ID: PMRREP8059| 199 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

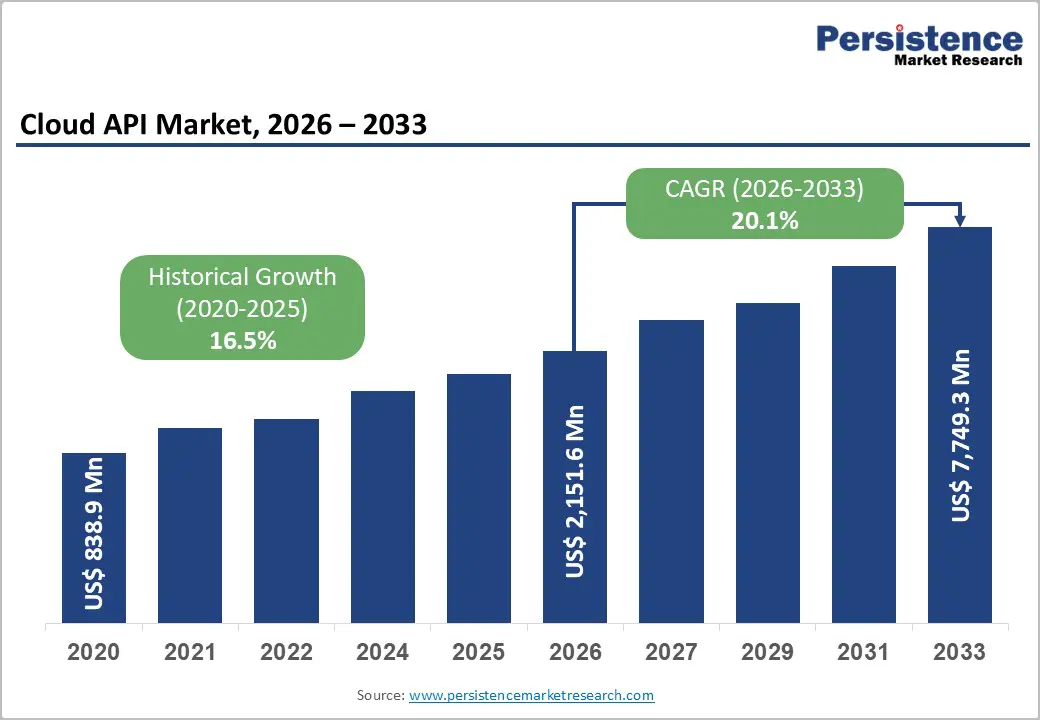

The global cloud API market size is likely to be valued at US$2,151.6 million in 2026 and is expected to reach US$7,749.3 million by 2033, growing at a CAGR of 20.1% during the forecast period from 2026 to 2033.

The market is accelerating as digital transformation intensifies, edge computing adoption rises, and AI/ML workloads require highly scalable API endpoints. The rising demand for secure and compliant data exchange across BFSI, healthcare, retail, and telecom is further driving API adoption. Enterprises are also leveraging APIs to boost developer productivity, speed innovation, and deliver more personalized digital experiences, solidifying Cloud APIs as a core component of modern IT architecture.

| Key Insights | Details |

|---|---|

|

Cloud API Market Size (2026E) |

US$2,151.6 Mn |

|

Market Value Forecast (2033F) |

US$7,749.3 Mn |

|

Projected Growth (CAGR 2026 to 2033) |

20.1% |

|

Historical Market Growth (CAGR 2020 to 2025) |

16.5% |

The shift from monolithic to microservices architectures is driving demand for robust, high-performance Cloud APIs, as modular services require seamless communication and interoperability. API-first strategies ensure APIs are designed before applications, accelerating development, enabling third-party integrations, and supporting DevOps and CI/CD pipelines. Containerization and Kubernetes orchestration, along with service meshes and serverless architectures, amplify the need for scalable, secure, and low-latency APIs that handle dynamic workloads, ensuring enterprises innovate rapidly and efficiently.

Global regulatory mandates are driving demand for compliant cloud API solutions, particularly in sectors like BFSI and healthcare. Over 50% of banks are implementing APIs for open banking e.g., PSD2 in Europe, open finance in Latin America, while healthcare regulations like CMS Interoperability require FHIR-compliant APIs for patient data portability. Frameworks such as GDPR, HIPAA, PCI DSS, and ISO 27001 increasingly enforce API-specific security, with over 80% of businesses expected to operate under strict API compliance by 2025. This pushes organizations to adopt enterprise-grade API management platforms offering security, monitoring, encryption, and audit capabilities, enabling secure, standardized, and compliant data integration.

