- Executive Summary

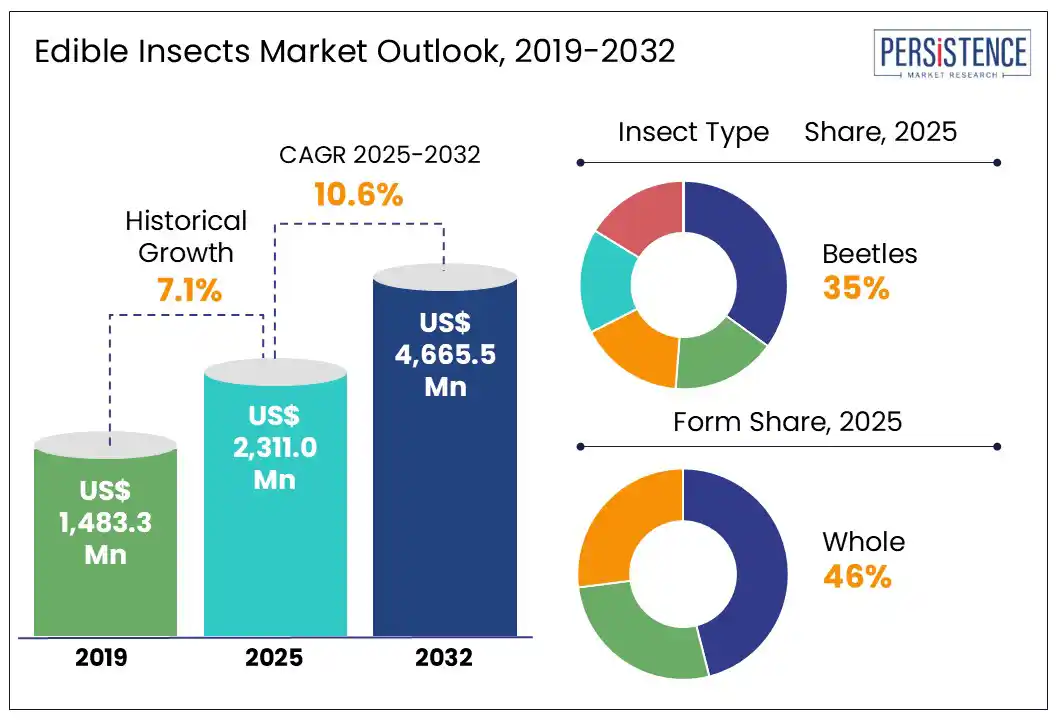

- Global Edible Insects for Animal Feed Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Mn

