ID: PMRREP33339| 200 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

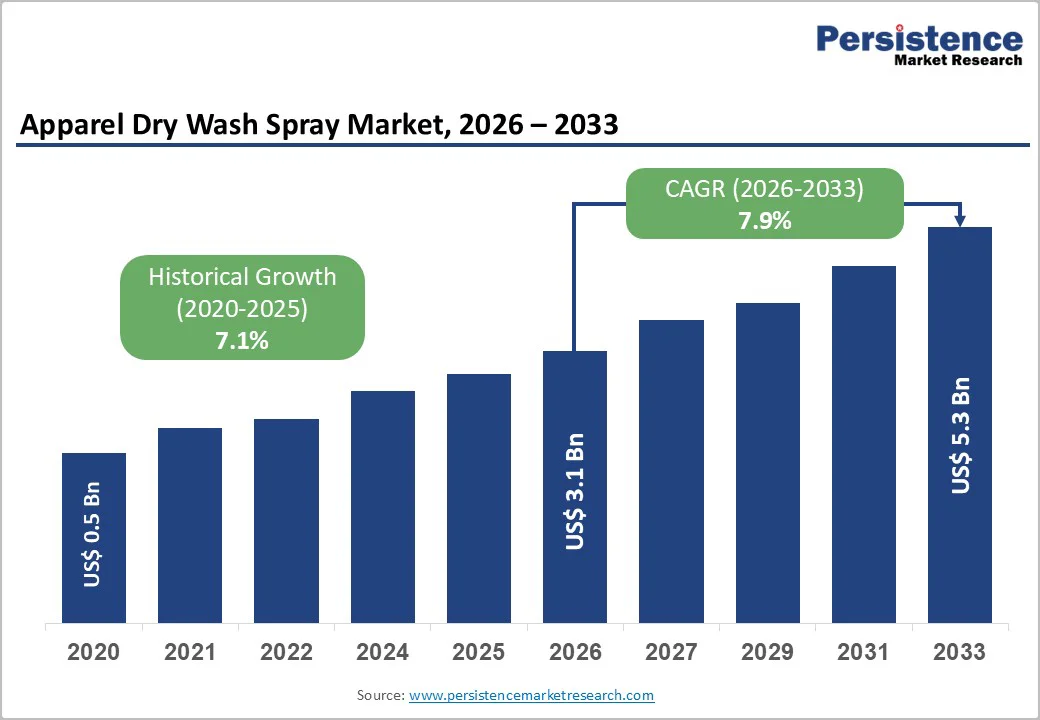

The global apparel dry wash spray market size is likely to be valued at US$ 3.1 billion in 2026 and is expected to reach US$ 5.3 billion by 2033, growing at a CAGR of 7.9% during the forecast period from 2026 to 2033.

Demand is increasingly supported by consumers’ shift toward convenient, water-saving garment care solutions, rising urbanization, and growing adoption of on-the-go hygiene products in developed as well as emerging economies. This market also benefits from heightened awareness of fabric preservation and energy efficiency, as dry wash sprays allow users to refresh apparel without frequent machine washing or ironing, aligning with sustainability and cost-saving priorities for households and commercial users alike.

| Key Insights | Details |

|---|---|

| Global Apparel Dry Wash Spray Market Size (2026E) | US$ 3.1 billion |

| Market Value Forecast (2033F) | US$ 5.3 billion |

| Projected Growth CAGR (2026 - 2033) | 7.9% |

| Historical Market Growth (2020 - 2025) | 7.1% |

Growing global awareness of water scarcity and the increasing need for convenient garment-care routines are major factors supporting the adoption of apparel dry wash sprays. With more than 2 billion people living in regions facing high water stress, consumers are actively seeking ways to reduce laundry frequency and save water. Dry wash sprays offer a practical solution by freshening garments, eliminating odors, and handling light soiling without machine washing.

They extend the usable life of garments such as office wear, outerwear, and premium apparel that do not require heavy washing. At the same time, modern lifestyles, characterized by limited time and growing dual-income households, create demand for products that deliver quick results. Dry wash sprays provide a fast, easy-to-apply alternative, helping consumers maintain fabric cleanliness between washes while complementing traditional detergents and fabric-care routines.