API security vulnerabilities remain a critical restraint, as enterprises face sophisticated cyber threats across increasingly complex and distributed API ecosystems. Ensuring consistent authentication, authorization, encryption, and threat detection across hybrid and multi-cloud environments adds operational complexity and cost. Fragmented API deployments and API sprawl of undiscovered endpoints heighten risks of breaches and regulatory non-compliance. Limited specialized skills, frequent updates in security standards, and compliance requirements further slow adoption, particularly among SMEs cautious about scaling API-based solutions.

Enterprises face significant integration challenges when migrating legacy workflows to API-driven architectures, such as disparate systems, inconsistent data formats, and dual operations with legacy systems increase operational complexity and security risks. Transforming SOAP-based legacy APIs to modern REST architecture demands substantial investment in middleware, API gateways, and data mapping solutions. SMEs often struggle with the steep learning curve and skill gaps for secure, scalable API management. Multi-vendor environments exacerbate interoperability issues, requiring federated API management to unify cloud and on-premises API access. These barriers slow cloud API adoption, particularly among organizations with large, complex IT estates.

AI-driven API management is emerging as a major opportunity as platforms increasingly use machine learning for automated anomaly detection, predictive analytics, resource optimization, and self-healing operations, significantly reducing overhead. With over 70% of companies planning to increase AI investments, organizations are adopting Cloud APIs to access generative AI models like GPT-4, Stable Diffusion, and DALL-E. Advanced API monetization frameworks, subscription, pay-per-use, and marketplace models are enabling developers to commercialize AI-powered cloud services. AI also simplifies integration across hybrid and multi-cloud environments by intelligently orchestrating complex API ecosystems. These capabilities collectively drive enterprise demand for Cloud APIs by improving agility, security, and cost efficiency.

Edge computing pushes computation closer to data sources, creating strong demand for cloud APIs that support high-speed, low-latency data exchange for real-time industries such as autonomous vehicles, industrial automation, telemedicine, AR/VR, and gaming. Major cloud providers are launching edge-optimized API gateways and hybrid deployment capabilities to orchestrate workloads across distributed environments. Low-latency needs also fuel the adoption of AI-driven API management, intelligent routing, and edge caching to sustain millisecond-level performance. As enterprises shift to API-first architectures for edge applications, opportunities grow for specialized API security, observability, and monetization tools, expanding revenue potential.

SaaS cloud APIs are expected to account for more than 41% share in 2026, driven by their ability to accelerate software development and power digital services through a flexible, as-a-service delivery model. SaaS APIs have fundamentally reshaped business and consumer software development by enabling third-party developers to integrate capabilities with minimal effort and cost. The rising adoption of microservices, low-code platforms, and AI-enabled SaaS tools further increases dependence on SaaS APIs for seamless data exchange and automation.

PaaS cloud APIs are projected to grow at a CAGR of 25.1% as businesses increasingly need faster and cost-effective application development without managing underlying infrastructure. Organizations rely on PaaS APIs to integrate cloud-native services, automate workflows, and scale applications dynamically. The rise of microservices, containerization, and DevOps practices further drives the need to streamline development and deployment. Startups and SMEs prefer PaaS for rapid prototyping and time-to-market advantages, fueling adoption.

Public clouds are expected to account for over 59% share with a value accounting over US$ 1,269.4 million in 2026, driven by their hyperscale reach, mature ecosystems, and pay-as-you-go models suited for unpredictable traffic patterns. Organizations increasingly rely on public cloud platforms for faster deployment, global accessibility, and seamless integration enabled by extensive API ecosystems. Businesses also prefer public cloud due to its lower upfront cost and automated management capabilities, which support efficient scaling and operational flexibility.

Multi-cloud adoption is expected to grow at the highest rate as organizations seek flexibility, redundancy, and the ability to avoid vendor lock-in. Businesses need seamless integration across multiple cloud providers to optimize performance, cost, and compliance. Cloud APIs enables this interoperability by standardizing data exchange and service orchestration. The rising complexity of IT environments and demand for scalable, resilient architectures further drive the need for multi-cloud API solutions.

Large enterprises are expected to account for more than 65% share in 2026, due to their advanced digitalization needs, complex IT infrastructures, and substantial investments in API-driven transformation. Their large-scale digital transformation programs require APIs for automation, data exchange, and microservices-based architecture. These organizations also use Cloud APIs to standardize IT operations across multiple global locations, enable real-time data-driven decision-making, and meet stringent compliance and security requirements in regulated industries.

Small & medium enterprises (SMEs) will grow at a rapid rate as they increasingly rely on APIs to reduce IT complexity and accelerate digital transformation without heavy infrastructure investment. SMEs need easy integration with SaaS tools, payment systems, CRM, ERP, and supply-chain platforms to stay competitive. Cloud APIs help them automate workflows, improve customer experience, and scale services quickly at low cost. Their rising adoption of cloud, mobile apps, and e-commerce platforms further boosts demand for flexible, pay-as-you-go APIs.