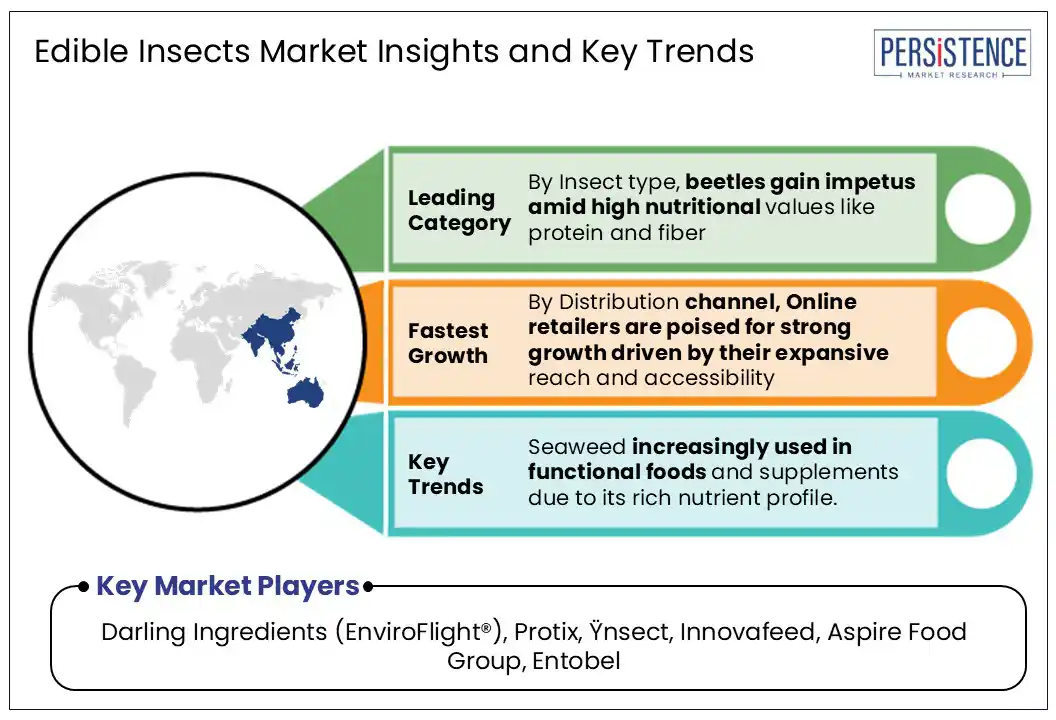

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Value Chain Analysis

- Key Market Players

- Regulatory Landscape

- PESTLE Analysis

- Porter’s Five Force Analysis

- Key Marketing Strategies

- Price Trend Analysis, 2019 - 2032

- Key Factors Impacting Product Prices

- Pricing Analysis, By Insect Type

- Regional Prices and Product Preferences

- Global Edible Insects for Animal Feed Market Outlook

- Key Highlights

- Market Volume (Tons) Projections

- Market Size (US$ Mn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size (US$ Mn) Analysis, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, 2025-2032

- Global Edible Insects for Animal Feed Market Outlook: Insect Type

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Insect Type, 2019-2024

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Attractiveness Analysis: Insect Type

- Global Edible Insects for Animal Feed Market Outlook: Form

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Form, 2019-2024

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Attractiveness Analysis: Form

- Global Edible Insects for Animal Feed Market Outlook: Application

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Application, 2019-2024

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis: Application

- Key Highlights

- Global Edible Insects for Animal Feed Market Outlook: Region

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Region, 2019-2024

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Region, 2025-2032

- North America

- Latin America

- Europe

- East Asia

- South Asia and Oceania

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Edible Insects for Animal Feed Market Outlook

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- By Country

- By Insect Type

- By Form

- By Application

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Country, 2025-2032

- U.S.

- Canada

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- Europe Edible Insects for Animal Feed Market Outlook

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- By Country

- By Insect Type

- By Form

- By Application

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Country, 2025-2032

- Germany

- France

- U.K.

- The Netherlands

- Spain

- Russia

- Rest of Europe

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- East Asia Edible Insects for Animal Feed Market Outlook

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- By Country

- By Insect Type

- By Form

- By Application

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Country, 2025-2032

- China

- Japan

- South Korea

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- South Asia & Oceania Edible Insects for Animal Feed Market Outlook

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- By Country

- By Insect Type

- By Form

- By Application

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Country, 2025-2032

- India

- Indonesia

- Thailand

- The Philippines

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- Latin America Edible Insects for Animal Feed Market Outlook

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- By Country

- By Insect Type

- By Form

- By Application

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Country, 2025-2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- Middle East & Africa Edible Insects for Animal Feed Market Outlook

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- By Country

- By Insect Type

- By Form

- By Application

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Country, 2025-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Insect Type, 2025-2032

- Black Soldier Fly (BSF)

- Mealworms & Silkworms

- Crickets & Grasshopper

- Beetles

- Others

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Form, 2025-2032

- Whole

- Powder

- Oil

- Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast, By Application, 2025-2032

- Aquafeed

- Poultry Feed

- Swine Feed

- Pet Food

- Livestock Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) and Volume (Tons) Analysis, By Market, 2019-2024

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Ynsect

- Overview

- Segments and Insect Type

- Key Financials

- Market Developments

- Market Strategy

- Protix

- Innovafeed

- Entobel

- EnviroFlight (Darling Ingredients)

- Aspire Food Group

- Chapul, LLC

- Nasekomo

- Hexafly

- Sentara Group

- nextProtein

- Keetup

- Grubbly Farms

- Others

- Ynsect

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment