ID: PMRREP32740| 190 Pages | 14 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

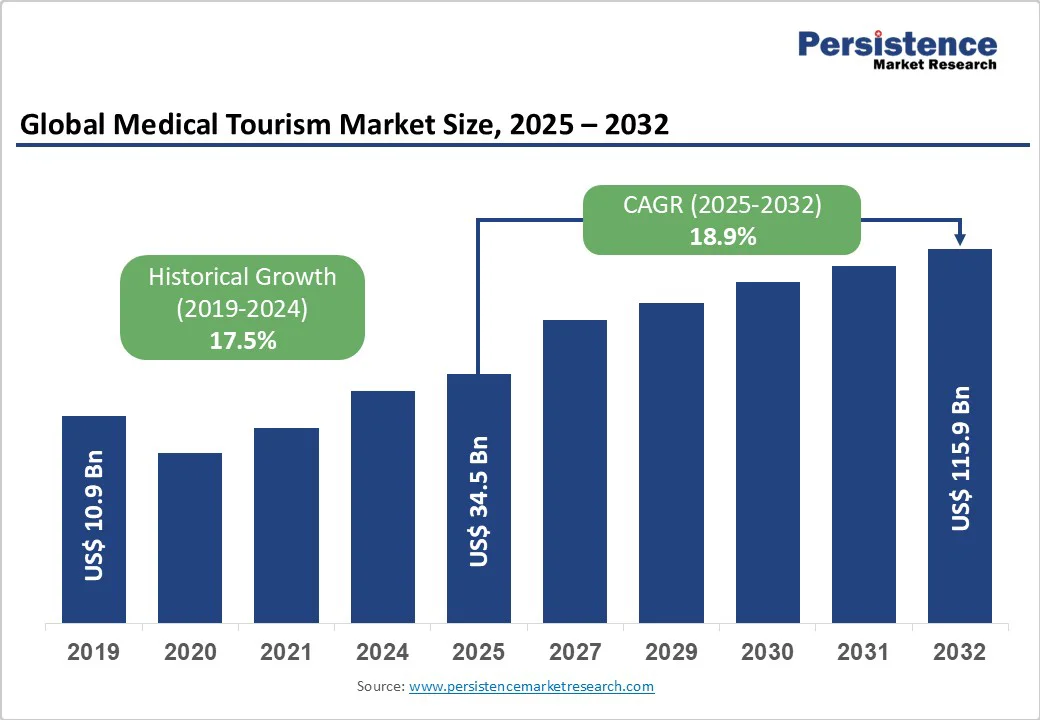

The global medical tourism market is likely to be valued at US$34.5 Bn in 2025 and is projected to reach US$115.9 Bn by 2032, growing at a CAGR of 18.9% during the forecast period from 2025 to 2032.

The global medical tourism industry is experiencing strong growth, driven by rising demand for cost-effective, high-quality, and specialized healthcare services. The increasing prevalence of chronic diseases, cosmetic procedures, and fertility treatments is boosting international patient inflow.

| Global Market Attribute | Key Insights |

|---|---|

| Global Medical Tourism Market Size (2025E) | US$34.5 Bn |

| Market Value Forecast (2032F) | US$115.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 18.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 17.5% |

The global market is experiencing significant growth, driven by the increasing demand for affordable and high-quality healthcare services. Countries such as India, Thailand, and Malaysia have become prominent destinations for international patients seeking cost-effective treatments.

For instance, India offers medical procedures at a fraction of the cost compared to Western countries, attracting a substantial number of medical tourists. In 2023, India recorded over one million health tourism arrivals, with a significant contribution from neighboring countries such as Indonesia.

Similarly, Thailand's medical tourism revenue reached approximately $850 million in 2023, while Malaysia's private healthcare and health tourism sector generated US$526 million in revenue in the same year. These figures underscore the growing trend of medical tourism driven by the affordability of treatments and the availability of high-quality healthcare services in these regions.

Patients undergoing medical procedures abroad often face heightened risks of post-surgery infections, exacerbated by inadequate follow-up care. A study analyzing 44 cases of complications from cosmetic procedures abroad found that infection was the most prevalent issue, with 98% of infections being bacterial, predominantly from the Mycobacterium genus.

The CDC also notes that complications from procedures performed in other countries can include wound infections and bloodstream infections, as well as challenges in accessing appropriate follow-up care upon returning home. Additionally, a case series highlighted that a lack of customary follow-up and accessibility can lead to delays in diagnosing infections and cause patients to seek care locally.

These instances highlight the crucial importance of ensuring proper post-operative care and follow-up for medical tourists to minimize risks and optimize recovery outcomes.

Telemedicine use in the U.S. surged during the COVID-19 pandemic, with 80.5% of office-based physicians using telemedicine for patient care in 2021, up from about 16% in 2019. Follow-ups and medication management have become one of the most common uses of telehealth; a 2023 U.S. survey found that 62% of adults used telehealth for follow-up visits.

