ID: PMRREP18172| 190 Pages | 15 Nov 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

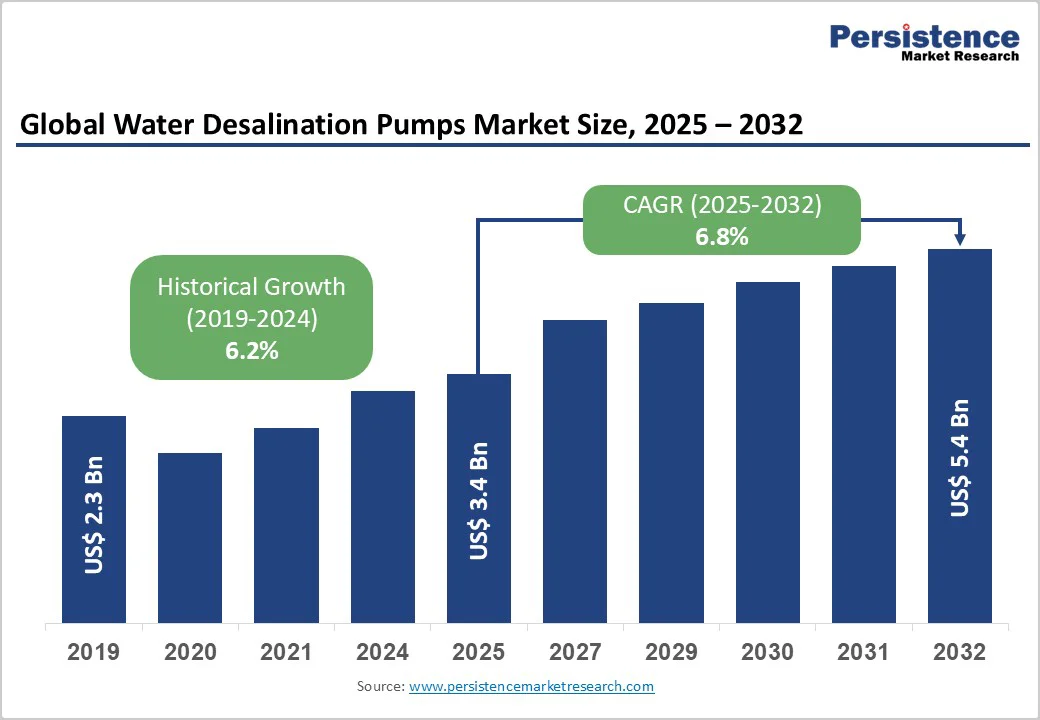

The global water desalination pumps market size is likely to be valued US$3.4 Billion in 2025, forecasted to US$5.4 Billion by 2032, growing at a CAGR of 6.8% during the forecast period from 2025 to 2032, driven by the increasing prevalence of water scarcity, rising demand for efficient pumping in desalination plants, and advancements in pump technologies. The need for high-pressure and corrosion-resistant pumps, particularly in large-scale projects, has significantly boosted the adoption of water desalination pumps across various demographics. The market is further propelled by innovations in centrifugal and submersible pumps, catering to preferences for energy-efficient and durable options. The growing acceptance of water desalination pumps as essential for potable water production, particularly in arid regions, is a key growth factor.

| Key Insights | Details |

|---|---|

| Water Desalination Pumps Market Size (2025E) | US$3.4 Bn |

| Market Value Forecast (2032F) | US$5.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.2% |

Rising Prevalence of Water Scarcity and Demand for Efficient Desalination

The growing global prevalence of water scarcity is a key factor driving the water desalination pumps market, as it fuels the adoption of more efficient desalination technologies and advanced water desalination pumps. Rapid urbanization, population growth, and industrial expansion are putting pressure on existing freshwater resources, making alternative water sources such as seawater and brackish water essential. Climate change further exacerbates water stress by causing unpredictable rainfall patterns, droughts, and depletion of groundwater reserves, compelling municipalities, utilities, and industries to adopt reliable desalination solutions to ensure a consistent water supply.

Efficient desalination is critical because traditional methods are energy-intensive and expensive, especially for high-volume operations. Modern pumps, integrated with energy recovery systems and optimized designs, enable desalination plants to operate more cost-effectively while minimizing environmental impact. High-pressure pumps, submersible pumps, and medium-to-large capacity solutions are being increasingly deployed to meet diverse water needs, from municipal supply to industrial processes.

High Development and Energy Consumption Costs

The high costs associated with development and energy consumption of water desalination pumps pose a significant restraint on market growth. Developing these pumps requires advanced alloys for corrosion resistance, rigorous pressure testing, and specialized seals to handle saline water. These processes involve substantial financial investment, often exceeding millions of dollars, which can be a barrier for smaller companies.

