ID: PMRREP20110| 220 Pages | 21 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

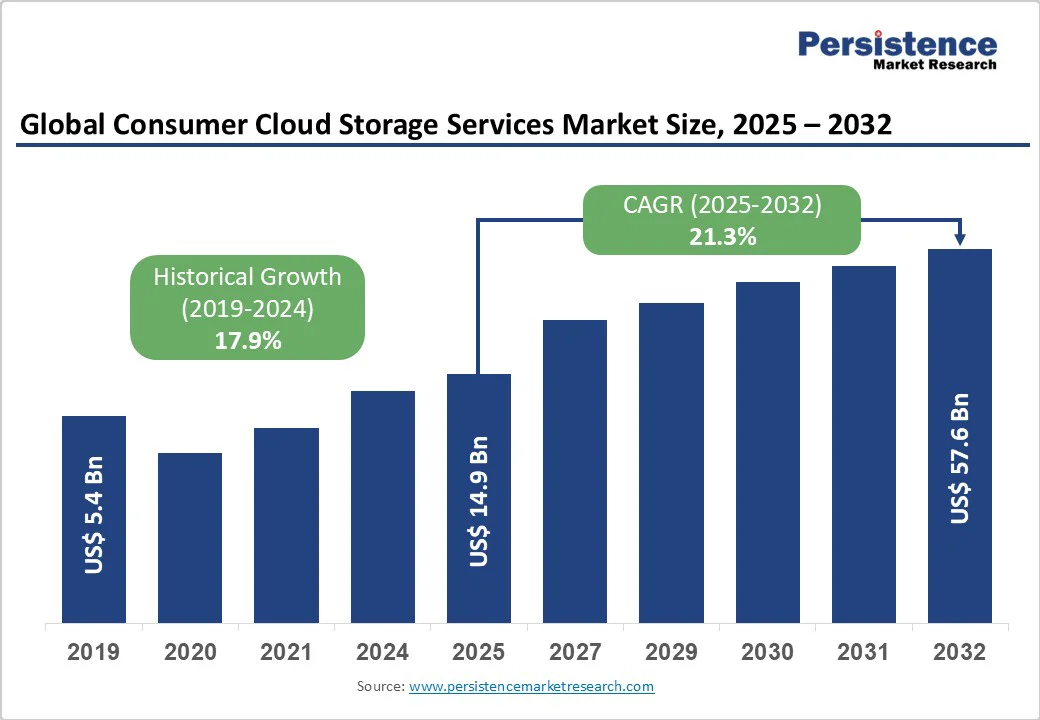

The global consumer cloud storage services market size is likely to be valued at US$14.9 Billion in 2025 and is expected to reach US$57.6 Billion by 2032 growing at a CAGR of 21.3% during the forecast period from 2025 to 2032, driven by escalating digital content creation, widespread adoption of cloud-based applications, and the increasing demand for low-cost, scalable, and accessible data storage solutions.

Technological advancements such as AI integration and evolving consumer behavior toward remote access underpin market expansion, alongside regulatory frameworks encouraging data security and privacy compliance globally.

| Key Insights | Details |

|---|---|

| Consumer Cloud Storage Services Market Size (2025E) | US$14.9 Bn |

| Market Value Forecast (2032F) | US$57.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 21.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 17.9% |

Rising digital content creation and remote work adoption are driving demand for flexible, scalable consumer cloud storage solutions. According to the World Economic Forum, global data generation is projected to reach hundreds of exabytes daily by 2025, necessitating flexible and scalable storage solutions.

The widespread adoption of remote work and mobile connectivity further boosts cloud storage use by enabling seamless data access and collaboration across geographies. This adaptation to remote working norms enhances consumer reliance on cloud ecosystems, directly impacting market revenues and accelerating service demand.

Technological innovation in cloud infrastructures, including improvements in storage virtualization, AI-driven data management, and encryption technologies, enhances cloud storage efficacy. Hybrid cloud models, integrating on-premises and public cloud resources, offer optimized cost management and data security, catering to the needs of diverse consumer segments. These advancements support data accessibility, disaster recovery, and latency requirements, supporting hybrid and public cloud deployments particularly.

The evolution of cloud-native storage interfaces and container orchestration fosters use-case versatility, making cloud storage services more attractive and structurally integral to consumer and SMB operations.

Governments and international bodies have implemented stringent regulations mandating data protection and user privacy, driving cloud providers to deploy enhanced security features.

