ID: PMRREP11227| 217 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

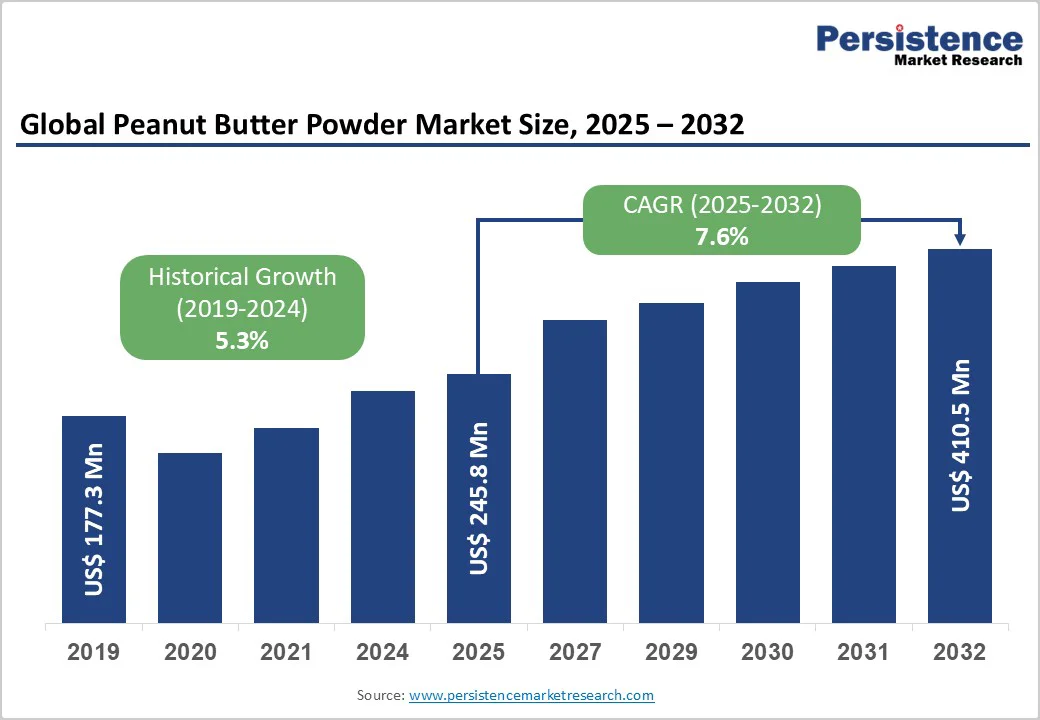

The global peanut butter powder market size is likely to be valued at US$245.8 Million in 2025 and is expected to reach US$410.5 Million by 2032, growing at a CAGR of 7.6% during the forecast period from 2025 to 2032, driven by rising demand for high-protein, low-fat, plant-based foods, growing health and wellness awareness, versatile applications in food and beverages, and expanding e-commerce and retail distribution channels.

| Key Insights | Details |

|---|---|

| Peanut Butter Powder Market Size (2025E) | US$245.8 Mn |

| Market Value Forecast (2032F) | US$410.5 Mn |

| Projected Growth (CAGR 2025 to 2032) | 7.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.3% |

A global dietary shift toward plant-forward eating is amplifying interest in peanut butter powder as a protein-dense, vegan-friendly ingredient. The rise of veganism and flexitarian lifestyles reflects a broader movement away from animal-derived products toward sustainable and nutritionally balanced options.

Peanut butter powder fits seamlessly into this transition, offering high protein with lower fat content than traditional peanut butter. It appeals to consumers seeking clean-label, minimally processed, and plant-based nutrition for shakes, smoothies, and baked foods.

Additionally, as flexitarian consumers increasingly substitute animal proteins with plant alternatives, brands are leveraging peanut butter powder in functional foods and meal replacements. This evolving preference for plant-based nourishment continues to anchor peanut butter powder as a key ingredient in the modern protein economy.

Volatile peanut harvests have become a growing concern for manufacturers of peanut butter powder, directly influencing production stability and profitability. Climate variability, unpredictable rainfall, and pest infestations often cause inconsistent yields across major peanut-producing regions such as the U.S., India, and China.

These fluctuations trigger raw material price swings that disrupt procurement planning and elevate manufacturing costs. For producers operating in highly price-sensitive markets, such instability compresses margins and challenges supply chain efficiency.

Export restrictions and logistical bottlenecks during poor harvest seasons further compound cost pressures. As global demand for plant-based protein rises, sustaining profitability amid erratic peanut prices forces companies to re-evaluate sourcing strategies and invest in risk mitigation through diversified supply networks.

Collaborations between peanut butter powder producers and bakery, dessert, or smoothie brands are emerging as a powerful strategy to expand visibility and consumer reach. By co-developing recipes and co-branded offerings, companies can integrate peanut butter powder into indulgent yet health-conscious formats such as protein muffins, smoothie blends, and frozen desserts.