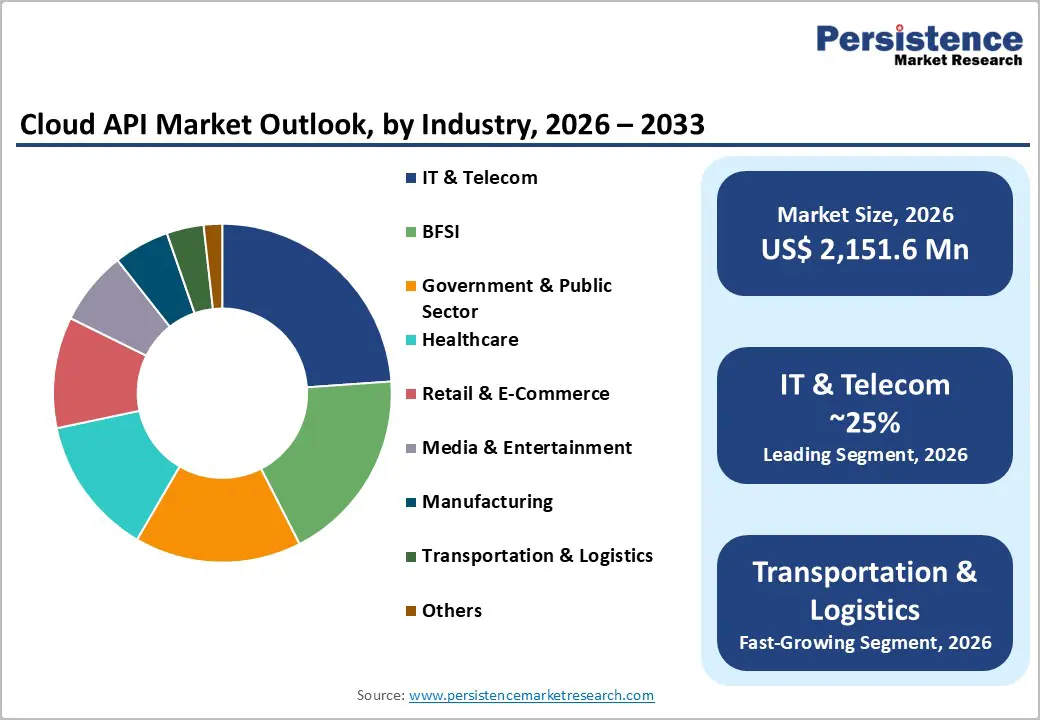

IT & Telecom are expected to account for more than 25% share with value reaching more than US$ 537.9 million in 2026, as the sector relies heavily on APIs to support high-volume data traffic, real-time service delivery, and rapid deployment of digital services. Telecom operators use Cloud APIs to modernize networks, integrate 5G, enable edge connectivity, and automate provisioning through NFV/SDN frameworks. IT service providers depend on APIs to connect cloud platforms, microservices, and DevOps pipelines, ensuring faster scalability and interoperability. The rising demand for API-driven customer portals, billing systems, and service orchestration further strengthens the sector’s dominance.

Transportation & logistics are emerging as a fast-growing segment, driven by API integration enabling real-time shipment tracking, automated order processing, route optimization, and enhanced supply chain visibility. Logistics APIs facilitate end-to-end business process automation, removing manual intervention from load-tender-to-invoice processes, inventory management, and shipment tracking. Real-time data access through APIs enables logistics companies to provide accurate shipping quotes, optimize delivery routes, reduce fuel costs, and improve customer satisfaction through transparent tracking and notifications.

