ID: PMRREP32902| 198 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

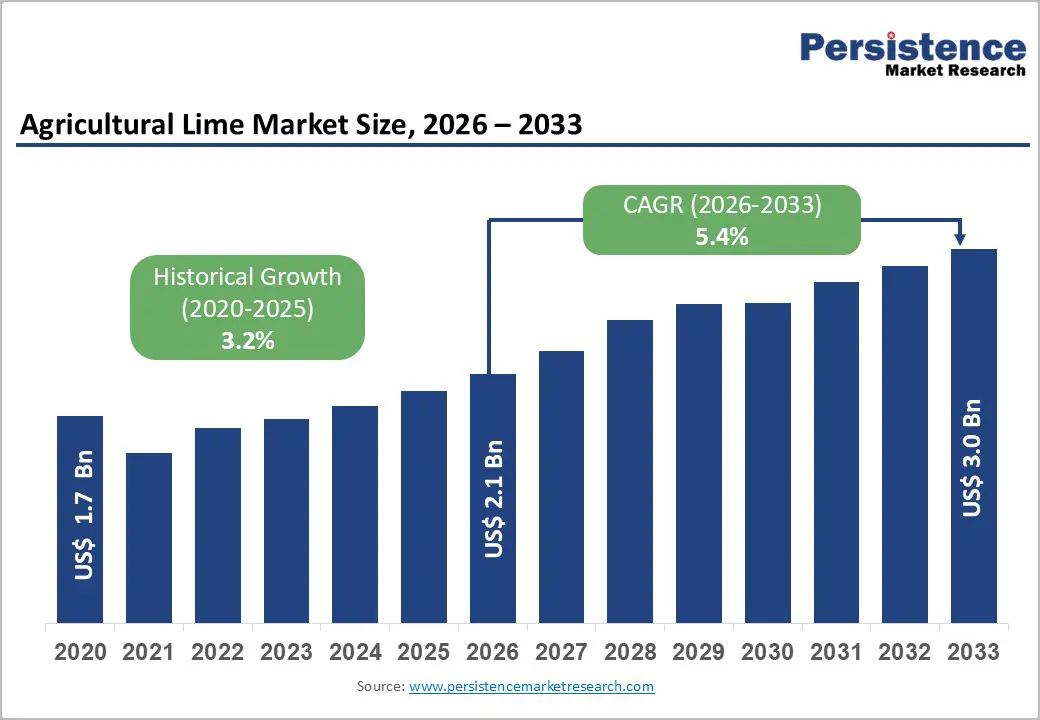

The global Agricultural Lime Market was valued at US$ 1.7 Billion in 2020 and reached US$ 2.1 Billion in 2026, with projections to reach US$ 3 Billion by 2033, growing at a CAGR of 5.4% between 2026 and 2033. The market previously demonstrated a historical CAGR of 3.2% (2020-2026), indicating an acceleration in growth momentum. This expansion is driven by accelerating global awareness of soil health management, increasing adoption of precision agriculture technologies, and rising food production demands in emerging economies. Government initiatives promoting sustainable farming practices, coupled with regulatory pressures on chemical input reduction, are creating favorable tailwinds for agricultural lime adoption across diverse geographies and crop production systems.

| Key Insights | Details |

|---|---|

|

Agricultural Lime Market Size (2026E) |

US$ 2.1 Bn |

|

Market Value Forecast (2033F) |

US$ 3.0 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

3.2% |

Key Growth Drivers

Soil acidification represents a critical global agricultural challenge affecting approximately 35% of the world's arable land, with particular severity in Sub-Saharan Africa, South Asia, and Southeast Asia. The Food and Agriculture Organization (FAO) reports that soil degradation impacts 33% of global arable land, necessitating interventions including lime application. In India, the Indian Institute of Soil Science (IISS) estimates that 49% of cultivated land is acidic, driving substantial domestic demand for agricultural lime. Lime application demonstrates documented yield increments of 34-252% in wheat and barley, 29-53% in soybean, and 42-332% in potato under moderate to severe soil acidification conditions in African agroecosystems. These compelling yield improvements, coupled with FAO projections indicating 50% growth in global food demand by 2050, are fundamentally reshaping farmers' adoption patterns and creating structural demand for soil pH correction solutions. The economic returns from lime application—averaging 3-5x return on investment in developing regions—establish agricultural lime as essential agricultural infrastructure supporting global food security objectives.

