ID: PMRREP32362| 190 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

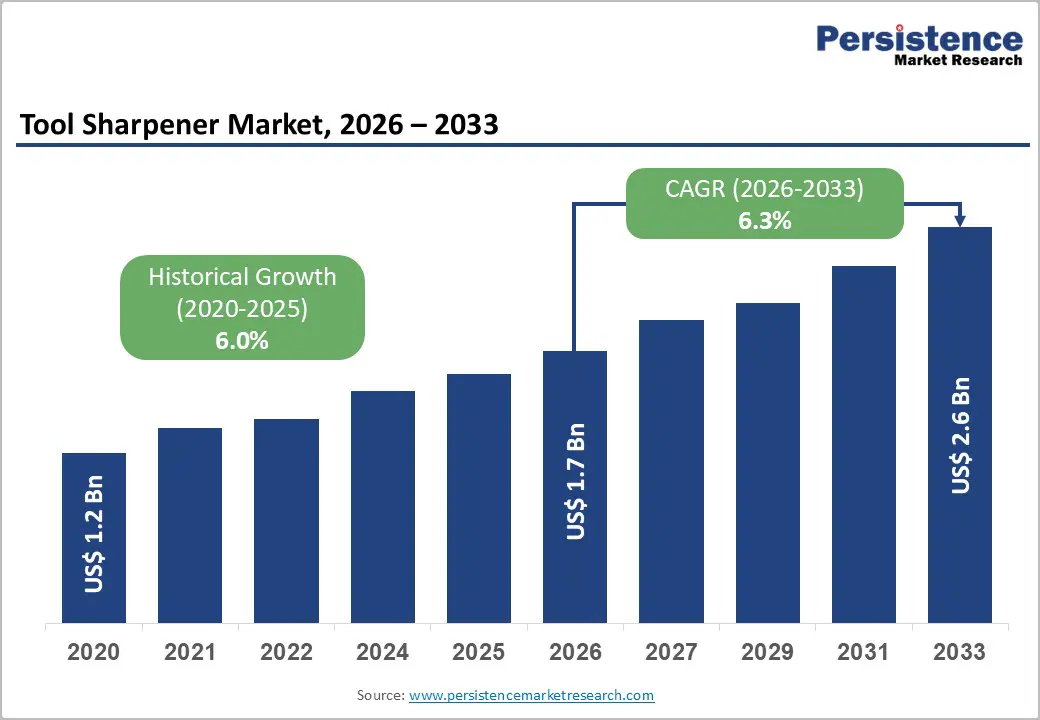

The global tool sharpener market size is likely to be valued at US$1.7 billion in 2026 and is expected to reach US$2.6 billion by 2033, growing at a CAGR of 6.3% during the forecast period from 2026 to 2033, driven by increasing demand for precision tools across industrial, culinary, and outdoor applications, rising adoption of automated and electric sharpeners, growing DIY and home improvement trends, and the expansion of manufacturing and metalworking sectors that require efficient tool maintenance solutions. Industrial sectors such as automotive, aerospace, metal fabrication, and manufacturing increasingly require advanced sharpening solutions to maintain tool precision, improve cutting efficiency, and reduce downtime, particularly in automated and high?volume production environments. The expansion of e-commerce and increased product availability have made specialty sharpeners more accessible, driving their adoption in both developed and emerging markets.

| Key Insights | Details |

|---|---|

| Tool Sharpener Market Size (2026E) | US$1.7 Bn |

| Market Value Forecast (2033F) | US$2.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.0% |

Manufacturers increasingly seek precision, consistency, and efficiency in tool maintenance to support highly automated production environments. Automated and smart sharpening solutions, such as CNC?controlled systems and robotic sharpeners, are being adopted widely in sectors, including automotive, aerospace, metalworking, and woodworking, due to their ability to deliver repeatable, micron?level sharpening accuracy with minimal human intervention. This trend is aligned with broader manufacturing shifts toward Industry 4, where real?time data integration, predictive maintenance, and connectivity between machines enhance operational efficiency and reduce downtime. Automation shortens tool change cycles, improves throughput, and reduces the high costs and labor constraints associated with traditional manual sharpening.

