ID: PMRREP19954| 200 Pages | 18 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

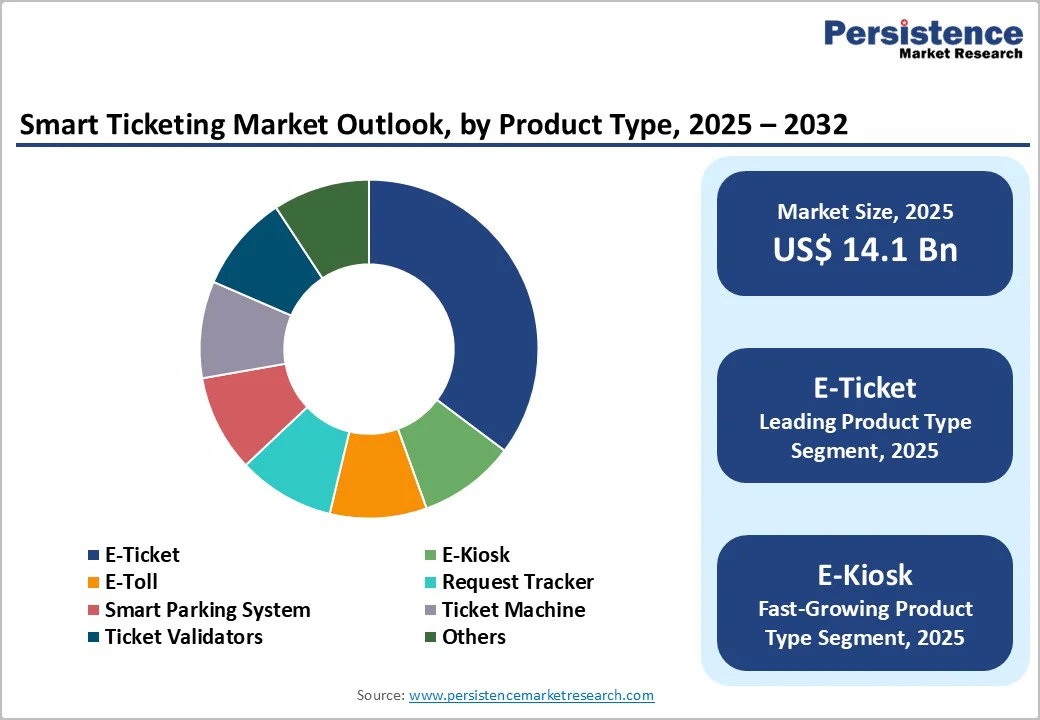

The global smart ticketing market size is valued at US$ 14.1 billion in 2025 and projected to reach US$ 35.9 billion by 2032, growing at a CAGR of 14.3% between 2025 and 2032.

The market expansion is fundamentally driven by accelerating urbanization, the surge in contactless payment adoption following post-pandemic behavioral shifts, and substantial government investments in smart city infrastructure across developed and emerging economies.

The integration of NFC ticketing is projected to grow fastest over the next decade reflecting a fundamental transformation in how consumers interact with mobility and entertainment services.

| Key Insights | Details |

|---|---|

| Smart Ticketing Market Size (2025E) | US$ 14.1 billion |

| Market Value Forecast (2032F) | US$ 35.9 billion |

| Projected Growth CAGR(2025-2032) | 14.3% |

| Historical Market Growth (2019-2024) | 15.1% |

The accelerating shift toward contactless payments is a primary growth catalyst for the global smart ticketing market, supported by rising mobile payment adoption and strengthening digital infrastructure.

According to the World Bank and GSMA, over 78-80% of adults in developed economies now use smartphones for digital or contactless transactions, reinforcing a natural transition toward mobile-first ticketing models that support NFC, QR-based, and wallet-enabled payments. Public transit operators worldwide are shifting away from cash-based and card-centric systems to digital platforms that offer faster validation and reduced operational complexity.

Post-pandemic behavior changes further accelerated this shift, with global contactless transaction volumes rising by more than 150% between 2020 and 2024. NFC remains a leading technology, enabling secure tap-and-go validation that minimizes queue times and enhances commuter throughput.

Rising smartphone penetration and growing consumer preference for seamless digital payments continue to expand the addressable market, driving rapid smart ticketing integration across transportation, events, and hospitality sectors.

Urbanization trends and smart city investments form another critical driver for market expansion, with the United Nations reporting that over 56% of the global population lived in urban areas in 2023, rising to an expected 68% by 2050.