Frameworks such as GDPR in Europe and data localization laws in multiple regions enforce compliance, propelling providers toward secure, transparent service offerings. These measures bolster consumer confidence, facilitating adoption and retention through verified safeguarding of sensitive information. Regulatory emphasis on cybersecurity thus catalyzes investments into cloud infrastructure resilience, benefiting the consumer cloud storage market's stability and trustworthiness.

Scaling global data centers to meet surging demand entails significant capital expenditure. Power, cooling, and real-estate costs account for over 60% of total operational expenses. In 2024, leading providers reported a 12% increase in infrastructure spending year-over-year, squeezing margins. This financial strain compels firms to balance capacity expansion with cost control, potentially delaying entry into emerging regions.

National data residency laws restrict cross-border data flow, necessitating localized data centers or partnerships. Over 75 countries enacted or proposed data localization regulations by 2025.

Compliance requirements introduce legal and technical overhead up to 8% of annual revenue in legal costs, dampening ROI for global expansions. Providers must navigate a patchwork of regional statutes, complicating service deployment and standardization.

Emerging markets in Southeast Asia and Latin America exhibit broadband subscription growth rates in 2024, according to the World Bank. Local cloud-native platforms can capture underserved segments by offering regional data residency and localized language support.

Partnerships with telecom operators to bundle storage with mobile data plans can drive user acquisition; for instance, in Brazil, a 2024 MVNO-cloud bundle pilot saw a 22% uplift in new subscriptions. Service providers that integrate offline synchronization and tiered caching can address latency constraints, unlocking new customer cohorts.

Integration of cloud storage with productivity suites, photo-editing apps, and personal finance tools fosters ecosystem lock-in. Google’s announcement in 2025 of 10 GB of bundled storage with its workspace platform led to a 12% boost in paid subscriptions for standalone storage services.

Collaborative editing and AI-powered photo organization features are key differentiators. The advent of consumer-centric blockchain-based file ownership and NFT-style metadata can create new value-added offerings and revenue streams by enabling verified digital asset management.

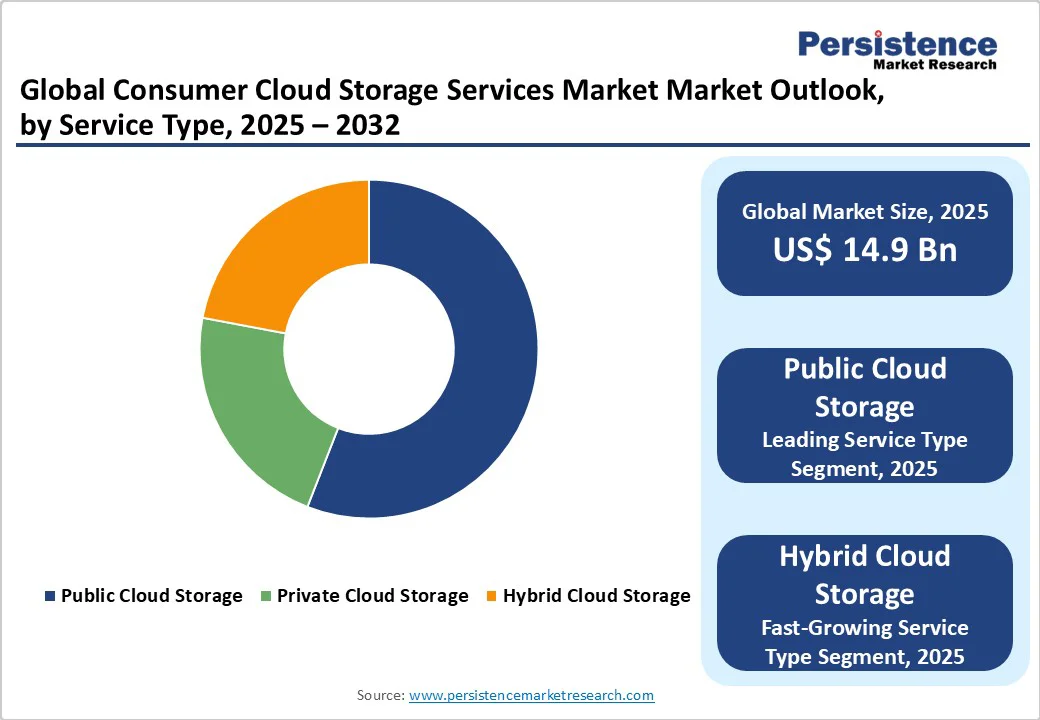

Public cloud services are anticipated to account for approximately 65% of total revenue in 2025, driven by global providers offering cost-efficient, multi-tenant architectures. The public segment benefits from extensive CDN networks AWS reports 230 edge locations by 2024, ensuring low-latency access.

