ID: PMRREP34590| 199 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

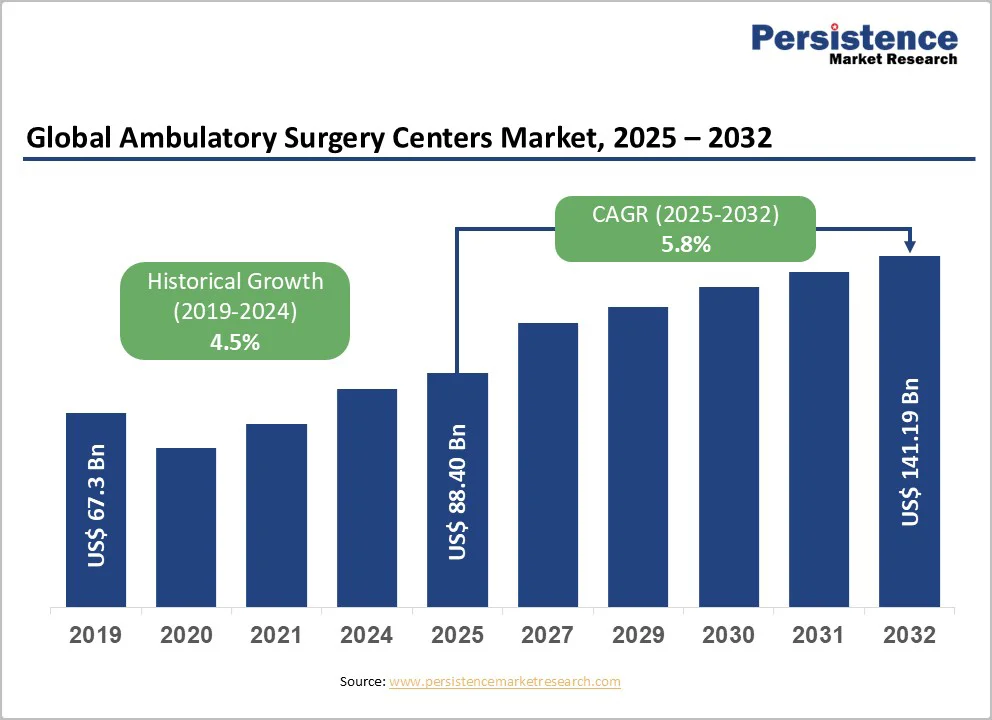

The global ambulatory surgery centers market size is estimated to grow from US$88.40 Bn in 2025 to US$141.19 Bn by 2032. The market is projected to record a CAGR of 5.8% from 2025 to 2032.

Global demand for ambulatory surgery centers (ASCs) is increasing as the prevalence of chronic diseases, orthopedic disorders, gastrointestinal conditions, ophthalmic problems, and trauma-related injuries continues to rise globally. A growing geriatric population, higher surgical intervention rates, and a broader shift toward outpatient, minimally invasive procedures are accelerating ASC adoption across developed and emerging markets.

Additionally, technological advancements in surgical equipment, anesthesia monitoring, sterilization platforms, and same-day recovery systems are enhancing procedural efficiency. Expanding insurance coverage, cost-effective care models, and the rapid development of ASC networks in developing regions are further supporting global market growth.

| Key Insights | Details |

|---|---|

| Ambulatory Surgery Centers Market Size (2025E) | US$88.40 Bn |

| Market Value Forecast (2032F) | US$141.19Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.5% |

The global ambulatory surgery centers market is being significantly driven by the increasing preference for cost-effective, minimally invasive, and same-day surgical procedures. Patients and healthcare providers are increasingly seeking outpatient alternatives to traditional inpatient surgeries due to lower procedural costs, reduced hospital stays, faster recovery times, and improved convenience.

Minimally invasive techniques, including laparoscopic, endoscopic, and robotic-assisted procedures, enable precise interventions with minimal tissue damage, resulting in faster discharge and higher patient satisfaction. The growing emphasis on efficiency and value-based care is further encouraging hospitals and physician groups to expand ASC adoption.