This population shift is pressuring cities to upgrade mobility and Metro Rail Infrastructure, leading to large-scale adoption of integrated ticketing platforms. Governments across China, India, the EU, and the Middle East are investing heavily in digital mobility ecosystems. China leads with the world’s largest urban transit expansion, surpassing 10,000 km of metro rail by 2024, alongside mandates for interoperable travel cards.

India’s nationwide digital public infrastructure and 98% contactless banking penetration have accelerated the deployment of virtual metro tickets within UPI-enabled mobile apps. The European Union’s Horizon 2020 and Connecting Europe Facility programs continue to channel multi-billion-euro investments toward smart mobility networks.

These initiatives reduce operational inefficiencies, lower manual processing costs by up to 30-40%, and generate rich passenger analytics, reinforcing the strategic importance of smart ticketing within next-generation urban mobility frameworks.

High upfront investment requirements remain a major constraint for smart ticketing adoption, especially for small transit agencies and municipalities in emerging markets. Implementing end-to-end digital ticketing platforms requires significant spending on hardware, software licensing, system upgrades, and workforce training.

Transitioning from legacy systems introduces integration challenges, demanding compatibility across diverse fare collection equipment and backend platforms. Metropolitan projects often exceed US$ 100 million and require phased rollouts lasting 18-36 months to avoid operational disruptions. The persistence of aging infrastructure, vendor lock-in concerns, and limited budget flexibility further slows adoption in Latin America and the Middle East & Africa.

Smart ticketing systems process extensive personal and financial data, creating heightened exposure to cyber threats such as phishing, credential theft, automated fraud, and bot-driven ticket misuse. As biometric authentication becomes more common, operators face growing obligations to comply with stringent frameworks, including GDPR, CCPA, and emerging Asia-Pacific privacy regulations.

Ensuring security requires advanced encryption, AI-enabled anomaly detection, Online Payment Fraud Detection tools, continuous monitoring, and layered cybersecurity protocols that increase operational costs. At the same time, evolving rules on blockchain-based ticketing, digital identity, and cross-border data transfers create regulatory uncertainty.

These compliance complexities often delay procurement decisions and discourage rapid technology deployment in sensitive jurisdictions.

The sports and entertainment sector is emerging as a high-value opportunity as stadiums, arenas, and event operators accelerate the shift toward digital, biometric, and cloud-enabled ticketing ecosystems. Large venues increasingly adopt facial recognition and iris-based authentication systems that cut entry wait times by more than half while eliminating unauthorized resales and counterfeit tickets.

Partnerships between global leagues and digital ticketing platforms enable enhanced features such as mobile-first purchasing, real-time seat upgrades, digital transfers, and immersive 3D seat previews.

Major global events, including the FIFA World Cup, have demonstrated the scalability of secure, high-volume digital ticket issuance while reinforcing the model for wider adoption. As event organizers prioritize revenue optimization, audience analytics, and fraud mitigation, smart ticketing penetration is expected to expand rapidly, creating multi-billion-dollar addressable opportunities by 2032.

The rapid adoption of QR-based scan-and-pay systems presents one of the most scalable opportunities in the smart ticketing market due to their low infrastructure cost, device-agnostic compatibility, and suitability for both developed and emerging economies.

Transit agencies, entertainment venues, and tourism operators increasingly deploy QR ticketing to replace paper tickets and reduce dependence on proprietary smart cards. Modern cloud platforms support instant QR code generation, secure validation, and integration with popular payment applications, including Paytm, Alipay, Apple Wallet, and Google Wallet.

QR systems also enable dynamic fare adjustments, real-time usage analytics, and effortless digital sharing, which makes them ideal for multimodal transport and event access. Their flexibility, combined with global smartphone penetration, positions QR-based ticketing as a major driver of rapid digital adoption across fragmented markets worldwide.

The E-Ticket segment leads the global market with a 38% share in 2025, driven by rapid digitalization and the shift toward mobile-first ticketing ecosystems. Its strength lies in eliminating the need for physical card production, reducing operational costs, and supporting sustainability goals through fully paperless processes.

Seamless integration with mobile apps and digital wallets such as Apple Pay and Google Pay has accelerated mass adoption across major transit systems. The segment’s software-centric nature also enables faster feature updates, easier scaling, and enhanced data analytics for dynamic pricing, demand forecasting, and personalized passenger engagement.

As consumer familiarity with QR-based validation increases, E-tickets continue to replace asset-heavy legacy systems worldwide.

