ID: PMRREP3457| 176 Pages | 14 Aug 2025 | Format: PDF, Excel, PPT* | Industrial Automation

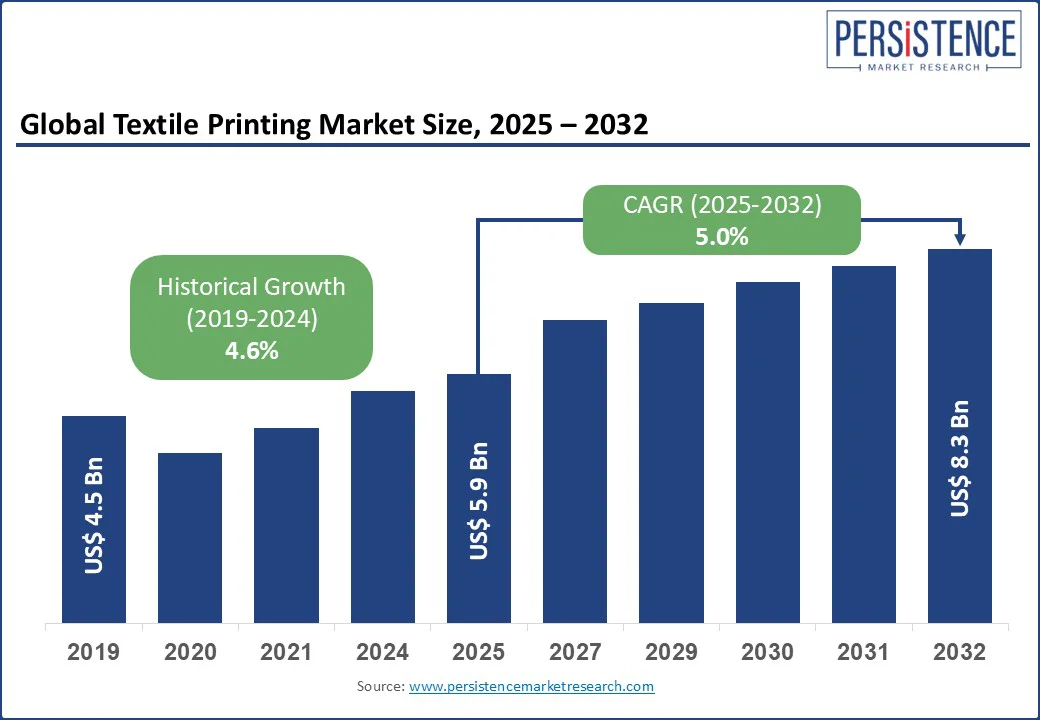

The global Textile Printing Market size is likely to value at US$ 5.9 Bn in 2025 to US$ 8.3 Bn by 2032, registering a CAGR of 5.0% during the forecast period 2025 - 2032.

The Textile Printing market has experienced steady growth, driven by increasing demand for customized and sustainable textiles, advancements in digital printing technologies, and rising applications in fashion, home decor, and advertising.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Textile Printing Market Size (2025E) |

US$ 5.9 Bn |

|

Market Value Forecast (2032F) |

US$ 8.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.6% |

The growing global demand for customized and personalized textiles is emerging as a major driver of the textile printing market. Consumers increasingly prefer unique, tailored designs over standardized, mass-produced items, and this shift is being strongly supported by the rapid expansion of e-commerce platforms such as Amazon and Etsy, which make on-demand printing more accessible to both businesses and individuals. In markets such as the U.S., the popularity of customized clothing continues to rise, reflecting a broader cultural trend toward self-expression and individuality in fashion and home décor.

Sustainability has become another critical factor shaping the Textile Printing market’s growth trajectory. Advances in textile printing technologies, particularly digital printing, have enabled the adoption of water-based and low-VOC inks, offering a more environmentally responsible alternative to traditional printing methods. Industry research indicates that these innovations help significantly reduce water consumption and production waste, addressing growing environmental concerns. As awareness of sustainable practices increases, consumers are demonstrating a strong willingness to choose eco-friendly products, even at a premium. This alignment between technological innovation and consumer values is creating new opportunities for growth in the global textile printing sector.