Alongside rising automation, a growing emphasis on tool longevity and lifecycle management is fueling demand for sophisticated sharpening solutions that extend tool life and reduce operational costs. In modern manufacturing, cutting tools represent a significant portion of operational expenses, and efficient sharpening practices can markedly improve their usable lifespan, reduce material waste, and optimize overall production economics. Automated sharpeners and reconditioning systems ensure tools retain their designed geometry and cutting performance far longer than manual methods, which can be inconsistent and time?intensive. Predictive maintenance with sensors and data analytics lets manufacturers monitor tool wear and schedule sharpening on time, preventing premature replacement and downtime.

Manufacturers and service providers face a complex web of regional, national, and industry-specific regulations that vary widely across different markets. In the U.S., organizations such as the Occupational Safety and Health Administration (OSHA) enforce strict safety standards for the design, maintenance, and operation of tools and machinery to safeguard workplace safety. These rules require protective guards, routine inspections, and documentation of tool conditions for all equipment used in industrial settings. In the European Union, the Machinery Directive sets common safety standards that industrial tools must meet before being sold on the market. Manufacturers still encounter differing interpretations and implementation timelines across member states.

This variation in safety and compliance standards presents both operational and financial challenges that can hinder growth and innovation in the market. Companies selling sharpeners internationally must adapt their products to meet different electrical, mechanical, and safety requirements, ranging from CE and ISO certifications in Europe to OSHA and ANSI standards in the U.S. This requires separate design, testing, and documentation processes for each target market. These multilayered standards drive up production costs and create significant barriers to entry for smaller businesses, who often struggle with the technical and financial demands of certification. This can limit competition and slow the adoption of new technologies.

Manufacturers and users increasingly seek precision, connectivity, and data?driven efficiency in tool maintenance. Smart and IoT?enabled sharpeners equipped with sensors, Bluetooth connectivity, and real?time diagnostics are transforming traditional sharpening tools into intelligent systems capable of tracking blade condition and usage patterns, providing predictive alerts before performance degrades. These capabilities enable users to schedule sharpening proactively, which can reduce tool replacement costs and minimize unplanned downtime by maintaining optimal tool performance. In industrial settings, smart integration allows sharpeners to connect with factory management systems and predictive maintenance platforms, facilitating seamless workflow optimization and enhanced productivity.

Smart sharpening technology integration is poised to reshape competitive dynamics in the market by fostering innovation and expanding use cases across industries. Advanced systems with predictive maintenance features and connectivity capabilities support the move toward industry manufacturing environments, where real?time data and automation are critical competitive advantages. By integrating with cloud platforms and mobile applications, smart sharpeners provide remote monitoring and control, making tool maintenance more efficient for facilities with distributed operations or multiple machines. The availability of intelligent features such as automatic tool detection, adaptive grinding parameters, and performance analytics enhances user experience, drives adoption among professional users, and supports higher value pricing models.

