ID: PMRREP14374| 179 Pages | 30 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

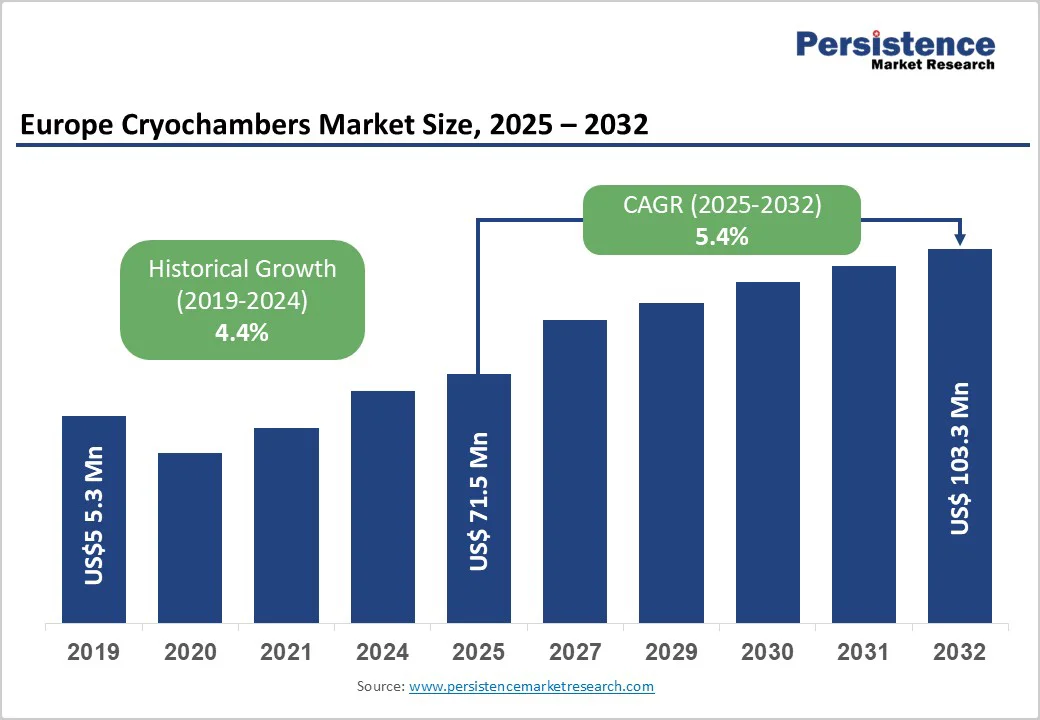

The Europe cryochambers market size is likely to be valued at US$71.5 Million in 2025. It is estimated to reach US$103.3 Million in 2032, growing at a CAGR of 5.4% during the forecast period 2025 - 2032, driven by increasing focus on sports recovery and non-invasive medical therapies.

The expanding network of luxury wellness resorts and aesthetic clinics is also boosting demand.

| Key Insights | Details |

|---|---|

| Europe Cryochambers Market Size (2025E) | US$71.5 Mn |

| Market Value Forecast (2032F) | US$103.3 Mn |

| Projected Growth (CAGR 2025 to 2032) | 5.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.4% |

The popularity of cryochambers in Europe has surged as dermatology and aesthetic clinics increasingly use cryotherapy for post-procedure recovery and skin rejuvenation. Whole-body cryotherapy helps reduce inflammation, tighten skin, and promote collagen production, making it a sought-after option for anti-aging and post-laser treatments.

According to the European Academy of Dermatology and Venereology (EADV), demand for cosmetic procedures in Europe rose by over 15% in 2024, especially in countries such as Germany, Italy, and France. This trend is encouraging clinics and medspas to adopt cryochambers as part of premium skincare and recovery packages, boosting their adoption in the aesthetic segment.

Cryochambers are gaining traction in Europe due to the rising preference for non-invasive and drug-free pain management. Sports medicine centers, physiotherapy clinics, and wellness studios are extensively using cryotherapy to treat chronic pain, arthritis, and sports injuries without relying on pharmaceuticals.

The European Pain Federation reports a steady rise in alternative pain therapies post-pandemic, with athletes and patients preferring methods that accelerate muscle recovery naturally. Professional football clubs in the U.K. and Spain have installed multi-person cryochambers to aid player recovery, underscoring the shift toward holistic, technology-based rehabilitation.

The growth of cryochambers in Europe is being restrained by rising safety concerns and litigation linked to frostbite and improper chamber usage. In several EU countries, incidents of skin burns and cold-induced injuries during whole-body cryotherapy sessions have led to strict operational guidelines.

A few wellness centers in France and Italy faced temporary shutdowns in 2024 following customer complaints of cold burns, highlighting the risks of untrained staff and inadequate monitoring systems. These safety lapses not only damage consumer confidence but also prompt tight insurance and certification requirements, making it difficult for small clinics and spas to operate safely and profitably.