Heightened hygiene awareness following the COVID-19 pandemic continues to influence purchasing behavior in the fabric-care category. Consumers are now more inclined to buy antibacterial, antimicrobial, and odor-neutralizing products that enhance fabric cleanliness without requiring a full wash. This shift is supported by sales trends in disinfectants and hygiene sprays, which surged significantly during and after the pandemic across key markets in North America, Europe, and the Asia Pacific.

As a result, manufacturers are reformulating dry wash sprays to include germ-control, odor-neutralizing molecules, and anti-static properties. These innovations attract users who want quick garment refreshment during travel, business trips, or in shared living environments such as student accommodations. Portable wrinkle releasers and fabric refreshers further strengthen the appeal of dry wash sprays, especially among individuals seeking practical, on-the-go garment-care solutions.

A key challenge for the apparel dry wash spray market is the price gap between premium dry wash sprays and traditional laundry detergents. Many waterless sprays, particularly those positioned as natural, organic, or premium, tend to cost significantly more per use than machine-washing solutions. This limits adoption across low-income and price-sensitive markets where consumers prioritize basic detergents that can manage heavy soiling and large loads.

The higher price point of dry wash sprays also affects repeat purchases, slowing mass-market penetration. Additionally, awareness about the functional value of dry wash solutions—such as wrinkle release, static removal, and odor elimination- remains low in semi-urban and rural regions. As a result, many consumers do not view dry wash sprays as essential household items, preferring conventional detergents instead, which further moderates market growth.

Another major restraint comes from growing consumer caution regarding the chemical composition of aerosol-based fabric sprays. Traditional dry wash sprays may include solvents, propellants, and synthetic fragrances that can trigger skin irritation or respiratory discomfort for sensitive users.

As awareness surrounding indoor air quality and chemical exposure increases, consumers are examining product labels more closely and seeking fragrance-free or allergen-friendly alternatives.

Regulatory authorities, including the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), continue to tighten restrictions on volatile organic compounds (VOCs), pushing manufacturers to reformulate products.

While necessary, these changes increase production costs and complicate product development for smaller brands. Overall, apprehension about chemical ingredients reduces consumer confidence in conventional dry wash sprays, limiting adoption among health-conscious and sensitive-skin user groups.

A major growth opportunity arises from the increasing global preference for sustainable, plant-derived, and environmentally friendly garment-care solutions. Consumers, especially in Europe and North America, are willing to pay a premium for products that feature biodegradable ingredients, low-VOC formulations, and recyclable or refillable packaging. This trend aligns with broader sustainability movements and circular-economy principles influencing the household-care industry.

Brands that offer transparent ingredient disclosures, eco-label certifications, and reduced carbon-footprint formulations can capture strong demand in the premium and mid-premium segments. The shift toward green chemistry also supports brand differentiation, helping manufacturers stand out in a competitive market. As regulatory pressure grows worldwide to limit harmful chemicals, companies that innovate early with clean-label, natural, and performance-efficient dry wash sprays are well-positioned to secure long-term market share.

Digital commerce presents a strong opportunity for both established and emerging dry wash spray brands. E-commerce adoption for home-care and personal-care categories has grown rapidly across China, the U.S., and Major European markets, with online sales contributing an increasing share of overall category revenue. This shift allows brands to market specialized products, such as travel-size wrinkle releasers, fragrance-free formulations for sensitive users, or sprays designed for sportswear and technical fabrics, directly to targeted customer groups.

Subscription-based models, influencer-led promotions, and curated product bundles enhance visibility and loyalty. Online platforms also provide access to real-time consumer insights, enabling companies to refine formulations, packaging, and marketing strategies. For niche and premium dry wash spray brands, D2C channels reduce dependency on retail distribution and improve margins, accelerating brand growth.