Government initiatives promoting sustainable textiles further amplify demand. In India, the Ministry of Textiles’ schemes, such as the Amended Technology Upgradation Fund Scheme (ATUFS), have subsidized digital printing equipment for manufacturers. These programs emphasize the role of efficient printing in reducing pollution, boosting institutional adoption in the Asia Pacific.

High initial costs of digital printing equipment pose a significant barrier to market growth, particularly for small and medium-sized enterprises. Advanced printers such as Kornit Digital’s Avalanche series can cost over $200,000, with maintenance adding 15-20% to total expenses, per industry estimates. These costs limit adoption in regions such as Latin America and rural Asia Pacific, where traditional screen printing remains more affordable.

Skilled labor shortages and the need for technical expertise remain significant challenges to the growth of the textile printing market. Operating advanced equipment such as direct-to-garment (DTG) and roll-to-roll printers requires specialized training and in-depth knowledge of printing processes, color management, and fabric handling. Many textile producers, particularly in developing markets, face difficulties in recruiting and retaining qualified technicians capable of managing these systems efficiently. The lack of readily available expertise slows the adoption of advanced printing technologies, while the high cost and time investment required for training further limit accessibility. This skills gap creates operational inefficiencies and can discourage smaller businesses from upgrading to modern systems, ultimately constraining the Textile Printing market’s overall growth potential.

The development of eco-friendly inks and sustainable printing technologies presents significant opportunities. With global concerns about textile waste, brands are investing in water-based and pigment inks. For example, in 2024, Epson introduced a low-VOC ink series for DTG printing in Europe, reducing emissions by 30%, boosting brand loyalty among eco-conscious consumers. In the Asia Pacific, companies such as Mimaki Engineering are exploring bio-based inks, extending product appeal.

On-demand and customized printing presents a significant growth opportunity for the textile printing market. The expansion of e-commerce has made short-run production more viable, helping brands reduce inventory costs and improve supply chain flexibility. This approach allows businesses to respond quickly to changing consumer preferences, minimizing waste and excess stock. By developing user-friendly direct-to-garment (DTG) systems tailored for small businesses, companies can tap into the growing demand for personalized products.

The increasing popularity of digital platforms further enhances these opportunities, as online marketplaces equipped with customization tools make it easier for consumers to create unique designs. Additionally, brands can leverage AI-powered design software to target niche markets such as sportswear enthusiasts, luxury fashion buyers, or eco-conscious consumers.

The textile printing market is segmented into Roll to Roll and DTG. Roll-to-roll dominates, holding approximately 60% of the Textile Printing market share in 2025, due to its high-speed production and suitability for large-scale fabric printing. Systems such as Durst Group’s Alpha series are widely used for banners and soft signage, offering efficiency in high-volume manufacturing.

DTG is the fastest-growing segment, fueled by demand for customized apparel and short-run production. DTG printers, such as those from Ricoh, allow direct printing on garments such as T-shirts, appealing to e-commerce and fashion brands in North America.

By fabric type, the Textile Printing market is divided into Cotton, Viscose, Wool, Silk, Polyamide Lycra, Polyester, and Others. Cotton dominates, accounting for 53% of the global Textile Printing market share in 2025, due to its widespread use in apparel, sustainability appeal, and compatibility with eco-friendly digital inks. It is a preferred fabric for both fashion and home decor applications.

Polyester is the fastest-growing segment, driven by its durability and increasing use in sportswear and banners. Digital printing on polyester, enhanced by vibrant inks, is gaining traction in advertising and fast fashion markets.