NFC technology is the dominant smart ticketing enabler, holding about 45% of the technology market in 2025 due to its fast, secure, tap-and-go transaction capability. Its encrypted data transfer, low latency, and seamless compatibility with smartphones and wearables provide a superior user experience compared to QR and RFID alternatives.

NFC’s ability to function without precise alignment significantly reduces bottlenecks during peak travel hours and supports high-throughput environments such as metro stations and bus networks. With transactions expected to grow from 11.2 billion in 2025 to 44.8 billion by 2030, NFC adoption is being further strengthened by 5G expansion and smart city initiatives that prioritize reliable, contactless mobility infrastructure.

Smart card systems remain the leading platform, accounting for roughly 52% of the market in 2025, supported by decades of infrastructure investment and well-established standards. Their continued dominance stems from strong security features, offline processing capabilities, and broad interoperability across buses, metros, and commuter rail networks in major cities.

Smart cards are particularly valuable in regions with inconsistent connectivity, enabling reliable validation without real-time network access. Advances in card readers and IoT-enabled terminals further enhance system durability and reduce maintenance requirements. While open-loop payments are gaining momentum, the entrenched installed base and regulatory familiarity ensure that smart cards will remain central to many transit networks over the next several years.

The transportation sector dominates the smart ticketing market with a 51% share in 2025, driven by the global push toward modern, scalable fare collection across metros, buses, railways, and integrated mobility services. Rising urban populations and increasing ridership volumes require efficient systems capable of handling high transaction loads while improving passenger flow and revenue protection.

Smart ticketing provides operators with critical data for route optimization, demand forecasting, and dynamic fare strategies that enhance operational efficiency. The sector’s strong regulatory oversight and long-term infrastructure planning further support continued technology upgrades. As multimodal platforms expand and cities pursue seamless mobility frameworks, transportation remains the primary catalyst for widespread smart ticketing adoption.

North America roughly accounts for 28% of the global smart ticketing market in 2025, supported by advanced digital payment readiness, early adoption of mobile and contactless technologies, and sustained federal and state-level investment in public transit modernization.

Major urban regions such as New York, San Francisco, Washington D.C., and Los Angeles continue to lead deployment of integrated fare systems that combine mobile ticketing, EMV acceptance, and real-time ridership analytics.

Transit authorities increasingly prioritize account-based ticketing, fare capping mechanisms, and multimodal integration to enhance service efficiency and promote equitable fare structures.

The region also benefits from a strong technology ecosystem centered in Silicon Valley, Seattle, and Boston, driving continuous improvements in cybersecurity, biometric authentication, cloud-native architectures, and blockchain-based ticketing validation. Commercial sports and entertainment venues contribute to innovation through interactive ticketing and identity-linked access solutions.