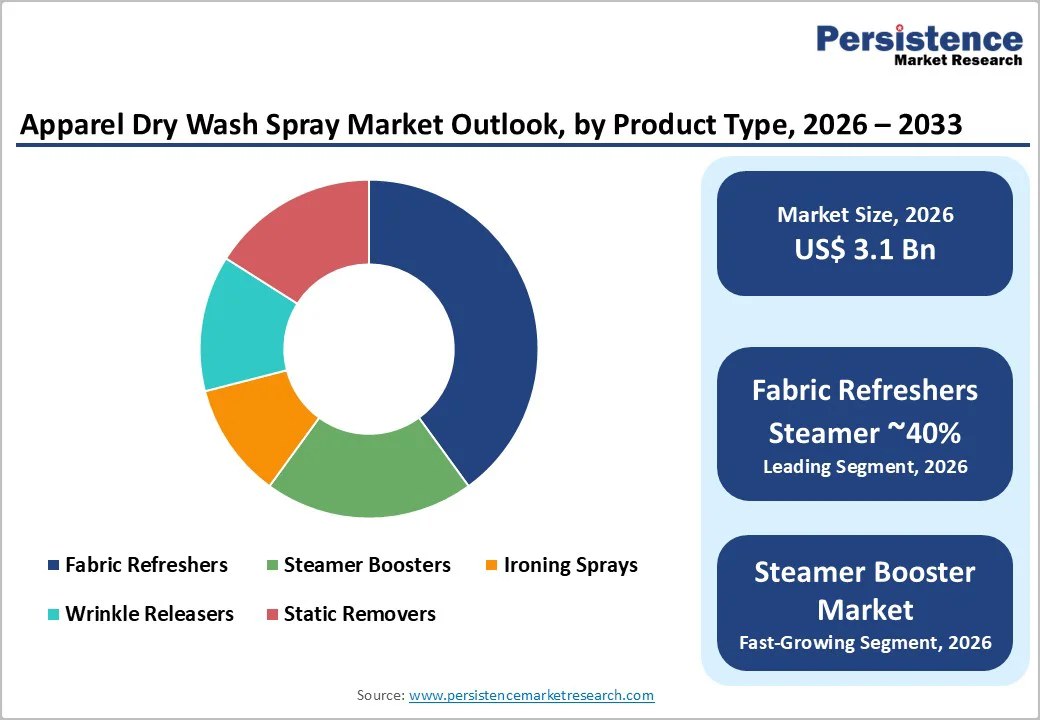

Within product types, fabric refreshers are expected to account for the leading share of the global apparel dry wash spray market, estimated at around 40% of total revenues in the mid-term forecast period. Fabric refreshers appeal to a broad user base because they offer multi-benefit performance, odor removal, light deodorizing, and mild wrinkle relaxation, suitable for everyday garments, upholstered furniture, and soft home textiles. Moreover, large consumer goods companies have successfully positioned fabric refresher sprays as essential for pet owners, families with children, and urban residents, strengthening brand recognition and shelf presence in supermarkets and online channels.

In terms of price range, the medium segment is likely to dominate the apparel dry wash spray market with an estimated share of about 50%. Mid-priced products strike a balance between affordability and perceived performance, making them attractive to middle-income households that demand convenience yet remain cautious on spending. This segment often includes branded offerings from multinational consumer goods companies and well-established regional players, which benefit from extensive distribution in supermarkets, drug stores, and online platforms.

As inflationary pressures affect household budgets in many economies, consumers trading down from premium lines often settle into mid-tier options rather than exiting the category entirely, helping to sustain demand growth. Medium-priced products also increasingly feature “better for you” attributes such as reduced harsh chemicals or pleasant, long-lasting fragrances, further reinforcing their appeal.

Across sales channels, online retailers are emerging as one of the fastest-growing and increasingly dominant routes to market, with an estimated share approaching 35% of global apparel dry wash spray sales. E-commerce platforms and brand webstores provide a broad assortment, customer reviews, and subscription options, which strongly influence purchase decisions for niche home-care products. During and after the COVID-19 pandemic, many consumers shifted household and personal care purchases online, and this habit has persisted thanks to delivery convenience and promotional pricing.

