ID: PMRREP13213| 198 Pages | 17 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

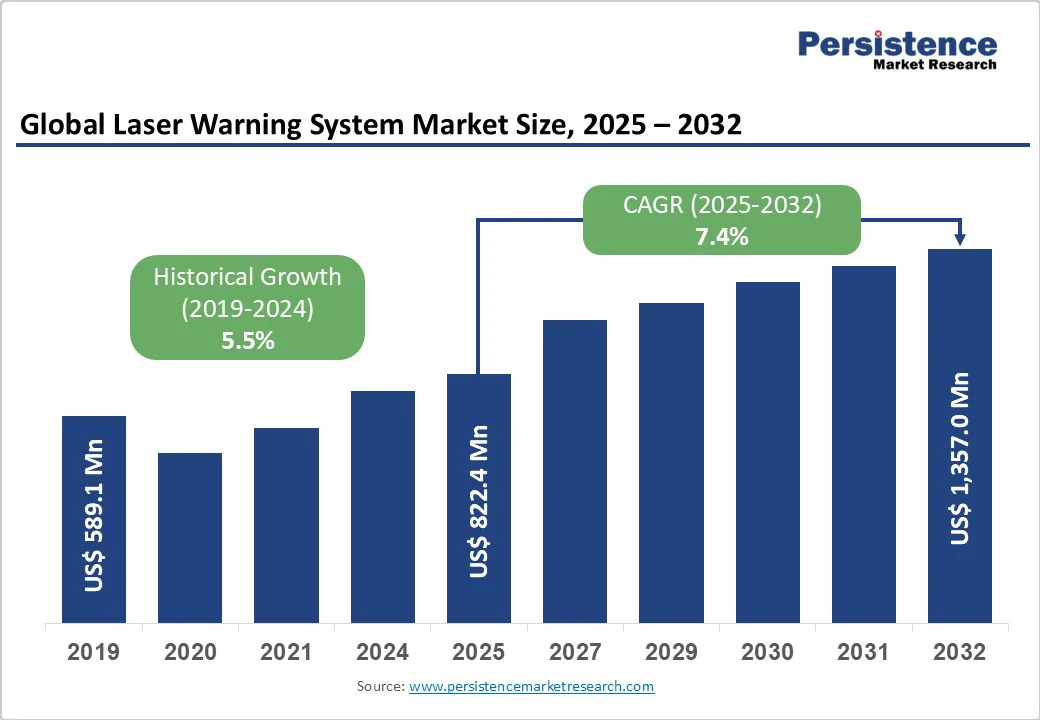

The global laser warning system market size is likely to be valued at US$822.4 Million in 2025 and is expected to reach US$1,357 Million by 2032, growing at a CAGR of 7.4% during the forecast period from 2025 to 2032, driven by increasing threats from guided missiles, laser designators, and anti-tank weapons, fueling the need for advanced early warning and countermeasure systems.

| Key Insights | Details |

|---|---|

|

Laser Warning System Market Size (2025E) |

US$822.4 Mn |

|

Market Value Forecast (2032F) |

US$1,357.0 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.5% |

Global defense budgets continue expanding at unprecedented rates, with military forces investing heavily in electronic warfare capabilities and countermeasure systems. Governments worldwide increased defense R&D allocations by over 9.4% in 2024, with combined global defense expenditure surpassing US$2.7 trillion. The U.S. allocated approximately US$1 billion specifically for the development of directed energy weapons, including laser systems in 2023, demonstrating a substantial government commitment to advanced defense technologies. This rising focus on directed energy weapons, advanced targeting, and electronic countermeasures is driving the demand for laser warning systems, as militaries seek reliable solutions to detect, track, and counter laser-based threats.

The growing complexity of modern combat environments marked by asymmetric threats, urban warfare, and the proliferation of portable laser designators among non-state actors has intensified the need for advanced defensive systems. Laser warning systems (LWS) provide early warnings against laser-guided threats, enabling timely countermeasures and reducing the risk of damage to personnel and equipment. The integration of LWS with broader defense networks, including electronic warfare and countermeasure systems, enhances situational awareness and coordination across military platforms.