Market Restraining Factors

Alternative soil remediation solutions, including elemental sulfur, aluminum sulfate, and synthetic pH-adjusting compounds, compete directly with agricultural lime for market share, particularly among cost-sensitive farmers. Some alternatives offer faster pH correction (elemental sulfur) or lower transportation costs (regional production). Organic farmers are increasingly exploring bio-based alternatives and industrial byproducts (e.g., sugar foam, wood ash, biochar) as lime substitutes. This competitive fragmentation constrains pricing power and requires ongoing product differentiation and technology investment to maintain market share against lower-cost alternatives.

Agricultural Lime Market Trends and Opportunities

The United Nations World Water Development Report (2022) estimates that 80% of global wastewater is discharged untreated, creating substantial demand for lime in municipal water treatment infrastructure. The U.S. EPA projects USD 271 billion in required wastewater infrastructure investments over two decades, directly benefiting lime suppliers. Agricultural lime exhibits expanding applications in acid mine drainage treatment, landfill stabilization, and industrial wastewater remediation. Asia-Pacific water treatment applications represent an estimated USD 150-200 million in incremental demand through 2033, with environmental remediation applications expanding at a CAGR of 6.8-7.2% across developed and developing markets.

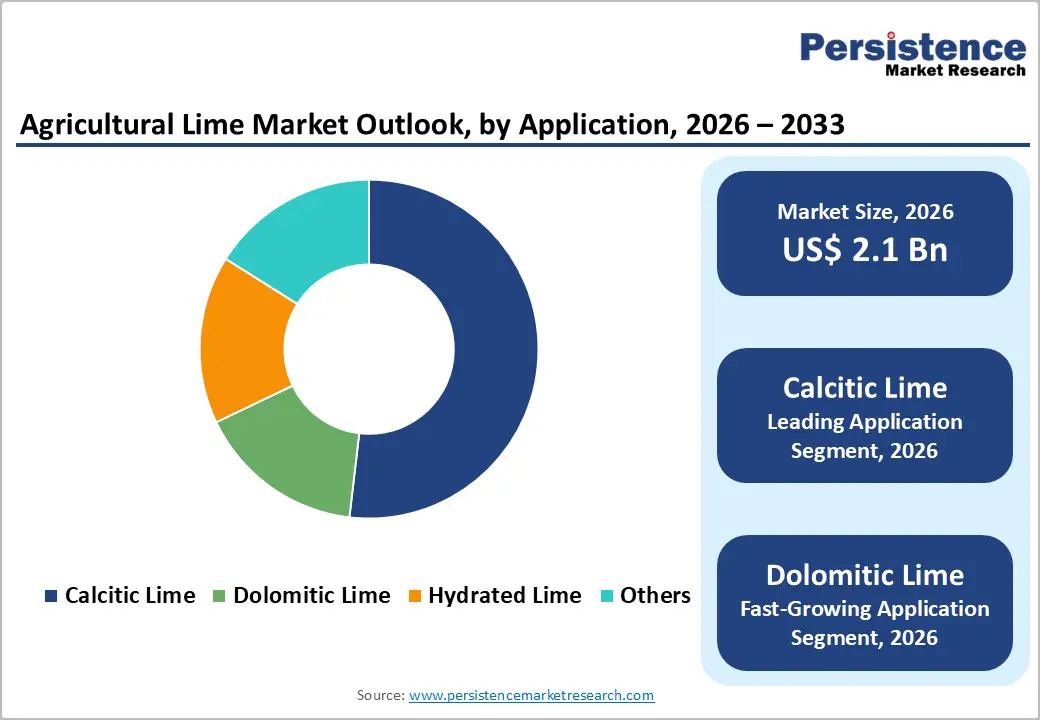

Product Type Insights

The product type analysis of the agricultural lime market highlights a clear contrast between volume-driven dominance and nutrient-driven growth. Calcitic lime, composed primarily of calcium carbonate derived from abundant limestone reserves, remains the dominant product segment, accounting for over 55% of global revenue. Its widespread availability, simple processing requirements, and cost efficiency make it the preferred choice for large-scale agricultural applications. Farmers favor calcitic lime due to its compatibility with existing spreading equipment and its effectiveness across a wide range of soil types. It plays a critical role in soil pH correction, improving nutrient availability, and enhancing microbial activity, making it the standard baseline product in most crop systems. Mature supply chains and established regional distribution networks further strengthen its market leadership.

In contrast, dolomitic lime is the fastest-growing segment, registering a projected CAGR of 6.1% between 2026 and 2033. Its growth is driven by rising awareness of magnesium deficiency in agricultural soils, particularly in regions with intensive monoculture farming and high nutrient extraction rates. Dolomitic lime, which supplies both calcium and magnesium, is increasingly adopted in parts of Asia-Pacific, Europe, China, India, and Eastern Europe. Agronomic studies indicating 30–50% yield improvements in magnesium-deficient soils are accelerating the uptake of dolomitic lime, positioning it as a critical input for productivity-focused farming systems.

Application Insights

