ID: PMRREP18556| 186 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

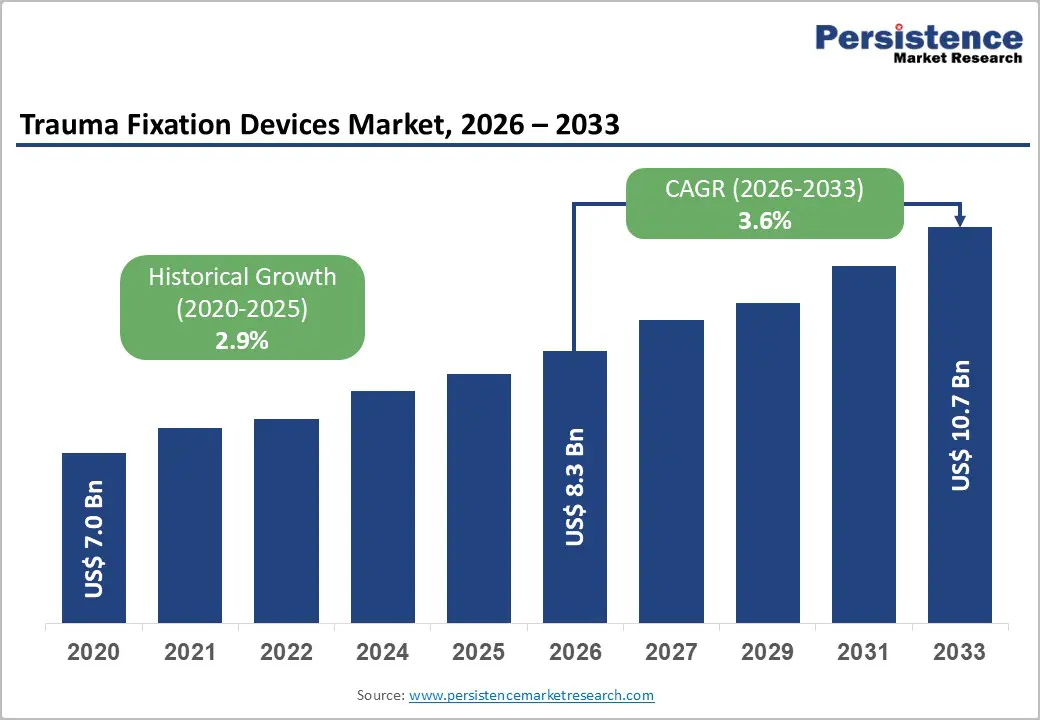

The global trauma fixation devices market size is estimated to be valued at US$ 8.3 billion in 2026 to US$ 10.7 billion by 2033, growing at a CAGR of 3.6% during the forecast period from 2026 to 2033.

The global market is expanding due to increasing trauma cases from road accidents, sports injuries, and orthopedic conditions. Advances in internal fixation technologies, including plates, screws, and nails, enhance surgical precision and patient outcomes. According to the WHO, over 1.35 million people die annually in road traffic accidents, with 20-50 million sustaining non-fatal injuries often requiring fracture stabilization. Aging populations and rising orthopaedic procedure volumes, supported by CDC data reporting 3.7 million daily accident-related injuries, drive replacement cycles and adoption of minimally invasive systems. This combination of clinical need and technological progress underpins sustained market growth.

| Key Insights | Details |

|---|---|

| Trauma Fixation Devices Market Size (2026E) | US$ 8.3 Bn |

| Market Value Forecast (2033F) | US$ 10.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 3.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 2.9% |

The global trauma fixation devices market is primarily driven by the escalating incidence of road traffic accidents, which continue to impose a significant clinical and economic burden. According to the World Health Organization (WHO), approximately 1.35 million people die annually in road traffic crashes, with an additional 20-50 million sustaining non-fatal injuries, many involving long-bone, pelvic, and spinal fractures requiring internal or external fixation. The Centers for Disease Control and Prevention (CDC) reports around 3,700 daily deaths in the U.S. alone from bus, motorcycle, and pedestrian accidents, highlighting extremities and spinal injuries as the most common areas necessitating surgical stabilization. These statistics underscore the urgent clinical need for high-performance fixation devices, including plates, screws, nails, and external fixators, particularly in high-volume trauma centers.

