ID: PMRREP21160| 200 Pages | 11 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

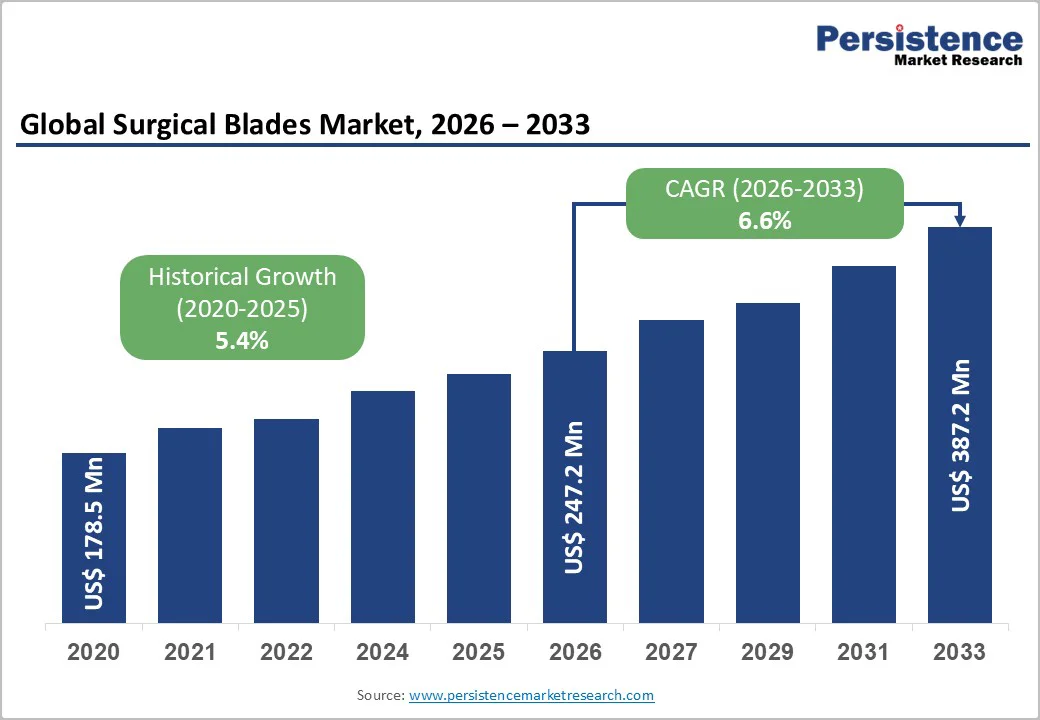

The global surgical blades market size is likely to value at US$247.2 million in 2026 and projected to reach US$387.2 million by 2033, growing at a CAGR of 6.6% during the forecast period from 2026 to 2033.

The global demand is growing steadily as hospitals and surgical centers increasingly prefer precision-engineered, sterile disposable cutting instruments to enhance patient safety and surgical efficiency. Rising surgical volumes, driven by trauma cases, chronic disease procedures, and expanding outpatient surgeries, continue to boost demand.

Advancements in stainless steel and coated blade technologies are improving sharpness, durability, and infection-control outcomes. Emerging economies are experiencing strong adoption due to improving healthcare infrastructure and higher procedure rates.

| Key Insights | Details |

|---|---|

| Surgical Blades Market Size (2026E) | US$247.2 Mn |

| Market Value Forecast (2033F) | US$387.2 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.6% |

| Historical Market Growth (CAGR 2020 to 2024) | 5.4% |

The growth of cosmetic and dermatology procedures is a significant driver for the surgical blades market. Increasing awareness of aesthetic treatments, rising disposable incomes, and the influence of social media have led to higher demand for procedures such as facelifts, mole removals, scar corrections, and laser-assisted surgeries.

These surgeries require precision and delicacy, which has boosted the adoption of fine, specialty surgical blades designed for sensitive tissues. Surgeons prefer ultra-sharp, micro-engineered blades to minimize tissue damage, ensure smooth incisions, and achieve optimal cosmetic outcomes.

Additionally, the expansion of dermatology clinics and cosmetic centers, along with rising medical tourism for aesthetic procedures in countries such as India, South Korea, and the U.S., is further driving the consumption of these specialized blades.

Reusable surgical blades, while cost-effective, pose a significant risk if not properly sterilized between procedures. Any lapse in sterilization protocols can lead to hospital-acquired infections (HAIs), which are associated with prolonged hospital stays, increased healthcare costs, and higher patient morbidity.

