ID: PMRREP18520| 240 Pages | 13 Feb 2026 | Format: PDF, Excel, PPT* | Packaging

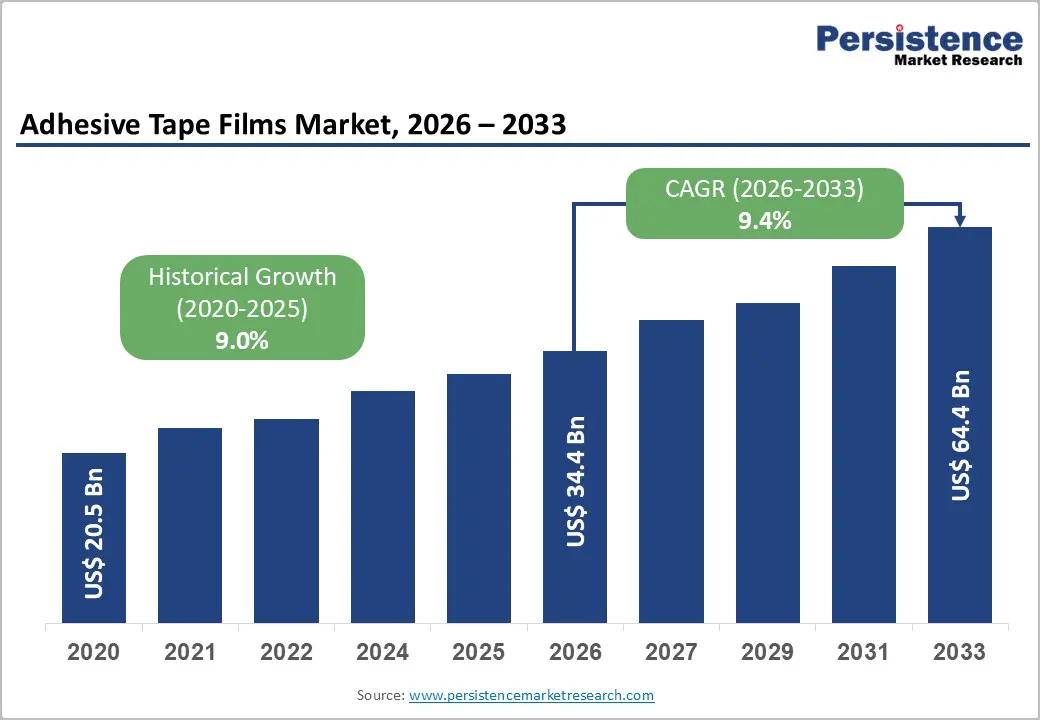

The global adhesive tape films market size is likely to be valued at US$34.4 billion in 2026 and is expected to reach US$64.4 billion by 2033, growing at a CAGR of 9.4% during the forecast period from 2026 to 2033, driven by rising adoption across packaging, automotive, electronics, construction, and healthcare applications. Demand is fueled by the rapid expansion of e-commerce and logistics, where adhesive tape films are essential for secure, lightweight, and cost-efficient packaging solutions. In the automotive sector, especially with the growing shift toward electric vehicles, manufacturers are increasingly replacing traditional mechanical fasteners with high-performance adhesive films to support light weighting, noise reduction, and improved design flexibility. The electronics industry continues to drive demand for thin, durable, and reliable bonding materials used in devices, displays, and thermal management systems, while healthcare applications benefit from skin-friendly, breathable, and precision adhesive films.

| Report Attribute | Details |

|---|---|

|

Adhesive Tape Films Market Size (2026E) |

US$34.4 Bn |

|

Market Value Forecast (2033F) |

US$64.4 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

9.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

9.0% |

Growth Analysis - Expansion of E-commerce and Packaging Applications

Adhesive tape films are essential for carton sealing, bundling, labeling, tamper evidence, and protective packaging in logistics operations. The shift toward lightweight, flexible, and automated packaging solutions increases reliance on high-performance adhesive films that ensure durability during transportation while maintaining cost efficiency. Growth in last-mile delivery and cross-border trade amplifies demand, especially for pressure-sensitive and transparent films that support branding and product visibility.