Europe’s environmental regulations are limiting the use of fluorocarbon-based cryosprays and refrigerants used in some cryotherapy equipment. The EU’s F-gas Regulation (revised in 2024) mandates a steep reduction in hydrofluorocarbon emissions, compelling manufacturers to redesign systems or switch to eco-friendly alternatives.

This transition increases production costs and delays product approvals, especially for portable or hybrid cryosystems. Germany and Scandinavia-based manufacturers are investing in alternative cooling technologies such as CO2 or electric refrigeration. However, compliance with evolving environmental standards remains costly and time-consuming, slowing development and regional product launches.

The expansion of green-ammonia plants across Europe is creating a promising opportunity for cryochamber manufacturers that rely on liquid nitrogen. Germany, the Netherlands, and Norway are investing heavily in renewable hydrogen and green ammonia infrastructure to enable low-emission nitrogen production. This shift supports cryotherapy centers seeking eco-friendly cooling solutions that align with Europe’s carbon-neutrality goals.

For example, Norway’s Yara International began operating a large-scale green ammonia project in 2024, supplying clean nitrogen derivatives to medical and industrial users. This sustainable sourcing reduces both operational costs and carbon footprints, helping cryotherapy businesses market themselves as environmentally responsible health and wellness providers.

The franchising model is emerging as a key growth avenue for whole-body cryotherapy centers in Europe. Wellness brands are replicating successful cryo-studio concepts across cities using standardized chamber setups, digital booking platforms, and shared marketing resources.

Companies such as CRYONiQ and CryoBuilt Europe have introduced franchise programs that enable entrepreneurs to open turnkey cryotherapy studios with training and maintenance support. This model helps brands maintain uniform service quality while rapidly expanding into untapped markets in Southern and Eastern Europe. The trend mirrors fitness chains’ growth strategy, allowing cryotherapy to shift from elite sports and medical use to mainstream wellness adoption.

Individual units/cryopods are anticipated to capture approximately 71.8% of the share in 2025, as they provide greater safety, comfort, and operational flexibility. Users can control temperature and exposure duration based on their tolerance levels, minimizing risks of overcooling or frostbite. These pods also require less space and can be installed in wellness studios or clinics without heavy ventilation systems. As they treat one person at a time, hygiene and privacy are better maintained.

Multi-person cryochambers continue to see consistent demand among high-volume users such as sports teams, wellness franchises, and rehabilitation centers. They allow multiple clients to undergo cryotherapy sessions simultaneously, improving time efficiency and operational profitability. In professional sports, multi-person units are ideal for treating entire squads after intensive training or matches, ensuring uniform recovery.

The sports medicine and pain management segment is expected to lead with nearly 55.3% share in 2025, owing to cryochambers' ability to reduce inflammation, muscle soreness, and recovery time. Europe’s athletes and physiotherapists increasingly rely on cryotherapy as a natural alternative to painkillers, promoting fast healing from injuries and fatigue. Clubs such as Bayern Munich and Manchester United have installed whole-body cryochambers in their facilities to improve post-match recovery.

Cryotherapy is gaining popularity in dermatology and aesthetic clinics as a post-treatment recovery tool. A brief exposure to sub-zero temperatures helps reduce swelling, tighten skin, and promote collagen regeneration, supporting anti-aging and skin-firming procedures. Clinics in France, Italy, and Germany now include localized cryotherapy for acne, scar reduction, and post-laser therapy. Several medspas have even introduced combined cryo-facial and LED therapy sessions to improve skin glow and elasticity, adding to the treatment’s appeal.