Online marketplaces also allow small and innovative brands, such as eco-friendly or fragrance-free specialists, to reach international audiences without heavy upfront investment in physical retail. The ability to offer detailed usage instructions, video demonstrations, and cross-selling with complementary products such as garment steamers further strengthens the online channel’s role in category expansion.

By end-user, the residential segment accounts for the majority share of the apparel dry wash spray market, estimated at roughly 70% of global demand. Households increasingly adopt fabric refreshers, wrinkle releasers, and static removers to extend the wear life of clothing and reduce reliance on ironing and dry cleaning, especially in small apartments and energy-constrained environments. Growth in urban middle-class populations and the popularity of delicate fabrics, athleisure, and blended textiles make consumers more conscious of garment care practices.

At the same time, commercial usage in sectors such as hospitality, rental services, and professional garment care is growing steadily, as hotels, airlines, and uniform providers explore water-saving and quick-turnaround fabric care solutions. However, the sheer volume of apparel owned and laundered in households ensures that the residential end-use segment remains the main revenue contributor over the forecast horizon.

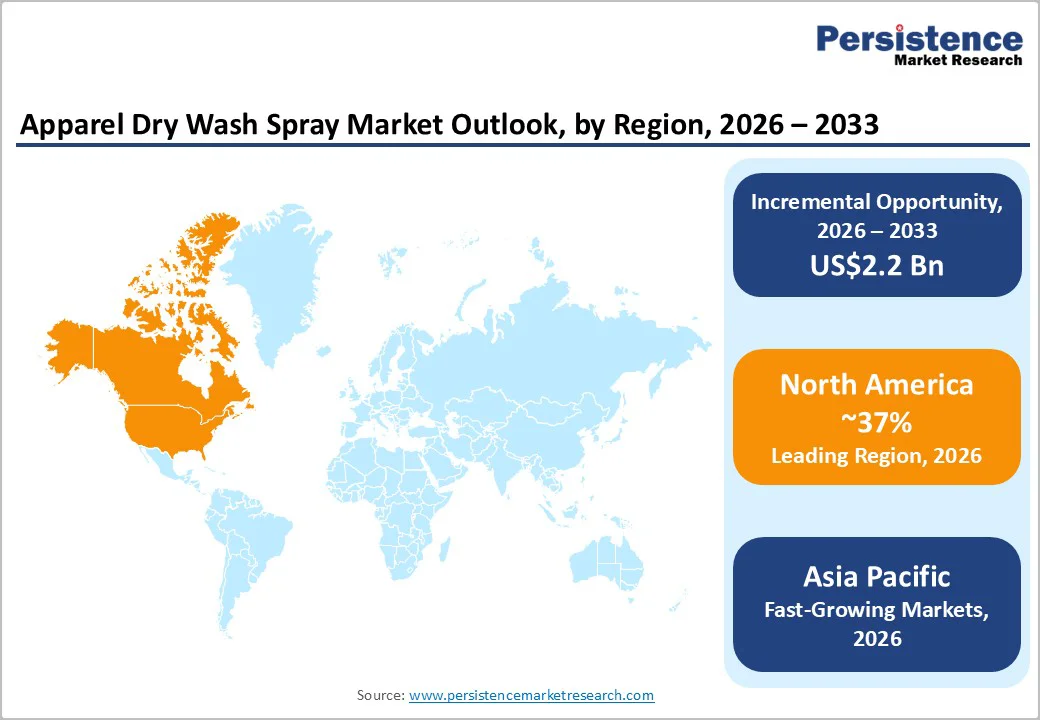

North America is one of the most established markets for apparel dry wash sprays, supported by high household spending on fabric-care and convenience-oriented home-care solutions. U.S. and Canadian consumers prioritize products that save time and reduce garment maintenance efforts, driving strong demand for wrinkle releasers, odor-neutralizers, and fabric refreshers. The region benefits from extensive retail infrastructure, including supermarkets, warehouse clubs, drugstores, and fast-growing e-commerce channels that ensure broad product availability.