Evolving consumer expectations for secure, sustainable, and visually appealing packaging are accelerating innovation in adhesive tape films. Packaging companies increasingly prefer water-based and recyclable adhesive films to align with environmental goals without compromising bonding strength. Automation in fulfillment centers also favors adhesive tape films compatible with high-speed machinery, reinforcing steady volume growth. As retail packaging continues transitioning toward flexible formats, adhesive tape films remain a core component, ensuring consistent demand across food, consumer goods, pharmaceuticals, and industrial packaging segments.

Automotive and Electric Vehicle (EV) Lightweighting Trends

Adhesive films enable weight reduction, improved aerodynamics, vibration damping, and enhanced design flexibility. In electric vehicles, where weight efficiency directly impacts driving range and battery performance, adhesive tape films are increasingly used for interior assembly, wire harnessing, insulation, and component bonding. Their ability to bond dissimilar materials such as plastics, composites, and metals supports modern vehicle architectures and modular designs.

The EV transition accelerates demand for high-performance adhesive tape films capable of withstanding heat, chemicals, and mechanical stress. Silicone and acrylic adhesive films are particularly valued for battery assembly, thermal management, and electronic protection. Automotive OEMs prioritize durability, safety, and noise reduction, all of which adhesive tape films address effectively. EV production expands, and regulations push for efficiency improvements, adhesive tape films gain long-term relevance across conventional and electric vehicle platforms.

Supply Chain Constraints Pose Structural Challenges

Fluctuations in resin availability, adhesive chemicals, and film substrates can lead to inconsistent pricing and delayed production. Events affecting transportation, trade flows, or energy costs amplify these challenges, impacting manufacturers' ability to meet demand reliably. Smaller producers are especially vulnerable, as they lack diversified sourcing or long-term supplier contracts. Sudden shortages often force producers to rely on spot sourcing at higher costs, reducing profit margins and price stability. For adhesive tape films, where consistent quality and supply are critical, such volatility can weaken customer relationships.

Geographic concentration of raw material suppliers creates structural risks, particularly for regions dependent on imports. Lead-time variability complicates inventory planning for packaging, automotive, and electronics customers who require a consistent supply. While companies are investing in localized manufacturing and supplier diversification, these transitions require time and capital. Until supply chains stabilize, cost volatility and procurement uncertainty will continue to restrain margin expansion and operational efficiency within the adhesive tape films market.

Environmental Regulations and Sustainability Pressures

Environmental regulations increasingly restrict the use of solvent-based adhesives and non-recyclable materials, posing compliance challenges for adhesive tape film manufacturers. Governments across major markets are tightening standards related to volatile organic compounds, plastic waste, and chemical safety. These regulations require reformulation, process changes, and certification investments, raising production costs and slowing time to market for new products. Certain high-performance formulations face limitations due to environmental impact concerns.

Sustainability pressures also influence customer purchasing decisions, forcing manufacturers to balance performance with eco-compliance. While alternatives such as water-based or bio-based adhesive films are gaining traction, they may not fully match the performance of traditional solutions in demanding applications. Transitioning product portfolios requires significant research, testing, and customer validation. Regulatory compliance acts as a restraint, particularly in cost-sensitive and high-performance segments of the adhesive tape films market.

Opportunity Analysis - Sustainable and Bio-based Adhesive Films

Rising demand for recyclable packaging, solvent-free adhesives, and low-emission products is driving innovation across the market. Bio-based raw materials and water-based formulations enable manufacturers to meet regulatory standards while appealing to environmentally conscious customers. Packaging, healthcare, and consumer goods sectors are early adopters, accelerating the commercialization of sustainable adhesive tape films. E-commerce and retail brands increasingly require eco-friendly sealing and labeling solutions to meet corporate sustainability targets. This shift encourages manufacturers to redesign product portfolios and invest in greener production technologies.

This opportunity extends beyond compliance, offering differentiation and premium positioning. Brands increasingly value sustainability credentials, driving demand for certified, recyclable, and eco-labeled adhesive tape films. Advances in material science are narrowing performance gaps between conventional and sustainable formulations, improving adhesion strength, durability, and thermal resistance. Performance reliability improves, and sustainable films are expanding into automotive, electronics, and industrial applications. This broadening adoption strengthens long-term growth potential and supports value-added innovation within the adhesive tape films market.

