ID: PMRREP3542| 185 Pages | 20 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

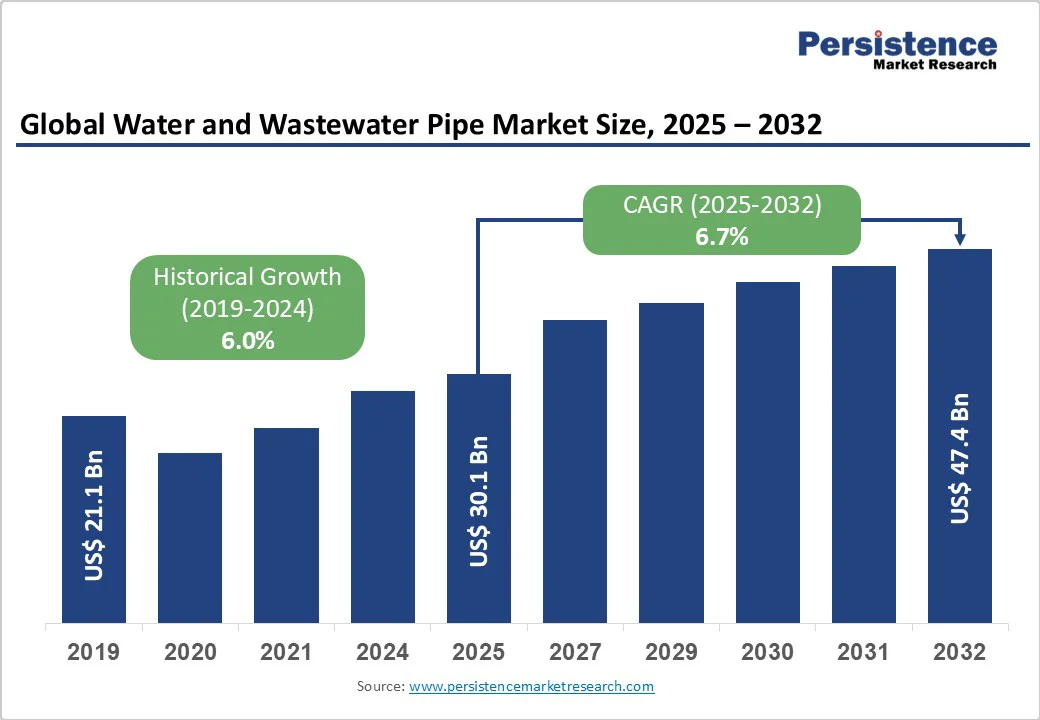

The global water and wastewater pipe market size is likely to be valued at US$ 30.1 billion in 2025, and is projected to reach US$ 47.4 billion by 2032, growing at a CAGR of 6.7% during the forecast period 2025 - 2032, owing to the critical role of water infrastructure in supporting global urbanization, industrial development, and climate resilience initiatives across major economies.

The expansion of the market is driven by unprecedented infrastructure modernization requirements, with ageing water systems requiring comprehensive overhaul across developed nations, while emerging economies invest heavily in new capacity development.

| Key Insights | Details |

|---|---|

| Water and Wastewater Pipe Market Size (2025E) | US$ 30.1 Bn |

| Market Value Forecast (2032F) | US$ 47.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.0% |

Water pipe infrastructure currently faces unprecedented renewal requirements, as systems installed during the mid-20th century approach end-of-life conditions. North American utilities experience approximately 260,000 water main breaks annually, resulting in US$ 2.6 billion in repair costs.

The United States alone requires an estimated US$ 452 billion to replace ageing water mains, with 20% of installed systems beyond their useful lives. European water networks similarly demand substantial investment, with the European Investment Bank (EIB) allocating € 15 billion during 2025 - 2027 for water infrastructure modernization.

These replacement programs have created a sustained demand for advanced pipe materials offering superior durability, corrosion resistance, and operational efficiency compared to legacy infrastructure.

Stringent water quality regulations drive systematic infrastructure upgrades across global markets. For example, the European Union (EU)'s revised Drinking Water Directive, effective in 2027, mandates enhanced safety standards for materials contacting drinking water, requiring uniform certification processes across member states.

In China, the 14th Five-Year Plan emphasizes digital water infrastructure integration, with Smart Water solutions deployed in 70% of new wastewater treatment plants. Simultaneously, urbanization trends worldwide have generated an exponential demand for water infrastructure capacity expansion.