Regulatory bodies impose stringent requirements for efficiency and durability. Compliance with these standards, along with the need for specialized facilities, increases overall costs and extends development timelines. For instance, engineering vertical turbine pumps for offshore can take years, with costs escalating due to multiple phases of cavitation trials. Smaller firms struggle against players like Flowserve. Furthermore, high power demands add to operational challenges, deterring adoption in energy-constrained regions.

Advancements in Energy-Efficient and Corrosion-Resistant Pumps

Advancements in energy-efficient and corrosion-resistant pumps present significant growth opportunities for the water desalination pumps market. Desalination processes, particularly reverse osmosis, require high-pressure pumps that consume substantial energy, making efficiency a critical focus for manufacturers. Modern pumps now integrate energy recovery systems, optimized hydraulic designs, and variable frequency drives (VFDs) to reduce power consumption without compromising performance. These innovations not only lower operational costs but also reduce the carbon footprint of desalination facilities, aligning with stricter environmental regulations in the region.

Corrosion resistance is another key area of advancement, addressing the challenges posed by seawater and brackish water, which can rapidly degrade conventional materials. Pumps now utilize high-grade stainless steel, duplex alloys, and advanced polymer coatings to withstand aggressive environments, extending service life and minimizing maintenance requirements. This reliability is crucial for municipal, industrial, and energy sectors, where downtime can be costly.

Pump Type Insights

Centrifugal Pumps dominates the market, accounting for 50% of the share in 2025, driven by seawater intake and increasing offshore adoption. Their immersion resistance makes them ideal for deep wells and challenging environments. Advanced marine-focused innovations enhance efficiency and reliability, boosting their appeal across industrial and coastal applications, and accelerating adoption in regions with high seawater desalination demand.

Submersible Pumps is the fastest-growing segment, driven by seawater intake and increasing adoption in offshore. Submersible offers immersion resistance, appealing for deep wells. Focus on marine innovation accelerates adoption in Middle East and Asia Pacific.

Capacity Insights

Large Capacity Pumps (Above 500 m³/h) leads the market, holding 40% of the share in 2025. Their prominence stems from use in mega-scale desalination plants and easy integration within utility infrastructure. These pumps efficiently handle high-volume water requirements, making them essential for municipal and industrial applications, with growing demand driving continued market leadership.

Medium Capacity Pumps (50 m³/h to 500 m³/h) is the fastest-growing segment, driven by mid-size projects and expanding industrial adoption. Their flexibility and ease of integration make them ideal for diverse applications, while cost-effectiveness enhances appeal. This combination of adaptability and affordability is accelerating uptake, supporting rapid market growth in municipal, industrial, and energy sectors.

Application Insights

Municipal Water Supply dominates the market, contributing nearly 45% of revenue in 2025. Widespread use in public desalination, coupled with population growth, drives dominance. Municipal water supply offers scalability, preferred for cities.

Industrial Water Supply is the fastest-growing segment, driven by expanding manufacturing activities and increasing water recycling initiatives. Industries demand versatile pump solutions that ensure consistent water purity and operational efficiency