These partnerships create an avenue to position peanut butter powder as both a flavor enhancer and a functional ingredient rich in protein and essential nutrients. For startups, aligning with established foodservice or retail brands accelerates market entry and builds credibility with target audiences. Larger players can leverage these alliances to diversify product portfolios, foster brand storytelling, and tap into cross-category demand for nutritious, versatile plant-based formulations.

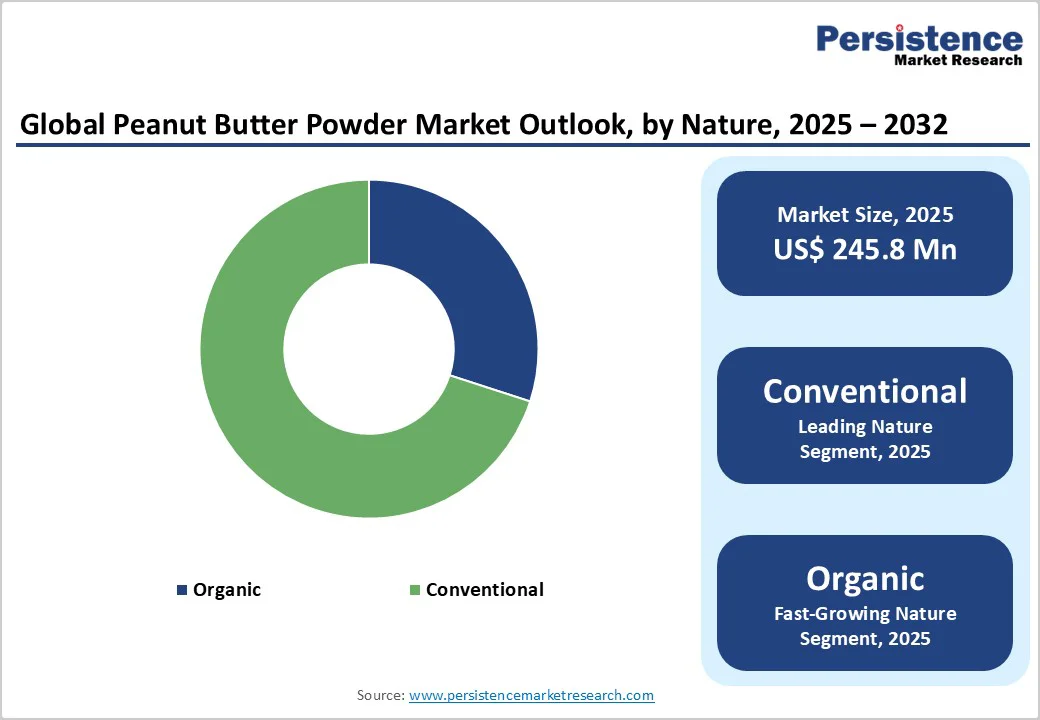

Organic peanut butter powder is projected to grow at a CAGR of 9.4% during the forecast period, driven by accelerating consumer preference for clean-label, chemical-free protein sources. Health-conscious buyers increasingly view organic certification as a marker of purity and transparency, reinforcing demand for products made without synthetic pesticides or additives. Growing awareness of sustainable farming and environmental responsibility further boosts the appeal of organic variants among eco-aware consumers.

Retailers and food manufacturers are incorporating organic peanut butter powder into snacks, smoothies, and meal replacements to align with this wellness-driven purchasing behavior. As consumers trade up for authenticity and traceability in plant-based proteins, the organic segment is positioned to capture premium value through credibility, ethical sourcing, and superior nutritional perception.

Hypermarkets/Supermarkets hold approximately 61% market share as of 2024, reflecting their dominance as the preferred distribution channel for peanut butter powder worldwide. These large-format retailers offer extensive brand visibility, attractive pricing, and the advantage of product sampling, encouraging impulse and repeat purchases among health-focused consumers. Their established supply networks and growing emphasis on stocking protein-rich, plant-based products further strengthen category penetration.

Specialty stores play an important role in promoting premium and organic peanut butter powders, catering to niche audiences seeking clean-label options. Online retail channels, meanwhile, are gaining traction due to convenience, broader product selection, and subscription-based delivery models. The physical retail environment continues to anchor consumer trust through tactile product experience and established brand familiarity.