Technological Convergence in Electronics and Flexible Displays

Modern electronics require ultra-thin, high-precision bonding solutions that offer thermal stability, electrical insulation, and durability without adding bulk. Adhesive tape films are increasingly used in smartphones, wearables, foldable displays, and semiconductor components where mechanical fasteners are impractical. Their ability to support miniaturization, reduce assembly complexity, and enhance device reliability makes them critical in advanced electronics manufacturing. Growing demand for compact, lightweight, and multifunctional devices reinforces the role of adhesive tape films in high-density electronic assemblies.

As flexible electronics adoption grows, demand rises for adhesive films that support bending, stretching, and long-term reliability. Silicone and specialty acrylic films play a key role in display lamination, sensor integration, and thermal management. Continuous innovation in film thickness, adhesion control, and multifunctionality enhances market potential. This technological shift opens high-value opportunities for manufacturers focused on performance-driven, application-specific adhesive tape film solutions tailored to next-generation electronics.

Product Type Insights

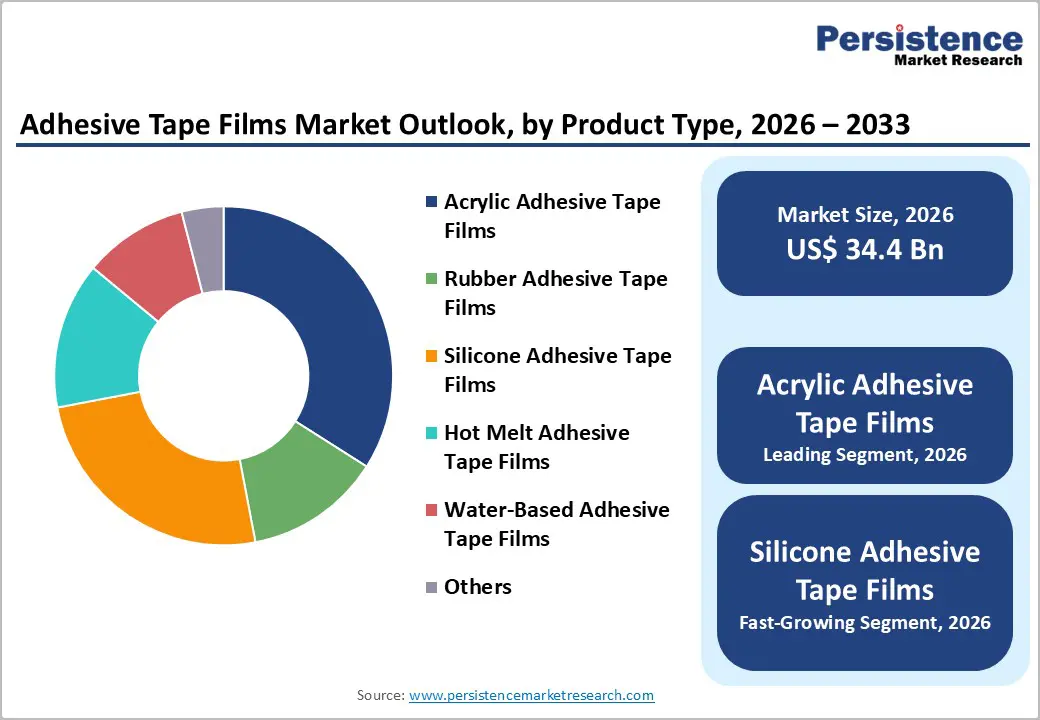

Acrylic adhesive tape films are expected to lead, accounting for approximately 50% of revenue in 2026, driven by their balanced performance characteristics and broad applicability. Acrylic formulations offer strong and consistent adhesion across a wide range of substrates, including plastics, metals, glass, and composites, while maintaining resistance to UV exposure, moisture, and temperature variation. In packaging, for example, acrylic adhesive tape films are widely used for carton sealing and labeling in e-commerce logistics, where durability and clarity are essential during transportation and storage.