Low- and middle-income countries bear a disproportionate share of the burden, accounting for nearly 90% of traffic-related fatalities, driving demand for cost-effective and readily deployable trauma solutions. Expanding emergency care infrastructure and higher hospital surgical volumes further reinforce adoption trends. OECD data showing approximately 52 accidents per 100,000 population in countries such as Canada and Italy illustrates how both high- and middle-income regions require reliable internal and external fixation options. This persistent injury prevalence ensures sustained procurement cycles and supports ongoing investments in trauma fixation technology across hospitals and specialty centers globally.

Despite market growth, post-operative complications and infection risks pose significant restraints for trauma fixation devices. Meta-analyses indicate that external fixators experience post-operative infection rates of 20-35%, often linked to pin-site infections and non-union cases, which can elevate revision surgery rates to nearly 10%. Additionally, the American Academy of Orthopaedic Surgeons (AAOS) reports higher DASH scores and increased displacement risks exceeding 50% with external fixation methods compared to internal approaches, affecting clinical confidence and prolonging rehabilitation timelines.

Stress shielding caused by the stiffness mismatch between metal plates (Young’s modulus ~193 GPa) and human bone (10-30 GPa) further delays bone healing and contributes to hardware failures, particularly in load-bearing applications. Surgeons must balance device rigidity with biological compatibility, which complicates design and selection, especially in patients with osteoporosis or compromised bone quality. These factors limit adoption in certain cases, increase the risk of litigation, and may result in extended hospital stays, collectively restraining the overall market growth despite rising trauma incidence and technological advancements.

The trauma fixation devices market is witnessing significant opportunities through the adoption of minimally invasive surgical techniques, particularly in ambulatory surgical centers (ASCs) and outpatient orthopedic facilities. Outpatient internal fixation procedures for distal radius, ankle, and small extremity fractures reduce hospital stays by 2-3 days while improving patient recovery times. Innovations such as DePuy Synthes’ TriLEAP plating system, introduced in 2024, enable percutaneous approaches that align with Enhanced Recovery After Surgery (ERAS) protocols, lowering complication rates by up to 30%. These developments make minimally invasive solutions attractive for high-volume outpatient centers and cost-sensitive healthcare settings.

The rising incidence of off-highway vehicle (OHV) injuries, with CPSC data reporting 102,000 annual cases in the U.S., underscores the need for rapid-stabilization nails and hybrid fixation solutions in non-trauma hospitals. Principles from the AO Foundation support early conversion from external to internal fixation, creating demand for hybrid systems in emerging markets such as ASEAN countries and India, where improving hospital infrastructure facilitates adoption. These trends, coupled with growing awareness among surgeons and patients, position minimally invasive fixation technologies as a key opportunity for manufacturers to expand market penetration and address evolving trauma care needs efficiently.

