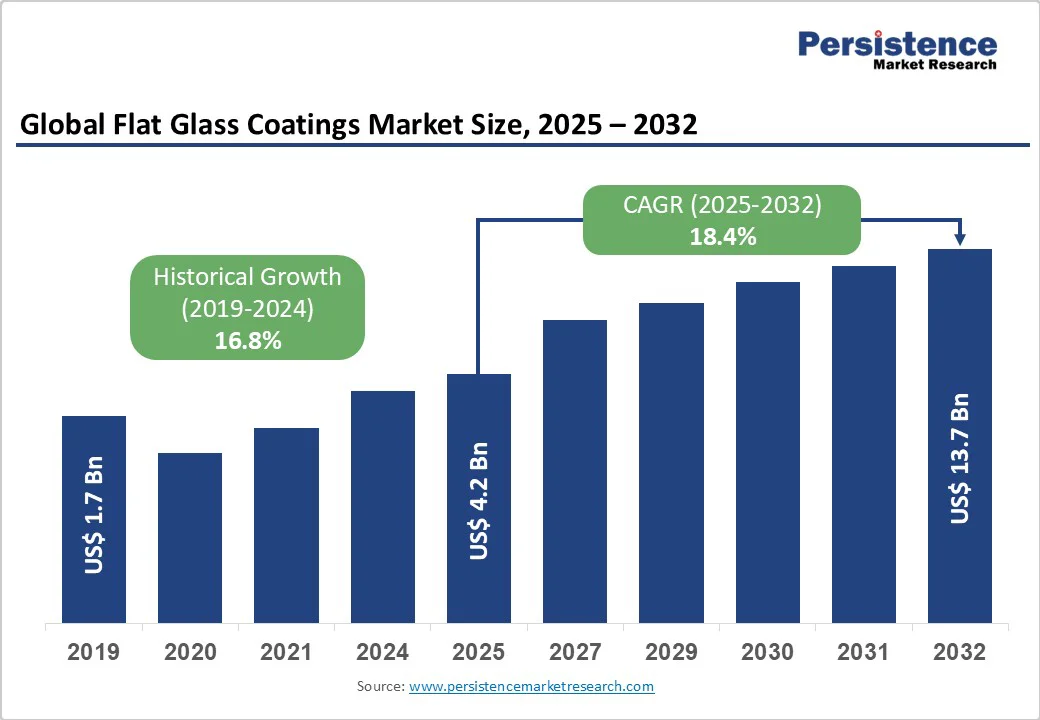

The global flat glass coatings market size is likely to be valued at US$4.2 Bn in 2025 and is projected to reach US$13.7 Bn by 2032, growing at a CAGR of 18.4% between 2025 and 2032.

The market is experiencing robust expansion, driven by increasing emphasis on energy efficiency in the construction and automotive sectors, coupled with advancements in sustainable coating technologies. This growth is supported by rising urbanization and infrastructure development in emerging economies, which heightens demand for durable and functional glass solutions.

| Key Insights | Details |

|---|---|

| Flat Glass Coatings Market Size (2025E) | US$4.2 Bn |

| Market Value Forecast (2032F) | US$ 3.7 Bn |

| Projected Growth CAGR (2025 - 2032) | 18.4% |

| Historical Market Growth (2019-2024) | 16.8% |

The primary driver of the fat glass coatings Market is the global push toward energy-efficient buildings, where low-emissivity (low-E) and solar-control coatings significantly reduce heat transfer and energy consumption for heating and cooling.

According to the International Energy Agency (IEA), buildings account for approximately 36% of global final energy use, prompting stricter regulations such as the European Energy Performance of Buildings Directive (EPBD), which mandates energy-saving materials.

This has led to widespread adoption in commercial and residential construction, with coated glass enabling up to 30% reduction in energy costs, as evidenced by green building certifications such as LEED and BREEAM. The trend is particularly strong in urbanizing regions, where infrastructure projects prioritize sustainability, ensuring sustained market expansion through enhanced product integration.

Technological innovations in the automotive sector are another key driver, with coated flat glass improving visibility, UV protection, and thermal comfort in vehicles, aligning with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

The International Organization of Motor Vehicle Manufacturers (OICA) reported global vehicle production reaching 80 million units in 2021, with BloombergNEF projecting that EVs will constitute 58% of new sales by 2040, necessitating anti-glare and scratch-resistant coatings.

These enhancements not only boost fuel efficiency by reducing air conditioning loads but also comply with emission standards such as Euro 6 and CAFE, fostering innovation among manufacturers. As consumer demand for safer, more comfortable rides grows, this driver solidifies the market's positive trajectory.

High production costs represent a significant restraint for the flat glass coatings market, as advanced materials such as nanomaterials and specialized polymers, along with processes such as chemical vapor deposition, require substantial capital investment.

Specialized equipment and cleanroom facilities inflate expenses, making it challenging for small manufacturers to compete, particularly in price-sensitive markets. This cost barrier limits adoption in developing regions, where untreated glass remains preferable despite long-term savings, potentially slowing overall market penetration.

Stringent environmental regulations pose another challenge, as many coating formulations contain volatile organic compounds (VOCs) and hazardous substances, subject to controls such as U.S. Environmental Protection Agency (EPA) standards and REACH in Europe.

Compliance demands costly reforms and R&D for low-VOC alternatives, increasing operational burdens and delaying product launches. This regulatory pressure can hinder innovation and market growth, especially for solvent-based technologies, by raising barriers for new entrants.

The integration of smart coatings offers a compelling opportunity, enabling responsive functionalities like self-cleaning, anti-fogging, and adjustable tinting that adapt to environmental changes, particularly in smart buildings and homes.