Silicone adhesive tape films are likely to represent the fastest-growing segment in 2026, supported by rising demand for high-performance bonding solutions in technically demanding environments. These films are valued for their exceptional heat resistance, flexibility, chemical inertness, and biocompatibility, making them ideal for applications where conventional adhesives fail. Growth is particularly strong in electronics, electric vehicles, aerospace, and medical devices, where materials must withstand extreme temperatures, repeated stress, and exposure to chemicals without degradation. For example, their use in EV battery assemblies, where silicone adhesive tape films support thermal insulation and component protection while maintaining long-term reliability.

Film Type Insights

Transparent adhesive tape films are projected to lead the market, capturing around 45% of the revenue share in 2026, supported by their widespread use in visibility-critical applications. Transparency enables product inspection, branding, and aesthetic consistency, which is especially important in packaging, labeling, and electronics assembly. Their role in e-commerce packaging is a for example, where transparent films allow barcodes, labels, and branding elements to remain visible while ensuring secure sealing. In electronics manufacturing, transparent films support precise alignment during assembly without obstructing visual inspection.

Opaque adhesive tape films are likely to be the fastest-growing film type, driven by increasing demand in applications where durability, protection, and surface coverage are prioritized over visibility. These films are widely used in construction, automotive, and industrial settings for masking, surface protection, insulation, and decorative finishes. Their ability to block light, hide imperfections, and provide enhanced resistance to abrasion and chemicals supports adoption in harsh environments. Regulatory requirements related to surface protection and workplace safety support demand growth. Design-driven applications are increasing the use of colored and specialty opaque films for functional aesthetics. For example, their growing use in automotive manufacturing, where opaque films protect painted surfaces and components during assembly and transportation.

North America Adhesive Tape Films Market Trends

North America is likely to be a significant market for adhesive tape films in 2026, driven by diversified industrial activity, technological innovation, and strong demand across key end-use sectors such as automotive, packaging, electronics, and healthcare. A major trend shaping this market is the increasing emphasis on high-performance and specialty adhesive films that support light weighting, enhanced bonding, and durability under extreme conditions. In the automotive sector, manufacturers are shifting from mechanical fasteners to adhesive bonding solutions to improve fuel efficiency and performance.

Leading industry players are actively investing in capacity expansion and product development to capture growing opportunities within the region. For example, 3M has been advancing its portfolio of pressure-sensitive adhesive films designed for electronics assembly and industrial bonding, integrating innovations that enhance performance in temperature resistance and substrate compatibility. These developments support key growth areas such as flexible electronics, medical adhesives, and industrial applications. The presence of established supply chains and proximity to major customers in the automotive and aerospace sectors also reinforces North America's strategic importance in the adhesive tape films landscape.

Europe Adhesive Tape Films Market Trends

Europe is likely to be a significant market for adhesive tape films in 2026, due to demand in automotive, industrial manufacturing, healthcare, and advanced packaging applications. A key trend is the shift toward high-performance and sustainable adhesive solutions, driven by stringent environmental regulations and corporate commitments to reduce carbon footprints. Manufacturers are increasingly adopting water-based and recyclable formulations to meet regulatory standards while maintaining strong bonding and durability. In electronics and consumer goods, adhesive tape films support miniaturization, flexible assemblies, and surface protection.

Momentum in Europe is driven by strategic initiatives from established industry players to expand product portfolios and geographic reach. For example, Tesa SE has been at the forefront of developing specialty adhesive tape films with enhanced eco-credentials and performance features sought by European manufacturers, particularly in automotive and industrial automation. Tesa’s innovations focus on optimized adhesion, surface versatility, and improved recyclability, aligning with strong regional emphasis on circular economy principles.