High pet ownership in the U.S. further boosts sales of odor-control sprays designed for clothing and household textiles. Regulatory oversight from agencies such as the EPA and CPSC influences product formulations, accelerating the shift toward low-VOC, hypoallergenic, and fragrance-free variants. Multinational brands and D2C players actively innovate with plant-based ingredients, gentle solvents, and refillable packaging formats.

Europe is a key market driven by strong environmental awareness and strict chemical safety regulations. Consumers in major economies such as Germany, the U.K., France, and Spain seek fabric-care products that combine effective performance with sustainability, leading to rising demand for eco-certified, plant-based, and low-VOC dry wash sprays. Retailers across the region are expanding offerings of natural, fragrance-free, and refillable product lines to align with evolving consumer expectations.

The European Chemicals Agency (ECHA) and sustainability initiatives under the European Green Deal significantly influence ingredient formulations, encouraging manufacturers to adopt safer, allergen-reduced components. Europe’s strong fashion culture and preference for preserving high-value garments support steady use of wrinkle releasers and fabric refreshers between professional cleaning cycles. Growth in online grocery and household-product delivery also makes niche and specialty brands more accessible. With a mix of price-sensitive and premium consumers, innovation, sustainability claims, and refined fragrance profiles remain critical competitive factors.

Asia Pacific is the fastest-growing region for apparel dry wash sprays, driven by urbanization, rising disposable incomes, and expanding middle-class populations across China, India, Japan, and Southeast Asia. As urban households move into smaller homes and adopt faster lifestyles, the need for quick garment-refreshing solutions increases, especially among working professionals and students. E-commerce penetration is exceptionally strong in China and Japan, enabling rapid access to both mass-market and niche fabric-care products.

Domestic players, particularly in China, Korea, and Japan, are innovating with locally inspired fragrances, gentle formulations, and packaging aligned with regional textile preferences. The region’s manufacturing strength allows competitive pricing and contract production for global brands. Government initiatives promoting water and energy conservation further support the adoption of dry wash sprays as alternatives to frequent laundering. While rural awareness remains lower, expanding retail networks and digital marketing continue to drive category growth, making Asia Pacific a major engine for long-term market expansion.

The global apparel dry wash spray market is moderately fragmented, with a mix of large consumer goods companies and specialized niche brands. Major players compete on fragrance innovation, fabric-safe chemistries, and sustainability credentials, while smaller entrants often differentiate through natural ingredients, vegan claims, or refillable packaging formats. Expansion strategies commonly include product line extensions into travel sizes, multi-surface sprays, and specialized formulas for sportswear or delicate fabrics, as well as geographic expansion into high-growth Asia Pacific and Latin American markets. Strategic partnerships with retailers, hospitality chains, and apparel brands are also emerging, alongside investment in research and development focused on biodegradable solvents, low-VOC propellants, and advanced odor-capture technologies to strengthen brand loyalty and regulatory compliance.

The global apparel dry wash spray market is expected to be valued at around US$ 3.1 billion in 2026 and reach approximately US$ 5.3 billion by 2033, reflecting a forecast CAGR of about 7.9% over 2026 - 2033.

Demand is driven by growing preference for convenient, water-efficient garment care solutions, heightened post-pandemic hygiene awareness, busy urban lifestyles, and rising adoption of on-the-go fabric refreshers and wrinkle releasers that reduce laundry frequency and energy consumption.

Fabric refreshers represent the leading product type, accounting for an estimated 40% share of global revenues, due to their broad applicability for odor control and fabric freshening across clothing, upholstery, and home textiles.

North America holds a prominent position in the global market, underpinned by high household penetration of fabric care products, strong purchasing power, stringent but innovation-friendly regulations, and active development of new formulations by leading consumer goods companies.

A major opportunity lies in developing eco-friendly, plant-based, and low-VOC dry wash sprays with recyclable or refillable packaging, catering to environmentally conscious consumers and helping brands differentiate while meeting evolving regulatory and sustainability requirements.

Key participants include Faultless Brands, Funkaway, Unilever, Summit Brands, Legend Brands, Natural Citizen, Bolton Group, and several other multinational and regional fabric care manufacturers.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Price Range

By Sales Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author