Even minor contamination can compromise surgical outcomes and erode trust in healthcare facilities. As a result, many hospitals and surgical centers prefer disposable, pre-sterilized blades to ensure patient safety and minimize infection risks.

The stringent infection-control standards mandated by regulatory bodies, combined with growing awareness of HAIs among healthcare professionals, further limit the adoption of reusable blades, particularly in high-volume and outpatient surgical settings.

The demand for micro-blades for precision surgeries is growing rapidly, driven by advancements in ophthalmology, neurosurgery, and reconstructive procedures that require highly accurate, minimally invasive incisions. These ultra-thin, precision-engineered blades enable surgeons to perform delicate operations with improved control, reduced tissue damage, and faster patient recovery.

Hospitals and specialty clinics increasingly prefer micro-blades for procedures such as cataract surgery, brain tumor removal, and cosmetic reconstruction, where precision is critical. Innovations in blade materials, coatings, and ergonomic designs further enhance performance. As surgical techniques evolve toward minimally invasive and high-precision interventions, the market for micro-blades is expected to expand significantly worldwide.

Disposable surgical blades hold the highest market share because modern healthcare systems prioritize infection prevention, safety, and operational efficiency. Single-use blades come pre-sterilized, eliminating the risk of cross-contamination and removing the need for costly, time-consuming sterilization processes.

They also ensure consistent sharpness and performance, which is essential for precise surgical outcomes. With rising surgical volumes and the rapid growth of ambulatory and outpatient procedures, hospitals prefer products that support fast turnover and minimize handling.

In addition, regulatory bodies increasingly promote or mandate disposable instruments to enhance patient safety. These advantages make disposable blades the preferred choice across most healthcare facilities.

Hospitals account for the highest share in the surgical blades market because they handle the largest and most diverse volume of surgical procedures, ranging from routine operations to complex specialty surgeries. Their 24/7 emergency services, high patient inflow, and advanced surgical departments create continuous demand for high-quality blades.

Hospitals also follow strict sterilization and infection-control protocols, leading to consistent procurement of both disposable and specialty blades. Additionally, the presence of multidisciplinary teams and multiple operating rooms increases consumption compared to clinics or ambulatory centers. With established budgets and centralized purchasing systems, hospitals remain the dominant and most stable end-use segment in this market.

North America leads the surgical blades market due to its advanced healthcare infrastructure, strong regulatory standards, and high surgical procedure volumes across hospitals and ambulatory surgical centers. The region shows a clear shift toward disposable, sterile blades driven by stringent infection-control guidelines and hospital safety protocols.

Technological advancements such as coated, precision-engineered blades and growing adoption of specialty micro-blades further support market expansion. The rise of minimally invasive and outpatient surgeries also increases the demand for ready-to-use, high-performance blades. Additionally, the strong presence of key manufacturers and streamlined procurement systems reinforces North America’s dominant position in the global market.

Asia-Pacific is emerging as a leading region in the surgical blades market, driven by rapid healthcare expansion, rising surgical procedure volumes, and growing investment in hospital infrastructure. Countries such as China, India, and Japan are experiencing increased adoption of disposable blades due to stronger infection-control practices and improved healthcare standards.

Expanding medical tourism, especially for orthopedic, cosmetic, and cardiovascular surgeries, further boosts demand. Local manufacturing is also rising, making high-quality blades more accessible and cost-effective. Additionally, government initiatives to upgrade surgical facilities and strengthen universal healthcare coverage are accelerating market growth, positioning the Asia-Pacific as one of the most dynamic regions.

The global surgical blades market features a highly competitive landscape with a mix of global manufacturers and strong regional players.

Companies compete on sharpness, material quality, safety features, and cost efficiency. Leading brands focus on product innovation, such as coated blades and safety scalpels, while regional firms emphasize affordability and large-volume supply. Increasing demand for disposable blades has intensified competition, prompting manufacturers to enhance sterilization standards and expand product portfolios.

The global surgical blades market is projected to be valued at US$247.2 Mn in 2026.

Rising surgical procedure volumes due to trauma cases, chronic diseases, and aging populations.

The global market is poised to witness a CAGR of 6.6% between 2026 and 2033.

Development of coated and anti-stick blades that enhance surgical efficiency and reduce tissue drag.

Swann-Morton, Feather Safety Razor Co., KAI Group, Mani Inc., and others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Material

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author