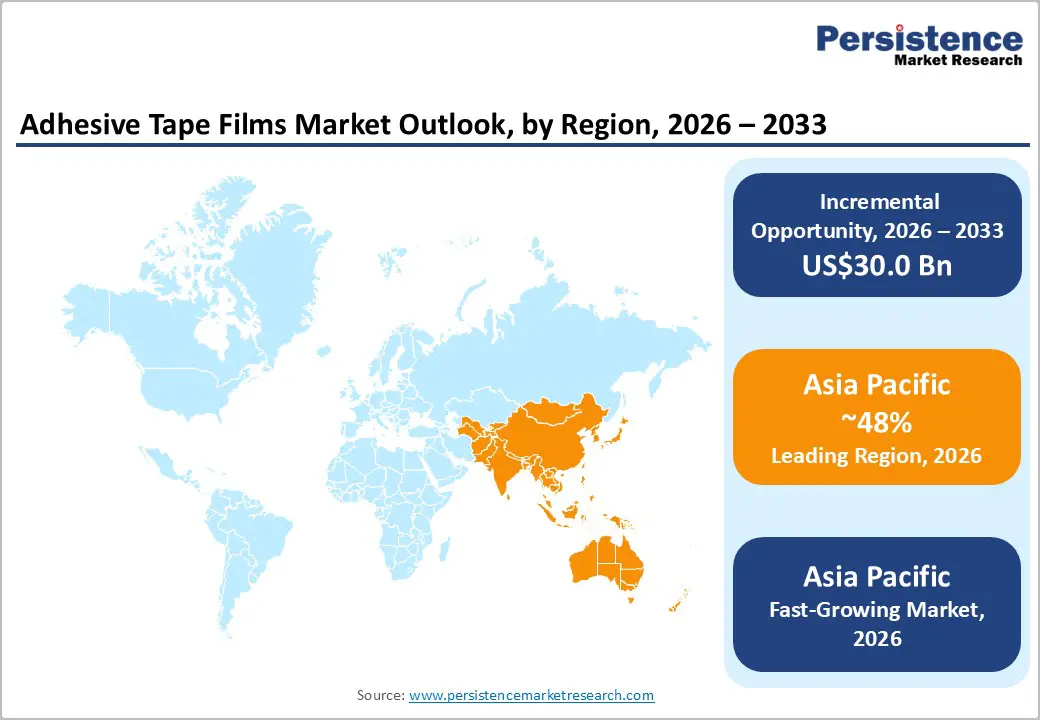

Asia Pacific Adhesive Tape Films Market Trends

The Asia Pacific region is anticipated to be the leading region, accounting for a market share of 48% in 2026, driven by rapid industrialization, expanding manufacturing bases, and strong end-use demand across packaging, automotive, electronics, and construction sectors. A key trend in the region is the increasing adoption of adhesive tape films as manufacturers seek lightweight, high-performance bonding solutions to replace mechanical fasteners. Growth in electric vehicle production, consumer electronics assembly, and infrastructure development fuels demand for performance-oriented films with enhanced thermal resistance, flexibility, and durability.

Regional companies and multinational players are actively expanding capacity and launching tailored products to capture specific opportunities within Asia Pacific. For example, Nitto Denko Corporation has introduced advanced adhesive tape films designed for high-end electronics and automotive applications, focusing on thermal management and reliability. Nitto’s innovations support trends in flexible displays, semiconductor packaging, and EV component bonding, where traditional adhesives may not meet performance requirements.

The global adhesive tape films market exhibits a moderately fragmented structure, driven by a mix of established multinational manufacturers and agile regional players that compete on innovation, performance, and sustainability. Major firms maintain strong positions through extensive R&D, broad product portfolios, and deep industry relationships in key end-use sectors such as automotive, electronics, packaging, and healthcare. Performance attributes such as thermal resistance, adhesion strength, substrate compatibility, and eco-credentials are critical competitive factors.

With key leaders including 3M Company, Avery Dennison Corporation, Henkel AG & Co. KGaA, Nitto Denko Corporation, and tesa SE shaping the industry landscape, competition is centered on expanding application coverage and meeting evolving performance and sustainability expectations. These players compete through new product launches, strategic partnerships, mergers and acquisitions, capacity expansion, and innovation in adhesive chemistries that address emerging demands such as low-VOC, recyclable, and high-temperature solutions.

Key Industry Developments:

The global adhesive tape films market is projected to reach US$34.4 billion in 2026.

The adhesive tape films market is driven by growing demand from packaging and e-commerce, automotive light weighting and EV production, electronics miniaturization, and the shift toward high-performance and sustainable bonding solutions.

The adhesive tape films market is expected to grow at a CAGR of 9.4% from 2026 to 2033.

Key market opportunities include the development of sustainable and bio-based adhesive tape films, expanding applications in electric vehicles and electronics, and rising demand for high-performance specialty films in advanced packaging and industrial uses.

3M, Avery Dennison Corp, H.B. Fuller, Henkel, Bostik, Pidilite Industries, Gorilla Glue, and Tesa are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Film Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author