Users leverage free-tier entry points, with paid plan conversion rates of 16-18% per region. Scalability and rapid feature rollout cycles accelerate adoption in photo-and-video-intensive use cases. Hybrid storage holds a significant share as consumers demand a balance of local device backups and encrypted cloud vaults. Services such as Microsoft OneDrive’s Files On-Demand enable seamless offline access while maintaining encrypted cloud archives.

Hybrid offerings mitigate latency issues in areas with lower bandwidth by caching frequently accessed files locally, enhancing performance and reliability for geographically dispersed users.

Web interfaces remain the primary access point, capturing nearly 60% of usage in 2025. Browser-based upload and download operations facilitate cross-platform compatibility without client installation. Major providers report average session durations of 12 minutes per user per week via web portals, reflecting reliance on browser workflows for file management. Web-first architectures benefit from progressive web app enhancements, enabling offline functionality without full desktop clients.

Mobile client usage surges at a 22% annual rate in 2025, spurred by smartphone penetration of 84% in developing economies per GSMA Intelligence. Mobile-first features such as automatic camera roll backup and selective folder synchronization drive user engagement. Google Photos mobile app surpassed 2 billion installs by mid-2025, illustrating consumer preference for on-device backup convenience.

Personal users are expected to dominate with an 80% share in 2025, leveraging cloud storage for personal media, document backups, and cross-device syncing. Average storage consumption per user reached 25 GB in 2024, with photo/video content comprising 68% of volume. Providers tailor consumer-focused plans offering family sharing and media-streaming integration to maximize engagement and encourage plan upgrades.

The home office segment expands with a significant growth rate, as freelancers and micro-enterprises adopt cloud storage for document collaboration and secure file sharing. Remote work adoption plateaued at 31% of the global workforce in 2024 per ILO data, sustaining demand for affordable, business-grade storage features such as granular permission controls and audit logs.

Plans up to 50 GB are projected to hold a 50% share in 2025, catering to casual users needing limited backup for documents and low-resolution media. Pricing for 50 GB tiers averages US$1.99/month globally, making it a cost-effective choice. This segment benefits from promotional campaigns bundled with device purchases, e.g., smartphone manufacturers offering 15-50 GB of free cloud storage for 12 months.

Mid-tier plans record a 23% annual uptake rate, meeting the needs of users with larger multimedia libraries. Average usage in this bracket reached 320 GB in 2024, driven by anecdotal increases in smartphone camera resolutions and 4K video capture. Promotional bundling with productivity subscriptions (Microsoft 365) further accelerates mid-tier adoption.