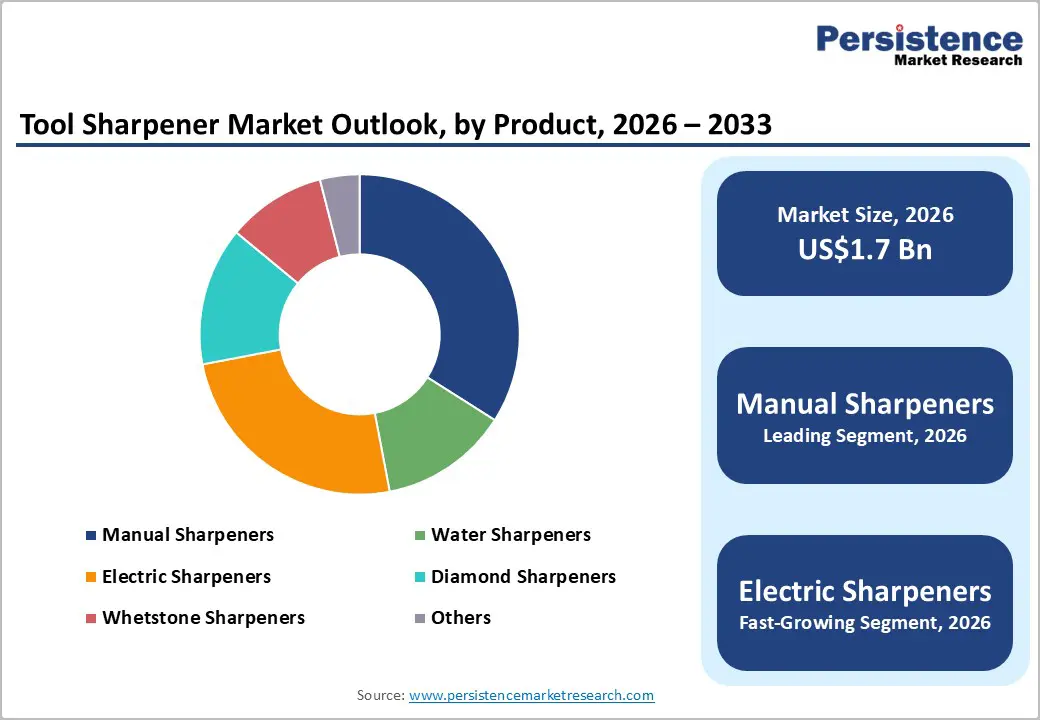

Manual sharpeners are expected to lead the tool sharpener market, accounting for approximately 35% of revenue in 2026, driven by their affordability, portability, and ease of use across household and small-scale professional settings. These sharpeners are widely available in retail channels, making them accessible to a broad consumer base, particularly in North America and Europe, where DIY trends and home maintenance culture remain strong. For instance, Work Sharp offers manual models tailored to home and workshop use, supporting the continued dominance of this segment. The straightforward design of manual sharpeners also matches consumer preferences for dependable, low-maintenance tools that do not require electricity or complicated setup.

Electric sharpeners are expected to be the fastest-growing segment during the forecast period, driven by rising adoption in both residential and commercial environments. Features such as automatic angle guides and motor-assisted operation enhance ease of use and ensure consistent sharpening results. Products such as the Rockler Work Sharp WSKTS2 Knife & Tool Sharpener Mk.2 illustrate this trend, offering dependable and repeatable performance for knives and tools, which appeals to both hobbyists and professionals. According to market research, electric sharpeners are accounting for an increasing share of overall sales, as their convenience, efficiency, and safety advantages make them more attractive than manual options, particularly for home cooks and catering businesses.

Kitchen knives are projected to lead the market, capturing around 30% of the revenue share in 2026, driven by the resurgence of home cooking and culinary activities post-pandemic. Consumers increasingly invest in quality knives for everyday use, with trends showing widespread preference for maintaining sharp blades to enhance safety and efficiency in meal preparation. For example, Zwilling J.A. Henckels, a renowned knife brand, offers kitchen knives with accompanying manual and electric sharpeners, reinforcing this segment’s leadership. The segment benefits from urbanization, increasing disposable income, and growing interest in gourmet and home-cooked meals. Retailers and online platforms have also made sharpeners and knife sets more accessible, ensuring consistent market penetration.

Industrial blades are likely to be the fastest-growing application, driven by the expansion of manufacturing and automated production facilities. Precision tool maintenance is critical for industries such as automotive, aerospace, and metal fabrication, where sharp blades ensure accuracy, efficiency, and reduced operational costs. For example, Seco Tools supplies industrial-grade sharpening solutions tailored for high-volume blade use, enabling firms to optimize performance while minimizing downtime. The increasing implementation of industry?4.0 practices, including predictive maintenance and smart tool monitoring, further accelerates demand. Industrial blades require specialized sharpening to maintain their geometrical precision, and advanced solutions such as CNC-controlled or IoT-enabled sharpeners cater directly to these requirements.