For example, Israel announced that its advanced "Iron Beam" laser defense system will be operational by the end of 2025. Developed by Elbit Systems and Rafael Advanced Defense Systems, Iron Beam is designed to intercept aerial threats such as rockets, mortars, and drones using high-power lasers. This system offers a cost-effective complement to Israel’s existing defense systems, such as Iron Dome and David’s Sling.

Advanced laser warning systems require substantial financial investment due to sophisticated component requirements and extensive testing protocols. High-power laser diodes, advanced optics, and robust targeting systems contribute significantly to development expenses, potentially limiting adoption among budget-constrained military organizations. Research and development costs are elevated by comprehensive testing requirements, ensuring performance reliability across a wide range of combat scenarios.

Custom integration with encrypted communication buses (MIL-STD-1553, ARINC 429) requires extensive certification tests spanning 6–12 months. These long lead times increase the total cost of ownership and deter rapid upgrades, particularly for legacy platforms lacking modular architecture. Sophisticated laser warning systems demand specialized expertise for installation, maintenance, and operation, potentially limiting deployment capabilities. Compatibility requirements with legacy defense systems necessitate additional investment in platform modifications.

Next-generation military platforms such as sixth-generation fighter jets, advanced naval ships, and autonomous ground vehicles require integrated laser warning capabilities from the design stage, creating new adoption opportunities. Space-based defense applications are emerging as nations develop systems to protect satellites from laser threats. Urban warfare and border security platforms increasingly use laser warning technologies for real-time threat detection, enhancing situational awareness and survivability. This broad integration across multiple domains is driving technological innovation and expanding market potential.

AI and ML integration enables faster and more accurate threat detection, reducing false alarms and optimizing response actions. Advanced signal processing enhances detection range and system performance, surpassing current capabilities. Networked defense system integration allows for comprehensive situational awareness and coordinated countermeasures. Embedding ML models within sensor firmware supports predictive threat classification and automatic activation of defensive measures, enhancing operational efficiency and platform survivability.

Passive laser warning systems are expected to account for more than 56% share in 2025, benefiting from established deployment patterns and cost-effectiveness considerations. They provide continuous, real-time threat detection without emitting signals, ensuring stealth and reducing the risk of enemy targeting. Their low maintenance, reliability in diverse environments, and compatibility with multiple platforms make them highly preferred.

Active laser warning systems are expected to grow at a significant rate due to increasing battlefield complexity. They provide immediate alerts and precise location data of incoming laser threats, enabling rapid countermeasures. The rise of advanced guided munitions and portable laser designators has increased demand for proactive defense capabilities. Active systems provide enhanced accuracy and extended detection ranges, particularly valuable for high-priority military platforms requiring comprehensive threat coverage.

The 700 - 1,400 nm wavelengths are expected to account for over 52% share in 2025 due to their alignment with the most common laser threat sources, including military-grade rangefinders, designators, and targeting lasers. Systems operating in this range can effectively detect and alert against threats in both land and airborne platforms, meeting the critical need for early warning and crew protection. This range balances sensitivity and reliability, ensuring timely countermeasure activation without excessive false alarms. Advanced InGaAs sensor technologies provide quantum efficiency exceeding 70% across this spectral range, ensuring reliable threat detection.

The 1,400 - 1,700 nm wavelength range is seeing the fastest growth due to its superior performance in detecting advanced laser threats, including those from modern targeting and designator systems. This range offers better atmospheric transmission and reduced interference from sunlight, improving detection accuracy in diverse operational environments. Integration with next-generation sensors and AI-driven threat assessment tools drives higher adoption of this wavelength range.