With the IEA forecasting that smart building technologies will reduce global energy use by 10% by 2030, demand for coatings in architectural and automotive applications surges, supported by innovations in electrochromic materials.

Recent developments, such as partnerships between glass producers and tech firms, highlight the potential for multifunctional surfaces that enhance user comfort and energy savings, positioning companies to capture premium segments in rapidly urbanizing areas.

Expansion in the renewable energy sector, especially solar, presents substantial opportunities, as anti-reflective and protective coatings boost photovoltaic panel efficiency and durability against harsh conditions. The solar energy market is projected to grow significantly, with over 230 GW of new solar capacity installed in China alone in 2023, per government reports, driving the need for coatings that improve light transmission by up to 4%.

Policies like the U.S. Inflation Reduction Act incentivize solar adoption, creating demand in utility-scale and building-integrated projects. This trend enables manufacturers to develop tailored solutions, tapping into the global shift toward clean energy to drive long-term revenue growth.

Polyurethane emerges as the leading resin segment, accounting for approximately 40% of the market share due to its exceptional durability, flexibility, and chemical resistance, making it ideal for demanding applications in construction and the automotive sectors.

Its ability to withstand UV exposure and abrasion extends the lifespan of glass, aligning with sustainability standards such as low-VOC formulations, as noted in industry analyses by chemical associations. Polyurethane's versatility in water-based systems further supports its dominance, enabling efficient application without compromising performance, particularly in energy-efficient glazing.

Water-based technology leads the segment with about 52% share in the flat glass coatings market, favored for its low environmental impact and compliance with global VOC regulations, such as those from the EPA and EU REACH.

This technology offers superior adhesion and ease of use in architectural and solar applications, reducing emissions while maintaining high clarity and weather resistance, as supported by advancements in formulation from material science journals. Its growth is driven by the shift toward eco-friendly practices in manufacturing hubs like the Asia Pacific, ensuring broad adoption across end-users.

The Mirror application dominates with roughly 40% market share, driven by its essential role in architecture, automotive, and decorative sectors, where enhanced reflectivity and durability are critical.

Coatings provide anti-fog and scratch-resistant properties, boosting safety and aesthetics, as seen in the rising use of smart mirrors with integrated tech like GPS, according to automotive industry reports. The Mirror Coatings Market integration further justifies its lead, with demand surging from urbanization and beauty applications, supported by certifications for high-performance glass.

North America leads the flat glass coatings market in innovation, with the U.S. dominating due to robust regulatory frameworks, such as ASHRAE 90.1 energy codes that mandate low-E coatings for new construction, fostering adoption in commercial buildings.

The solar sector is gaining momentum, with the Solar Energy Industries Association (SEIA) reporting over 30 GW of capacity added in 2023, requiring anti-reflective coatings to improve efficiency. This ecosystem supports R&D investments, enhancing product durability.

Innovation thrives through collaboration, as EV production in states like Michigan drives demand for UV-protective coatings that align with CAFE standards for fuel efficiency. Government incentives under the Inflation Reduction Act further propel growth, positioning the region as a hub for advanced technologies.

Europe exhibits strong performance in the flat glass coatings Market, led by Germany, the U.K., France, and Spain, where harmonized regulations like the EPBD enforce energy-efficient glazing across member states. The construction boom, as evidenced by Eurostat data showing €1.8 trillion invested in 2023, boosts demand for architectural coatings for insulation. Sustainability-focused drives low-E adoption, reducing energy use by 20-30%.

Regulatory alignment via REACH promotes eco-friendly water-based technologies, evident in Germany's glass industry expansions. Recent developments, such as France's smart city initiatives, highlight opportunities for automotive glass integration with the Automotive Glass Market to enhance safety features.

Asia Pacific drives dynamic growth in the flat glass coatings Market, with China, Japan, India, and ASEAN countries leveraging manufacturing advantages and rapid urbanization. China's New Urbanization Plan fuels infrastructure demand, including solar control coatings in high-rises, supported by over 230 GW of solar installations in 2023, according to national energy reports. Cost-effective production in the region enhances competitiveness.

Growth dynamics are amplified by India's renewable push, with the Portable Solar Panels Market expanding alongside the adoption of coatings to improve efficiency. ASEAN's manufacturing hubs, such as Vietnam's new facilities, underscore the region's export potential, driven by low labor costs and policy incentives for green tech.

The flat glass coatings Market exhibits a moderately consolidated structure, dominated by established players like Arkema, PPG Industries, and Fenzi, who control over 50% share through innovation and global supply chains.

Companies pursue expansion via strategic acquisitions and R&D investments in sustainable technologies, such as low-VOC resins, to meet regulatory demands. Key differentiators include proprietary nanoformulations for self-cleaning properties, while emerging models focus on circular-economy practices such as recycled-content integration, fostering resilience amid volatility.

The flat glass coatings market is valued at US$ 4.2 Bn in 2025 and expected to reach US$ 13.7 Bn growing at a CAGR of 18.4% by 2032.

Key drivers include rising energy efficiency needs in buildings and automotive innovations, supported by regulations such as EPBD and EV growth projections.

Water-based technology leads with about 50% share, due to its low-VOC compliance and versatility in architectural and solar uses.

Asia Pacific holds the leading position with 56.4% share, driven by urbanization in China and India alongside strong manufacturing.

The renewable energy sector, particularly solar applications, offers significant potential through efficiency-enhancing coatings amid global clean energy shifts.

Prominent players include Arkema, Inc., PPG Industries Inc., and Fenzi Spa, known for innovations in sustainable and high-performance coatings.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Resin

By Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author