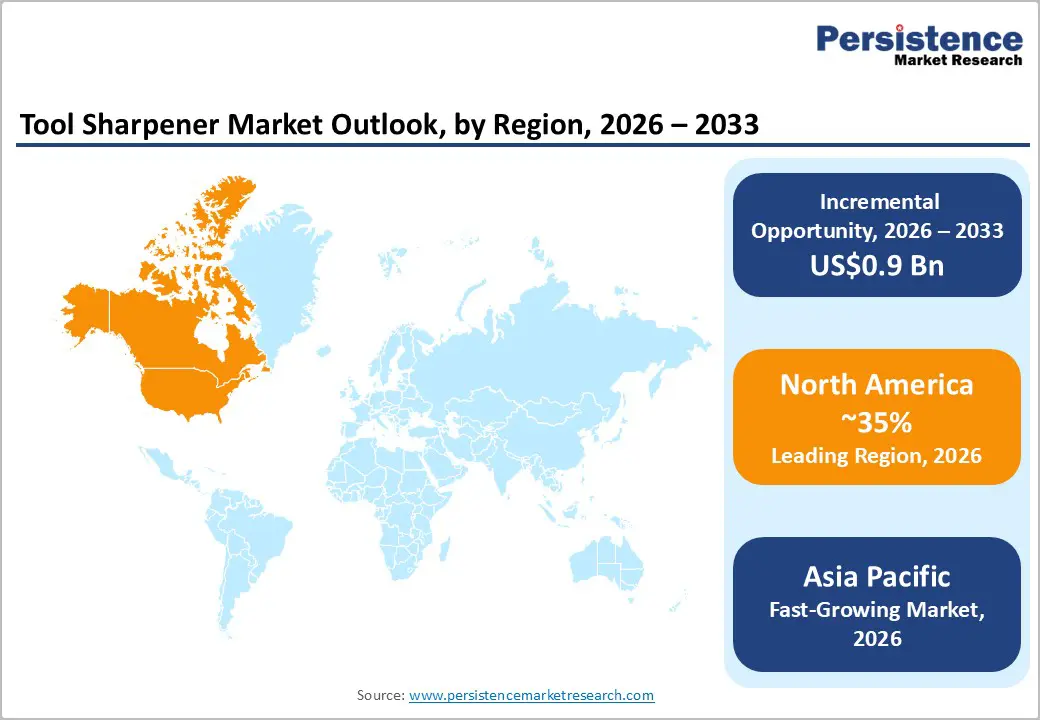

North America is anticipated to be the leading region, accounting for a market share of 35% in 2026, driven by strong DIY culture, home cooking interest, and increased awareness of tool maintenance. The growing adoption of electric sharpeners with automatic angle guides and safety features appeals to both novice users and seasoned professionals seeking consistent sharpening results with minimal effort. For example, Chef’sChoice electric sharpeners have gained market attention in North America for their precision and broad compatibility with both Western and Asian?style blades, reinforcing the trend toward technologically-enhanced consumer tools that deliver reliable edge maintenance.

Industrial and professional applications are influencing broader tool sharpener market trends in North America, as manufacturers and service providers seek advanced solutions that align with precision requirements in metalworking, woodworking, and fabrication contexts. Businesses across these sectors increasingly favor sharpeners that offer repeatability, speed, and integration with automated workflows, reflecting investments in productivity and tool longevity. The mature industrial infrastructure in the region supports demand for high?performance and automated sharpening solutions that can handle complex tool geometries and frequent usage cycles. Trends also highlight the importance of sustainability and cost efficiency, with many commercial buyers prioritizing solutions that extend tool life and reduce waste.