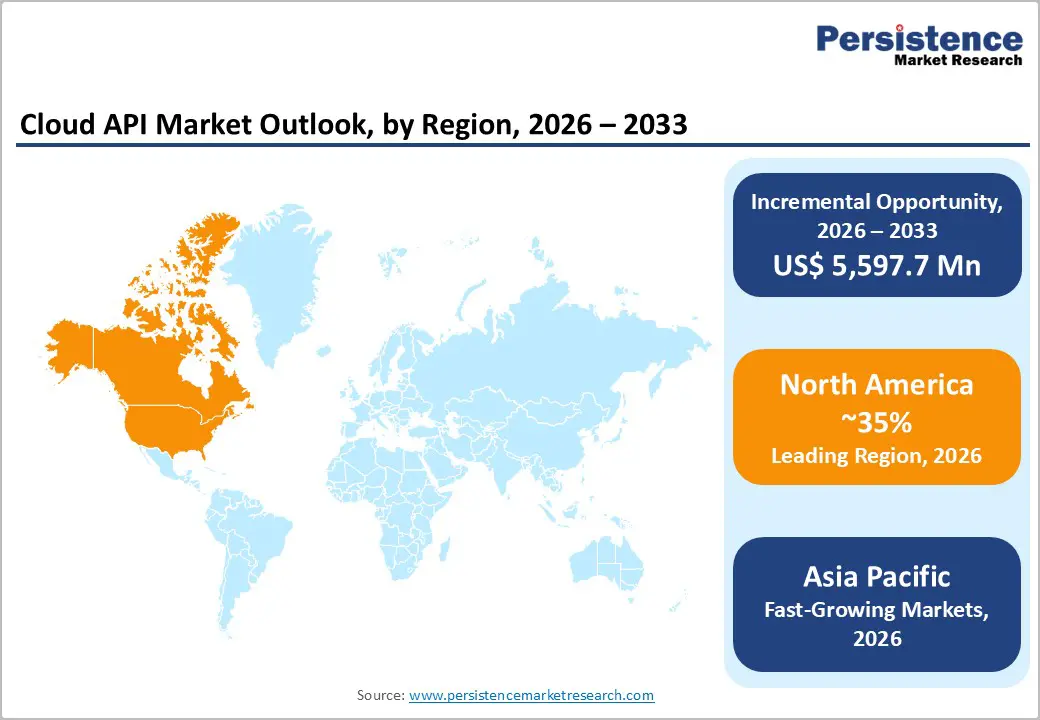

North America is projected to account for over 35% with a value reaching ~ US$ 753.1 Mn by 2026, driven by advanced infrastructure, robust venture funding, and leading cloud providers such as AWS, Microsoft Azure, and Google Cloud. In the U.S., enterprises and startups use Cloud APIs for digital transformation, legacy modernization, and rapid app development, while government initiatives such as api.data.gov, which serves 25 federal agencies with over 450 APIs, along with the “Cloud Smart” policy and healthcare interoperability rules, drive public sector adoption. Canada’s cloud-first strategy further supports APIs for integration, automation, and service delivery. The focus on Zero-Trust architectures and FedRAMP compliance increases demand for managed API gateways, identity integration (OIDC/SAML), and continuous monitoring APIs.

Asia Pacific is experiencing the fastest-growth, with a projected CAGR of 26.5% and expected to exceed US$ 3,053.2 million by 2033. China’s Digital China initiative, with its 2024 Development Index at 150.51, core digital industries contributing ~10% of GDP, and over 41 zettabytes of data generated, is driving massive digital activity and API demand. India’s Digital India programme, including the API Setu portal, standardizes APIs for interoperable public services. Japan leverages APIs in secure cloud adoption across manufacturing, healthcare, and finance, integrating industrial IoT and smart factories. South Korea combines high internet penetration with corporate cloud adoption, where conglomerates like Samsung SDS and Naver Cloud use APIs for internal systems, telecom, and AI/edge services.

Europe’s cloud API market is expanding at a 17.8% CAGR, driven by advanced digital infrastructure, GDPR-aligned regulations, and government-led digital transformation initiatives. Leading countries, Germany, the UK, and France, have experienced a strong enterprise cloud adoption, supported by public cloud investment and hyperscale expansion, which increases on-demand compute and API endpoints. Government digitization programs (e-health, e-ID, tax, business registries) and reusable API mandates create procurement-driven demand, pulling private providers and integrators along. The EU Digital Decade (2025) emphasizes cloud foundations and public APIs, while the CBS AI Monitor 2024/25 reports 23% of companies with ≥10 employees using AI, boosting demand for model-serving and data APIs.

The cloud API market is fragmented, with numerous players competing across service models. Companies are innovating API functionalities, enhancing interoperability with multiple cloud platforms, and offering flexible pricing models to attract diverse enterprise and SME clients. Many focus on strategic partnerships and developer ecosystems to expand adoption, while others leverage advanced security and compliance features to differentiate themselves in regulated industries.

The global Cloud API market is projected to be valued at US$2,151.6 Mn in 2026.

The need for seamless integration between cloud services and enterprise systems, enabling faster automation, scalability, and real-time data exchange, is a key driver of the market.

The market is expected to witness a CAGR of 20.1% from 2026 to 2033.

Rising demand for AI-enabled APIs, low-code/no-code integration tools, and industry-specific API solutions is creating strong growth opportunities.

IBM Corporation, Google LLC, Oracle Corporation, Microsoft Corporation, SAP SE, Amazon Web Services, Inc., Salesforce.com, Inc. are among the leading key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Service Model

By Deployment

By Enterprise Size

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author