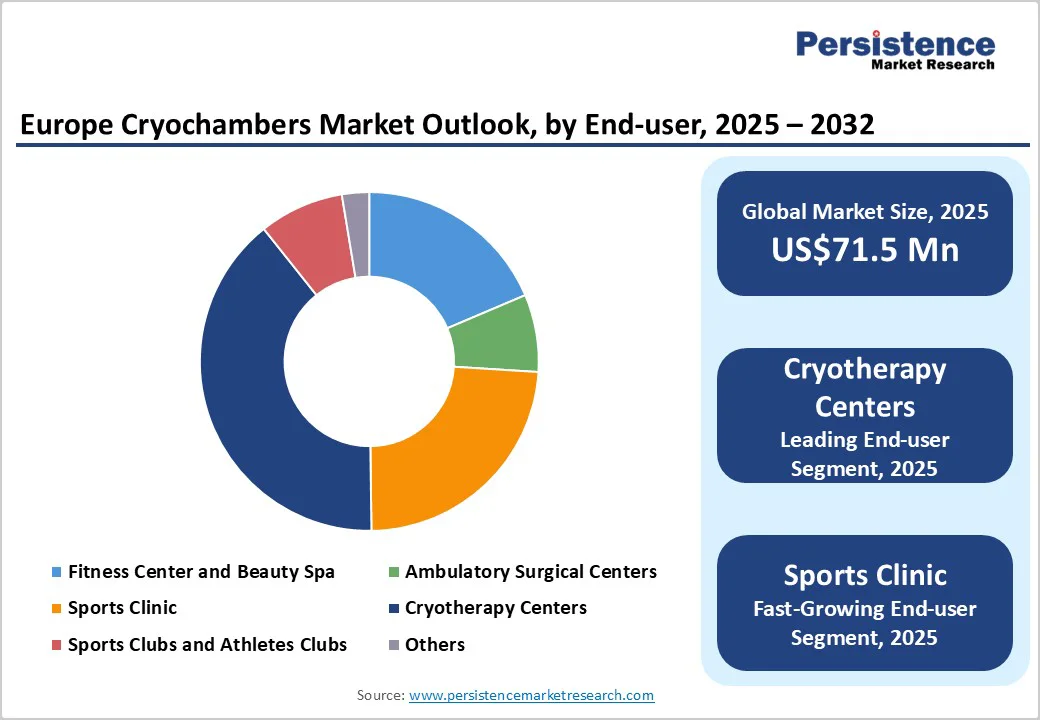

Cryotherapy centers are expected to dominate, with around 39.5% of the market share in 2025, as they specialize in cold therapy as their core service and operate multiple units to serve different clients throughout the day. These centers attract a mix of athletes, wellness enthusiasts, and patients seeking recovery from chronic pain or fatigue. The franchising trend has helped expand such centers across Europe, with standardized equipment and training ensuring consistent results.

Sports clinics play a key role in driving cryochamber adoption across Europe by focusing on performance improvement and injury rehabilitation. These clinics use cryotherapy to accelerate recovery between training sessions and prevent overuse injuries in athletes. National sports institutes and football clubs often collaborate with cryotherapy manufacturers to customize chamber designs suitable for high-frequency use.

In 2025, Germany is poised to account for approximately 32.1% of the share, supported by its superior medical technology base and focus on rehabilitation therapies. Companies such as MECOTEC and Zimmer MedizinSysteme dominate the market with electric cryochambers used in hospitals, physiotherapy clinics, and elite sports facilities. MECOTEC’s electric models are especially popular since they meet strict EU safety standards and avoid the risks of liquid nitrogen systems.

Cryotherapy has moved beyond medical applications to wellness and recovery centers, mainly in cities such as Berlin, Munich, and Frankfurt. Various domestic football clubs and rehabilitation centers have adopted cryotherapy for muscle recovery and pain management, while wellness resorts are promoting whole-body cryo sessions as part of luxury spa packages.

In the U.K., the market is expanding steadily as wellness, sports recovery, and aesthetic clinics embrace non-invasive cold therapies. Domestic innovation is a key factor, with Quantum Cryotherapy introducing the CryoQube, an entirely British-designed whole-body cryochamber, reflecting a shift toward local production and technology independence. Wellness franchises, boutique gyms, and physiotherapy studios are incorporating cryotherapy as a value-added service to attract premium clientele.

The trend is also gaining attention in professional sports, where clubs and training facilities use cryochambers to accelerate recovery. However, the U.K. market remains highly service-oriented; growth depends on quality assurance, staff training, and reliable maintenance support rather than on mass adoption.

Cryochamber adoption in France is increasing more cautiously due to strict safety regulations and recent incidents that have raised public scrutiny. While cryotherapy has found a place in dermatology, sports medicine, and luxury wellness centers, safety-related controversies, including a fatal nitrogen leak at a Paris gym in 2025, have slowed the market’s progress. These events prompted tight oversight by local health authorities, with a focus on operator training and equipment certification.

However, wellness studios and aesthetic clinics in Paris, Lyon, and Marseille continue to introduce cryotherapy as part of anti-aging, weight management, and recovery programs. Modern consumers remain curious but cautious, and manufacturers are focusing on electric, nitrogen-free systems to rebuild trust and ensure compliance with evolving safety norms.

The European cryochambers market is characterized by a mix of established medical equipment manufacturers and new wellness-oriented brands. Germany remains the hub of production and innovation, with companies such as MECOTEC, Zimmer MedizinSysteme, and Cryo Science leading the market.

These players have built strong reputations through CE-certified products and compliance with European safety standards, which gives them an advantage among hospitals, rehabilitation centers, and sports medicine clinics. New entrants, including Cryonix and CryoBuilt, are expanding their footprint by delivering compact and cost-effective units designed for gyms, spas, and wellness studios.

The Europe cryochambers market is projected to reach US$71.5 Million in 2025.

Rising preference for non-invasive pain management and increasing consumer focus on preventive healthcare are the key market drivers.

The Europe cryochambers market is poised to witness a CAGR of 5.4% from 2025 to 2032.

The surge in electric cryochamber installations and the development of eco-friendly cooling systems are the key market opportunities.

Zimmer Medizin Systeme GmbH, KrioSystem Sp. z.o.o., and Air Products and Chemicals, Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-user

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author