For instance, India's Jal Jeevan Mission has already provided tap water connections to 12.20 crore additional rural households as of February 2025, representing massive infrastructure deployment.

Fluctuating raw material prices, particularly for PVC resin, steel, and iron ore, create significant cost pressures throughout the pipe manufacturing value chain. The plastic pipe industry experiences periodic supply disruptions due to petrochemical feedstock availability constraints, affecting production scheduling and pricing stability.

Global supply chain disruptions impact material availability and transportation costs, particularly affecting international project delivery timelines and budget predictability. These cost volatilities challenge long-term infrastructure project planning and create budget uncertainty for municipal water authorities operating under strict fiscal constraints.

Water infrastructure projects require substantial upfront capital investments that often exceed municipal budget capacities. Developing economies face particular challenges accessing affordable financing for comprehensive pipe network modernisation, with global water infrastructure requiring up to US$ 7 trillion by 2030 to meet the Sustainable Development Goals (SDGs).

As a result, small and medium-sized water utilities encounter difficulty securing funding for proactive asset replacement, often deferring maintenance until emergency repairs become necessary. The complex regulatory approval processes and environmental assessment requirements further extend project timelines and increase development costs, limiting market accessibility for smaller-scale infrastructure initiatives.

The convergence of IoT sensors, artificial intelligence (AI), and data analytics creates transformative opportunities for intelligent pipe system management. Advanced leak detection technologies enable proactive maintenance strategies, reducing water losses that currently account for 19.5% of treated water in the United States.

Digital twin technologies and predictive analytics optimize pipe network performance, extending asset lifecycles and improving operational efficiency. Smart infrastructure integration enables real-time monitoring of pipe conditions, pressure variations, and water quality parameters throughout distribution networks.

Municipal utilities implementing comprehensive smart water systems report significant reductions in non-revenue water losses and improved customer service reliability. The growing emphasis on water conservation and resource efficiency will stoke the demand for intelligent pipe systems equipped with advanced monitoring capabilities and automated control functions.

Furthermore, climate change adaptation requirements are set to create substantial opportunities for resilient pipe system development. Extreme weather events necessitate infrastructure capable of withstanding floods, droughts, and temperature fluctuations while maintaining service continuity. Climate-resilient water infrastructure investments through multilateral development banks totaled US$ 19.6 billion in 2024.

Green infrastructure integration, including stormwater management and water recycling systems, demands specialized pipe materials and configurations. The increasing focus on circular economic principles is likely to drive the demand for recyclable pipe materials and closed-loop water systems requiring sophisticated distribution networks.