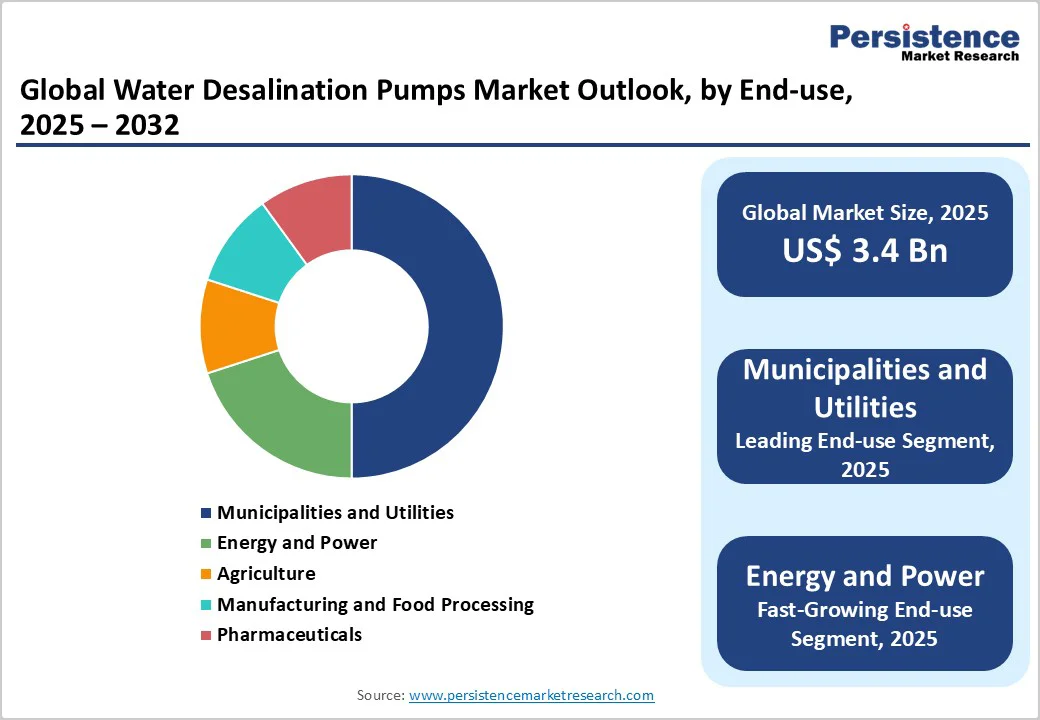

End-use Insights

Municipalities and Utilities dominate the market, with 50% share in 2025. Their leadership is supported by public funding and extensive infrastructure access. These entities are the primary end-users for freshwater supply, and rising urbanization and population growth are driving increased demand for reliable desalination pump solutions across municipal and utility networks.

Energy and Power are the fastest-growing, driven by increasing cooling water demands and adoption in power plants. High-pressure pump solutions, known for their reliability and efficiency, are preferred, supporting continuous operations. This combination of robust performance and sector-specific demand is fueling market expansion in the region.

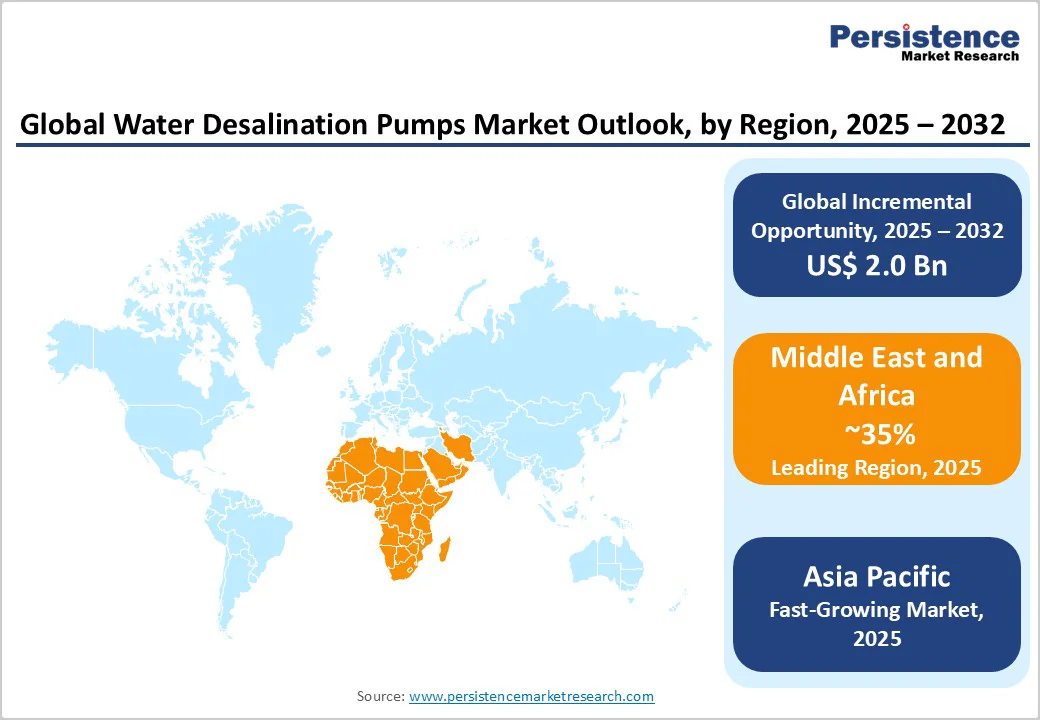

Middle East and Africa Water Desalination Pumps Market Trends

The Middle East and Africa (MEA) is the dominating market, holding 35% share in 2025, driven by severe freshwater scarcity, rapid urbanization, and heavy reliance on desalination for potable and industrial water supply. Countries such as Saudi Arabia, the UAE, and Israel are leading large-scale desalination initiatives, fueling demand for high-capacity and energy-efficient pumps. The region is witnessing an increasing shift toward advanced reverse osmosis (RO) systems and hybrid desalination plants powered by renewable energy sources such as solar and wind.