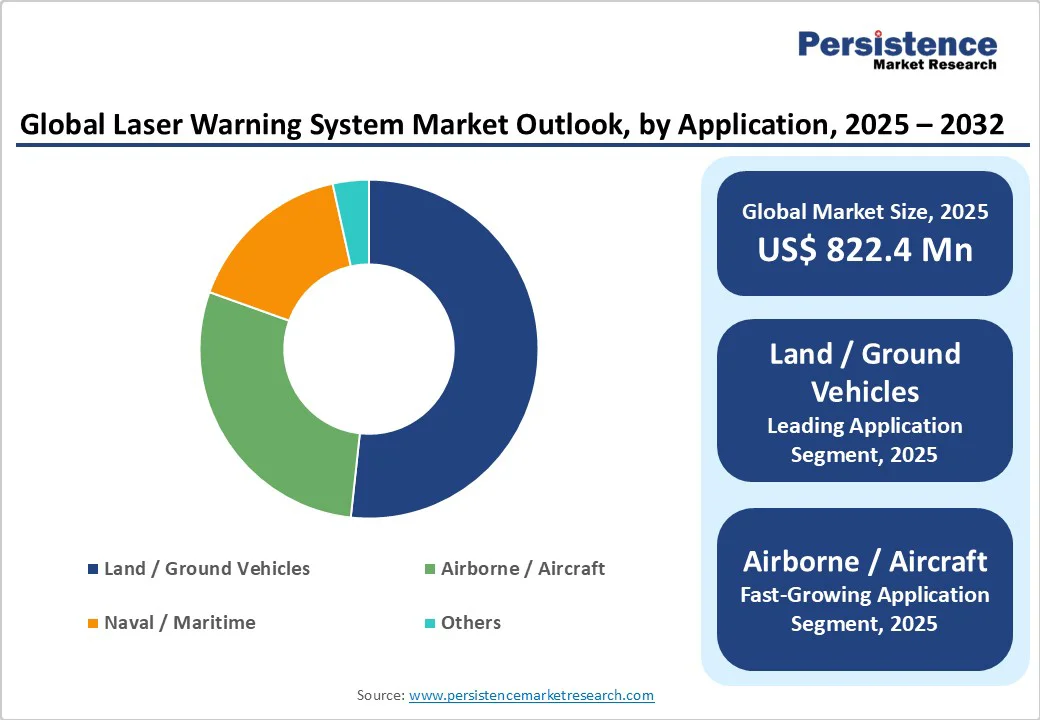

Land/Ground vehicles are expected to account for more than 45% share in 2025, as they face constant threats from guided missiles, laser designators, and anti-tank weapons in diverse combat environments. The increasing deployment of armored vehicles in urban warfare and asymmetric conflict zones drives the need for early laser threat detection. Ground forces require systems that enhance situational awareness, improve crew survivability, and enable timely countermeasures.

Airborne/Aircraft represent the fastest-growing segment as they are increasingly exposed to advanced threats such as laser-guided missiles, UAV-based targeting, and portable laser designators, creating a critical need for rapid detection and countermeasures. Modern aerial missions demand enhanced situational awareness, precise threat localization, and automated defensive responses to ensure crew and asset survival. The rising adoption of networked air defense and multi-role aircraft requires the integration of laser warning systems for comprehensive protection.