Additionally, the rising prevalence of chronic and orthopedic conditions, including arthritis, cardiovascular disorders, gastrointestinal diseases, and musculoskeletal injuries, is fueling the demand for outpatient surgical interventions. For instance, in 2024, the Centers for Disease Control and Prevention reported that one in five adults in the U.S. has arthritis, driving increased demand for outpatient orthopedic procedures at ambulatory surgery centers.

Many of these conditions require recurring or elective procedures, which can be efficiently managed in ASCs, reducing the burden on inpatient hospital facilities. The increasing aging population and higher incidence of lifestyle-related disorders are also contributing to the volume of outpatient surgeries. This convergence of cost efficiency and clinical necessity makes ASCs a preferred choice for both patients and healthcare providers worldwide.

The establishment of ambulatory surgery centers requires significant upfront capital investment, including the construction of specialized facilities, the purchase of advanced surgical equipment, and the installation of digital workflow and patient-monitoring systems.

In addition to financial outlay, ASCs must comply with stringent regulatory and accreditation requirements, such as those set by the Joint Commission, Centers for Medicare & Medicaid Services (CMS), and local health authorities. Navigating these complex guidelines can be time-consuming and resource-intensive, often delaying operational launch and increasing the overall cost of entry, restraining market growth, particularly in emerging economies.

Moreover, outpatient surgical procedures, while generally safe, carry inherent risks of post-operative complications such as infections, bleeding, or adverse reactions to anaesthesia. Since ASCs typically manage patients for shorter durations compared to hospitals, monitoring and controlling such complications can be challenging.

Additionally, medico-legal concerns, including malpractice claims, informed consent issues, and liability for unexpected outcomes, pose a significant operational risk. These factors may lead to higher insurance premiums, cautious patient selection, and increased administrative oversight, potentially limiting the pace of ASC expansion in certain regions.

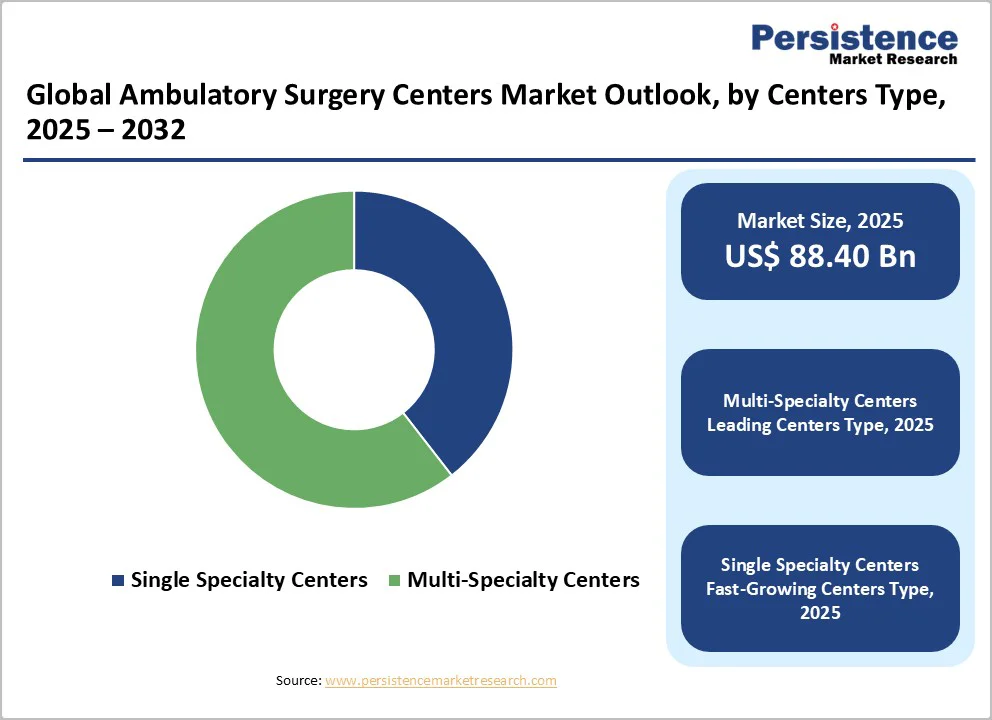

Single-specialty centers focused on high-demand procedures such as orthopedics, ophthalmology, and gastroenterology are creating significant opportunities in the market. These centers provide specialized care, improved operational efficiency, and higher patient throughput compared to multi-specialty facilities.