Soil treatment remains the dominant application for agricultural lime, accounting for over 60% of global revenue and representing the core demand pillar of the market. Its widespread use is driven by the critical role lime plays in correcting soil pH imbalances, neutralizing acidity, and improving nutrient availability, which directly enhances crop yields and soil productivity. Commercial farming, horticulture, and turf management sectors rely heavily on lime-based soil treatment due to well-established agronomic practices, proven yield benefits, and relatively simple application methods. In addition, increasing regulatory focus on soil health management and sustainable agricultural practices further supports stable and recurring demand for soil treatment applications. This segment reflects mature adoption patterns, with consistent consumption across both developed and developing agricultural economies.

In contrast, water treatment is emerging as the fastest-growing application segment, registering a CAGR of around 6.2% during 2026–2033. Growth is fueled by tightening water-quality regulations, rising investments in municipal wastewater infrastructure, and expanding industrial water-treatment needs. Agricultural lime is increasingly used for wastewater neutralization, potable water pH adjustment, and industrial effluent treatment due to its effectiveness and environmentally favorable profile. Adoption is particularly strong in the Asia-Pacific region, where rapid urbanization, industrialization, and water scarcity challenges are accelerating demand. Environmental regulations promoting low-toxicity and chemical-free treatment solutions further position lime as a preferred option, driving sustained growth in this segment.

Form Insights

The agricultural lime market shows a clear divergence in form preferences, with powder maintaining dominance while granules emerge as the fastest-growing format. Powder-form agricultural lime accounts for over 60% of market revenue, primarily due to its cost-effectiveness and long-established use across large-scale farming operations. Farmers widely prefer powder lime because it is economical to produce, transport, and apply using conventional spreading equipment already available on most farms. Mature supply chains, standardized commodity pricing, and strong familiarity among growers further reinforce its leading position. For broad-acre soil treatment, powder lime remains the most practical and financially viable option, especially in price-sensitive agricultural regions.

In contrast, granulated agricultural lime is experiencing rapid growth, recording a projected CAGR of 6.3% between 2026 and 2033. This growth is driven by rising adoption in precision agriculture, horticulture, turf management, and landscaping applications. Granules offer significant advantages, including reduced dust generation, safer handling, and improved application accuracy. Compatibility with GPS-guided and modern spreading equipment enables precise dosage control, aligning well with advanced farm management practices. Additionally, horticultural and premium landscaping segments increasingly favor granules for their cleaner handling and better visual appeal. Although granulated lime commands a higher price than powder, demand is expanding steadily in market segments that prioritize safety, convenience, and precision over basic cost considerations.