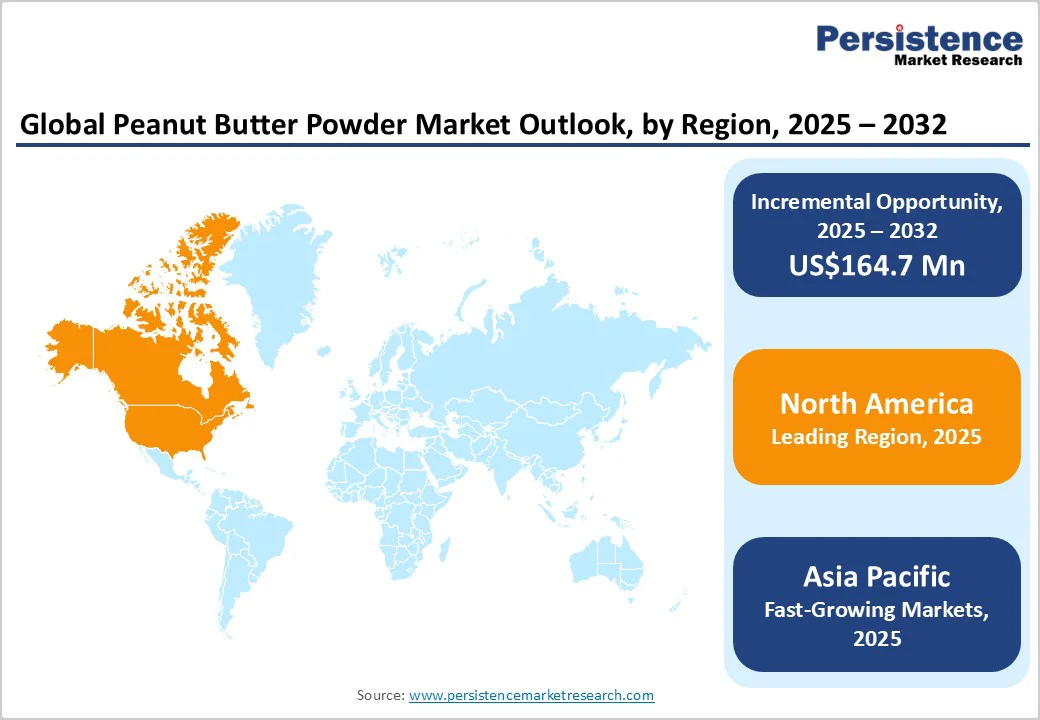

North America holds approximately 44% market share in the market, supported by strong consumer interest in protein-enriched and low-fat food options. In the U.S., the trend toward convenient, shelf-stable plant proteins is accelerating demand across sports nutrition, baking, and meal replacement segments. Consumers are increasingly using peanut butter powder in smoothies, oatmeal, and snacks as a clean-label alternative to traditional spreads.

In Canada, rising awareness of allergen-friendly and organic formulations is influencing product innovation and private-label expansion. Leading brands such as PB2 Foods, Crazy Richard’s, and PBfit are focusing on flavor diversification, sugar reduction, and eco-conscious packaging. These trends reflect a broader shift toward functional nutrition, transparency, and sustainability across North American food choices.

The Asia Pacific peanut butter powder market is expected to grow at the highest CAGR, driven by rising urbanization, expanding middle-class income, and the growing appeal of Western-style nutrition. In India, fitness-conscious consumers are incorporating peanut butter powder into protein shakes and home baking, while China’s demand is being propelled by the booming e-commerce sector and interest in clean-label snacks.

Southeast Asian markets are witnessing innovation in flavored peanut powders for smoothies and instant mixes tailored to local taste preferences. In Japan, manufacturers are promoting peanut butter powder as a low-fat, versatile ingredient suited for both traditional and modern cuisines. Increasing consumer awareness of plant-based proteins and sustainable sourcing continues to fuel market expansion across diverse dietary cultures in the region.

The global peanut butter powder market remains moderately consolidated, with a mix of established brands and emerging innovators competing on quality, functionality, and sustainability. Leading players are strengthening their market positions through vertical integration, allowing better control over sourcing, production, and pricing stability. Companies are investing in advanced drying and flavor-retention technologies to improve texture and nutrient density.

Startups are emphasizing certified organic farming and clean-label formulations to attract health-driven consumers. Many producers are securing USDA Organic, Non-GMO, and allergen-free certifications to reinforce brand trust. Across the sector, strategic collaborations, private-label expansion, and sustainable packaging initiatives are defining competition, as companies aim to align with evolving global trends in plant-based nutrition.

The peanut butter powder market is projected to be valued at US$245.8 Million in 2025.

Increasing adoption of vegan and flexitarian lifestyles is a key factor driving growth in the peanut butter powder market.

The confectionery market is projected to grow at a CAGR of 7.6% between 2025 and 2032.

Partnering with bakery, dessert, or smoothie brands to develop co-labeled recipes is the key market opportunity.

Major players in the peanut butter powder market include PB2 Foods, BetterBody Foods, Augason Farms, Crazy Richard’s, Naked Nutrition, and Peanut Butter & Co.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Nature

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author