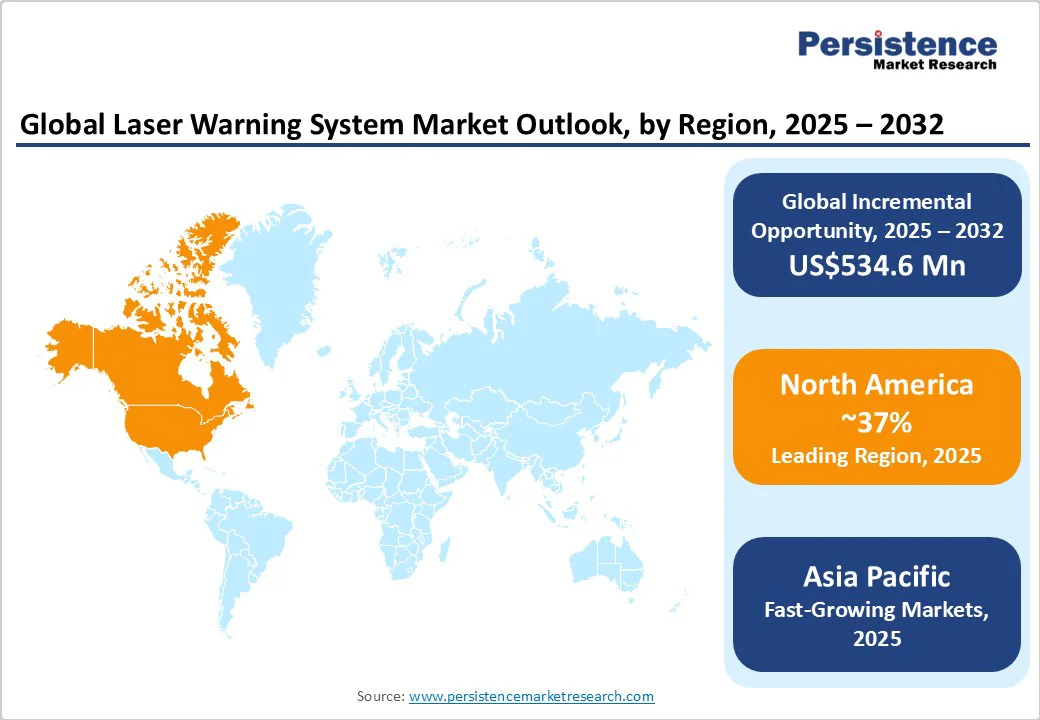

North America is expected to account for over 37% share in 2025, driven by substantial U.S. defense spending and technological leadership. Advanced research institutions and established supply chains support continuous innovation and rapid deployment. For example, in December 2023, Danbury Mission Technologies was awarded a US$136 Million, 5-year IDIQ contract by the U.S. Army to deliver AN/VVR-4 Laser Detecting Systems for multiple ground vehicles, including test hardware and support services. The AN/VVR-4, developed in Danbury, provides advanced battlefield awareness and survivability, meeting current and future Army requirements.

Canada’s procurement of Arctic surveillance platforms and Mexico’s border security upgrades represent emerging pockets of growth. A robust innovation ecosystem, driven by DARPA initiatives, accelerates sensor technology maturation, while regulatory frameworks, MIL-STD compliance, and joint-service certification boards ensure high reliability but extend deployment timelines.

Asia Pacific is the fastest-growing market, driven by extensive defense modernization initiatives across China, India, and regional allies. China’s 2025 defense budget rose by 7.2% to approximately US$245 Billion, with major investments in high-altitude warfare capabilities and advanced surveillance systems.

India’s cumulative defense spending is projected to exceed US$535 Billion during 2026-2030, emphasizing military modernization and technology acquisition. Regional geopolitical tensions, including China-India border disputes, further drive defense investments. Japan and South Korea contribute through advanced technology adoption and platform modernization programs, while ASEAN nations increasingly prioritize defense upgrades, creating additional market opportunities.

European Defense Fund mandates requiring interoperability and standardization across EU member states create structured market opportunities. Germany and France lead European investment in military laser weapon development, driving corresponding demand for warning systems.

The U.K.'s recent investment in laser warning receiver technology for space systems demonstrates expanding application scope. Thales and BAE Systems' collaboration on advanced defense technologies reinforces regional technological capabilities. European focus on indigenous defense capabilities and reduced foreign technology dependence supports market growth.

The global laser warning system market is moderately consolidated, with a few major defense technology companies dominating global supply through advanced R&D and long-term government contracts. Leading manufacturers focus on strategic collaborations, product differentiation through AI and sensor fusion, and platform integration across air, land, and naval systems to strengthen market position. Companies also pursue localized production partnerships to meet regional defense procurement norms and expand aftermarket service capabilities for lifecycle support.

The laser warning system market size is projected to be valued at US$822.4 Mn in 2025.

The growing need for enhanced situational awareness and crew survivability against laser-guided threats is a key driver of the laser warning system market.

The market is poised to witness a CAGR of 7.4% from 2025 to 2032.

AI-driven threat detection and integration with networked defense systems create strong growth opportunities.

BAE Systems, Elbit Systems Ltd., Leonardo S.p.A., Thales Group, Saab AB, and Hensoldt AG are among the leading key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By System

By Wavelength

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author