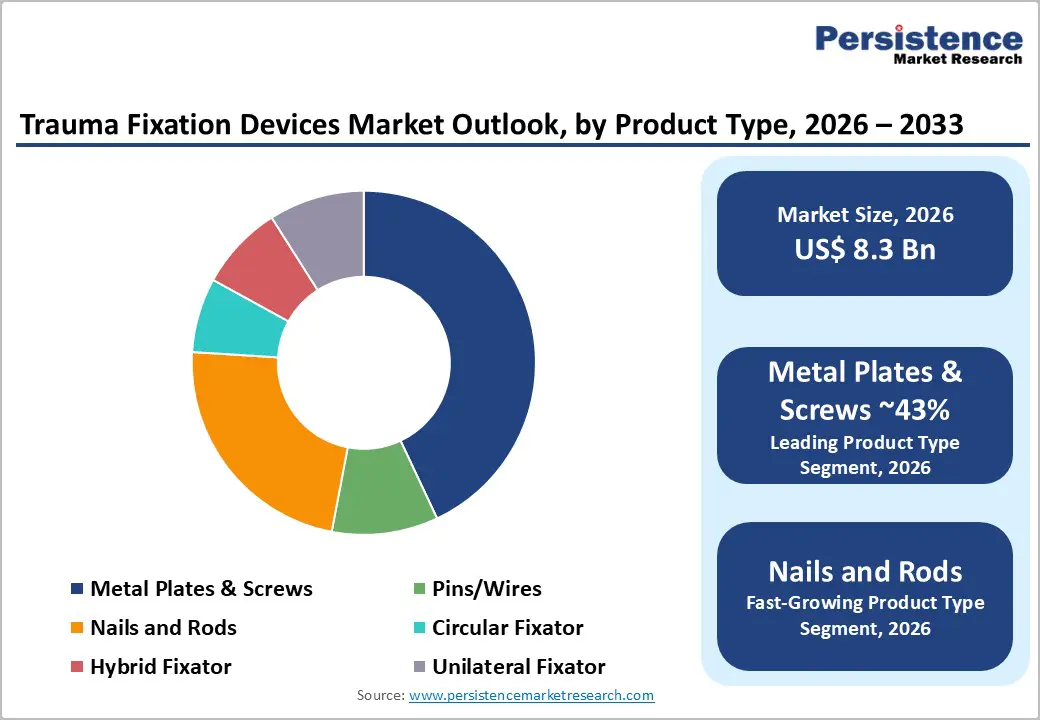

Metal plates and screws are the leading product segment in the trauma fixation devices market, capturing approximately 43% share in 2025 due to their versatility in treating complex fractures. These devices are widely used for long-bone and periarticular fractures, offering stable fixation and enabling biological healing through controlled micromotion. Stainless steel (316L) and titanium variants provide excellent resistance to tension, compression, and torsion, while modern locking plate designs reduce post-operative infection rates to below 4% in tibia and femur procedures.

AAOS guidelines recommend plates for open reduction internal fixation (ORIF), emphasizing optimized screw density and anatomical alignment to support fracture consolidation. The modular design of plates and screws also contributes to their widespread adoption, accounting for approximately 65% of internal fixation preferences. Compared to intramedullary nails, plates are favored for distal fractures, periarticular reconstructions, and cases requiring precise anatomical reduction, making them essential in both trauma and orthopedic surgical practices.

Orthopedic centers lead the end-user segment, holding around 38% share in 2025, owing to their focus on specialized trauma care and multidisciplinary teams. These centers manage high volumes of complex fracture cases, including long-bone, periarticular, and extremity injuries, ensuring optimal outcomes through advanced fixation techniques. In the U.S. alone, approximately 29.4 million emergency department visits for injuries contribute to significant procurement of plates, screws, nails, and external fixators.

Orthopedic centers leverage expertise in minimally invasive surgery, enhanced recovery after surgery (ERAS) protocols, and precision-guided fixation to reduce complications such as non-union or malalignment. AAOS data indicate that outcomes in these centers consistently surpass those in general hospitals for complex deformities and multi-fragmentary fractures. Their focus on internal fixation devices, procedural standardization, and dedicated trauma teams positions orthopedic centers as preferred end-users for high-performance plates, screws, and modular systems, driving continued demand and market growth in both developed and emerging regions.