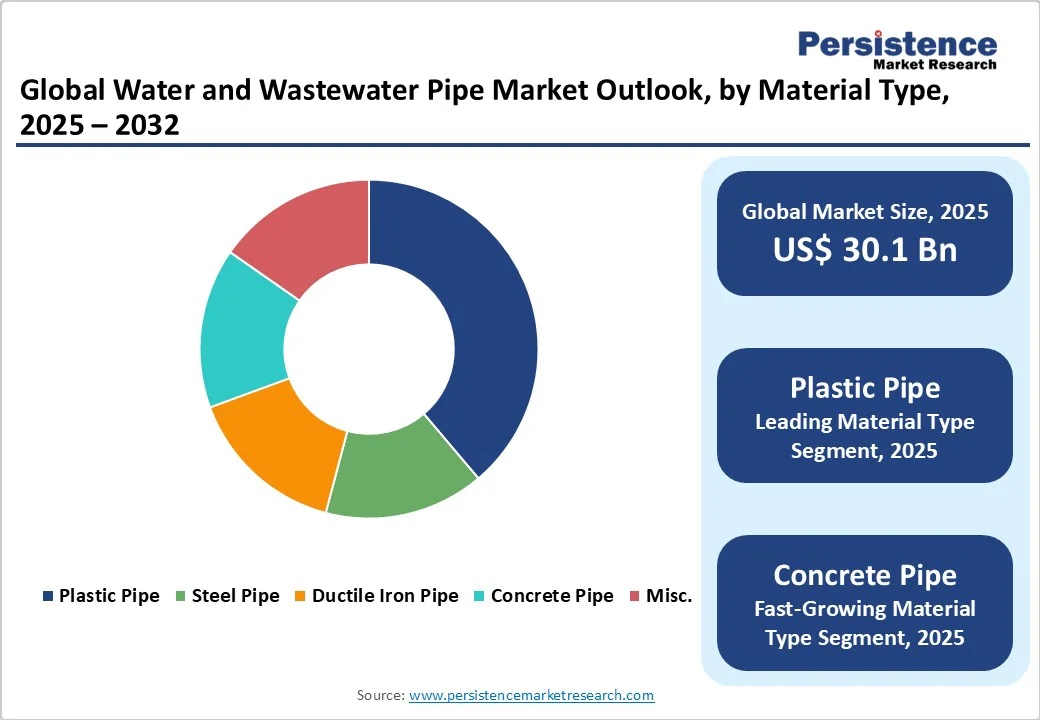

Plastic pipes are set to dominate with approximately 40.5% of the water and wastewater market revenue share in 2025. These pipes are lightweight and corrosion-resistant, and their easy-to-install properties make them suitable for municipal and industrial networks.

North America and Europe have documented usage in drinking water and wastewater systems, with life cycle assessments showing lower carbon footprints and reduced energy requirements. PVC, ABS, and MDPE variants are widely adopted due to cost-efficiency and regulatory compliance.

Concrete pipes are likely to the fastest-growing segment through 2032, driven by large-scale municipal water and wastewater projects in emerging economies. The material is preferred for high-capacity drainage systems and underground storage, with recent deployments including Cemex’s Austerlitz storage basin in France (2025). Concrete pipes provide durability, resistance to high pressure, and are increasingly aligned with urban flood management initiatives.

Up to 1200 mm diameter pipes are set to the lead with around 50.3% share in 2025, as pipes of this width are widely used in municipal water distribution and smaller industrial pipelines. Their manageable handling and installation requirements support cost-effective deployment across urban networks. Countries like Canada and Germany report extensive usage in municipal systems, with urban planning policies emphasising efficient water conveyance at moderate diameters.

On the other hand, above 3600 mm diameter pipes are expected to emerge as the fastest-growing segment during 2025 - 2032, supporting large-scale projects such as inter-basin water transfers, bulk irrigation, and reservoir connections.

China’s 200 large water transfer projects and 95,000 reservoirs built in 2024 reflect high-capacity pipeline demand. These pipes are technically challenging to manufacture and install, requiring advanced machinery and expertise, offering growth potential for specialized suppliers.

Municipal applications are slated to hold approximately 60.5% market share in 2025, reflecting the focus on public water supply, wastewater collection, and sewage treatment infrastructure. On-going and upcoming water projects in Europe, India, and North America reinforce this segment’s prominence, with regulations mandating full coverage of urban populations. Municipal pipelines typically demand compliance with health and safety standards, durability, and pressure tolerance.

Agriculture is poised to be the fastest-growing end-use application between 2025 and 2032, benefiting from enormous investments in irrigation systems, groundwater management, and rural water distribution. India’s Jal Jeevan Mission, Brazil’s Water for All program, and Mexico’s National Water Plan demonstrate significant irrigation infrastructure spending, emphasising long-distance conveyance, efficient water use, and resilient pipe materials suitable for agricultural environments.