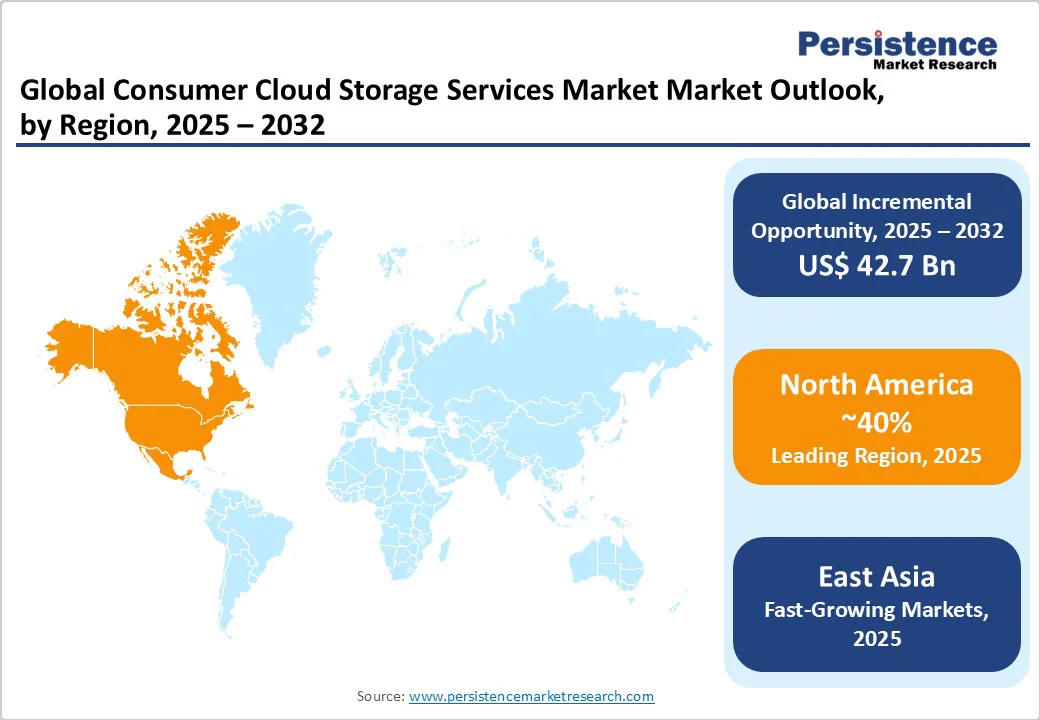

East Asia represents the fastest-growing segment with 15% of the global revenue in 2025. China leads with 35% of the regional consumption, supported by 1.02 billion broadband subscriptions in 2024, according to the Ministry of Industry and Information Technology.

Domestic providers such as Tencent Cloud and Alibaba Cloud offer localized data residency, with 91% of users preferring in-country storage to comply with cybersecurity law requirements. Japan’s fixed broadband speeds averaged 286 Mbps in 2024, facilitating high-volume cloud backups.

South Korea’s 5G-enabled mobile backup services account for 18% of total mobile storage transactions in 2025. Regulatory frameworks such as China’s Multi-Level Protection Scheme enforce data security standards, elevating consumer trust in local platforms.

North America is projected to dominate with 40% of the global revenue in 2025. High ARPU levels averaging US$28.80/month reflect premium plan take-up among tech-savvy consumers. The U.S. and Canada registered 94% fixed broadband penetration in 2024, according to FCC and CRTC data, enabling seamless cloud experiences.

Apple iCloud leads with 34% consumer share, followed by Google Drive at 25% and Dropbox at 15%. The U.S. CLOUD Act has established data access protocols, prompting service providers to enhance transparency reports and user consent mechanisms.

Strategic partnerships between telecom operators, e.g., AT&T, Verizon, and the EU’s Data Act proposal, expected to pass in 2025, will mandate in The EU’s Data Act and cloud providers for bundled storage offerings contribute to a 12% uplift in subscriptions in 2024.

Europe is anticipated to hold a 25% market share in 2025. The EU Digital Strategy’s data sovereignty provisions have driven onshore cloud storage growth, with 64% of consumers opting for GDPR-compliant services.

Germany and France account for 42% of regional revenues, leveraging mature broadband infrastructures offering average fixed speeds above 225 Mbps. The U.K.’s Ofcom reported 91% household broadband coverage at speeds over 30 Mbps in 2024, supporting widespread cloud adoption.

Local providers such as Nextcloud and Tresorit gained traction by offering end-to-end encryption and self-hosted options. The EU’s Data Act proposal, expected to pass in 2025, will mandate interoperability standards, presenting new opportunities for multi-cloud service integrators.

The global consumer cloud storage services market is oligopolistic, dominated by a few major players such as Google (Google One), Apple (iCloud), Microsoft (OneDrive), Amazon (Amazon Drive), Dropbox, and pCloud. These companies leverage strong brand recognition, extensive cloud infrastructure, and integration with existing ecosystems to maintain significant market shares.

They continue to innovate by introducing AI-enhanced features, enhanced security, seamless cross-platform compatibility, and flexible subscription plans to attract and retain users. High infrastructure costs and regulatory scrutiny, such as antitrust investigations in the U.K., create barriers for new entrants. The market is concentrated, competitive, and driven by technological differentiation and consumer trust.

The consumer cloud storage services market is projected to be valued at US$14.9 Billion in 2025.

Public Cloud Storage is expected to hold a 65% market share in 2025, driven by its cost-efficiency, scalability, and widespread adoption across consumer applications.

The consumer cloud storage services market is poised to witness a CAGR of 21.3% from 2025 to 2032.

Consumer cloud storage services market growth is driven by rising digital content, remote work adoption, cloud technology advancements, hybrid cloud models, and strong regulatory support for data privacy and security.

Key market opportunities in the consumer cloud storage services market include expanding into emerging markets with localized solutions and partnerships, and integrating cloud storage with adjacent services such as productivity apps, AI-powered tools, and blockchain-based digital asset management to create new value-added offerings.

Key players include Google (Google Drive), Apple (iCloud), Microsoft (OneDrive), Amazon (Amazon Drive), Dropbox, and pCloud.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data | 2019 to 2024 |

| Market Analysis | US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Landscape |

|

| Report Highlights |

|

By Service Type

By Deployment Mode

By Storage Capacity

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author