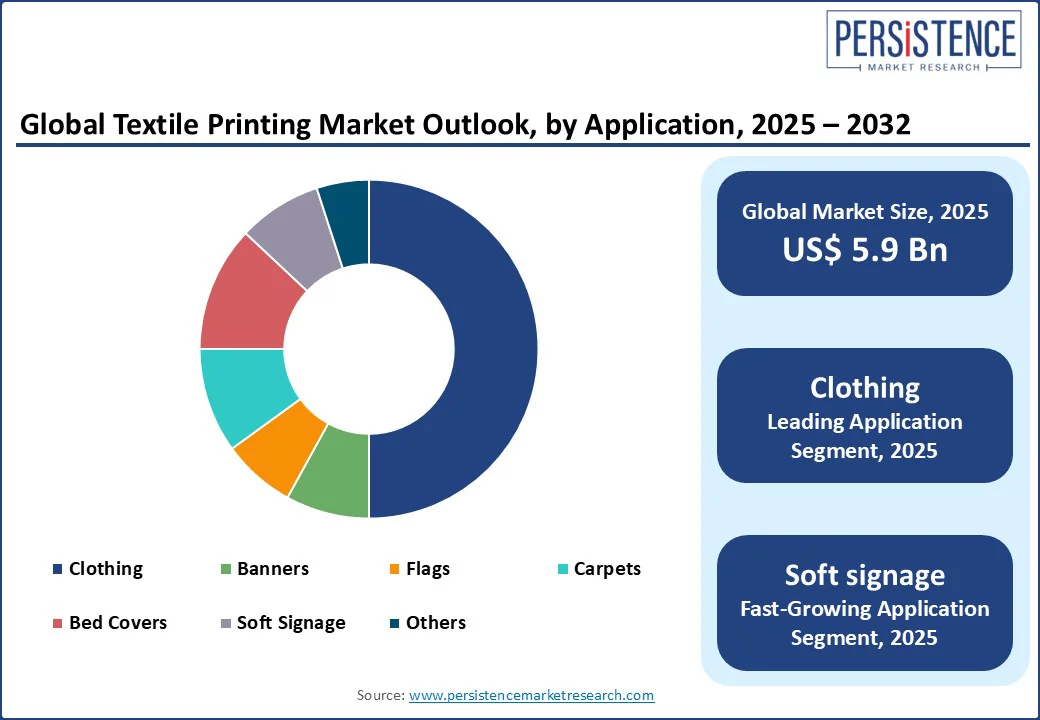

The global Textile Printing market is segmented into Clothing, Banner, Flags, Carpets, Bed Covers, Soft Signage, and Others. Clothing leads with a 50% share in 2025, driven by the fashion industry’s need for printed apparel such as t-shirts and dresses. Brands such as Kornit Digital dominate with solutions for customized clothing.

Soft signage is the fastest-growing segment, fueled by advertising and event demands. Digital printing on fabrics for banners and displays offers vibrant colors and durability, growing in urban markets.

In North America, the U.S. is the fastest-growing market for textile printing, driven by high demand for customized apparel and advanced digital technologies. In the U.S., direct-to-garment (DTG) printing continues to gain momentum, with polyester and cotton fabrics leading applications in sportswear and fashion. The growth of e-commerce, supported by platforms such as Printful, has strengthened the adoption of on-demand printing models, enabling faster turnaround times and greater flexibility in design offerings.

Consumer trends increasingly favor sustainable and eco-friendly inks, driving brands such as Epson to expand their green product portfolios. Innovation remains a key focus, with companies such as Ricoh introducing AI-optimized printers to enhance print precision and operational efficiency. Regulatory initiatives that promote environmentally responsible manufacturing are further accelerating the shift toward advanced, sustainable textile printing technologies in the U.S. market.