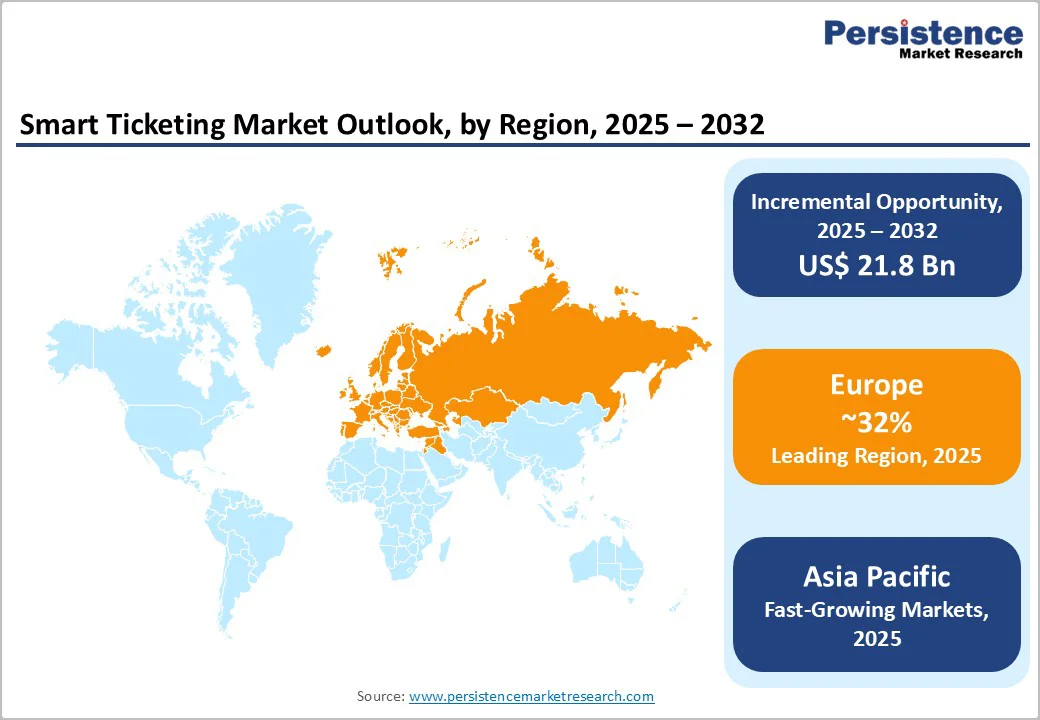

Europe maintains the largest share of the global smart ticketing market with about a 32% share in 2025, reflecting its mature mobility networks, extensive public transportation usage, and strong regulatory emphasis on interoperability and data protection.

Countries such as Germany, the United Kingdom, France, and Spain continue to lead the adoption of digital fare media, supported by unified standards and long-standing smart card ecosystems that are now transitioning toward mobile, EMV-based, and account-based ticketing models.

Ongoing investments in semiconductor manufacturing and secure digital payment infrastructure reinforce the region’s ability to support long-term expansion with reliable supply chains. European policies, including GDPR and open-loop payment directives, accelerate integration across operators and cross-border mobility corridors, making seamless travel a regional priority.

The rapid incorporation of IoT and LTE Advanced & 5G capabilities into transportation systems enhances real-time monitoring, multimodal coordination, and sustainable mobility objectives.

Asia-Pacific stands as the fastest-growing region in the smart ticketing market, projected to expand at 16.9% CAGR through 2030, propelled by rapid urbanization, government-led digital public infrastructure programs, and aggressive transit network expansion.

China leads regional growth with large-scale integration of mobile transit payments, nationwide interoperability mandates, and advanced metro and high-speed rail systems that are embedding account-based architectures.

India follows with strong momentum due to extensive metro expansion, high smartphone penetration, and digital payment ecosystems that support a QR code-based scan-and-pay system without the need for legacy hardware.

Japan and South Korea continue to advance highly mature ticketing systems focused on seamless intermodal connectivity and user convenience, while Australia’s rollouts of account-based platforms reflect broader demand for vendor-agnostic and interoperable solutions. Asia-Pacific’s market expansion is supported by regional manufacturing advantages, strong mobile adoption, and integration of smart ticketing into broader 5G and smart cities frameworks.

The global smart ticketing market is slightly fragmented, with the top tier of providers holding roughly one-fifth of total share in 2024. The landscape remains fragmented due to diverse product categories, technology layers, and regional procurement models, allowing specialized vendors to retain strong positions through niche capabilities and localized integration expertise.

Market structure is increasingly shaped by open-architecture platforms that minimize vendor lock-in and support flexible combinations of hardware, software, and payment technologies. Strategic collaborations between transit agencies, technology developers, and payment networks are becoming central to ecosystem development, enabling unified mobility experiences across multimodal transport.

Cloud-native fare collection systems, mobile-first designs, and interoperability frameworks are strengthening the competitiveness of emerging players, particularly in regions with highly distributed transit operations. Industry-wide investment priorities emphasize biometric verification, AI-driven fraud detection, secure digital identity, and dynamic pricing engines, with chip-level innovation and expanded regional manufacturing capacity further supporting long-term supply resilience.

The global smart ticketing market is valued at US$ 14.1 billion in 2025 and is projected to reach US$ 35.9 billion by 2032 at a CAGR of 14.3% in the forecast period.

Demand is driven by rising adoption of contactless payments, rapid post-pandemic digitalization, expanding urban transit usage, supportive government digital mobility initiatives, and advancements in NFC, RFID, and QR-based systems.

E-Ticket leads with approximately 38% market share in 2025 due to its paperless design, mobile integration, lower infrastructure costs, and seamless compatibility with digital wallets.

Europe leads with around 32% share in 2025, supported by advanced transit infrastructure, strong regulatory frameworks, and extensive smart mobility investments across major economies.

The Sports & Entertainment segment presents the largest opportunity, growing at 14.1% CAGR with strong demand for biometrics, dynamic pricing.

The market is moderately consolidated with leading positions held by companies such as Conduent, HID Global, Giesecke+Devrient, Cubic, and Thales Group, alongside emerging innovators like Littlepay, Masabi, Scheidt & Bachmann, and VIX Technology.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Technology

By System Type

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author