Europe is expected to represent a significant market for tool sharpeners in 2026, supported by a strong focus on high-quality kitchen tools and a growing interest in both traditional and advanced sharpening technologies. Germany, in particular, hosts well-established cutlery and sharpening specialists such as F. Dick, a company renowned for premium sharpening steels and semi-automated wet grinding systems serving professional kitchens and industrial applications. This regional emphasis on precision, durability, and craftsmanship drives regular use of sharpeners across both household and commercial settings, while European consumers increasingly favor products that combine dependable performance with long-term reliability.

Europe tool sharpener market is also evolving through innovation and diversification of product offerings, with moderate but steady growth driven by both manual and electric sharpening systems. The region is witnessing increased interest in premium electric sharpeners and multi?stage systems that improve ease of use and sharpening accuracy, catering to professional kitchens and tech?oriented home users alike. The resurgence of artisanal cooking and gourmet food culture encourages the adoption of advanced sharpeners that can deliver consistent edge quality with minimal effort, while specialty kitchenware retailers and online platforms expand accessibility to these products across urban centers.

The Asia Pacific region is expected to be the fastest-growing market for tool sharpeners in 2026, driven by increasing industrial activity, greater consumer awareness of blade maintenance, and rising household expenditure on kitchen and outdoor equipment. Major markets such as China, India, and Japan are leading this growth, supported by rapid urbanization, an expanding middle class with higher disposable incomes, and a strong cultural focus on culinary precision and proper tool care. The region’s robust manufacturing base, particularly in metal fabrication, automotive, and woodworking, continues to stimulate demand for both manual and powered sharpening solutions, as industries prioritize tool durability and operational efficiency.

Ongoing technological innovation and intensifying domestic competition are further reinforcing the Asia Pacific tool sharpener market by driving product diversification and the introduction of advanced features. Regional manufacturers are developing sharpeners with ergonomic designs, enhanced abrasive materials, and hybrid functionalities to meet growing expectations for performance and durability. For instance, TAIDEA, a Chinese sharpening equipment brand, is gaining momentum across the region by offering specialized whetstones and bench grinders for kitchen, outdoor, and industrial applications, combining traditional craftsmanship with modern precision standards. The demand for electric and automatic sharpeners is rising as both consumers and businesses seek solutions that minimize manual effort while delivering consistent edge quality.

The global tool sharpener market exhibits a moderately fragmented structure, driven by a wide range of manufacturers competing across manual, electric, and automated sharpening technologies that cater to both consumer and industrial applications. Several legacy brands and established industrial tool companies maintain strong positions through diversified product portfolios, broad distribution networks, and ongoing innovation in sharpening mechanisms and materials. Product differentiation is a key factor, with companies focusing on features such as multi-stage sharpening, precision angle guides, diamond abrasive technologies, and user-friendly designs to attract both professional and household users.

With key leaders including Work Sharp (Darex LLC), Chef’sChoice (EdgeCraft Corporation), Makita Corporation, Robert Bosch GmbH, and Stanley Black & Decker, the market reflects a balance of household tool specialists and broader industrial tool manufacturers. These players compete through continuous product innovation, extensive marketing efforts, expanded distribution channels, and strategic partnerships to enhance presence and brand loyalty. Companies also prioritize research and development to introduce smart and connected sharpening tools with advanced functionalities that meet evolving customer demands.

The global tool sharpener market is projected to reach US$1.7 billion in 2026.

Rising demand for tool longevity, increasing industrial automation, growth in professional and home improvement activities, and the need for cost-efficient maintenance solutions across manufacturing and household applications.

The tool sharpener market is expected to grow at a CAGR of 6.3% from 2026 to 2033.

The development of smart and electric sharpeners, rising demand from industrial and professional users, expansion in emerging markets, and increasing preference for sustainable, long-lasting tool maintenance solutions.

WIDIA Product, Seco Tools, Guhring, Liebherr, W.W. Grainger, and Core Cutter LLC are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author