By concentrating on specific surgical areas, they can offer advanced technologies, targeted staffing, and optimized care pathways, resulting in better patient outcomes and enhanced revenue generation. The increasing prevalence of chronic and elective conditions is driving the establishment of more single-specialty ASCs globally.

Furthermore, integrating telehealth, AI-assisted imaging, and digital patient monitoring systems presents another significant opportunity for ASCs to enhance clinical efficiency and the patient experience. These technologies enable remote consultations, real-time data analysis, and streamlined post-operative care, making outpatient procedures safer and more accessible.

Additionally, growing medical tourism and rising demand for cost-efficient elective surgeries in regions such as the Asia-Pacific and Latin America are expanding market potential. Emerging economies are witnessing increased investments in modern outpatient infrastructure, creating favorable conditions for ASC growth and the adoption of innovative surgical solutions.

The multi-specialty centers segment is projected to dominate the global ambulatory surgery centers market in 2025, accounting for 60.5% of revenue. The segment’s strong performance is driven by its ability to offer a broad range of high-volume procedures, including orthopedics, gastroenterology, ophthalmology, and pain management, within a single integrated facility.

Their diversified service mix, higher patient throughput, stronger reimbursement appeal, and ability to optimize resource utilization make them the preferred choice for hospital systems, physician groups, and payers seeking cost-efficient outpatient surgical care.

Additionally, multi-specialty ASCs benefit from higher investment inflows from private equity and corporate healthcare networks. Their capability to rapidly scale, integrate digital workflow systems, and expand procedural portfolios further drives segment growth.

The freestanding ambulatory surgical center segment is projected to dominate the global ambulatory surgery centers market in 2025, accounting for 66.9% of revenue. This is driven by their lower operational costs, flexible staffing models, and their ability to deliver same-day surgical care at significantly lower prices than hospital-based settings.

These centers also benefit from strong physician ownership trends, streamlined scheduling, and faster turnaround times, which enhance clinical efficiency and patient convenience. Additionally, supportive regulatory reforms and rising private equity investments are accelerating the expansion of freestanding ASC networks across major markets.

Their adaptability in adopting minimally invasive technologies and digital workflow systems further strengthens procedural throughput. Growing patient preference for convenient, low-cost outpatient care continues to boost segment growth.