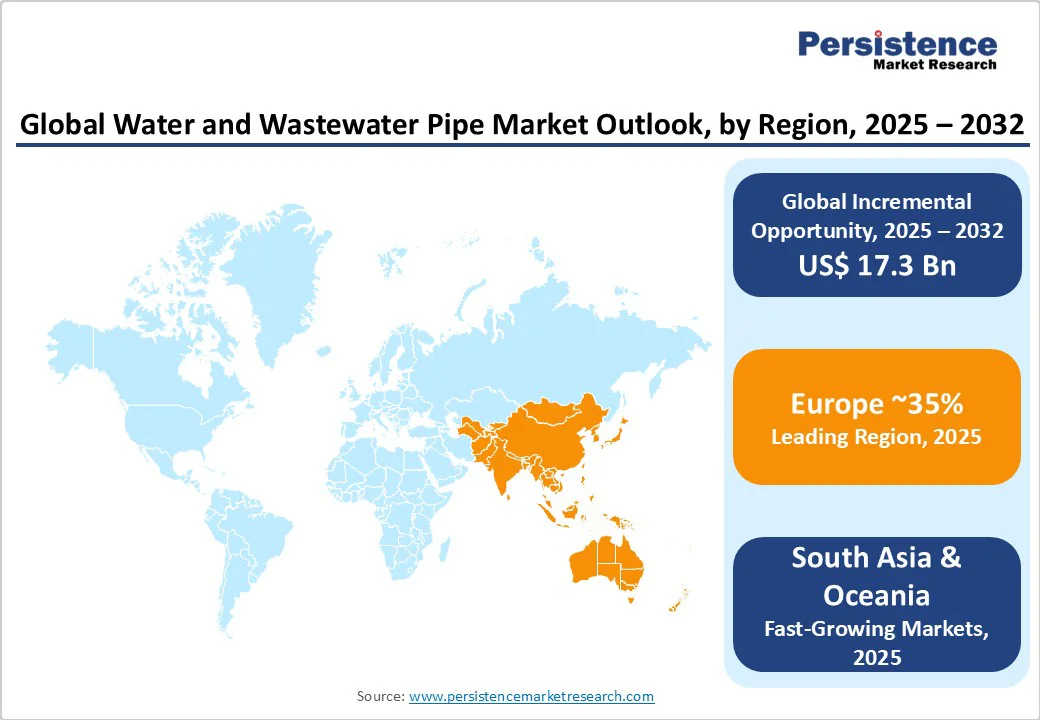

Asia Pacific, set to capture around 31.6% of the water and wastewater pipe market share in 2025, is the largest regional market. It maintains leadership through sustained urbanization and industrial development, with China investing a record US$ 187.8 billion in water conservancy facilities during 2024.

The country’s massive infrastructure programs include 95,000 reservoirs, 200 large water transfer projects, and 6,924 irrigation districts completed in 2024. China's smart water infrastructure deployment also leads global adoption rates, with digital water solutions implemented in 70% of new wastewater treatment plants. Advanced manufacturing capabilities, comprehensive supply chains, and government policy support for infrastructure modernization are some of the other advantages enjoyed by the regional market.

India's Jal Jeevan Mission has provided tap water connections to 12.20 crore additional rural households as of February 2025, representing unprecedented infrastructure deployment. Australia's AU$ 1.14 billion water investment in FY26 forms part of AU$ 47.8-billion, decade-long infrastructure program addressing climate resilience and population growth. The regional market benefits from public-private partnership (PPP) models, with India's hybrid annuity models for sewage treatment plants demonstrating successful private sector engagement.

North America is slated to hold nearly 27% market share in 2025 due to the growing urgency of replacing ageing water and wastewater infrastructure. The region experiences 260,000 water main breaks annually, costing US$ 2.6 billion in repairs, highlighting urgent replacement requirements. Lead service line replacement programs receive US$ 15 billion through federal infrastructure legislation, driving systematic pipe system modernization.

The United States Infrastructure Investment and Jobs Act has allocated around US$ 55 billion for water and wastewater infrastructure upgrades, while Canada invests over US$ 4.5 billion in drinking water and wastewater projects over six years. The adoption of smart water technologies has been further accelerated by regulatory requirements and operational efficiency initiatives addressing water losses.

The global water and wastewater pipe market structure is moderately consolidated, with a mix of large multinational manufacturers and regional players competing across material types. Leading companies include Saint-Gobain Group, Aliaxis Group SA/NV, JM Eagle Inc., CEMEX S.A.B. de C.V., and China Lesso Group Holdings Limited.

These players focus on strategic acquisitions, technological innovation, and sustainable pipe solutions to enhance market presence and address growing urban and industrial water infrastructure needs. Companies are increasingly integrating smart water technologies, digital monitoring systems, and climate-resilient materials to meet regulatory standards and customer demands.

The market is expected to grow steadily, driven by infrastructure modernisation, urbanization, and environmental compliance, with future opportunities in smart, resilient, and energy-efficient pipe systems.

The global water and wastewater pipe market is projected to reach US$ 30.1 billion in 2025.

Growing urgency to replace aging water infrastructure, stringent regulatory compliance, and urban population growth are driving the market.

The market is poised to witness a CAGR of 6.7% from 2025 to 2032.

Integration of smart water technologies and climate-resilient pipe infrastructure offers significant opportunities.

Key market players include Saint-Gobain Group, Aliaxis Group S.A., JM Eagle Inc., CEMEX S.A.B. de C.V., China Lesso Group Holdings Limited, and IPEX Inc.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Geographic Coverage |

|

| Segmental Coverage |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Material Type

By Diameter

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author