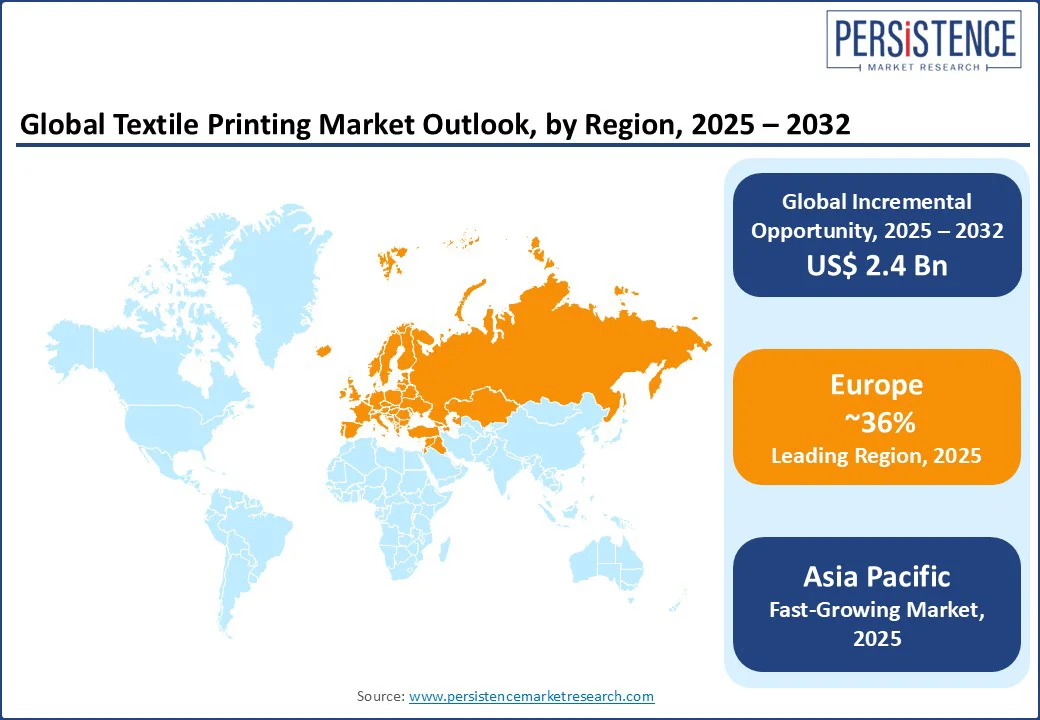

Europe dominates with a 36% market share in 2025, led by Germany, Italy, and France, driven by advanced textile manufacturing and regulatory support for sustainability. Germany leads the regional textile printing market, supported by strong performance from brands such as Mimaki Engineering and Durst Group. The EU’s Green Deal and Circular Economy Action Plan encourage the use of eco-friendly inks and advanced digital printing methods, driving greater adoption in cotton-based fashion and home décor applications.

Italy’s market benefits from its rich luxury fashion and textile heritage, with roll-to-roll printing techniques dominating high-end cotton and silk production. In France, growth is fueled by rising demand for soft signage in advertising, with companies such as Konica Minolta delivering specialized solutions for cotton and polyester fabrics. Across the region, regulatory incentives promoting sustainable production, combined with consumer preference for eco-friendly textiles, continue to strengthen market expansion.

Asia Pacific is a significant market, led by China, India, and Japan, driven by large-scale textile production and export demand. In India, rising fashion and home decor demand drives roll-to-roll printing on cotton, with companies such as Konica Minolta dominating. India’s textile sector is experiencing strong export growth, supported by government initiatives such as the Production Linked Incentive (PLI) scheme for textiles. These measures are boosting the adoption of digital printing technologies, particularly for cotton fabrics, as manufacturers seek to meet international quality and sustainability standards.

China’s market is characterized by high-volume production for applications such as clothing and banners, with leading brands such as Roland DG Corporation excelling in cotton and polyester printing. Japan places emphasis on high-quality direct-to-garment (DTG) printing for soft signage and premium cotton apparel, with companies such as Mimaki Engineering gaining market presence. Across the region, rapid urbanization and the expansion of e-commerce in both B2B and B2C channels continue to drive market growth.

The textile printing market is highly competitive, with global and regional players vying for share through innovation, pricing, and sustainability. The rise of digital techniques intensifies competition, as consumers demand customization and eco-friendly options. Strategic partnerships and technological advancements are key differentiators.

The Textile Printing market is projected to reach US$ 5.9 Bn in 2025.

Rising demand for customized textiles, sustainability, and government initiatives are the key market drivers.

The Textile Printing market is poised to witness a CAGR of 5.0% from 2025 to 2032.

Innovation in eco-friendly inks and on-demand printing are the key market opportunities.

Epson, Kornit Digital, and Mimaki Engineering are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Printing Technique

By Fabrics

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author