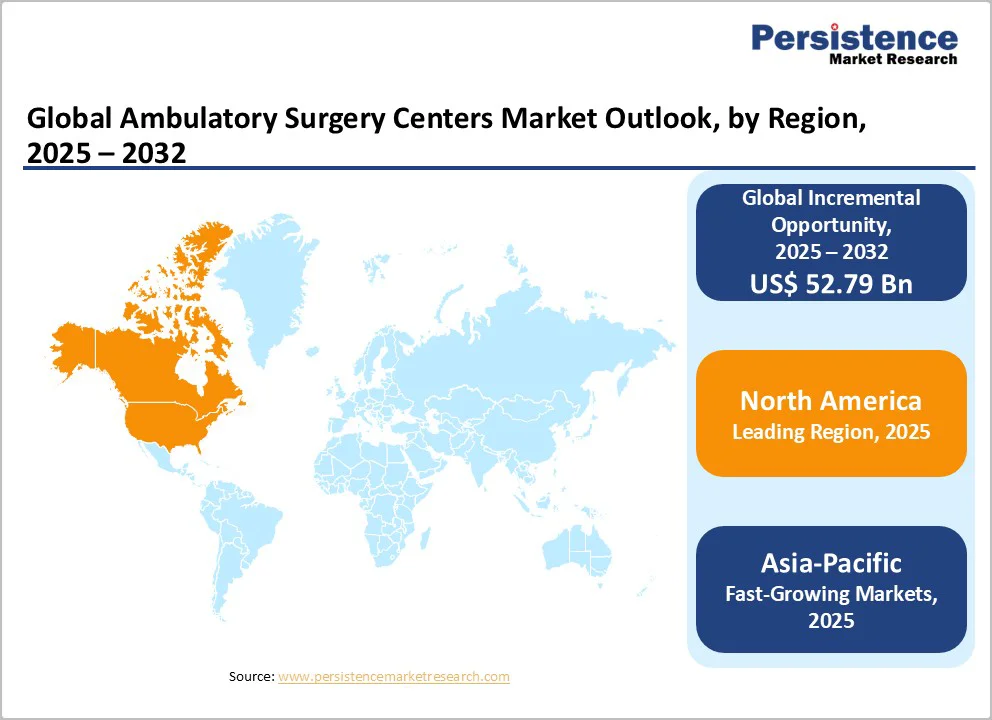

The North American market is expected to dominate globally with a value share of 48.6% in 2025, with the U.S. leading the region due to its advanced outpatient surgical infrastructure, high procedure volumes, strong reimbursement support, and rapid adoption of minimally invasive and same-day surgery technologies.

The region also benefits from the widespread presence of large ASC networks, well-established clinical guidelines, and strong physician participation in joint ownership models. Additionally, continuous investments in digital workflow systems, infection-control upgrades, and specialized surgical equipment further strengthen the U.S. leadership in the global ambulatory surgery centers market.

Rising consolidation among ASC operators and increasing integration with hospital systems are also enhancing operational efficiency and care coordination. Growing patient preference for cost-effective, quick-recovery outpatient procedures continues to drive the region's growth.

The European market is expected to grow steadily, driven by expanding day-care surgery programs, rising adoption of minimally invasive procedures, supportive government policies promoting outpatient care, and ongoing investments in modernizing surgical infrastructure across public and private healthcare systems.

Increasing surgeon preference for same-day procedures, improved reimbursement pathways, and growing focus on reducing hospital waiting times are further accelerating ASC adoption. Additionally, advancements in sterilization, anesthesia, and digital workflow platforms are helping enhance procedural safety and efficiency across European ambulatory centers.

Rising cross-border healthcare mobility and demand for cost-efficient elective surgeries are also contributing to market expansion. Strengthening collaboration between private ASC operators and national health systems continues to support steady regional growth.

The Asia Pacific market is expected to register a relatively higher CAGR of around 7.8% between 2025 and 2032, fueled by expanding private hospital networks, rising demand for cost-efficient day-care surgeries, and growing investments in modern outpatient surgical infrastructure across emerging economies.

The increasing prevalence of chronic diseases, a rapidly aging population, and a strong governmental focus on improving surgical capacity are further accelerating ASC adoption. Additionally, rising medical tourism, greater acceptance of minimally invasive procedures, and greater insurance coverage penetration are strengthening the region’s growth outlook.

Rapid urbanization and growing patient awareness of the convenience of outpatient care are driving higher procedure volumes. The adoption of advanced surgical technologies and digital workflow systems is further enhancing operational efficiency and clinical outcomes.

The global ambulatory surgery centers market is highly competitive, with major players such as Envision Healthcare Corporation, Healthway Medical Group, Nexus Day Surgery Centre, Pediatrix Medical Group, CHSPSC, LLC., and Endeavor Health, leading through diversified procedural offerings, high-volume surgical capabilities, and well-established operational networks.

Market participants focus on expanding multi- and single-specialty centers, adopting minimally invasive and same-day surgery technologies, and integrating digital workflow and patient monitoring systems. Strategic initiatives include mergers and acquisitions, partnerships with hospitals and physician groups, expansion of outpatient facility networks, and investment in advanced surgical equipment and anesthesia platforms, strengthening their competitive positioning globally.

The global ambulatory surgery centers market is projected to be valued at US$88.40 Bn in 2025.

Rising demand for cost-effective, minimally invasive, and same-day surgical procedures, supported by increasing outpatient care adoption and advanced surgical technologies are driving the global ambulatory surgery centers market.

The global ambulatory surgery centers market is poised to witness a CAGR of 5.8% between 2025 and 2032.

Expanding single-specialty centers, integrating digital and minimally invasive technologies, and tapping into emerging regions with growing outpatient care demand are creating strong growth opportunities in the market.

Envision Healthcare Corporation, Healthway Medical Group, Nexus Day Surgery Centre, Pediatrix Medical Group, CHSPSC, LLC., and Endeavor Health are some of the key players in the ambulatory surgery centers market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Center Type

By Modality

By Services

By Procedure Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author