Technological advancements, including IoT-enabled monitoring, variable frequency drives (VFDs), and energy recovery systems, are improving efficiency and operational reliability under harsh environmental conditions. Governments and private entities are investing in infrastructure expansion projects, driving opportunities for modular and smart pump solutions tailored for both municipal and industrial applications. Ongoing public–private partnerships and investments in sustainable water management are supporting market expansion.

North America Water Desalination Pumps Market Trends

North America is accounting for 20% share in 2025, driven primarily by the increasing demand for freshwater in arid regions and industrial sectors. Urbanization, population growth, and climate change-induced water scarcity are compelling governments and private players to invest in desalination infrastructure. Reverse osmosis (RO) technology remains the most adopted method due to its energy efficiency and reliability, while high-pressure pumps, including centrifugal and multistage pumps, are critical components for effective desalination operations.

Technological advancements, such as energy recovery systems and AI-enabled pump monitoring, are improving operational efficiency and reducing energy costs, making large-scale desalination projects more economically viable. The market is also witnessing a shift toward sustainable and low-emission solutions to comply with stringent environmental regulations in the U.S. and Canada. Key end-users include municipal water authorities, industrial facilities, and power generation plants. Leading players are expanding their footprint through partnerships, acquisitions, and local manufacturing to meet rising demand.

Europe Water Desalination Pumps Market Trends

Europe accounts 20% share in 2025, driven by water stress in southern regions and stringent regulatory pressures. With nearly 20?% of the global desalination?pump market share, Europe is gaining traction in this specialised equipment segment. A key trend is the upgrade of pump systems to support advanced technologies such as high?efficiency motor drives, variable?frequency drives (VFDs) and IoT?enabled monitoring to optimise energy use and reduce downtime. Material innovations such as corrosion?resistant duplex stainless steel for pumps handling high?salinity seawater are meeting longevity demands in coastal Mediterranean countries such as Spain, Italy, and Greece.

Another major shift: modular pump systems designed to accelerate deployment are becoming more common, particularly in smaller capacity desalination plants for tourism and municipal sectors. Furthermore, sustainability is front?of?mind: many facilities integrate renewable?energy sources (solar, wind) and energy?recovery systems to align with the region’s green transition goals.

Asia Pacific Water Desalination Pumps Market Trends

Asia Pacific is the fastest-growing market for water desalination pumps, driven by increasing freshwater scarcity, rapid urbanization, and rising industrial demand in countries such as China, India, and across Southeast Asia. Coastal cities and island regions are investing heavily in desalination infrastructure to meet municipal and industrial water needs, fueling demand for high-capacity and energy-efficient pumps. Technological advancements, including IoT-enabled monitoring, modular pump units, energy-recovery systems, and corrosion-resistant materials, are improving operational efficiency and reducing maintenance costs.

The adoption of renewable-energy-powered desalination systems, particularly solar and wind-driven pumps, is also gaining traction in off-grid and hybrid installations. Public-private partnerships (PPPs) and modular containerized systems are being increasingly implemented in remote or underserved areas to ensure reliable water supply. Despite these opportunities, challenges such as aging infrastructure, high energy consumption, and a shortage of skilled technical labor continue to constrain market expansion.

The global water desalination pumps market is highly competitive, characterized by the presence of major pump manufacturers and regional specialists. In developed regions such as North America and Europe, companies such as Flowserve Corporation and GRUNDFOS Holding A/S lead the market through strong research and development capabilities, advanced technological innovations, and extensive distribution networks. These players focus on developing high-efficiency and corrosion-resistant pumps to meet the growing sustainability standards.

In the Asia Pacific region, local manufacturers such as Shanghai Kai Quan Pump are gaining momentum through cost-effective and localized solutions tailored to regional water needs. The market is witnessing a strong shift toward energy-efficient and smart pump technologies, integrated with IoT-based monitoring and automation systems to enhance operational reliability and reduce energy costs. Strategic partnerships, acquisitions, and collaborations among industry players are intensifying competition and expanding global reach.

The global water desalination pumps market is projected to reach US$3.4 Billion in 2025.

The rising prevalence of water scarcity and demand for efficient desalination are key drivers.

The market is poised to witness a CAGR of 6.8% from 2025 to 2032.

Advancements in energy-efficient and corrosion-resistant pumps are a key opportunity.

Ebara, Flowserve, GRUNDFOS Holding, ITT, and KSB are key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Pump Type

By Capacity

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author