End User Insights

Commercial farming operations represent the dominant end-user segment in the agricultural lime market, accounting for over 65% of total revenue. Large-scale farms cultivating cereals, oilseeds, and legumes form the backbone of demand, as soil pH management is critical for maximizing nutrient availability, crop yields, and long-term soil health. Agricultural lime is widely integrated into structured soil management and productivity optimization programs, particularly in regions with intensive farming practices. High awareness among farmers, supported by agronomic advisory services and on-field demonstrations, reinforces consistent adoption across commercial farms. In addition, the scale of application in farming—covering large acreage—ensures stable, recurring demand, making farms the most commercially significant end-user segment.

In contrast, lawns and turf management represent the fastest-growing end-user category, projected to expand at a CAGR of 6.7% between 2026 and 2033. This segment includes residential lawns, golf courses, sports complexes, and public green spaces. Growth is driven by the rising adoption of precision lime application to achieve optimal soil pH, improved turf density, and enhanced visual appeal. Premium turf applications, particularly golf courses and professional sports facilities, increasingly demand specialized lime formulations and professional application services. Moreover, expanding housing markets and higher consumer spending on landscaping and property aesthetics are driving demand for residential lawn care, especially in developed economies with established lawn care industries.

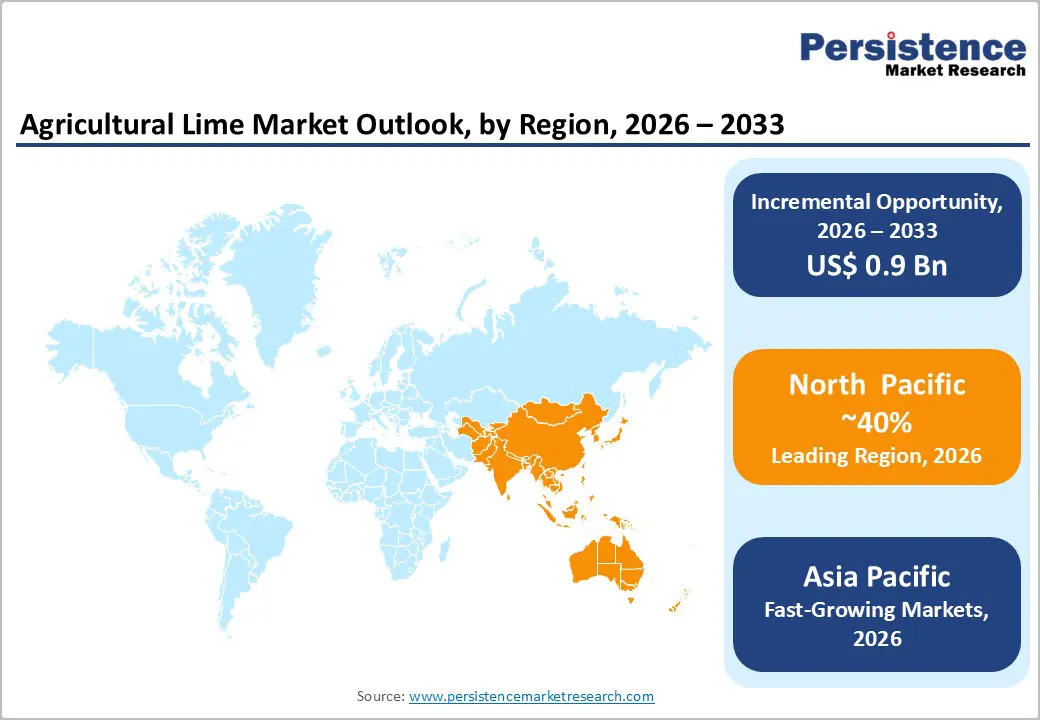

North America holds a dominant position in the global agricultural lime market, accounting for over 40% of total revenue, driven primarily by the United States’ vast agricultural base and advanced commercial farming systems. In 2026, the U.S. alone consumed nearly 2 million tons of agricultural lime, supporting a regional market value exceeding USD 1.2 billion. Market growth remains stable, with a projected CAGR of 4.1–4.5% between 2026 and 2033, reflecting mature adoption levels and consistent demand across large-scale farming operations.