The National Health Interview Survey (U.S.) reported that 37.0% of adults used telemedicine in the past 12 months in 2021. In Telangana, India, telemedicine services benefitted 2.23 crore (22.3 million) people over three years under the state scheme, assisting remote populations in particular.

In medical tourism, telemedicine can support pre-travel consultations, virtual follow-ups post-surgery, and continuity of care without requiring patients to travel back. The high physician adoption and large patient usage shown in these sources suggest telemedicine is well-positioned to reduce risk, improve patient satisfaction, and lower costs for international patients, making it a strong opportunity in the market.

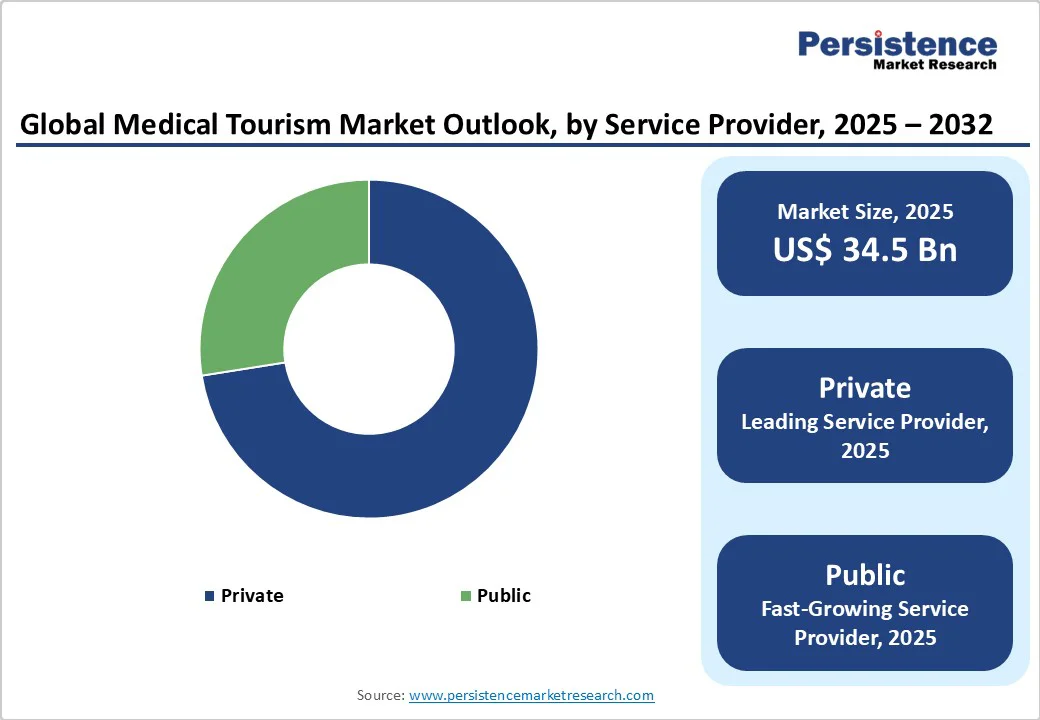

Private healthcare institutions lead the medical tourism service provider segment with a 72.5% share in 2025, driven by several reasons supported by data. In Malaysia, in 2023, nearly 700,000 healthcare tourists sought private medical services, contributing around RM 2.23 billion in revenue, a 33% increase from 2019.

In Thailand, about 65% of the 38,512 medical facilities are private clinics or hospitals, and many large private hospitals are JCI-accredited, which adds credibility for international patients. Additionally, in India, the number of foreign patient arrivals increased to nearly 650,000 in 2024, up from approximately 180,000 in 2020, largely handled by private hospital chains such as Apollo, Fortis, and Max Healthcare.

The private sector also offers the most advanced medical technology, shorter waiting times, and more personalized, patient-centric services, all of which appeal to medical tourists.

In Thailand, aesthetic medicine is the second most popular treatment for medical tourists after dental care, with over 7,000 aesthetic clinics serving both domestic and international clients. A survey by Thailand’s Economic Intelligence Center showed 44% of respondents had undergone cosmetic procedures, and 63% of those had multiple treatments.

In the U.S., nearly 20-26 million surgical and minimally invasive cosmetic procedures were performed in 2022, marking a substantial increase since 2019. These procedures include liposuction, breast augmentation, rhinoplasty, facial injectables, and non-surgical skin treatments. The popularity stems from relatively short recovery times, lower costs abroad, and the strong appeal of aesthetic enhancement among younger demographics.