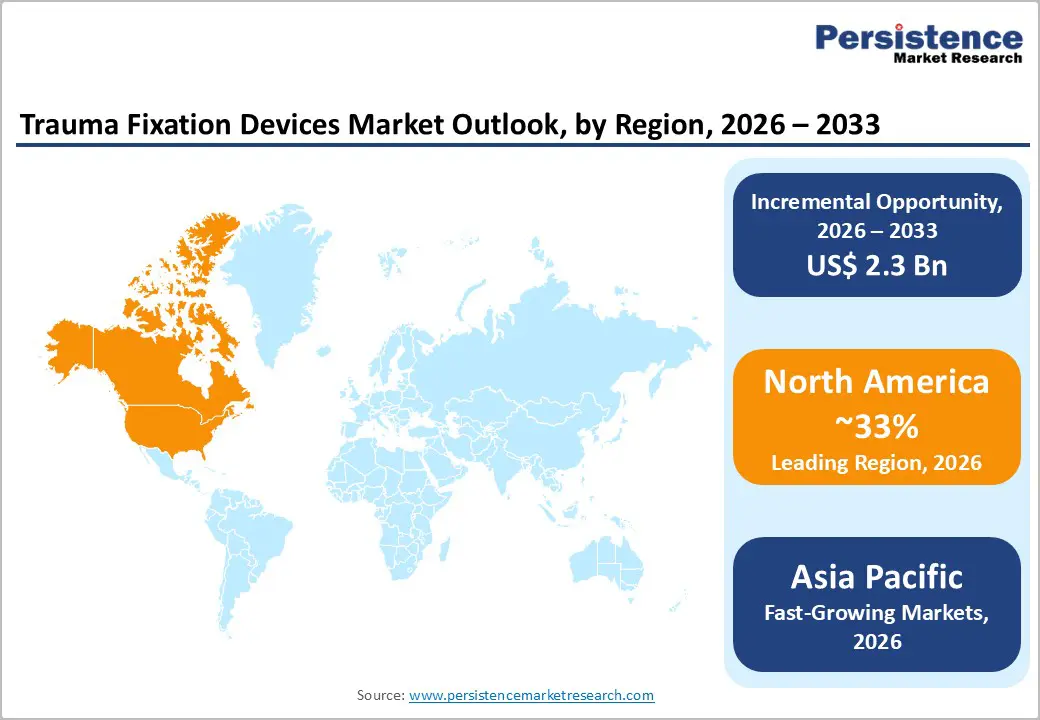

North America, led by the U.S., dominates the trauma fixation devices market due to advanced healthcare infrastructure, high procedure volumes, and robust trauma care networks. According to the CDC, in 2020, the U.S. recorded approximately 169,936 accidental deaths and 39.5 million physician visits related to trauma, highlighting the critical need for effective fixation solutions. Regulatory support through FDA clearances, such as Stryker’s Titanium Trauma System in August 2025 and Zimmer Biomet’s ROSA shoulder robotics in 2024, accelerates the adoption of internal fixation devices. The Consumer Product Safety Commission reports around 102,000 annual off-highway vehicle (OHV) injuries, with plates used in nearly 29% of fracture cases, further reinforcing demand.

Strong reimbursement policies, adherence to AAOS guidelines, and growing emphasis on internal fixation procedures sustain approximately 65% market dominance of plates and screws. Robotics-assisted systems like MAKO and ROSA enhance surgical precision, particularly in extremities and complex fractures. The National Safety Council’s 2024 data show a 17% increase in recreational injuries, supporting sustained device adoption. These trends collectively ensure the continued procurement of advanced trauma fixation devices across hospitals, orthopedic centers, and emergency departments throughout North America

Asia Pacific represents the fastest-growing trauma fixation devices market, driven by rising trauma incidents, hospital expansions, and growing orthopedic awareness. The region accounts for 1.4 million annual road traffic deaths, predominantly in low- and middle-income countries, according to WHO, emphasizing the urgent need for fracture stabilization solutions. Rapid motorization and increasing accident rates in countries like India and China have exposed gaps in formalized trauma systems, prompting expansion of orthopedic centers and trauma care facilities. Japan focuses on precision trauma fixation technologies, whereas China and India are emerging as major manufacturing hubs for cost-effective internal and external fixators.

Affordable solutions from regional manufacturers, including Double Medical and other local suppliers, support adoption across public hospitals and private clinics. ASEAN countries benefit from foreign direct investment in healthcare infrastructure, enabling procurement of modern plates, screws, nails, and external fixators for high-volume trauma centers. Government initiatives to enhance orthopedic care, coupled with increasing awareness among patients and surgeons, drive demand for minimally invasive and intramedullary fixation techniques. These factors position the Asia Pacific as a key growth region, with rapid adoption expected across both urban hospitals and emerging secondary care centers.

The global trauma fixation devices market is moderately consolidated, dominated by key players such as Zimmer Biomet, Stryker, DePuy Synthes, and Orthofix. These companies strengthen their positions through continuous research and development in robotics and bioabsorbable materials. Strategic initiatives include securing FDA and MDR approvals, mergers and acquisitions to expand product portfolios, and developing minimally invasive kits aligned with enhanced recovery after surgery (ERAS) protocols. Product differentiation focuses on titanium modular systems, 3D-printed implants, and advanced fixation solutions. Emerging trends include subscription-based robotics services and patient-specific implants, catering to personalized surgical planning and improved clinical outcomes.

The global trauma fixation devices market is projected to be valued at US$ 8.3 Bn in 2026.

Rising fracture incidence, aging population, road accidents, sports injuries, orthopedic surgeries, and hospital infrastructure expansion drive demand.

The global trauma fixation devices market is poised to witness a CAGR of 3.6% between 2026 and 2033.

Minimally invasive fixation systems, advanced external fixators, AI-assisted planning, emerging markets, and growing trauma care centers present opportunities.

Companies such as Zimmer Biomet Holdings, Inc., Stryker Corporation, Johnson and Johnson (DePuy Synthes), and Wright Medical Group, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Fixation Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author