The United States is the largest consumer within the region, with more than 45 million tons of lime applied annually across row crops, pasturelands, and specialty agriculture. Abundant limestone reserves in the Appalachian region and Midwest underpin efficient supply chains, enabling cost-effective production and distribution. Federal support programs, particularly the USDA’s Environmental Quality Incentives Program (EQIP), further strengthen demand by incentivizing soil health improvements and sustainable land management practices.

Growth is increasingly shaped by precision agriculture technologies. GPS-guided equipment and IoT-enabled soil monitoring systems are optimizing lime application rates, improving cost efficiency and crop productivity. Regulatory emphasis on reducing chemical inputs and promoting sustainable farming practices positions agricultural lime as a preferred soil amendment. Looking ahead, while the market is mature, targeted opportunities exist in precision turf management, organic farming, and environmental remediation, supported by continued investment in technology integration and product innovation.

Asia-Pacific stands out as the fastest-growing regional market for agricultural lime, recording a projected CAGR of 6.6% between 2026 and 2033. The region accounts for nearly 25–30% of global agricultural lime consumption, supported by growth rates that significantly outpace those of developed markets. This momentum is primarily driven by widespread soil acidification, with nearly 70% of arable land across the region exhibiting acidic conditions. In India alone, about 49% of cultivated land requires pH remediation, creating a large and recurring demand base for lime applications.

Rising food production pressures further reinforce market expansion. FAO projections indicating a 50% increase in global food demand by 2050 have intensified agricultural practices across the Asia-Pacific region, where population growth and urbanization demand higher crop yields. Agricultural lime plays a critical role in improving soil health, nutrient uptake, and productivity, making it an essential farm input.

Government-led agricultural programs add structural support to demand growth. Subsidy schemes, soil health missions, and technical assistance initiatives in India, China, and Southeast Asia are actively promoting the use of lime, especially among small and price-sensitive farmers. Concurrently, improvements in logistics infrastructure, limestone mining capacity, and rural supply chains are enhancing market access.

Country-level dynamics remain strong. India is growing at an estimated 6.8–7.1% CAGR, China at 6.2–6.5%, while Southeast Asian markets such as Vietnam, Cambodia, and Laos offer high-growth potential. A fragmented supplier landscape favors regional manufacturers, while international players increasingly invest in local production and distribution to capture long-term growth opportunities.

The global agricultural lime market exhibits a moderately fragmented competitive structure with approximately 150-200 identifiable suppliers ranging from international commodity producers to regional limestone quarry operations. Market consolidation below supplier level (i.e., among distributors and farmer cooperatives) exceeds producer-level concentration. The top 5 global producers control approximately 25-30% of total market supply, indicating a competitive market structure with moderate barriers to entry. Regional producers command significant market share in geographically distinct markets, leveraging local limestone deposits and established distribution networks. The market structure supports supplier profitability through regional differentiation and specialty product development rather than dominant-firm pricing power.

The Agricultural Lime market is estimated to be valued at US$ 2.1 Bn in 2026.

The primary demand driver for the agricultural lime market is the widespread and worsening problem of soil acidification, which directly reduces crop productivity and nutrient efficiency.

In 2026, the North America Pacific region will dominate the market with an exceeding 40% revenue share in the global Agricultural Lime market.

Among applications, soil treatment has the highest preference, capturing beyond 60% of the market revenue share in 2026, surpassing other applications.

Graymont, Lhoist Group,Minerals Technologies Inc., Nordkalk Corporation, Carmeuse Group, Mississippi Lime Company, and Boral Limited. There are a few leading players in the Agricultural Lime market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Form

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author