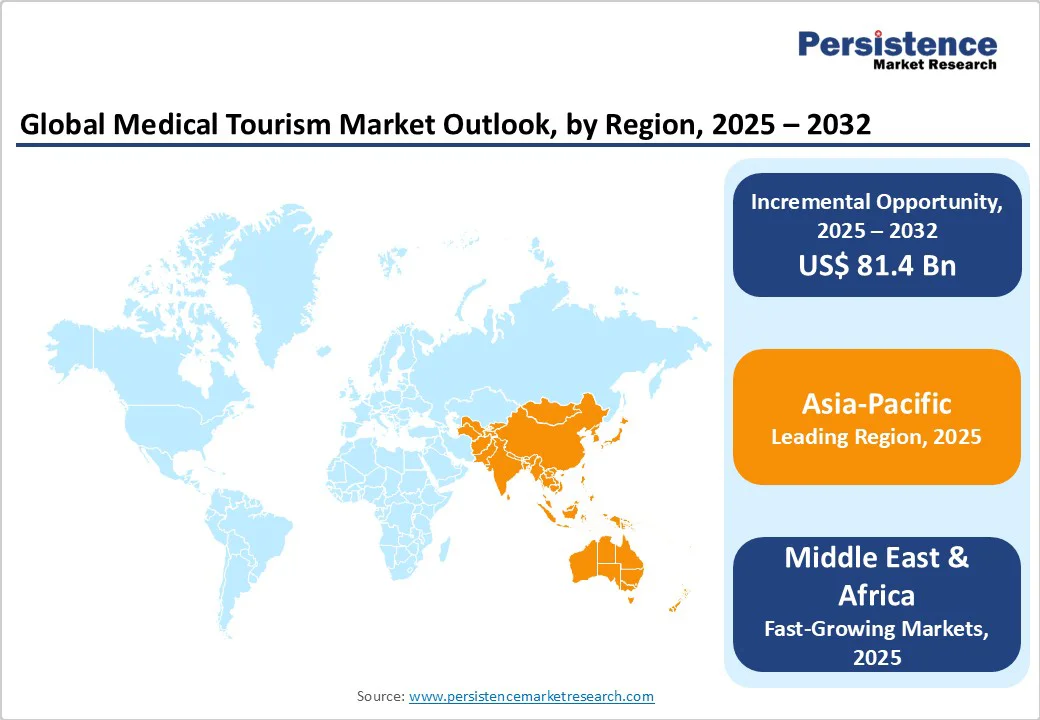

The Asia Pacific is the leading region in the market, with a 45.7% share in 2025, driven by its strong mix of affordability, infrastructure, and rising patient volumes. For example, India registered 131,856 foreign medical tourist arrivals in just the first four months of 2025, accounting for approximately 4.1% of total foreign tourist arrivals.

Malaysia saw over 1.5 million international patients in 2024, with medical tourism revenue reaching MYR 2.72 billion. Thailand’s health tourism sector was valued at THB 670 billion in 2025, with direct health service businesses contributing THB 220 billion. Policy support, including visa facilitation, government promotion, and hospital accreditation, has further boosted confidence among international patients.

Europe is one of the leading regions in the market, as it combines high-quality care with attractive cost savings, cross-border accessibility, and robust regulatory frameworks. For example, Germany treats ~250,000 international patients annually, generating over €1.2 billion (~ USD 1.3 billion) in revenue.

European Union citizens benefit from the EU’s Cross-Border Healthcare Directive, which enables patients to seek treatment in other member states under reimbursable conditions, thereby reducing waiting times and improving patient choice. Spain receives over 600,000 international patients annually, seeking specialized care such as eye surgery, orthopedics, and post-operative treatments, which generates approximately €500 million in related revenue.

These features, including advanced infrastructure, regulatory support, recognized hospitals, and cost-effectiveness, explain Europe’s leading position in medical tourism.

North America plays a crucial role in the market, largely driven by outbound travel from the United States. According to U.S. surveillance data, 1.32% of adults across 11 states and territories traveled abroad for medical care, with Mexico being the top destination and 55% of these treatments related to dental procedures.

The CDC estimates that millions of Americans seek healthcare overseas each year for cost savings, cosmetic surgery, dental work, fertility treatments, and other medical procedures. Notably, 61% of these travelers cite lower treatment costs as the main reason. High healthcare expenses, limited insurance coverage for elective procedures, and the pursuit of affordable, high-quality care position North America as a major source region in global medical tourism.

The global medical tourism market is growing as providers enhance healthcare infrastructure, expand service offerings, and establish strategic partnerships. Leading hospitals focus on improving patient experience, accreditation, and specialized care, while emerging clinics target niche treatments such as fertility, cosmetic, and dental procedures.

Collaborations, cross-border partnerships, and regional expansions strengthen competitiveness, driving patient inflow for elective surgeries, wellness programs, cardiac care, and advanced diagnostics, thereby accelerating the adoption of international healthcare services worldwide.

The global medical tourism market is projected to be valued at US$ 34.5 Bn in 2025.

Rising healthcare costs, affordable international treatments, advanced facilities, specialized care, government support, and increasing demand for cosmetic and elective procedures drive growth.

The global medical tourism market is poised to witness a CAGR of 18.9% between 2025 and 2032.

Telemedicine, wellness tourism, cross-border insurance, specialized centers of excellence, and government-backed infrastructure programs present significant growth opportunities in medical tourism.

Major players in the global are Apollo Hospitals, Bumrungrad International Hospital, Fortis Healthcare Limited, KPJ Healthcare Berhad, Samitivej Hospital, Bangkok Hospital, and Others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Service Provider

By Treatment

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author